Should you’re going to be a dealer, you’re going to lose cash in some unspecified time in the future, and in case you might be nonetheless within the section of making an attempt to keep away from all shedding trades and looking for a “Holy-grail” buying and selling system with a 75% strike charge, you need to neglect about all that proper now. As cliché as it might sound, shedding actually is a part of profitable as a dealer; the 2 are inseparable. Should you don’t discover ways to lose correctly you’ll by no means make constant cash as a dealer.

Should you’re going to be a dealer, you’re going to lose cash in some unspecified time in the future, and in case you might be nonetheless within the section of making an attempt to keep away from all shedding trades and looking for a “Holy-grail” buying and selling system with a 75% strike charge, you need to neglect about all that proper now. As cliché as it might sound, shedding actually is a part of profitable as a dealer; the 2 are inseparable. Should you don’t discover ways to lose correctly you’ll by no means make constant cash as a dealer.

Actuality test…ALL professional merchants lose cash, and so they perceive that it’s simply a part of the “recreation”. Sadly, for a lot of merchants, each commerce is accompanied by a large FEAR of shedding cash and typically intense emotional attachment.

Among the key explanation why merchants grow to be fearful about shedding their cash embrace the next:

1. They don’t perceive that mathematically, over a sequence of trades, a dealer can lose a majority of their trades and nonetheless be broadly worthwhile, basic math proves this.

2. They’re merely petrified of shedding cash basically.

3. They’re buying and selling positions which might be too massive (risking greater than they actually must be), inflicting concern, sleepless nights and large emotional swings.

In the remainder of this lesson I’m going to give you some perception into the concern of shedding cash within the markets and the right way to conquer it. That is some fairly highly effective stuff so be sure you truly learn the entire article and re-read it if it’s a must to. What you be taught right here ought to provide the energy to eradicate your concern of shedding cash within the markets and can aid you develop right into a assured and emotionally collected dealer.

Worry of shedding cash is usually a good, pure emotion, however we have to rework its focus.

Worry of shedding cash is an efficient emotion to have in lots of areas of life, if we didn’t have it there could be much more chaos on the earth and within the markets. People are protecting of their acquired wealth and property, and rightly so; they labored onerous for it.

Nonetheless, in buying and selling, this pure vitality to be defensive and emotional with cash must be reworked and refocused into a unique psychological state…

As a substitute of being petrified of shedding your cash when buying and selling, embrace the management you may have on every commerce; a dealer has full management over the danger administration of each commerce through cease losses and place sizing, [and for more advanced traders, derivatives and hedging mechanisms (not discussed here)]. These danger administration instruments are your method of being in charge of your cash/funds, and as a substitute of being “fearful” about shedding cash, you need to really feel empowered and assured as a result of you possibly can predetermine how a lot you might be snug with doubtlessly shedding BEFORE you enter a commerce by utilizing these instruments.

Nonetheless, simply utilizing these instruments to regulate your danger per commerce just isn’t fairly sufficient to completely take away the concern of shedding.

Ask your self some critical questions

Should you really feel concern or any emotion in any respect if you place a commerce, it is advisable “slap” your self within the face and ask your self 3 massive questions (and reply actually):

1. Do I actually have the information and confidence to be buying and selling with actual cash within the first place?

Should you’re buying and selling your hard-earned cash within the markets however you don’t know what your buying and selling edge is and also you don’t have 100% confidence in your capability to investigate and commerce the markets…you most likely shouldn’t be buying and selling. One of many greatest causes merchants grow to be afraid to lose their cash is as a result of they aren’t assured in their very own capability to commerce! It appears foolish I do know, however it’s very true; many merchants merely don’t have a buying and selling technique mastered, they don’t have a buying and selling plan, buying and selling journal, and so on…they merely aren’t ready to danger actual cash within the markets but…thus they really feel concern once they commerce.

2. Am I buying and selling a place dimension that’s too massive for my private danger profile / per-trade danger tolerance?

Should you don’t know what your per-trade danger tolerance is, then it is advisable determine that out first. It’s mainly simply the greenback quantity that you simply really feel like you might be 100% snug with doubtlessly shedding on any commerce; since you CAN lose on any commerce…do not forget that. It’s important to keep in mind your total monetary scenario after which decide how a lot cash you need to realistically and actually have in danger out there on anybody commerce…be sincere with your self right here. You’ve received to think about your self as a danger supervisor and as somebody who’s managing funds, quite than only a small-time man making an attempt to get fortunate; your buying and selling mindset will immediately affect your buying and selling outcomes.

3. Do I actually perceive the maths’s behind buying and selling?

After I say the “maths behind buying and selling” I’m primarily referring to danger reward and the way it pertains to your total profitable share. For instance, on a sequence of 20 trades, you might be more likely to lose not less than 35 to 45% of the trades, and most merchants who’re profitable lose wherever from 40 to 50% of the time, some even as much as 60% of the time. However, by means of the ability of danger reward you possibly can lose greater than you win and nonetheless come out very worthwhile. We are going to develop on this under.

Embrace the assumption that shedding is OK

Shedding is nice when you’re chopping your losses rapidly and perceive that by doing so that you’re merely preserving capital and that your profitable trades pays to your shedding trades with revenue left over. That is the ability of your common danger reward ratio over a sequence of trades coming into play; we are going to see this in motion under…

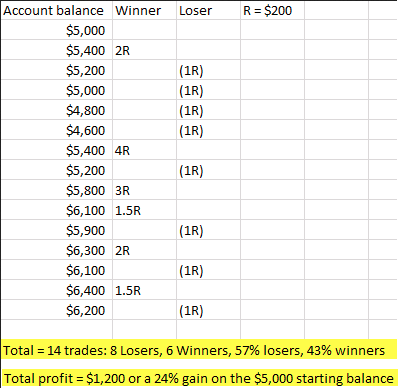

Even very worthwhile merchants usually lose greater than they win, to show this level let’s check out a case research displaying 14 trades with a only a 43% win charge. To be clear, meaning you might be shedding 57% of the time and profitable simply 43% of the time. It may be onerous to affiliate “shedding” nearly all of your trades with earning money, however as I mentioned in one among my current articles, you don’t must be proper to earn money buying and selling.

This picture exhibits us that worthwhile merchants can lose extra trades than they win and nonetheless come out very worthwhile over a sequence of trades. Thus, shedding cash on anybody commerce shouldn’t concern you:

Belief your technique and Belief the maths

As we are able to see within the hypothetical observe document above, the maths exhibits us that even whereas shedding 57% of our trades, if we let our winners run to round 2 to 1 or higher and minimize our losses at -1R or much less, the income will handle themselves. It’s value noting we included a few 1.5R winners, as a result of typically it would make extra sense to take a reward of barely lower than 2R, relying on market circumstances. The typical danger reward on this instance was 1:1.75, and when you can purpose for a mean danger reward of round 1:1.5 or 1:2, over the long term you need to come out forward. The “secret” is retaining ALL your losers at 1R or much less and ONLY buying and selling when our worth motion buying and selling edge is actually current.

Should you observe an precise plan, shedding is simpler to just accept, as a result of not less than you had a plan and a roadmap as to what you have been making an attempt to do; the mind then sees it as extra logical and thus you’re much less more likely to expertise apprehension or concern. The set and neglect idea I all the time discuss will help with coaching your mind into accepting losses. Additionally, you will keep away from interfering with loads of your trades which may produce pointless losses.

The “Sleepless night time check”

All the things we mentioned above is correct and essential, however there actually is one easy “concern check” that I’ve discovered to be very efficient for many merchants. That check is just to gauge how you’re feeling at night time earlier than you go to mattress when you have a commerce on. Should you discover you can’t cease interested by your commerce(s) or you might be glued to your pc display screen whereas you need to be sleeping, you might be nonetheless experiencing concern of shedding. So right here’s a quite simple check for you:

One easy rule…when you can’t fall asleep at night time feeling snug and comfy with the commerce(s) you may have on…

1) You’re both buying and selling too massive of a place dimension / risking an excessive amount of at your cease stage

2) Or, you don’t have any thought what you’re doing and lack confidence in your trades

Conclusion:

The concern of shedding cash or of shedding a commerce could be crippling to a dealer, inflicting them to overlook out on high-probability commerce setups, second-guess themselves continuously and it may even trigger them to be unable to sleep. Clearly, if we’re to succeed at buying and selling we have now to beat this concern. Conquering the concern of shedding cash and trades begins with acceptance; we have now to first settle for that we’re going to lose cash and have shedding trades, even when we attempt to keep away from them. Thus, there isn’t any sense in “making an attempt” to keep away from shedding trades, as a substitute we have now to be taught to roll with them and include them. We do that by following by means of with the ideas we mentioned above, so let’s sum them up briefly:

The concern of shedding cash or of shedding a commerce could be crippling to a dealer, inflicting them to overlook out on high-probability commerce setups, second-guess themselves continuously and it may even trigger them to be unable to sleep. Clearly, if we’re to succeed at buying and selling we have now to beat this concern. Conquering the concern of shedding cash and trades begins with acceptance; we have now to first settle for that we’re going to lose cash and have shedding trades, even when we attempt to keep away from them. Thus, there isn’t any sense in “making an attempt” to keep away from shedding trades, as a substitute we have now to be taught to roll with them and include them. We do that by following by means of with the ideas we mentioned above, so let’s sum them up briefly:

• Mastering our worth motion buying and selling technique and “trusting” it: grasp it, personal it and imagine in it.

• Handle your cash and make use of strong danger administration; this implies chopping losses at 1R or much less and aiming for an honest danger reward of about 1:2 on every commerce. We additionally have to attempt to let some winners run to get bigger danger rewards like 1:3, 1:4 or extra.

• Belief the maths: keep in mind the instance observe document above and that even a 40% win charge could make excellent cash with a mean danger reward ratio of roughly 1:1.5 or extra.

To be taught extra concerning the above ideas and to get on the observe to conquering your concern of shedding cash within the markets, checkout my Foreign currency trading course and members’ neighborhood.

Good buying and selling, Nial Fuller