Inventory markets offered off throughout Asia, after a weaker shut on Wall Avenue. Fee hike issues picked up once more within the wake of the warmer than anticipated US inflation print yesterday and nonetheless tight jobless claims numbers and put shares on the again foot. The reviews noticed the market value again in threat of one other Fed price hike this 12 months of about 38%, although the chance was briefly as excessive as 50-50. The info, the specter of one other Fed hike, and geopolitical dangers soured investor sentiment.

European futures are additionally within the crimson, whereas US futures present indicators of stabilisation. The ten-year Treasury yield is down -3.3 bp at 4.664%, because the curve shifts decrease. Within the Eurozone, the quick finish is outperforming, however the 10-year Bund yield can be down -1.0 bp at 2.71%, whereas spreads are coming in.

- USDIndex has moved off the highs seen within the wake of yesterday’s knowledge and is at 106.20. USDJPY is hovering under 150 because the yield hole with the US widened on hotter-than-expected inflation knowledge.

- Yields: Yields cheapened additional on the again of the poorly subscribed bond public sale. The bearish motion in Treasuries has given an excuse to take earnings. Treasury yields rose to their highest ranges of the week.

- Shares: Wall Avenue slipped and closed with a -0.63% drop on the US100, -0.62% on the US500, and -0.51% on the US30.

- UKOIL is about for a weekly acquire of over 2%, whereas USOIL is about to climb about 1% for the week as traders keep watch over the Center Japanese exports because of the Gaza disaster. USOIL as much as $83.70.

At present: ECB President Lagarde, FOMC Member Harker & BOE Gov Bailey converse.

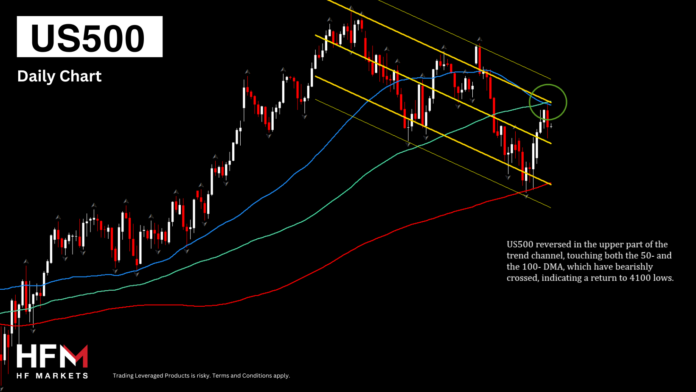

Attention-grabbing Mover: US500 (-0.62%) reversed within the higher a part of the development channel, touching each the 50- and the 100- DMA, which have bearishly crossed, indicating a return to 4100 lows.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or ought to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.