Inventory market sentiment has turned bitter once more, as yields decide up and traders modify Fed expectations. Hopes of early charge cuts appear to be fading and Asian inventory markets bought off in a single day. Futures are down throughout Europe and the US as properly, with European and Chinese language knowledge weaker than anticipated.

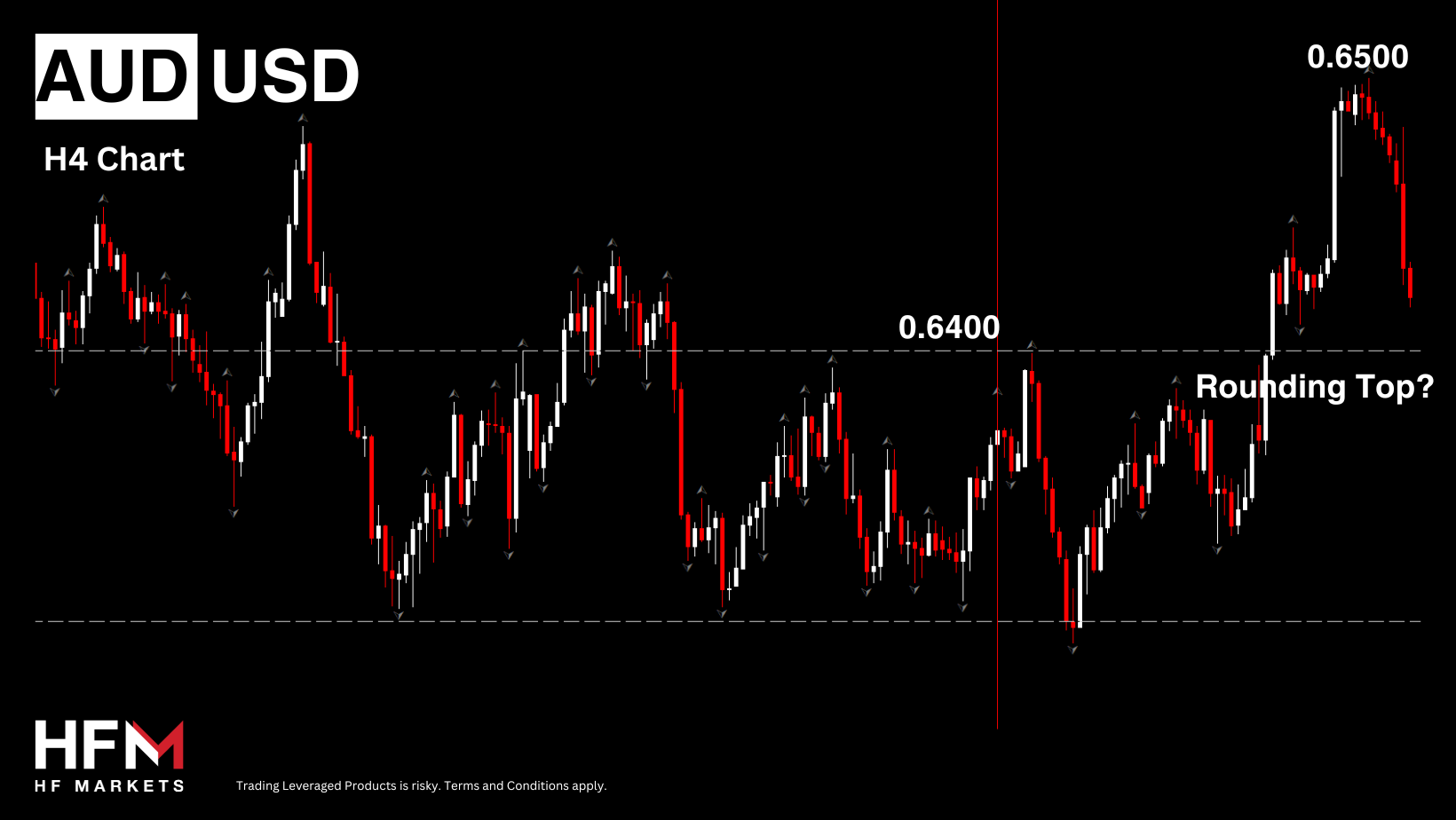

- The RBA resumed elevating rates of interest in a broadly anticipated transfer, whereas signalling a better hurdle to additional coverage tightening that pushed the native foreign money decrease.

- German industrial manufacturing declined -1.4% m/m in September, greater than anticipated. This was the fourth consecutive month of contraction. The numbers flag recession dangers, particularly as orders knowledge stays subdued and the Manufacturing PMI in contraction territory.

- China’s commerce knowledge confirmed an accelerated decline in export progress, however imports unexpectedly improved, which is conserving hopes of a stronger restoration alive, particularly after efforts from Beijing to spice up native demand.

Fed: Implied Fed funds futures dropped additional because the market futures costs out Fed charge hike dangers and convey ahead the possibilities for the beginning of charge cuts. The chance for a 25 bp tightening on the December FOMC is lower than 10%, whereas the January contract factors to about 13%. The market is constructing in charge cuts round Might, with a 50-50 wager, whereas the implied June contract trades at 5.007%, with July at 4.84%. The Goldilocks reported that October payrolls would have been up about 180k if the 33k in strikers had been added again in, which suggests the economic system is slowing because the FOMC desires to see, and isn’t coming in for a crash touchdown.

- USDIndex recovered from in a single day losses to a session low of 105.35. The buck has not completed beneath the 105 stage since September 13. The VIX dipped -0.07% to 14.90 after rising to an intraday excessive of 15.58. AUDUSD drifted to 0.6420 from 0.6500. USDJPY reverted to 150.36.

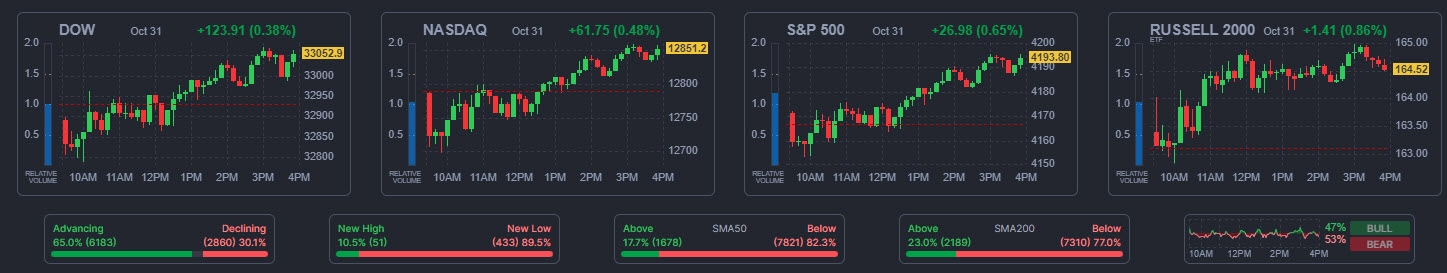

- Shares: Wall Road closed with fractional beneficial properties. The US100 superior 0.30%, with the US500 up 0.18% and the US30 0.10% increased. S&P sectors had been combined with beneficial properties in IT and healthcare offsetting drops in actual property and power. JPN225 (-1%) snaps 4-day profitable streak as US Treasury yields rise.

- WeWork confirmed it’s searching for chapter safety, a agency as soon as valued at near $50 billion.

- Nintendo hikes revenue forecast as Swap battles on.

- UBS posts $785mn quarterly loss resulting from Credit score Suisse integration prices.

- Oil declined to $78.83, as unsure demand prospects and renewed issues concerning the Fed’s tightening measures outweighed Saudi Arabia and Russia’s prolonged provide cuts, resulting in a decline in oil costs.

- Gold skilled losses, buying and selling at $1,966, whereas BTC remained just under the $35,000 mark.

Attention-grabbing Mover: AUDUSD (-1%) after RBA hiked charges by 25 bp, which can have acted as a reminder that key central banks nonetheless retain a tightening bias. Subsequent Help at 0.6400 & 0.6380.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a common advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.