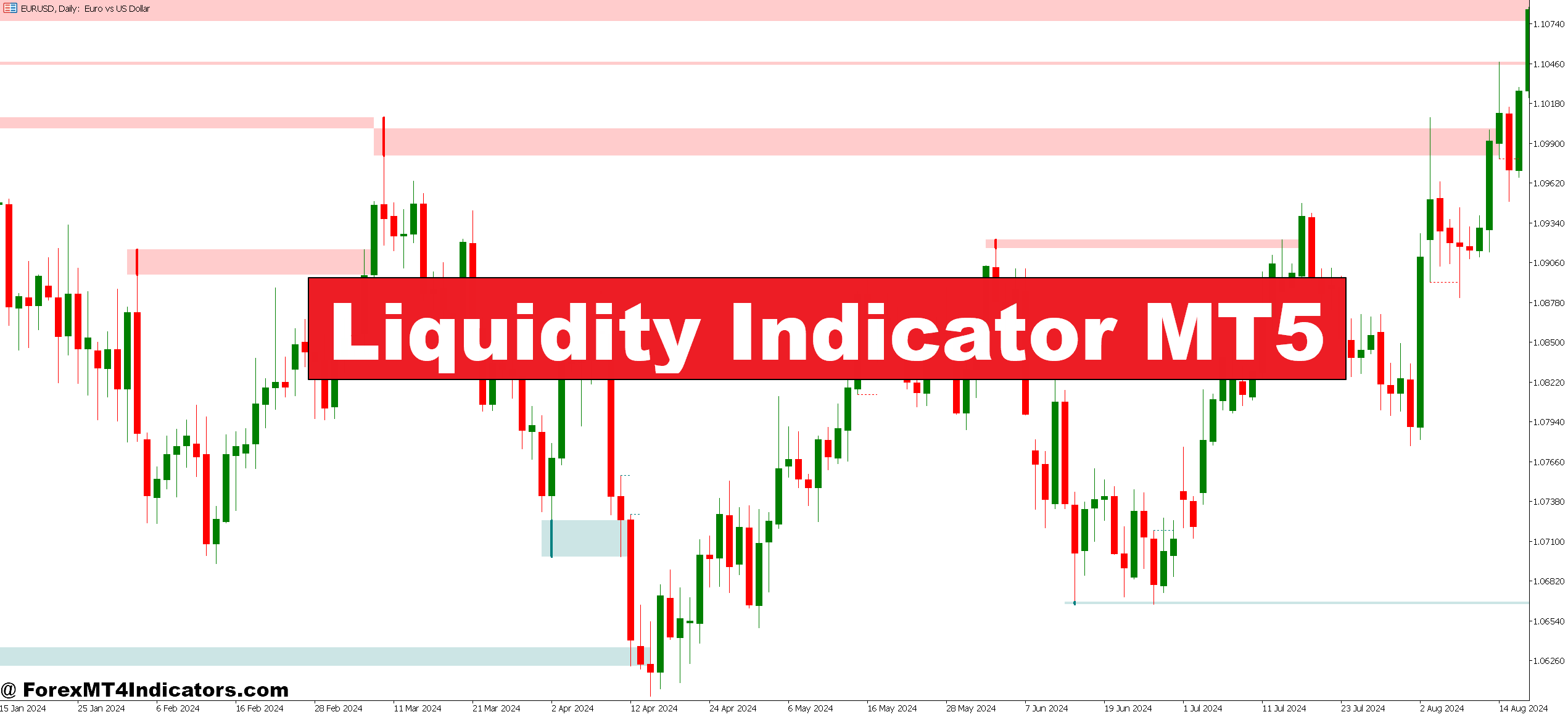

The Liquidity Indicator for MetaTrader 5 identifies zones the place massive volumes of pending orders cluster. Consider it as a warmth map for institutional positioning. When banks place large stop-loss orders or set restrict orders to enter positions, they create liquidity swimming pools. These swimming pools act as magnets—worth typically gravitates towards them earlier than making vital strikes.

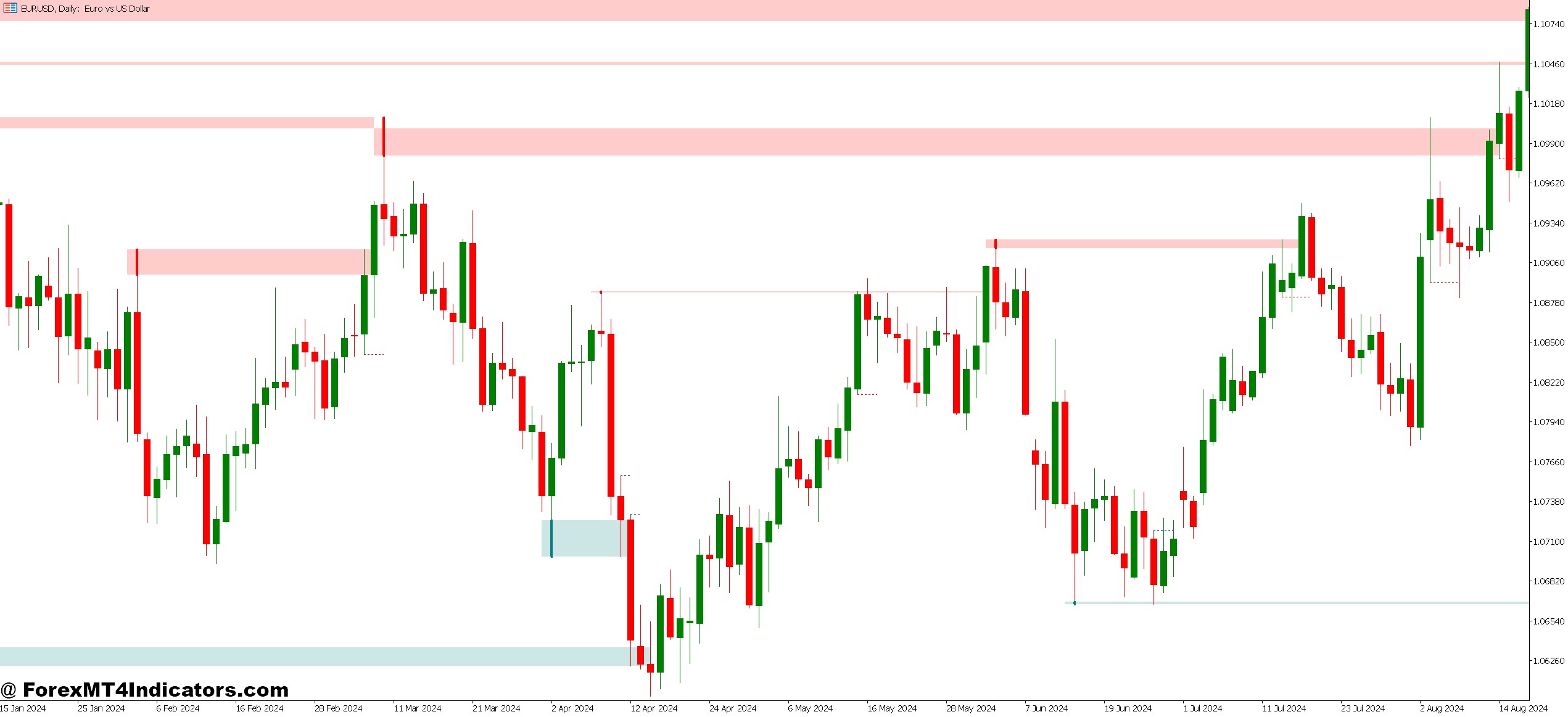

The indicator shows these zones instantly on charts, sometimes as horizontal ranges or shaded areas. Inexperienced zones often mark buy-side liquidity (areas with clustered cease losses above the present worth or purchase restrict orders). Pink zones point out sell-side liquidity beneath the value.

Right here’s what makes this completely different from commonplace help and resistance: these ranges aren’t primarily based on the place the value bounced earlier than. They’re calculated from order guide knowledge, quantity evaluation, and algorithmic detection of institutional footprints. The indicator processes tick knowledge and market depth info that handbook evaluation merely can’t deal with.

How It Calculates Liquidity Zones

The calculation methodology varies between indicator variations, however most use a mixture of quantity profiling and order circulate evaluation. The indicator scans for:

- Quantity spikes at particular worth ranges: When buying and selling quantity surges at a specific worth with out vital motion, it alerts absorption—establishments filling massive orders.

- Swing excessive and low clusters: Retail merchants predictably place stops simply past apparent swing factors. The indicator identifies these “cease hunts” ready to occur.

- Historic liquidity sweeps: Areas the place worth beforehand spiked by ranges rapidly, typically grabbing liquidity earlier than reversing.

Some variations incorporate Time and Gross sales knowledge, monitoring massive particular person transactions that counsel institutional exercise. Others use a proprietary algorithm that weighs current worth motion extra closely, making the degrees dynamic somewhat than static.

The technical facet will get advanced, however merchants don’t have to code algorithms. What issues is recognizing that these calculations catch patterns human eyes miss. On a GBP/JPY 1-hour chart throughout the London session, the indicator may present a pink liquidity zone at 188.50. Worth faucets it, spikes to 188.35 (grabbing stops), then reverses 60 pips greater. That’s not random—it’s institutional order circulate in motion.

Buying and selling With Liquidity Zones: Sensible Software

The indicator works greatest when merchants cease combating liquidity and begin anticipating its results. Three core methods emerge:

- Liquidity seize reversals: Worth approaches a liquidity zone marked by the indicator. As an alternative of buying and selling the breakout, look ahead to the “sweep and retreat” sample. When EUR/USD confirmed a liquidity pool at 1.0920 final month throughout the New York session, the value spiked to 1.0928, then dropped 45 pips in two hours. Merchants who shorted after the liquidity seize caught the transfer.

- Affirmation for breakout trades: Breakouts succeed extra typically when there’s no main liquidity zone close by. If the indicator exhibits clear house above a resistance breakout, establishments aren’t positioned to defend that stage. That’s a inexperienced gentle. But when a thick liquidity zone sits 15 pips above the breakout? That’s a entice ready to spring.

- Vary buying and selling between zones: When two liquidity zones bracket worth motion on decrease timeframes, commerce the vary. Promote close to the higher zone, purchase close to the decrease zone. This works notably effectively throughout Asian session chop when main pairs lack directional momentum.

Settings matter. Most merchants run the indicator on 1-hour and 4-hour charts for swing trades, and 15-minute charts for day buying and selling. Sensitivity settings management what number of zones show—greater sensitivity exhibits extra ranges however creates noise. Begin conservatively. A 30-period lookback with medium sensitivity filters out weak zones whereas highlighting institutional positioning.

Timeframe choice impacts sign high quality. The 5-minute chart exhibits each minor liquidity pocket, creating paralysis by evaluation. The every day chart smooths out a lot knowledge that short-term alternatives disappear. The 1-hour chart hits the candy spot for many foreign exchange pairs.

Benefits and Actual Limitations

The indicator’s power lies in forward-looking evaluation. Assist and resistance look backward at the place the value bounced. Liquidity zones stay up for the place orders are stacked. This creates an edge, particularly throughout unstable information releases when liquidity zones can predict the place the value will “hunt” earlier than making its true directional transfer.

It additionally reduces guesswork about cease placement. If a liquidity zone sits 25 pips beneath entry, that’s the place institutional stops possible cluster. Putting your cease 5-10 pips past that zone is sensible—you’re protected if the sweep occurs, however you’re not getting stopped out earlier than the transfer you need.

However right here’s the reality: this indicator isn’t foolproof. Liquidity zones don’t assure the value will attain them. Typically market situations shift, and orders get pulled. Excessive-impact information can blow by liquidity zones with out the anticipated response. And false alerts occur—worth checks a zone with out the anticipated reversal.

The indicator additionally lags on thinly traded unique pairs. It wants quantity and order circulate knowledge to operate. On EUR/USD or GBP/USD? Glorious. On USD/TRY or EUR/NOK? The zones lose reliability as a result of institutional exercise is sparse and knowledge is thinner.

Some variations of the indicator are resource-heavy, inflicting MT5 to decelerate when operating a number of pairs concurrently. Merchants with older computer systems typically expertise lag throughout high-volatility intervals when the indicator recalculates continuously.

How It Compares to Normal Order Circulation Instruments

Order circulate indicators aren’t new. The Liquidity Indicator competes with instruments like Delta Quantity, Cumulative Quantity Delta (CVD), and Market Profile. So what’s completely different?

Market Profile exhibits worth areas and quantity distribution, however doesn’t particularly determine institutional order clusters. It tells you the place most buying and selling occurred, not the place unfilled orders wait. CVD tracks shopping for versus promoting stress in real-time however doesn’t undertaking ahead to pending orders.

The Liquidity Indicator bridges that hole. It’s forward-looking in a method volume-based instruments aren’t. When mixed with one thing like a 20-period EMA for pattern route and RSI for momentum affirmation, merchants get a extra full image. The indicator handles the “the place” (liquidity zones), whereas conventional instruments verify “when” (entry timing).

In comparison with footprint charts utilized by futures merchants, the MT5 Liquidity Indicator is less complicated and extra accessible. Footprint charts require vital display screen time to interpret accurately. This indicator distills advanced order circulate into visible zones that don’t require months of studying curve.

That stated, skilled order circulate merchants utilizing platforms like ATAS or Sierra Chart entry deeper knowledge. The MT5 model works with retail dealer feeds, which suggests it’s an approximation of true institutional positioning somewhat than direct change knowledge. Nonetheless, for foreign exchange merchants caught with MT5 and retail brokers, it’s among the many higher choices accessible.

Learn how to Commerce with Liquidity Indicator MT5

Purchase Entry

- Worth sweeps beneath the liquidity zone and rejects – Await a wick beneath the pink zone on 1-hour EUR/USD, then enter when worth closes again above with 15-20 pip cease beneath the wick low.

- Double backside varieties at liquidity stage – When worth checks a inexperienced zone twice inside 4 hours with out breaking, purchase the third contact with a 25-pip cease on GBP/USD pairs.

- Liquidity zone aligns with every day help – Solely take buys when the indicator’s zone matches a every day chart help stage; this confirms institutional and technical confluence on 4-hour timeframes.

- Morning spike grabs liquidity throughout London open – If worth drops 20+ pips within the first half-hour of the London session to hit a zone, wait quarter-hour, then purchase if a reversal candle varieties.

- Danger 1% most per liquidity setup – Even with excellent zone alignment, by no means danger greater than 1% of account steadiness; false sweeps occur 30-40% of the time in uneven markets.

- Skip buys when main information releases loom – Keep away from entries inside 1 hour earlier than NFP, CPI, or central financial institution bulletins; liquidity zones develop into unreliable throughout high-impact occasions.

- Verify with RSI beneath 30 – Purchase alerts are strongest when worth hits a liquidity zone, AND RSI drops underneath 30 on the identical timeframe, suggesting oversold bounce potential.

- Exit 50% at 2:1 risk-reward – When commerce strikes 40 pips in revenue (with 20-pip cease), shut half place and path cease to breakeven on the rest.

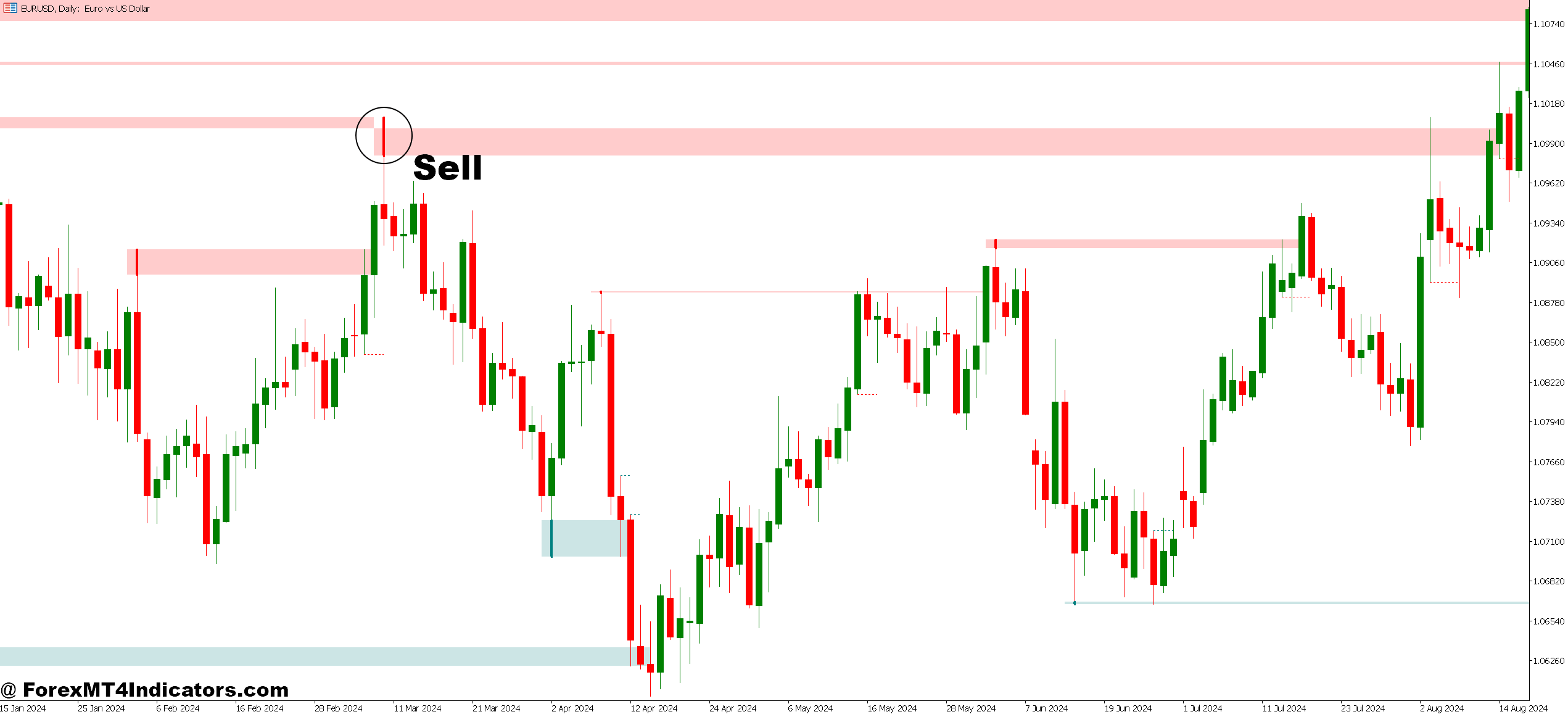

Promote Entry

- Worth spikes above the liquidity zone, then reverses – Brief when EUR/USD wicks 10-15 pips by a inexperienced zone onthe 1-hour chart, then closes again beneath it inside two candles.

- Triple prime rejection at pink zone – If worth checks the identical liquidity stage thrice on 4-hour GBP/USD with out breaking greater, promote the third rejection with 30-pip cease.

- Night pump targets New York liquidity – Look ahead to late-session rallies (3-5 PM EST) that spike into zones; these typically reverse sharply as establishments fill orders.

- Each day resistance confirms indicator zone – Solely brief when liquidity zone overlaps with every day chart resistance; standalone zones on decrease timeframes produce 50%+ false alerts.

- By no means promote in sturdy uptrends – Skip brief setups when worth is above 200-period shifting common on 4-hour chart, no matter liquidity zone hits.

- Cut back dimension throughout Asian session vary – Reduce place dimension by 50% for sells throughout Tokyo hours (midnight-5 AM EST); low quantity creates unpredictable liquidity reactions.

- Await bearish engulfing affirmation – Don’t brief instantly at zone contact; look ahead to a full bearish engulfing candle to shut earlier than entry on 1-hour timeframes.

- Set alerts, don’t chase – Place MT5 alerts 5 pips earlier than liquidity zones somewhat than watching screens; chasing entries after zone breach sometimes leads to late, poor-quality fills.

Making It Work in Actual Buying and selling

The Liquidity Indicator MT5 affords a window into institutional order circulate that the majority retail setups lack. It received’t substitute strong buying and selling fundamentals—danger administration, technique consistency, emotional management—however it provides a layer of market consciousness that may shift chances. For merchants prepared to be taught its alerts and combine them thoughtfully, it’s a precious addition to the technical evaluation toolkit. The query isn’t whether or not it’s excellent—no indicator is. The query is whether or not understanding the place large cash is positioned offers you a bonus. For a lot of merchants, that reply is sure.

Really useful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90