The Israel-Hamas battle dominated developments throughout key commodity markets final week. Gold benefited from secure haven flows, and oil costs spiked. Threat urge for food stabilized considerably right this moment, as traders watch efforts to comprise the battle.

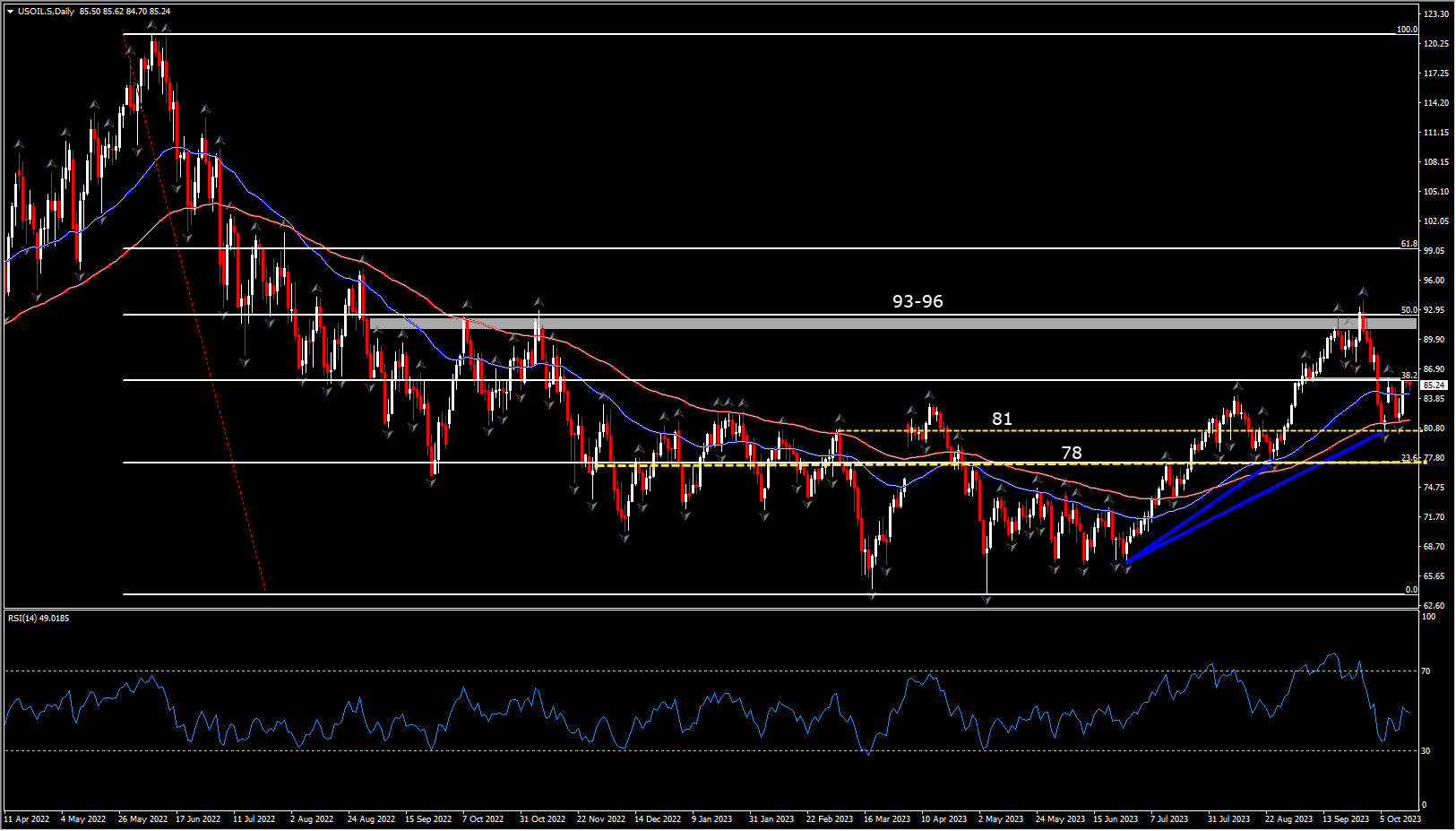

USOIL surged almost 6% on Friday and posted a weekly achieve of 5.9% amid concern that the battle between Israel and Hamas would widen. UKOIL traded at $90.89 per barrel on Friday, however costs have settled down considerably right this moment. For now, traders are watching efforts to comprise the battle, and markets are usually not actually pricing within the threat of an extra escalation that would doubtlessly threaten provides.

Nonetheless, the Worldwide Power Company warned final week that “markets will stay on tenterhooks because the disaster unfolds”. JPMorgan flagged that offer may very well be hit if the US have been to strictly implement restrictions on Iranian oil exports, or if the battle have been to result in disruption within the Strait of Hormuz. Iran officers in the meantime prompt {that a} floor assault on Gaza may immediate different militant teams to enter the battle. Towards that background, fears that oil may hit $100 a barrel have picked up once more.

Fuel futures declined right this moment, and US costs fell to the bottom degree in over every week amid elevated manufacturing and decreased exports to Mexico, in addition to forecasts of gentle climate by the tip of the month. In Europe costs have additionally settled, after rising sharply final week. TTF soared 41% to hit a excessive of EUR 56 per megawatt-hour on provide considerations and climate developments. Israel has morphed from a fuel importer to an exporter over the previous 20 years and manufacturing on the “Tamar” platform has already been halted within the wake of the battle.

On the similar time, strike motion at Chevron’s key fuel manufacturing websites is about to renew this week, which is complicating the image. A possible halt of the “Gorgon” and “Wheatstone” tasks, which collectively account for over 5% of worldwide liquefied pure fuel manufacturing capability, may additional undermine provide. In the meantime the investigation of the leak on the Balticconnector subsea fuel pipeline between Finland and Estonia is ongoing, however Nordic and Baltic seismologists mentioned that that they had detected blast-like waves final Sunday when the pipeline ruptured. They prompt that the information was not robust sufficient to say whether or not explosives have been concerned. Official companies have prompt that mechanical injury and never an explosion appeared just like the almost definitely trigger, however provide stays disrupted.

Europe’s fuel storage ranges are nearly full however are inadequate to defend the world by the winter, which suggests EU nations will depend on ongoing deliveries. That is very true if the climate turns hostile. For now, European fuel costs have settled down, and TTF is -8.9% decrease than on Friday, whereas UK fuel has corrected by -9.3%. Each are nonetheless up 40% in comparison with the identical time final month, and whereas costs are significantly decrease than within the corresponding interval final 12 months, developments spotlight that central banks must consider a doable back-up in vitality costs.

The gold worth has benefited from secure haven demand, and it surged greater than 3% on Friday as markets watched developments within the Center East and Israel’s preparation for a floor assault. Threat aversion eased considerably at the beginning of this week and haven flows receded, however bullion is presently nonetheless buying and selling at $1,920 — greater than 3% increased than every week in the past.

Within the larger image, XAUUSD skilled a slight pullback after being overbought, with the 200-day EMA offering assist and catching traders’ consideration. The pivotal query is whether or not the market can keep this degree; a breakdown may result in additional corrections, presumably dropping to $1900.

Shorting the market is dangerous given current surges, and a considerable correction is unsure. Merchants may take into account shorting provided that gold falls beneath $1900 or reverses and breaks above $1950, doubtlessly reaching $2000. The market is presently at a battle level, indicating erratic worth actions. Warning is suggested, with a necessity to watch US rates of interest, as rising charges sometimes result in decrease gold costs, a correlation supported by current market conduct.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a basic advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.