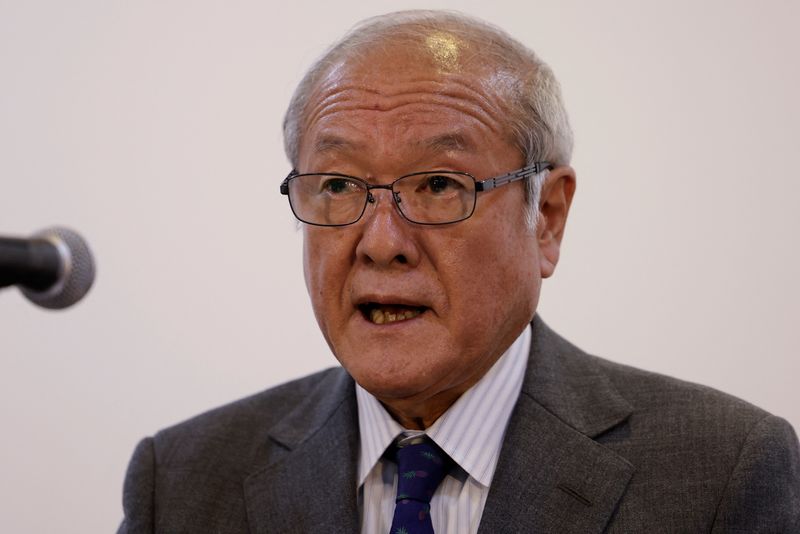

© Reuters. FILE PHOTO: Japanese Finance Minister Shunichi Suzuki arrives for a information convention in the course of the annual assembly of the Worldwide Financial Fund and the World Financial institution, following final month’s lethal earthquake, in Marrakech, Morocco, October 13, 2023. REUTERS

By Leika Kihara

MARRAKECH, Morocco (Reuters) – Japanese Finance Minister Shunichi Suzuki stated on Friday he advised his G20 counterparts that Tokyo could have to take “acceptable motion” within the exchange-rate market as world financial tightening might heighten volatility in foreign money strikes.

The remarks got here because the yen renewed its declines in opposition to the greenback, and underscored Tokyo’s resolve to maintain markets on edge over the possibility of exchange-rate intervention to prop up the Japanese foreign money.

“I advised the G20 assembly we should be conscious of the chance that market volatility might heighten, together with within the foreign money market, as financial tightening continues globally,” Suzuki advised a information convention after attending a gathering of Group of 20 (G20) finance ministers and central financial institution governors.

“I additionally stated extra volatility within the foreign money market was undesirable, and that we could have to take acceptable motion relying on developments,” Suzuki stated.

The greenback rose broadly on latest sturdy U.S. inflation information, on expectations the U.S. Federal Reserve will hold charges increased for longer.

The greenback fetched 149.53 yen on Friday, not removed from the 150 mark seen by merchants as Tokyo’s line-in-the-sand for foreign money intervention.

A senior Japanese ministry of finance official advised reporters that whereas Suzuki’s newest feedback said the apparent, the very fact they have been made on the G20 flooring in instances of heightening market volatility was significant.

The official stated Tokyo stood able to act within the foreign money market if market strikes turn out to be too unstable.

A weak yen boosts Japanese exports, but in addition pushes up the price of importing gasoline and uncooked supplies, giving Tokyo coverage makers a headache. Japan final intervened within the foreign money market to prop up the yen in September and October final 12 months.

Financial institution of Japan Governor Kazuo Ueda advised the identical information convention that his views on the worldwide financial outlook haven’t modified a lot, after attending the Group of Seven (G7) and G20 finance leaders’ gathering this week.

The outlook for the worldwide economic system is amongst components the BOJ will scrutinize in figuring out the timing for phasing out its large stimulus program, analysts stated.

Markets are specializing in the BOJ’s new quarterly development and inflation forecasts, set for launch at its subsequent two-day coverage assembly that concludes on Oct. 31.

The G7 and G20 conferences have been held on the sidelines of the annual Worldwide Financial Fund and World Financial institution assembly in Marrakech this week.