The Drawback with Conventional Grid Buying and selling

Grid buying and selling is without doubt one of the hottest methods amongst retail merchants due to its simplicity. A grid EA locations purchase and promote orders at fastened worth intervals, aiming to revenue from market fluctuations no matter path.

Nonetheless, the largest weak point of conventional grid methods can be their defining function: they open trades blindly, with out understanding market construction, development path, or momentum.

This method works quickly in ranging markets, however it behaves like playing throughout sturdy developments. When worth strikes aggressively in a single path, blind grids preserve including dropping positions, resulting in extreme drawdown or full account wipeout.

The true downside will not be grid buying and selling itself — the issue is utilizing grids with out market intelligence.

Why Grid Buying and selling Acquired a Dangerous Popularity

Grid buying and selling is commonly criticized as a result of many implementations ignore market context. In sturdy developments, a grid that retains averaging in opposition to worth can accumulate giant floating losses in a really brief time.

This habits has led to the notion that grid methods are inherently unsafe. In actuality, most failures come from poor management logic, not from the grid idea itself.

A grid is just a place administration technique. With out path, filters, or limits, it behaves randomly. With construction and guidelines, it turns into predictable.

The popularity downside comes from how grids are used — not what they’re.

Ranging vs Trending Markets: Why Context Issues

Markets don’t behave the identical manner always.

In ranging circumstances, grids can carry out effectively as a result of worth naturally oscillates between help and resistance ranges. In trending circumstances, nonetheless, the identical grid logic can turn into harmful if it continues so as to add positions in opposition to momentum.

A trend-aware grid technique first classifies market state:

- Vary

- Weak development

- Sturdy development

Based mostly on this classification, the system can:

- Allow grids

- Prohibit grids to at least one path

- Cut back place dimension

- Pause buying and selling utterly

This easy context test dramatically modifications long-term survivability.

Including Market Intelligence to Grid Buying and selling

A contemporary grid technique doesn’t must guess. It will possibly observe, filter, and align with the market earlier than inserting any grid orders. As a substitute of opening grids mechanically, a wise grid system first solutions three important questions:

Is the market trending or ranging?

What’s the dominant path?

Is momentum sturdy sufficient to justify new positions?

That is achieved by integrating development detection and technical indicators immediately into the grid logic.

1. Development-Aligned Grids As a substitute of Bidirectional Playing

Moderately than opening each purchase and promote grids on the identical time, a trend-aware grid system:

Opens buy-only grids in bullish circumstances

Opens sell-only grids in bearish circumstances

Avoids buying and selling utterly when circumstances are unclear

Widespread instruments used for this embrace:

This single change dramatically reduces drawdown throughout sturdy market strikes.

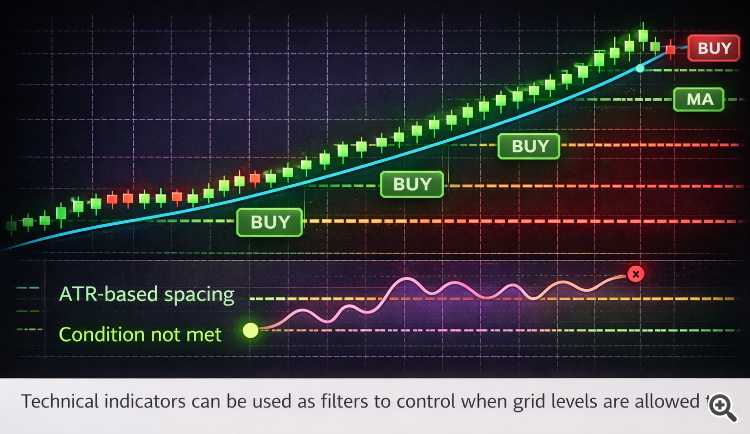

2. Indicator-Filtered Grid Entries

Grid spacing alone will not be sufficient. Good grid methods use indicators as entry filters, not indicators.

Examples:

RSI or momentum indicators to keep away from shopping for into overbought circumstances

Volatility filters to stop grids throughout excessive market spikes

ATR-based spacing to adapt grid distance dynamically to market circumstances

This transforms the grid from a static lure right into a responsive system that adapts to market habits.

3. Conditional Grid Enlargement As a substitute of Mounted Layers

Conventional grids preserve including positions it doesn’t matter what. A contemporary grid system expands solely when:

If circumstances change, the system can:

Pause new grid ranges

Cut back place dimension

Shut publicity early

This makes the grid behave extra like a skilled position-management device reasonably than a martingale.

Threat Management: The Lacking Layer in Most Grid Methods

Many grid methods fail as a result of threat is managed implicitly reasonably than explicitly. A contemporary grid system ought to outline:

Most variety of grid ranges

Most whole publicity per image

Most acceptable drawdown

Circumstances for compelled shutdown

When mixed with development and indicator filters, these limits forestall grid growth from turning into uncontrolled averaging. Threat management doesn’t scale back profitability — it ensures the technique can keep out there lengthy sufficient to be worthwhile.

From Playing Logic to System Logic

Grid methods fail after they assume the market will all the time return. They succeed after they function beneath the belief that typically it is not going to.

By incorporating development evaluation, indicator affirmation, and strict threat boundaries, grid buying and selling shifts from hope-based logic to system-based choice making.

Conclusion

Grid buying and selling doesn’t need to be reckless.

By combining development evaluation, technical indicators, and adaptive logic, grid methods can evolve from high-risk playing instruments into managed, rule-based buying and selling methods.

A wise grid technique:

Trades with the market, not in opposition to it

Reduces pointless drawdown

Avoids catastrophic development publicity

Behaves predictably beneath stress

The way forward for grid buying and selling will not be about including extra orders — it’s about including higher choices earlier than inserting them.

Grid buying and selling isn’t useless. Blind grid buying and selling is.