Introduction

Optimus Time Tracker Indicator

Worthwhile Buying and selling often happens when we’ve the percentages in our favour, though we might not must be proper on a regular basis to earn a living, we not less than must be assured within the method we’re taking once we speculate.

Technical evaluation and principally all type of evaluation is constructed on the truth that “Historical past is More likely to repeat itself” from learning the occasion of the previous we are able to have the ability to uncover patterns in information which then kind the premise of our resolution making..

The Theme of Possibilities run by means of out the buying and selling trade and for good cause, buying and selling is a numbers recreation and a recreation of odds, Merchants are in a relentless bid of weighing the chance of 1 final result over the opposite final result. That is the fundamental idea of how worthwhile buying and selling must be. Nonetheless to ensure that us to correctly estimate possibilities we must have in useful the info and statistics that backs every final result, solely then can we correctly body the thought for one final result over the opposite.

Technical evaluation is constructed on 2 pillars; 1. Time 2. Worth. In depth work and analysis has been carried out within the discipline of worth nevertheless, little or no emphasis and a focus has been given to time for probably the most half, this leaves an uncharted edge within the discipline of Time.

Now, that is the place the mixing of the Optimus Time Tracker Indicator Is useful, This indicator is constructed to Accumulate the Knowledge and Show the Statistics of an important Components of Time relative to cost, the end result produced are eye opening and one may instantly see patterns as to how worth is contained inside finite time constructs, and from this information alone one can carve out a worthwhile buying and selling method counting on the statistics and possibilities surrounding the Subject of Time.

On this publish our goal is to disclose the varied methods one may apply the data generated by the Optimus Time Tracker Indicator in ones Buying and selling routine or method, we indulge you to remain tuned in till the top, as this learn will certainly be worthwhile…

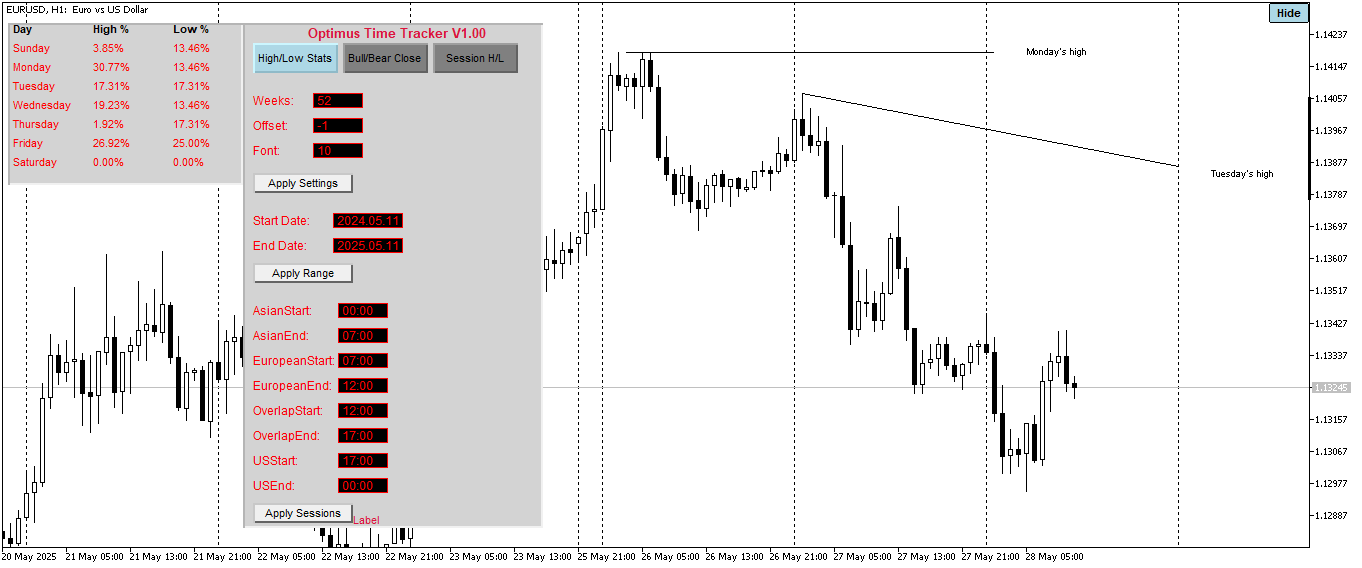

The Weekly Excessive and Low Statistics

That is the primary mode of the indicator, and it gathers information on the frequency with which every day of the week varieties the excessive or low for the weeks inside the lookback interval or the customized vary enter. This data is very invaluable, because it provides us perception into once we can usually count on these vital worth factors to kind…… This may assist how merchants analyze and the way we decide our bias particularly when lined up with market construction…

instance; When worth is approaching a Degree of help on a Tuesday and from our stats we are able to see that Tuesday is extra more likely to kind the low of the week, and worth has a bullish construction, this may also help us decide that the help will maintain and Wednessday’s worth motion is likey to remain above Tuesday’s low and we’d be trying to go lengthy on Wednessday, and on that Tuesday we’d be looking forward to worth motion indicators indicating that worth has discovered help solidifying that the low of the week has been made.

Let’s Take a look at an precise Current instance; within the chart above we are able to see that our lookback interval is about to 52 weeks, this implies we’re contemplating the final 52 weeks which is one 12 months from the earlier week, and on this instance we are able to see that monday has a 30.77% probability of creating the excessive of the week, having this in thoughts we then check out the market construction, and we are able to see that worth delivered a robust bullish growth from Thursday of the earlier week, this counsel to us that there’s a excessive probability that worth is most apt to retrace off the highs to kind a extra sustainable construction and with that risk we are able to see that there’s a excessive chance for the excessive which was made on Monday to be protected, and for Tuesday to increase to the draw back.

This can be a legitimate commerce situation and we’d additionally break it down additional to see how the opposite modes of the Optimus Time Tracker Indicator performed key roles in making this commerce a excessive chance commerce.

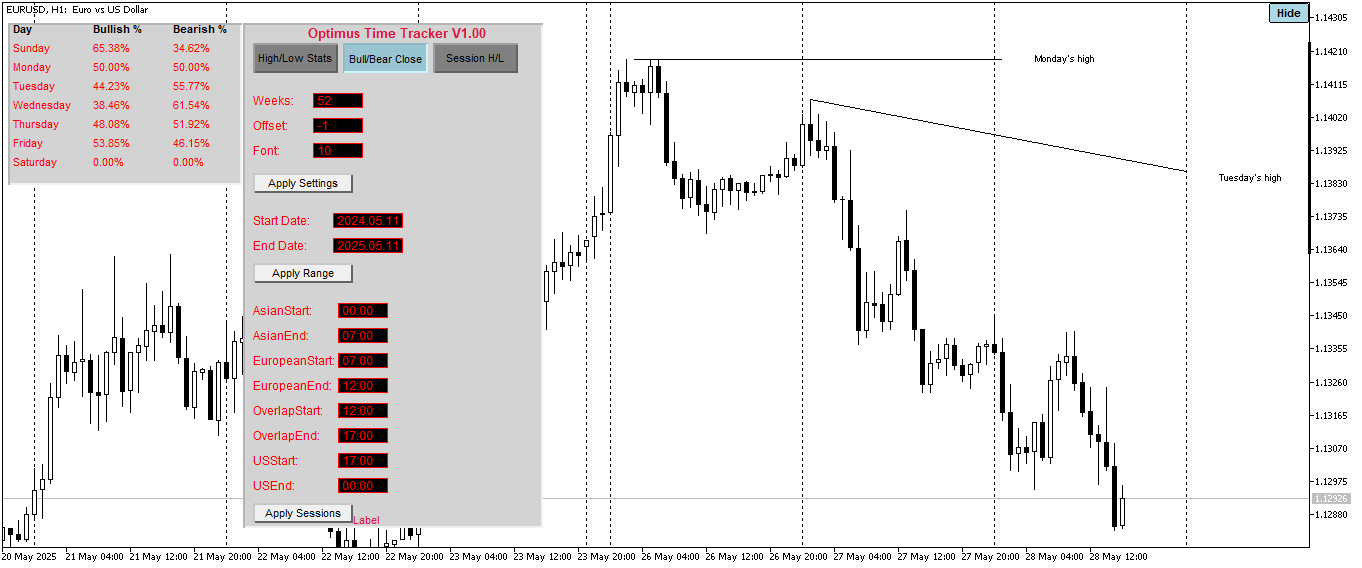

The Bullish and Bearish Shut Mode

This Mode could be very essential within the willpower of bias as this mode cuts straight by means of the info and extracts the perception into the frequency for the way every day of the week closes both Bullish or Bearish. You would be supprised the hidden patterns we uncover once we take a eager look into what this information tells us. Occassionaly we see some days which have an uneven weighing for the distribution of the shut both within the bullish or the bearish camp for the times of the week. when a day of the week has a studying that’s above 50% on one camp over the opposite, it means that there’s a greater probabilities for that exact day to shut on that facet of the fence. This will likely sound like a easy or naive interpretation of the info, however thoughts you that this information updates each new week guaranteeing that the studying is present and related to cost. You would be supprised how the growing days of the present week have a excessive chance of closing as recommended by the Knowledge. Nonetheless we shouldn’t be carried away by the readings of the info on this mode and count on on a regular basis to shut in accordance with what the info tells us, We should always do not forget that our job as merchants or speculators is to weigh the chance of favorable outcomes when sure variables and components are current. Having this in thoughts, our commerce choice course of ought to embrace utilizing this information as a information or a confluence after which choosing trades which can be in alignment with what this information suggests.

The next instance will shine extra gentle on how the Bullish and Bearish Shut Mode may be utilized together with the opposite mode, including an additional layer of confluence and total complementing the present market construction;

Within the chart Instance above we are able to see that on the Bullish and Bearish Mode, Tuesday has Closed Bearishly 55.77% of the time inside the lookback interval, which is the final one 12 months counting from the final accomplished week. This alone is insightful and when this aligns with what the present market construction is suggesting, it will increase the probablilty that the bearish motion will unfold. now let us take a look at how this provides as much as the readings of the earlier mode;

Within the Weekly Excessive and Low Stats we may see that Monday had the very best frequency for making the excessive of the week, this to start with suggests to us that about 30% of the weeks inside the look again interval had bearish expansions that ensued from monday, the primary buying and selling day of the week. Having this in thoughts plus the present bearish construction, it isn’t inprobable for us to anticipate that Tuesday will ship to the draw back. Now if Monday is apt to make the excessive of the week and Tuesday is extra more likely to shut as a bearish bar, we’re then inclined to hunt for a possibility to take a brief place on Tuesday. That is the place the subsequent mode of the Optimus Time Tracker Indicator Is available in Helpful, “The Excessive and Low of the Day By Session Mode”.

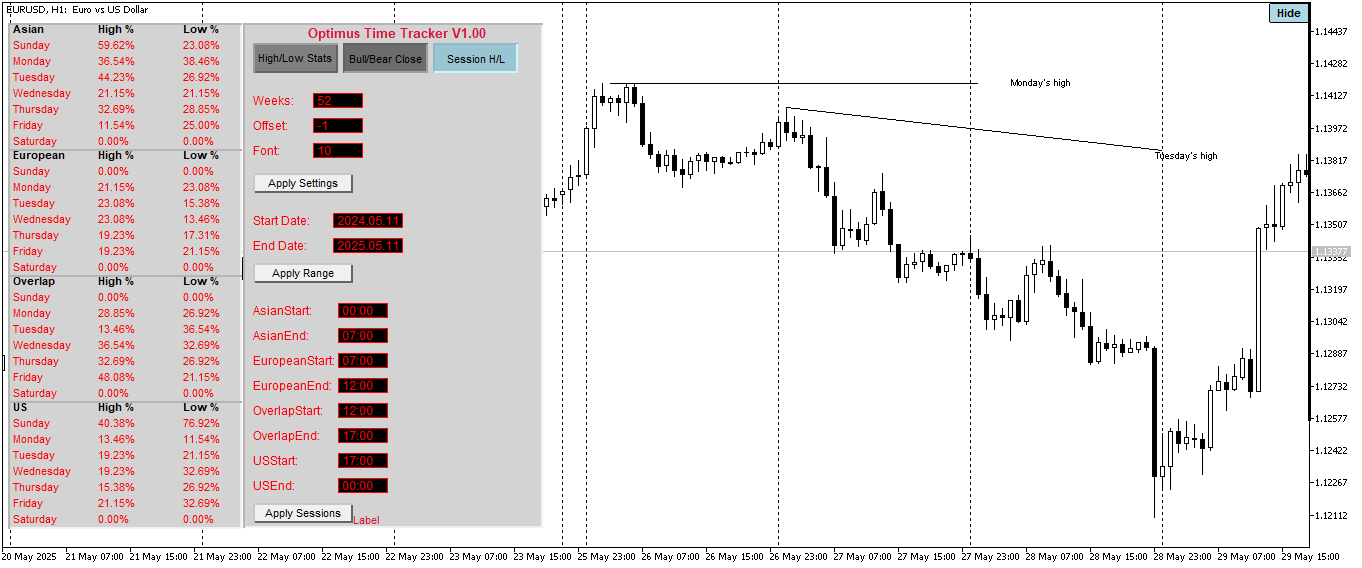

The Excessive and Low of The Day by Session Mode

This modes collects and Calculates the info on the frequency of the classes that made the excessive and low of the day for every of days of the week inside the look again interval or the customized vary enter, the session are distributed into 4 sections and it is boundaries are outlined by the consumer enter, if the consumer prefers the session boundary time to be aligned to his or her native time, the consumer can modify the server Offset enter if the native time differs from the dealer time; in any other case, the offset ought to be set to zero to take care of the dealer’s time. The session are divided into; Asian Session, London Session, Overlap Session and the New York Session. Mainly this are the trade customary classes. Now, how does this information assist our resolution making as to what worth is more likely to do? To reply this query we are going to discuss with the present instance we have been Making good use of and see how this might have added an additional layer of readability to the commerce situation from Tuesday’s Worth motion.

Lets Discover the wealthy perception we are able to extract from the readings of the info of the Excessive and Low of the Day by Session Mode, within the Chart Instance Above, we are able to see that the excessive of the day on Tuesday often varieties within the Asian Session by a Robust Studying of 44.23%, that is unimaginable, and we are able to additionally see that the low on Tuesdays inside the lookback interval Usually varieties within the Overlap Session with a Robust studying of 36.54%, having this in thoughts and likewise contemplating the readings of the earlier modes, the Likelihood for worth to increase to the draw back skyrockets. Now, once we check out the value motion on Tuesday, we may see that the excessive on Tuesday digged into the FVG from Monday’s worth motion, it did not take out Mondays excessive after which reversed kind that time, this occured inside the Asian session and worth expanded to the draw back and the low of the day was made inside the Overlap Session.

Having all this in alignment, the Decline on Tuesday now not appears to be a product of randomness and our resolution making is niether a product of guess work, we rigorously accessed the attainable outcomes then primarily based on the Statistics of the info from the Optimus Time Tracker Indicator in confluence with easy Market Construction Ideas, we selected probably the most Possible final result.

In Life typically, Simplicity is essential and this additionally applies in Buying and selling, the extra simplified our buying and selling methodology may be the simpler it’s for correct execution, the Optimus Time Tracker Indicator presents such simplicity and the method defined on this publish is only one approach it is data might be utilized, there a number of different methods this data may be utilized which all depends upon the wealthy creativeness and perception of the consumer.

Get the Optimus Time Tracker Indicator Right now and Discover its limitless Potentials.