What do you get when you put two merchants aspect by aspect for 4 weeks with the very same coaching and buying and selling plan? Most certainly, you’re going to get dramatically totally different outcomes. Buying and selling is a extremely individualistic career, and no two merchants assume precisely alike or possess the identical stage of pure buying and selling talent, intelligence, expertise or instinct. Whenever you’re a pupil of the markets attempting to develop your capacity to seek out top-quality buying and selling indicators on the charts, even after years of research, it may nonetheless be mentally difficult and disturbing.

What do you get when you put two merchants aspect by aspect for 4 weeks with the very same coaching and buying and selling plan? Most certainly, you’re going to get dramatically totally different outcomes. Buying and selling is a extremely individualistic career, and no two merchants assume precisely alike or possess the identical stage of pure buying and selling talent, intelligence, expertise or instinct. Whenever you’re a pupil of the markets attempting to develop your capacity to seek out top-quality buying and selling indicators on the charts, even after years of research, it may nonetheless be mentally difficult and disturbing.

There may be clearly a plethora of variables and influences that have an effect on a dealer’s resolution making course of when analyzing a chart, discovering a buying and selling sign after which executing a commerce. At present I’m going to speak about the primary problem on this course of; filtering unhealthy indicators from good indicators.

It’s most likely secure to say that you just wrestle together with your buying and selling selections generally, you wrestle to tug the set off as a result of a insecurity, otherwise you wrestle since you aren’t positive if this can be a ‘good sign’ or a ‘unhealthy sign’. Understanding what to search for and what one of the best indicators appear to be is without doubt one of the most important steps to rising your chart-reading abilities and confidence in your buying and selling capacity.

On this lesson, we’ll focus on a easy buying and selling sign mixed with varied ‘filters’ {that a} dealer might search for to enter trades. Take into accout, the sign itself could possibly be substituted with different methods or indicators of your selecting. The aim of this text is to give you a information to ‘filter’ your buying and selling indicators and construct your confidence.

Ideas for filtering commerce indicators

The next ideas for filtering trades may be utilized to any commerce sign or entry set off, however we’re primarily utilizing each day chart pin bar methods within the examples under, in addition to one 4 hour chart instance. It must be famous earlier than continuing that these aren’t “inflexible” guidelines however extra like normal filters that it is best to apply with discretion:

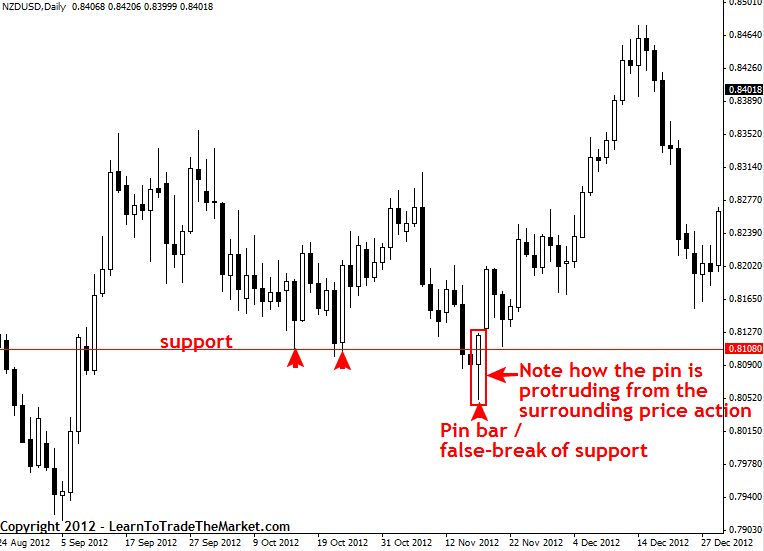

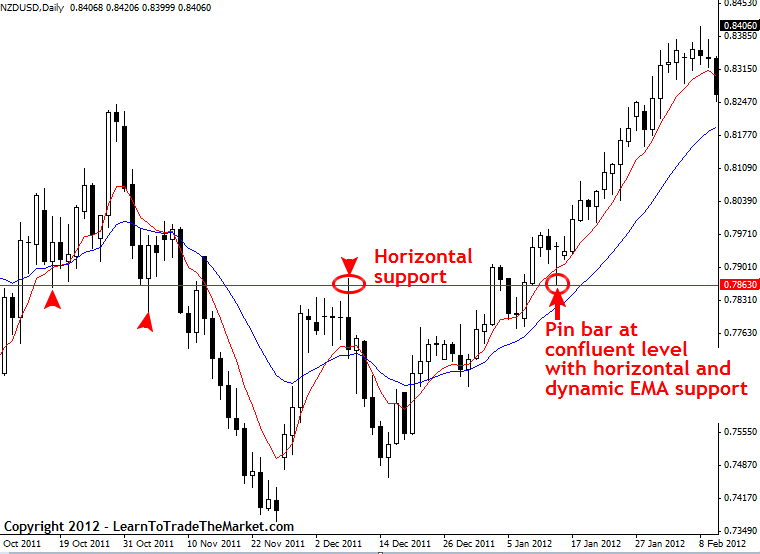

1. Search for a sign with a protruding tail that creates a false-break of a stage

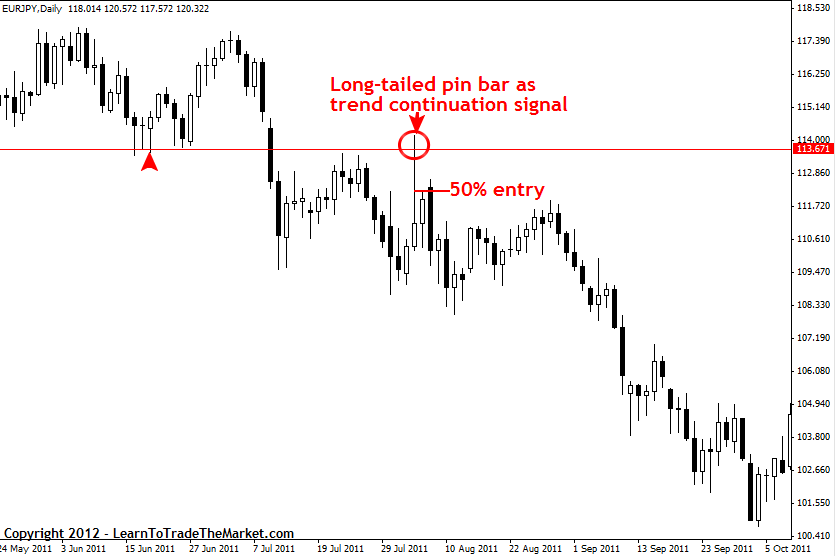

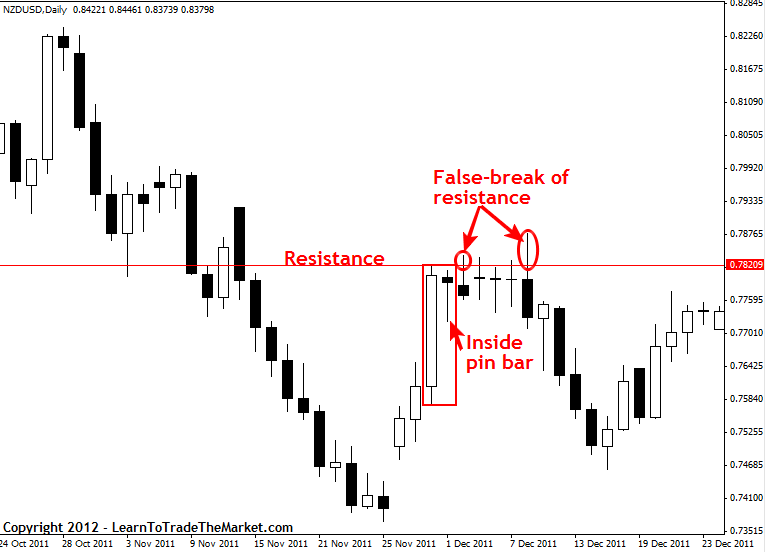

Once we see a reversal / rejection sign like a pin bar with the tail or “rejection half” of the sign clearly protruding from a key stage available in the market, it’s a sometimes a really high-probability sign. When a pin bar sign has a tail that protrudes by way of a stage, it additionally implies that it created a false break buying and selling technique, and a false-break of a stage provides much more weight to any sign. A false-break of a key stage is an important occasion, it exhibits that the market couldn’t maintain itself under or above an essential stage and {that a} transfer in the wrong way is very possible. We will see an instance of a pin bar sign that protruded by way of a key assist within the NZDUSD, making a false-break of that stage:

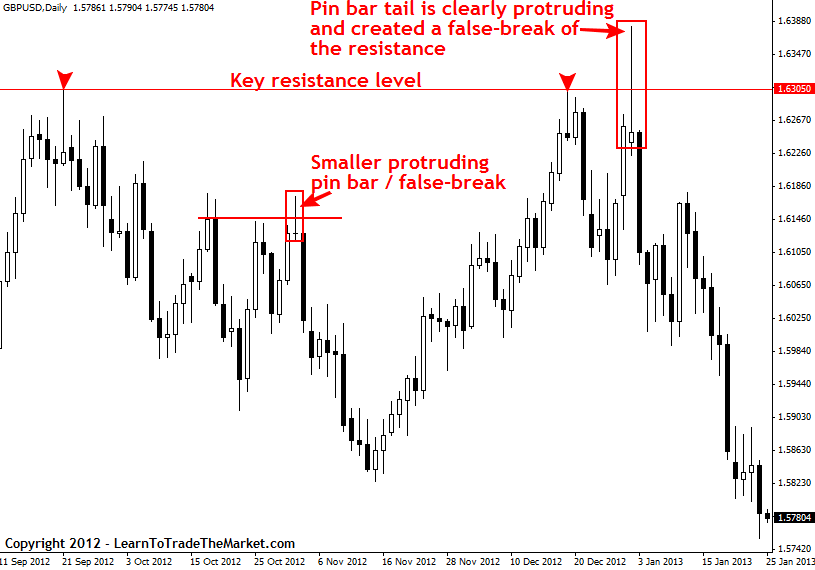

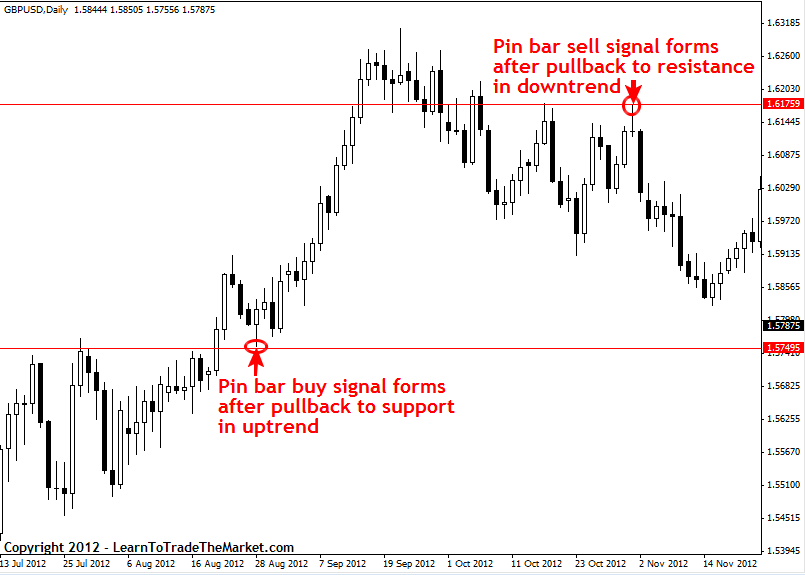

Within the GBPUSD chart under, we will see two extra examples of pin bar indicators that had clear and apparent protrusions by way of a stage and that additionally created false-breaks of the degrees. Each of those indicators result in substantial strikes decrease, in truth, worth continues to be transferring decrease as of this writing from the long-tailed pin bar that created a false-break by way of 1.6300 resistance on January 2nd:

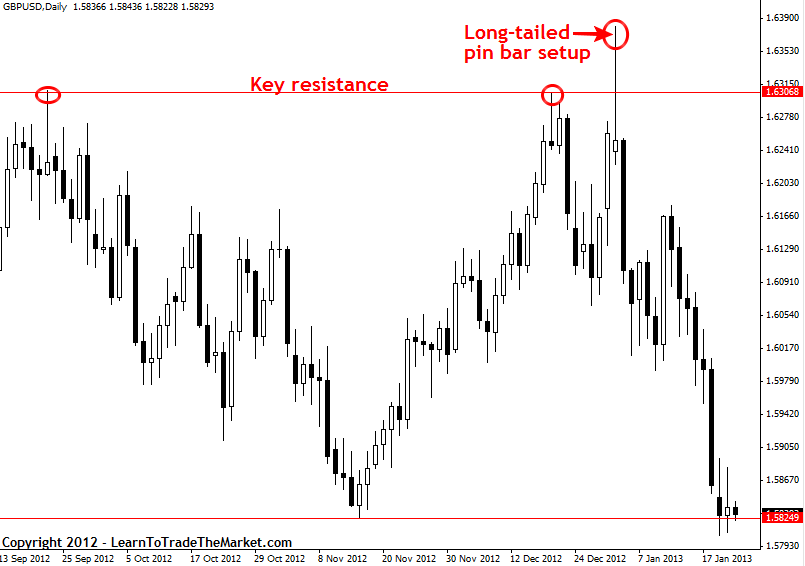

2. An extended-tailed pin bar is a high-probability pin bar

The tail on a pin bar is essential, it exhibits rejection of worth. It’s secure to say, typically talking, the longer the tail on a pin bar the extra “forceful” the rejection of worth. This basically implies that a longer-tailed pin bar is extra vital than a shorter-tailed pin, and that longer tail helps to “spring” costs in the wrong way. It doesn’t imply that ‘each’ long-tailed pin bar works out completely, however actually a lot of them do and it’s a high-probability setup that must be a staple of any worth motion dealer’s buying and selling plan. Be aware additionally that within the GBPUSD instance under, the long-tailed pin bars tail was clearly protruding and created a false-break of a key resistance, as we mentioned within the earlier tip:

Within the instance under, we will see a long-tailed pin bar that occurred throughout the context of a downtrend within the EURJPY. Whenever you see a transfer towards a development after which a long-tailed pin bar kinds, it’s a very good clue that the retracement is terminating and the development will resume from the long-tailed pin bar. The important thing right here is motion; when worth is transferring then the pin bars or different indicators are going to be rather more efficient than they are going to be in stagnate or consolidating market. Be aware the 50% retrace entry of the pin bar, that is an entry method we train on our programs and it really works good on long-tailed pins, providing you with a significantly better threat reward potential because of the tighter cease loss distance.

3. Don’t “guess” on a breakout…look ahead to affirmation as a substitute

Merchants usually get sucked into tempting trying breakout trades. Many breakouts lead to false-breaks as we noticed earlier. Whereas there’s no “positive approach” to know whether or not any given breakout will likely be a real one or a fake-out, it’s high-risk buying and selling proper right into a key resistance or assist; the nearer a market is to a key stage, the much less likelihood it has of constant. Don’t guess on a breakout earlier than it occurs, as a substitute look ahead to an in depth above or under the extent, as a result of you possibly can all the time enter later after the breakout on a retrace. Inside bars trigger loads of false-break situations like these, particularly when a market is range-bound and never trending or if the within bar setup is implying a counter-trend breakout like we see under:

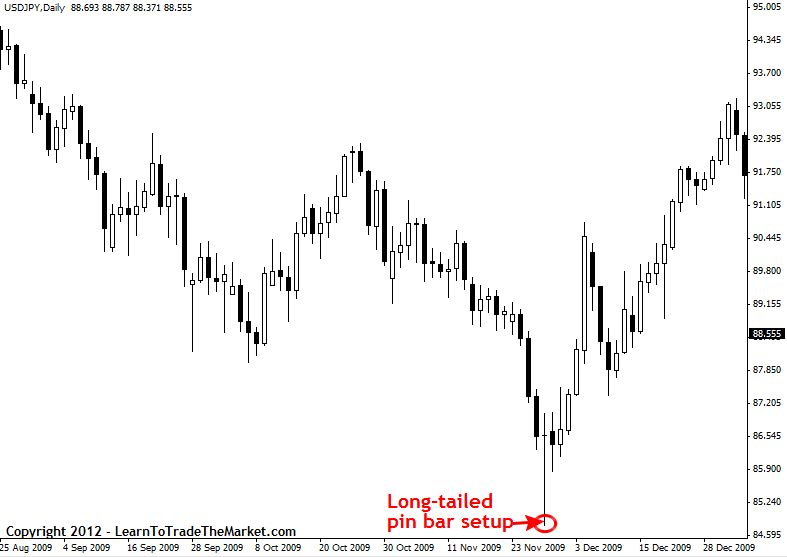

4. Lengthy-tailed pin bars work excellent as reversals after a sustained transfer

One facet of long-tailed pin bars that can be utilized as a sort of filter is that they have an inclination to work very nicely after a sustained transfer in a single path; usually marking essential market turning factors and even long-term development adjustments. For instance, within the USDJPY chart under, we will see {that a} long-tailed bullish pin bar occurred after a sustained downtrend, then the pin kicked off a big transfer increased…

5. Search for continuation indicators after a pullback to assist or resistance within the development

One of many “bread and butter” buying and selling filters that I apply regularly is to easily search for retracements or “pullbacks” to assist or resistance inside a trending market. For instance, within the chart under we will see each an uptrend and a downtrend within the GBPUSD. Be aware how within the uptrend the retrace was fairly small…however the development was clearly up and the pin bar had “confluence” with a key assist stage available in the market…so it was a high-probability setup. Within the downtrend portion, the retracement to resistance was a extra vital pullback, and we had a key resistance stage being rejected throughout the broader downtrend…this ended up being a really profitable sign as nicely.

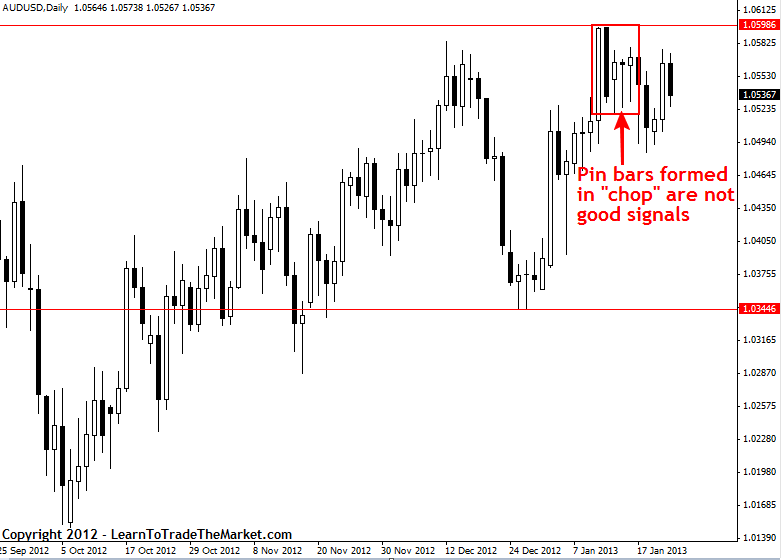

6. Don’t commerce indicators in tight “chop”

Buying and selling indicators that type in the midst of thick consolidation, also called “chop”, is normally a foul concept. For instance, when you see consecutive bars of consolidation for a time frame, after which a pin bar sign kinds inside that chop…the sign turn out to be much less legitimate. ALWAYS look ahead to momentum and a confirmed break of the uneven congestion space to validate your sign…a “confirmed” break can be an in depth exterior of the chop. Beneath, we see an instance of some latest pin bars that failed on the AUDUSD, word how there was no protrusion from the encompassing worth motion and that they fashioned in the midst of “chop”:

7. Search for “confluence”

A “confluent stage” is solely a stage that has at the least two supporting elements behind it. These elements is likely to be an apparent assist or resistance stage with a dynamic EMA stage, or a 50% retrace and a key assist and resistance stage; the extra the merrier. Merely put…confluence provides weight to ANY commerce sign. In search of a sign that kinds at a confluent level available in the market is without doubt one of the finest filters for separating a ‘good’ sign from a ‘unhealthy’ sign. Be aware: while generally you possibly can commerce a each day chart sign that didn’t happen at an clearly confluent stage, you need to keep away from buying and selling 4 hour indicators or 1 hour indicators that don’t have any confluence with different supporting elements (see level 8 for an instance of this)

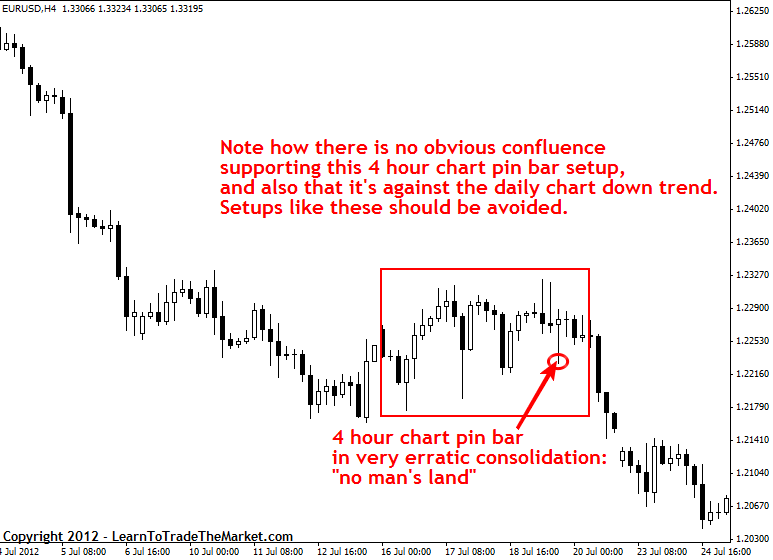

8. Keep away from indicators that type in “no man’s land”

Probably the greatest “filters” is definitely the dearth of any supporting elements or confluence. If you happen to see a commerce setup that’s basically simply “floating” in “no man’s land” with out something to present “weight” to it, it’s most likely a very good setup to go on. That is much more correct for intra-day indicators. A 4 hour or 1 hour sign with none kind of confluence behind it’s normally not a high-probability setup value buying and selling. See the instance under:

You shouldn’t need to “assume” too arduous about whether or not or not a setup is legitimate

The purpose of utilizing filters like those we mentioned above is that it is best to by no means “guess” a few commerce setup or attempt to persuade your self a setup is legitimate. The most effective indicators will “leap” out at you and are so apparent that you just don’t even enter into that mindset of guessing and attempting to persuade your self a sign is value taking. Bear in mind, the market will all the time be there, so go away any sense of urgency on the door…when you’re not “positive” that your sign is there ready so that you can commerce it, then stroll away, there will likely be one other sign tomorrow or the subsequent day.

Don’t get caught up in fretting over what “may have been”

If you happen to go on a commerce and it goes on to work out in your favor, study from it, and enhance your data type it, however don’t beat your self up or fall into the lure of believing your lacking all these ‘nice indicators’… keep in mind even a number of the worst indicators can find yourself figuring out, and when you begin instructing your self with ‘hindsight’ and telling your self “oh i ought to have traded that and subsequent time I’ll”… you’re actually going to confuse the hell out of your unconscious and it’ll find yourself destroying your buying and selling profession. So while it is best to study from every potential missed commerce, you shouldn’t turn out to be emotional or “apprehensive” that you’re “dropping cash” since you’re passing up some good setups.

Studying to go on trades is a part of being a dealer, and as you get your individual filters down like those we mentioned above, you’ll begin to develop a extra refined sense of which indicators are value buying and selling and which aren’t, over time you’ll get higher at this. A very powerful factor is to stay sickeningly affected person on the sidelines…let loads of trades go and don’t get connected to hindsight commerce setups that

“would possibly” have labored out for you.

The “large boys” know methods to filter their trades

If you happen to’ve fallen prey to considering that the “large boys” are buying and selling 100 occasions a day and day buying and selling till their eyes bleed, you’re mistaken. Lots of the guys with large cash wait on the sidelines patiently and “pounce” solely when one of the best indicators, ranges and traits are current on their charts. It’s essential study to assume like the massive boys, act “as if” you’re a “participant”; be clever and cease utilizing the marketplace for leisure and begin treating this as an actual enterprise.

The most effective and most rational clarification for why it is best to commerce much less is as a result of there are inherently much less good indicators for any technique or system; give it some thought…the explanation a sign is high-probability is as a result of it doesn’t occur extraordinarily usually, if it did then it wouldn’t be a high-probability occasion would it not? If you happen to power your self to commerce on a regular basis you’re going to be taking a big amount of ineffective and second-rate indicators, that is merely a waste of your money and time.

Making a filter guidelines for you trades

train for any dealer is to create their very own guidelines of various filters that they use to scan the markets for potential indicators. You’ll be able to simply create a fast guidelines with one to 3 sentences describing what the filter is after which an instance picture of the filter below it.

Right here’s an instance filter guidelines that I’ve created from the examples above (in yours you’ll place an instance picture under or subsequent to every sentence like those above however possibly slightly smaller):

1. Search for a sign with a protruding tail that creates a false-break of a stage. Look ahead to apparent protrusions and false-breaks of key ranges available in the market. This filter may be utilized to trending markets or to counter-trend trades. Wherever you’ve a key assist or resistance stage, preserve a watch out for false-breaks / protrusions of that stage.

2. An extended-tailed pin bar is a high-probability pin bar. Lengthy-tailed pin bars work very nicely in trending markets and as counter-trend indicators, as we noticed within the examples above. An extended-tailed pin bar is all the time one thing to maintain a watch out for when analyzing the markets.

3. Don’t “guess” on a breakout…look ahead to affirmation as a substitute. filter to make use of for tempting trying breakout trades is to attend for the breakout and shut above or under the extent. Then, the breakout is “confirmed” and you can begin in search of a sign within the path of the break. It will aid you keep away from many false-breaks, particularly in range-bound markets.

4. Search for continuation indicators after a pullback to assist or resistance within the development. Development continuation indicators are a ‘bread and butter’ technique that you’ll want to look ahead to.Look ahead to traits after which retracements inside these traits, then preserve a watch out for indicators forming from “worth” areas that point out the development would possibly resume.

5. Don’t commerce indicators in tight “chop”. Be cautious buying and selling pin bars or different indicators that type in thick and uneven consolidation. If you happen to see two or three pin bars in a row as in our instance above and the market shouldn’t be coming off within the path implied by the pins, it’s a sign that it’s most likely not going to come back off. We have to see momentum and a transparent breakout from consolidation earlier than coming into from a sign fashioned in “chop”.

6. Search for “confluence”. Look ahead to apparent “sizzling factors” available in the market, or areas the place two or three or extra ranges are intersecting…these are very high-probability ranges to commerce from.

7. Keep away from indicators that type in “no man’s land”. This one is form of the alternative of the confluence level. If you happen to see a sign that simply appears to be like prefer it fashioned with none kind of confluence and appears prefer it’s simply positioned fallacious, it is best to most likely keep away from it. This filter is very essential to make use of on the 4 hour and 1 hour charts.

While having issues like checklists and an total buying and selling plan are crucial, they’re just one a part of discovering one of the best buying and selling indicators. The person or girl doing the evaluation and pulling the set off is JUST as essential because the technique or buying and selling plan they’re utilizing.

As merchants, we have to develop our unconscious “intestine” buying and selling really feel on an ongoing foundation, studying from the charts and preserving notes and easily immersing ourselves in day-to-day market evaluation and remark (word I didn’t say immerse ourselves in ‘buying and selling’). This helps us develop a very good instinct and intestine really feel which go hand in hand with a very good buying and selling technique.

Conclusion

After twelve years within the markets and 5 years of instructing merchants, it’s apparent to me that the primary drawback for many merchants is figuring out methods to filter a very good commerce from a foul commerce. So many merchants miss nice trades and so many merchants are likely to get stung by buying and selling every thing that they “assume” is likely to be a sign. This is sort of a madman with a gun strolling round capturing something that strikes. Buying and selling and cash is a weapon, and similar to a gun, you do must be cautious with it. It’s essential be affected person and filter your trades…then “decide your targets” and execute the commerce with absolute precision and confidence.

In case you are interested by creating your capacity to filter good commerce indicators from unhealthy commerce indicators and enhance your total confidence stage in pulling the set off on high quality trades…it is best to take a look at my dealer’s training programs and each day commerce setups e-newsletter the place I develop on these ideas in higher element.