A typical query starting merchants ask me is whether or not or not I exploit intraday or “decrease time-frame charts” and if that’s the case, how do I exploit them?

A typical query starting merchants ask me is whether or not or not I exploit intraday or “decrease time-frame charts” and if that’s the case, how do I exploit them?

For essentially the most half, the reply is sure, I do use intraday charts. Nonetheless, (you knew there was going to be a nonetheless, proper?) there’s a time and place for all the things, particularly intraday charts. It’s essential you perceive when to make use of them and the way to use them. That is one thing I’m going into a lot larger element on in my superior value motion buying and selling course, however for at the moment’s lesson, I wished to offer you a quick overview of simply how I incorporate intraday charts into my day by day buying and selling routine.

This tutorial will reveal a number of of the core methods I exploit intraday chart time frames to offer further affirmation to day by day chart indicators in addition to handle threat, handle place dimension and enhance the chance reward of a commerce.

My favourite intraday chart time frames to commerce…

Sometimes, individuals who e-mail me concerning the intraday time frames wish to know if I ever commerce solely off of those decrease time frames. The reply is, sure, I generally do commerce the 1-hour or 4-hour charts on their very own with out considering the day by day or weekly time-frame. Nonetheless, 90% of the time I exploit the 1-hour and 4-hour charts to substantiate the upper time-frame sign, primarily the day by day chart time-frame.

On this approach, the intraday charts work as an further level of confluence to offer weight to a commerce and additional affirm whether or not or not I wish to enter it. The opposite massive benefit of the intraday charts is that they’ll permit me to fine-tune my entry to attain higher threat administration. Extra on these matters later.

- A very powerful factor to recollect is that I by no means go decrease than the 1-hour chart as a result of from my expertise, any time-frame beneath the 1-hour is simply noise. As you go decrease in time-frame, there are rising quantities of meaningless value bars that you need to sift by means of and this makes the story of the market cloudier and cloudier, till you attain a 1-minute chart the place you might be mainly simply attempting to make sense of gibberish.

- I solely have a look at the 1-hour and 4-hour charts when I’m taking a look at intraday time frames. The anchor chart that I base most of my buying and selling choices on is all the time the day by day chart time-frame.

- For many who like to have a look at weekly charts, the ideas on this lesson may very well be utilized there as effectively. You’d primarily use the day by day charts to substantiate weekly indicators and add confluence to them, in addition to fine-tune your threat administration. It ought to be famous, I not often commerce off weekly charts alone, however for the die-hard weekly-chart merchants, maintain this in thoughts when studying the remainder of this tutorial.

- Keep in mind, it’s NOT important to commerce the day by day chart with affirmation from the intraday. It’s simply one thing you would possibly wish to implement as you develop into extra superior and have mastered the fundamentals of buying and selling day by day chart time frames.

- Keep in mind, that is NOT day buying and selling! The size of time we’re holding these trades remains to be meant to be a full in a single day place or a number of days / weeks. Keep in mind, the preliminary commerce set off remains to be the upper time-frame chart.

Utilizing Intraday Charts for Second Likelihood Commerce Entries

Everybody hates lacking out on a wonderfully good commerce, myself included. Fortunately, there are a variety of various methods you may get second likelihood commerce entry on a sign you initially missed.

A kind of methods is by use of the 1-hour or 4-hour charts to search for a sign just a few hours and even days later, to re-enter within the course of the unique day by day chart sign that you simply missed.

Within the instance under, we see a clear-as-day pin bar purchase sign from help within the S&P500, circled within the chart under. In the event you missed this one, you have been undoubtedly kicking your self…

Nonetheless, for savvy value motion merchants, they know a second-chance entry will typically current itself on the intraday charts not lengthy after the day by day sign fires off. Discover, within the chart under, we see a fakey pin bar combo sample shaped shortly after the day by day pin bar. Additionally, discover there was a bigger 4-hour pin bar that shaped the identical day because the day by day sign, including extra confluence to that day by day sign.

Utilizing Intraday Charts to Affirm Each day Alerts

Typically, you might even see a possible day by day chart sign however you don’t really feel satisfied. It might not “look proper” to you and you’re feeling it wants some extra affirmation because of this. That is regular, and it occurs typically.

You’ll generally then get a 1-hour or 4-hour chart displaying a super-convincing sign after the day by day one you weren’t positive about.

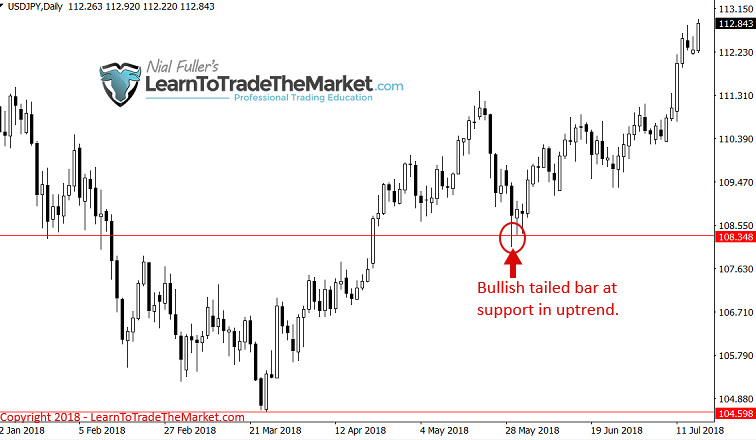

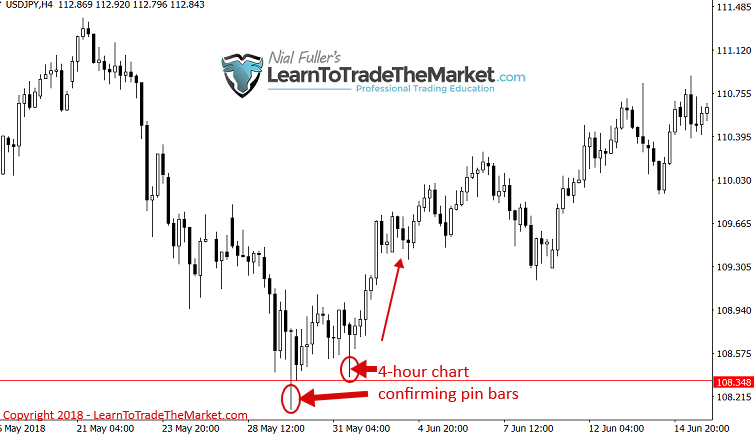

Discover, within the chart under, we had a bullish tailed bar at help in an up-trending market. However on the time that bar shaped, you’d in all probability be questioning if it was actually value taking or not, as a consequence of its bearish shut and the previous swing decrease.

Intraday chart to the rescue. Discover the 2 convincing 4-hour pin bars that shaped across the time of the above day by day chart bullish tailed bar. You might have used these 4-hour pins to additional affirm your feeling concerning the day by day chart sign you weren’t positive about.

Typically, you will notice a day by day chart sign varieties however doesn’t have any actual apparent confluence with a powerful pattern or key chart stage. In these circumstances, you possibly can depend on a clear intraday sign to be the confluence that you might want to both enter the commerce or go on it.

Discover within the day by day S&P500 chart under, there was an intense dump in early 2018. It will have been very robust for many merchants to purchase proper after such a powerful sell-off. There was a variety of bearish momentum and strain overhead and this might have solid doubt on the day by day chart pin bar indicators seen under.

The 1-hour chart would have helped us on this scenario. As seen under, back-to-back 1-hour chart pin bars shaped on the time of the above day by day indicators, indicating additional confluence and giving us additional affirmation, it was secure to enter lengthy. Additionally, getting into on these 1-hour pin bars allowed a a lot tighter cease loss and thus higher threat / reward profile as will probably be mentioned within the subsequent part.

Utilizing Intraday Charts to Tweak Your Danger Reward and Place Dimension

As we all know, the day by day chart requires us to make use of wider stops more often than not (until we use the 50% tweak entry as exception), so most often, once we use the 1 or 4-hour intraday chart, we will implement a tighter cease loss and modify place dimension accordingly. This permits us to considerably enhance our threat reward as a result of the cease loss distance is decreased and the place dimension could be elevated because of this, however the revenue goal stays the identical.

This isn’t going to be the case on each commerce on intraday charts, generally the chance administration finally ends up being similar to what it could have been on the day by day chart by itself. However there are various situations the place it really works out to the place you possibly can double or triple the potential reward on a commerce by using intraday indicators.

Within the Dow Jones day by day chart instance under, we will see a transparent pin bar sign shaped and in case you had entered close to the pin excessive with the traditional cease placement of the pin low, you’d seemingly get a 2R reward, POSSIBLY 2.5 or 3R on the most.

The 4-hour Dow Jones chart round this similar time, fired off a 4-hour pin bar shortly after the day by day pin above, offering us the potential to important commerce that pin bar as an alternative, this reduces the cease loss by about half and permits us to double the place dimension, upping the reward to 6R max as an alternative of 3R. Maximizing profitable trades is basically the way you construct a small account into an enormous one and the way you make massive cash within the markets.

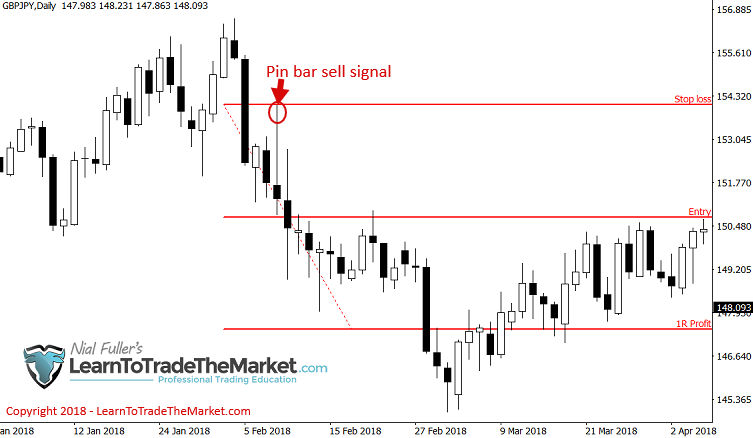

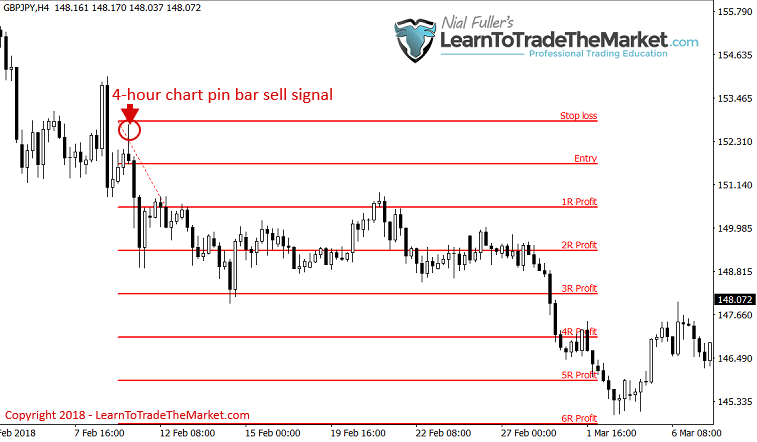

An identical scenario within the instance under. A pleasant GBPJPY bearish day by day pin bar shaped, albeit a fairly vast one. Your cease loss would have been over 300 pips from pin excessive to low on this one, significantly limiting the potential Danger Reward:

The 4-hour chart fired off a a lot smaller pin bar after the above day by day pin. This allowed us to show a 1R winner right into a 5R or extra potential.

Conclusion

The intraday tweaks and ‘tips’ that I confirmed you in at the moment’s lesson are simply a number of the methods I make the most of the 1-hour and 4-hour charts with my three core value motion buying and selling methods in my buying and selling plan.

Worth motion buying and selling doesn’t merely include simply on the lookout for just a few candle patterns on a chart after which putting a commerce, not even shut. There may be much more concerned. The method of really discovering and filtering trades, managing threat / reward after which executing the commerce and managing it each technically and mentally, is one thing you possibly can’t be taught in a single day. There’s a technical evaluation aspect and a psychological aspect to each commerce, and each elements should be discovered and practiced again and again earlier than you actually acquire the flexibility to make constant cash available in the market.

After studying at the moment’s lesson, I hope you’ve a greater understanding of the way to use the intraday charts correctly, in contrast to most merchants. Don’t make the error of utilizing the intraday charts to micro-manage your place and over-trade. That is flawed and can trigger you to lose cash.

As an alternative, make the most of the ideas and tips discovered on this lesson and the others I educate in my buying and selling course, to make use of the intraday charts to your benefit. Buying and selling is about making essentially the most out of sign, and that is what I exploit the intraday charts for, to not over-trade or meddle in my trades like most merchants do. I hope you can also now use the intraday charts to your benefit by implementing the idea and ideas on this tutorial to in the end enhance the chances of any given commerce figuring out in your favor and maximize its revenue.

What did you consider this lesson? Please go away your feedback & suggestions under!