On this week’s lesson, I’m going to share with you a confirmed method for changing into a “Grasp” of your Foreign currency trading technique. In the event you’re an everyday reader of my weblog then that I confer with “mastering” your buying and selling technique in a lot of my articles, and immediately’s lesson goes to get into the meat of precisely HOW to grasp your buying and selling technique and WHY it’s so necessary.

On this week’s lesson, I’m going to share with you a confirmed method for changing into a “Grasp” of your Foreign currency trading technique. In the event you’re an everyday reader of my weblog then that I confer with “mastering” your buying and selling technique in a lot of my articles, and immediately’s lesson goes to get into the meat of precisely HOW to grasp your buying and selling technique and WHY it’s so necessary.

Staying centered on one buying and selling technique lengthy sufficient to essentially learn to commerce it successfully is one thing that many merchants wrestle with. Primarily based on my private expertise from observing and serving to 1000’s of merchants, the merchants who give attention to studying one entry set off or one setup at a time are sometimes those who succeed at buying and selling. Since I’m a value motion dealer and I educate value motion buying and selling, I educate my members to focus their consideration on studying ONE value motion setup at a time, till they really feel they’ve “mastered” it, after which they’ll transfer on and add extra setups to their arsenal.

Mastering one setup at a time helps create focus and readability in a dealer’s thoughts by eradicating muddle and minimizing selections.

Why you want to change into a “Grasp” of your buying and selling technique

I do know that this may appear apparent, however you actually need to “Grasp” your buying and selling technique earlier than you strive buying and selling it on a reside account. Why am I saying this if it appears so apparent you ask? It’s easy, from my interactions with merchants on daily basis, I do know for a indisputable fact that far too a lot of them are diving into live-account buying and selling with none actual clue as to what their buying and selling technique is or commerce it. Many merchants “assume” or “really feel” like they know what their buying and selling technique is and commerce it, however the reality is that almost all starting and struggling merchants haven’t actually “mastered” their buying and selling technique but.

Ask your self these two questions: Do I do know my buying and selling technique inside and outside? Am I on the level the place I can flick by the charts in 5 or 10 minutes and immediately know if there’s a setup price buying and selling or not? In the event you can’t reply an trustworthy “sure” to each of those questions then you definately aren’t able to commerce reside and you haven’t mastered your buying and selling technique but.

I speak about buying and selling like a sniper in a lot of my articles. Whether or not it’s what crocodiles can educate you about buying and selling or commerce from a espresso store in a minimalistic method; the underlying level is principally the identical; buying and selling in a relaxed and scaled-back method is finest. However, HOW do you arrive at that time of buying and selling in a relaxed and assured method? You must first change into a grasp of your buying and selling technique, after which you should have the flexibility to shortly scan the markets and make a assured choice to commerce or to not commerce. In the event you aren’t doing that, then you might be in all probability sitting there for hours mulling over your charts till you finally persuade your self of a commerce sign that later you realized was probably not price buying and selling in any respect. If this sounds acquainted then learn on, I’m going to let you know repair it…

Creating FOCUS

Most merchants wrestle with focus, and it’s not stunning actually. How are you going to simply focus when there are such a lot of completely different buying and selling strategies, financial information occasions and different market variables bombarding you on daily basis?

With all of the completely different buying and selling techniques and methods on the market, how are you going to actually know if what you’re doing is “proper” or if it should work should you can’t give attention to it sufficient? Properly, the reply to that query is that you would be able to’t. You may’t know if any technique or system will work till you strive it, and the bottom line is that you must strive it over a big sufficient sequence of trades to see it play out.

MOST merchants wrestle with sticking to 1 buying and selling technique lengthy sufficient to see it play out. Why? It’s as a result of they attempt to sort out an excessive amount of at one time; they attempt to commerce with 10 completely different foreign exchange indicators or they attempt to commerce 30 completely different markets without delay with 5 completely different entry triggers. The reality is, the entry set off is the best a part of buying and selling, and it’s additionally the half that merchants over-complicate essentially the most.

How do you create the main focus that you want to actually MASTER your buying and selling technique? It’s really fairly easy; you break your buying and selling technique down into smaller items; you un-complicate it. That is really the “key” to mastering something in life, whether or not it’s studying a e-book, learning for a take a look at or getting by your work day; should you break issues down into smaller items, it is possible for you to to focus extra on each bit, quite than making an attempt to do an excessive amount of at one time. This, in flip, will enable you to obtain the bigger end-goal sooner and extra successfully than should you attempt to do an excessive amount of without delay with no plan of motion.

Easy methods to MASTER one value motion setup at a time

Let’s get into the “meat” of the method of mastering one value motion setup at a time. Earlier than we start, it’s price noting that after I say “one setup” I don’t imply “solely” a pin bar or solely another value motion bar…a value motion technique or “setup” consists not solely of the bar however of the encompassing market situations and occasions as nicely.

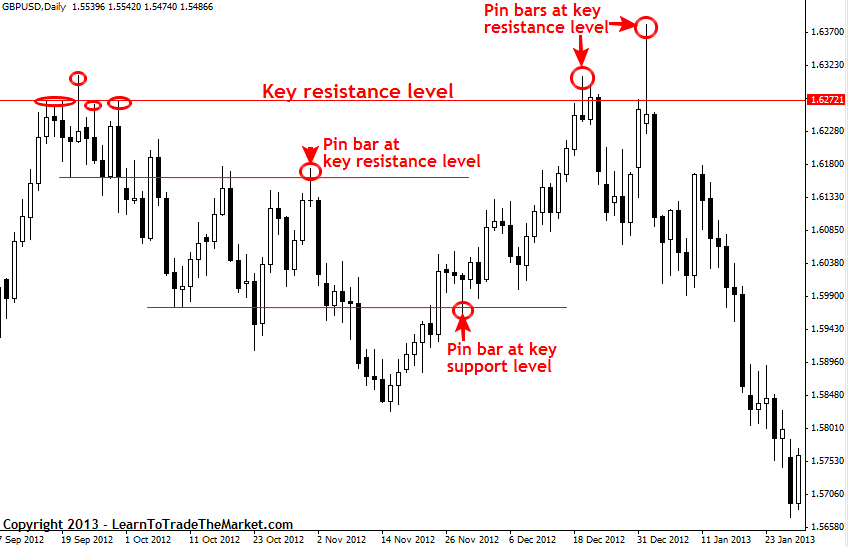

For instance, within the charts under, we’re going to take a look at mastering the every day chart pin bar setup from key chart ranges of horizontal help and resistance. Thus, you don’t commerce except there’s an apparent every day chart pin bar setup fashioned at or rejecting a key stage of horizontal help or resistance. Let’s take a look at some examples now:

Within the instance chart under, we are able to see 4 completely different examples of trades that will match our standards of buying and selling solely every day chart pin bars from key ranges of help or resistance. These can be the ONLY varieties of setups you’ll be in search of till you are feeling you mastered them:

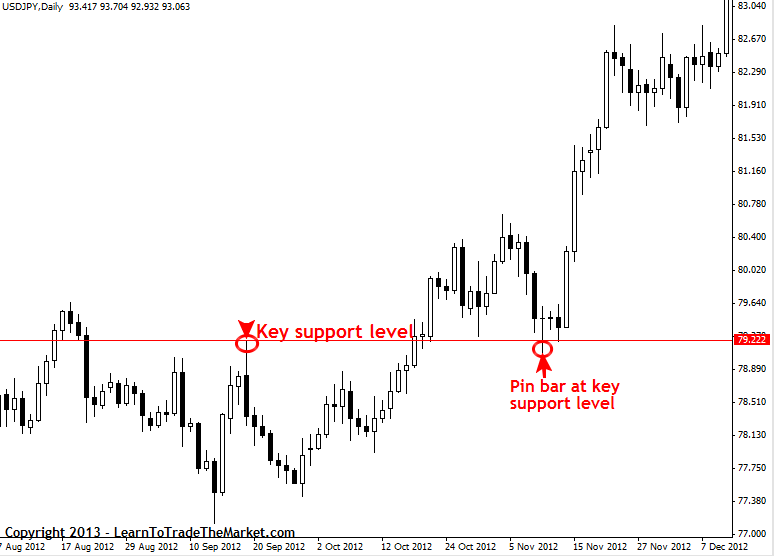

Within the instance chart under, we are able to see instance of a pin bar on the every day chart of the USDJPY that fashioned rejecting a key horizontal help stage by 79.20. It’s price noting that this pin bar really kicked off the massive up development within the USDJPY that’s nonetheless underway:

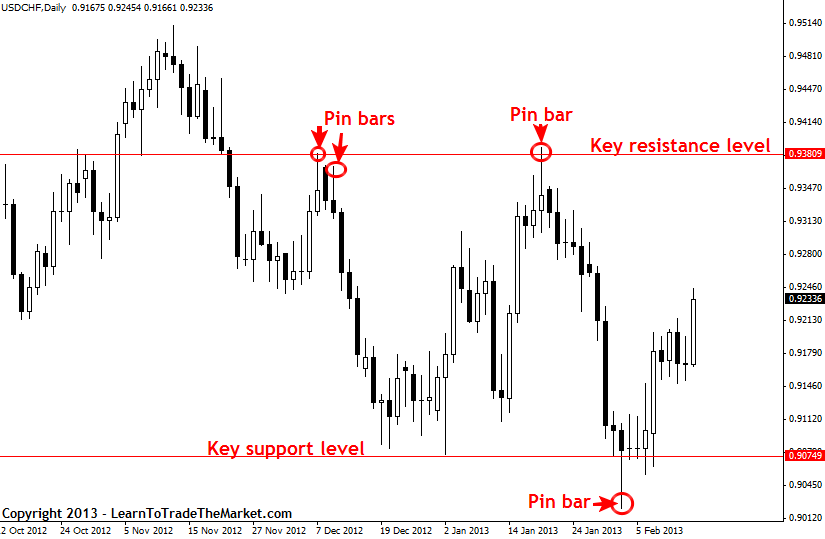

Within the instance chart under, we’re taking a look at extra examples of every day chart pin bars that fashioned at or close to key ranges of horizontal help or resistance:

One necessary factor to pay attention to with buying and selling a technique that includes discovering key ranges like this; you must wait till a key stage really types…don’t guess. I wrote an article about how to attract help and resistance that may enable you to to tell apart key ranges from much less important / minor market ranges. That is why within the USDCHF instance (the final one above); I didn’t mark that first pin bar from help that fashioned on January 2nd for example of our commerce setup that we’re mastering. On the time that pin fashioned that stage was probably not established but, so it wasn’t a “key stage” and thus it didn’t meet the factors of the “one setup” that we’re specializing in.

To make this train of mastering one setup at a time work, you actually must obey the foundations that you just’ve outlined for the actual setup you are attempting to grasp. On this case, our foremost “guidelines” can be this:

1) Establish the plain / key chart ranges on the every day chart

2) Search for apparent pin bar reversal setups which have fashioned at or close to these ranges. That means, pin bars which are displaying rejection of the extent and (or) are making a false-break of them.

Now, take into account that even with such a easy algorithm, with value motion there’s all the time discretion concerned….you must determine if a pin bar is “apparent” and if a stage is “key”…however these items are straightforward to get higher at by coaching, time and follow. I’ve already linked you guys to some good articles on these subjects inside this lesson, so it’s best to perceive what I’m speaking about right here.

In closing…

Skilled merchants don’t sit in entrance of their charts questioning what to do. They know what to do already; they’re simply ready for the proper combos of occasions to come back collectively to offer them a cause to commerce. Understanding what these are occasions are, precisely what they seem like and commerce them is one thing you possibly can simply accomplish by following the template specified by immediately’s lesson. You first determine on what your entry set off is, in our case it was the every day chart pin bar, and then you definately determine commerce it. There are lots of completely different combos of value motion setups and elements of confluence that you would be able to be taught to grasp. Finally, all of those setups that you just’ve mastered will start to “paint an image” of the marketplace for you and you’ll start to have readability and confidence everytime you take a look at a market’s value motion.

In the event you don’t assume and act like a professional dealer then you’ll by no means change into one, so begin changing into a “grasp” value motion dealer by studying one explicit setup at a time. Get it down on demo first, then strive buying and selling it reside, and should you discover after a pair months that you’re making constant cash with it, then you possibly can contemplate including one other setup. Your goal must be to have a handful of setups that you’ve got an “intimate” data of; that you’re a “grasp” of. At that time, buying and selling merely turns into a sport of ready patiently for the worth motion setups that you’ve got mastered to point out themselves available in the market. It actually will be so simple as that.

If you wish to be taught extra concerning the value motion setups that I’ve personally mastered, checkout my value motion buying and selling course.