One of many key philosophies of my Foreign currency trading method is to commerce “finish of day”, and by that I imply buying and selling after the New York shut, which marks the top of the present Foreign currency trading day. Many merchants electronic mail me asking me issues like “Why is the New York shut so vital” and “How do I commerce end-of-day and why ought to I?” On this article I’m going to reply these questions, so hopefully after studying it you’ll have a good suggestion as to precisely why end-of-day value motion buying and selling methods are so highly effective.

One of many key philosophies of my Foreign currency trading method is to commerce “finish of day”, and by that I imply buying and selling after the New York shut, which marks the top of the present Foreign currency trading day. Many merchants electronic mail me asking me issues like “Why is the New York shut so vital” and “How do I commerce end-of-day and why ought to I?” On this article I’m going to reply these questions, so hopefully after studying it you’ll have a good suggestion as to precisely why end-of-day value motion buying and selling methods are so highly effective.

My goal right here is to indicate you why I wish to enter lots of my value motion alerts at or shortly after the New York shut, meaning “After Wall St Closes”.

Why accomplish that many merchants enter trades on the “Finish of the day”?

The solutions are fairly easy:

1. “Cleaner” buying and selling alerts – Buying and selling end-of-day removes noise and offers a transparent and helpful image of what has occurred through the buying and selling day. The sign carries extra “weight” and has the next likelihood than a sign which kinds through the intra-day session. Many merchants choose to commerce off these every day chart alerts as a result of it’s a much less annoying technique to commerce because you don’t must ‘wade by way of’ hours of less-significant value motion.

Particularly for starting and struggling merchants, sticking to the every day chart time frames and buying and selling in an ‘end-of-day’ method is essential for understanding how the markets transfer every day and for studying to commerce from essentially the most related view of the market.

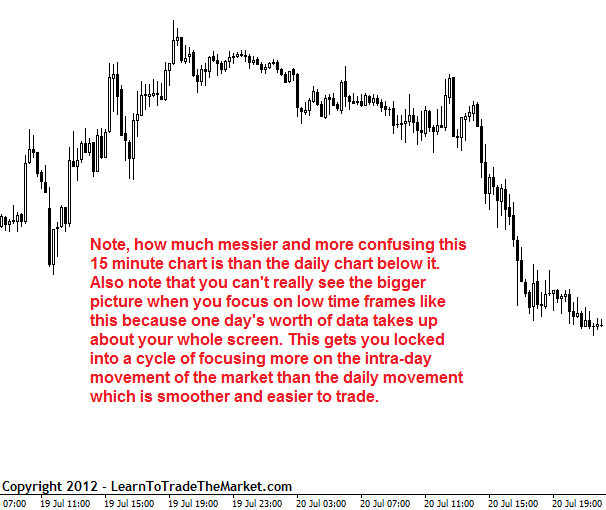

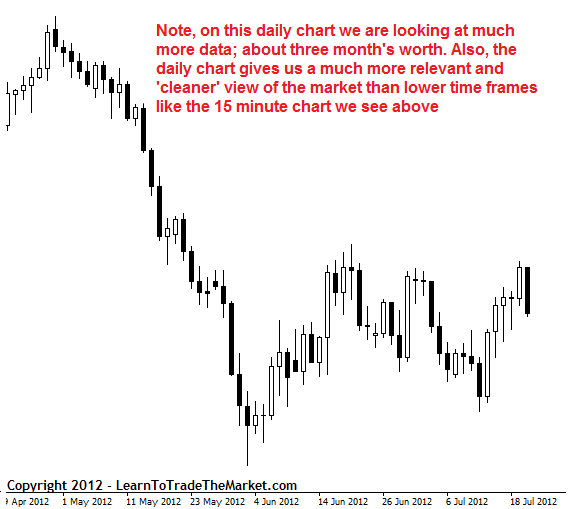

Right here’s an intra-day 15 minute chart of the GBPUSD after which a every day chart of the GBPUSD beneath it. You possibly can see how a lot ‘calmer’ and clearer the every day chart is and the way it could be simpler to commerce off of and far much less prone to trigger you to commerce emotionally than the 15 minute chart:

2. Time restrictions – A significant component in most dealer’s lives is time, so the end-of-day method permits the dealer to go about their each day enterprise or job, after which come and take a look at the market on the finish of the Wall Road shut or shortly after, preserving a watch out for a pleasant value motion sign. It is a far totally different method than that of a ‘day-trader’ who sits in entrance of his or her pc all day combing by way of tons of intra-day / quick timeframe information looking for a sign that may inherently be far decrease likelihood than the identical sign on the every day chart.

There may be additionally a ‘hidden’ profit right here; while you commerce end-of-day and deal with the every day charts as a substitute of the intra-day charts, you’re FAR much less prone to turn into emotional and over-trade. Merchants who sit at their computer systems for hours on finish and take a look at desperately to discover a sign, in all probability will discover a ‘sign’. However it in all probability is not going to be a really high-probability one and it’s extra prone to be one thing they simply form of ‘made up’ or rationalized on the spot relatively than being an precise occasion of their pre-defined buying and selling edge. One among my core buying and selling philosophies is to commerce foreign exchange like a sniper and never a machine gunner, and that is far simpler to do if you’re an end-of-day dealer who has a disciplined every day buying and selling routine.

3. Simplicity and Readability – Analyzing a value chart and making a call on the near-term route of the market shouldn’t be a sophisticated or ‘messy’ activity, so it is sensible to examine your charts for a short while every day shortly after the NY shut. Buying and selling on this method simply retains issues clear and easy, and actually, that is how I’ve traded for therefore a few years, but so many individuals on the market overlook this method, and I can’t perceive why. When the market closes, there may be both a sign or no sign, so if there’s a sign, the dealer can act in line with their buying and selling plan and place trades and many others.

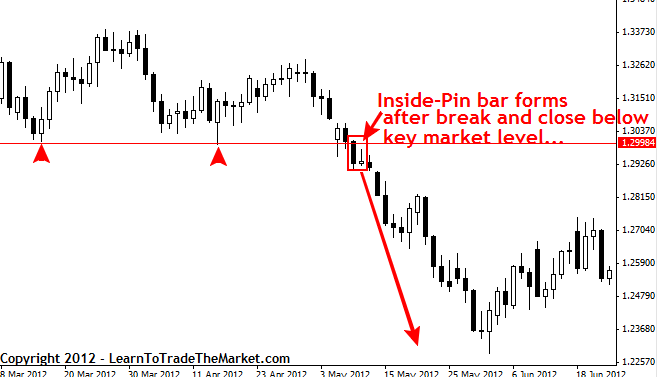

An instance of an end-of-day commerce could also be so simple as ready for a break of a key market stage after which ready for the market to substantiate the get away on the New York shut, after which on the lookout for a value motion sign on a retrace again to the breakout stage within the hope of being profitable with the pattern get away, and many others.

Right here’s an instance of what this may appear like on a every day chart of the EURUSD:

Hopefully, now you will have a good suggestion as to why specializing in the every day chart and end-of-day buying and selling methods are so vital. While there isn’t any ‘good’ method for studying to commerce and for getting your buying and selling ‘again on monitor’, in my view the perfect factor you are able to do is to commerce in an end-of-day method. Most merchants soar right down to the intra-day charts earlier than they’ve a strong grasp of the right way to commerce off the every day charts, and this simply causes all types of emotional buying and selling errors to happen.

Please be happy to look at a few of my free buying and selling movies to get a greater image of the model of value motion buying and selling that I’m instructing in my foreign currency trading course and members’ part. I feel when you perceive somewhat extra about value motion buying and selling methods and buying and selling on the every day chart time frames, you’ll marvel the way you ever traded some other approach.