We’ve all heard that solely about 10% of individuals make it within the buying and selling enterprise, so how do they do it? What’s their mindset like, what’s their buying and selling course of and routine like? What are they doing that you’re not? In at present’s lesson, I’m going to provide you some perception into these questions that may hopefully be the catalyst for a major enchancment in your buying and selling efficiency.

We’ve all heard that solely about 10% of individuals make it within the buying and selling enterprise, so how do they do it? What’s their mindset like, what’s their buying and selling course of and routine like? What are they doing that you’re not? In at present’s lesson, I’m going to provide you some perception into these questions that may hopefully be the catalyst for a major enchancment in your buying and selling efficiency.

Decrease your commerce frequency

How steadily are you buying and selling? As soon as every week? 3 times every week? Twenty occasions every week? Perhaps it’s so steadily you actually do not know? The chances are, that if you’re not within the 10% of persistently profitable merchants you’re in all probability buying and selling far too steadily.

I do know that for me personally, the largest ‘ah ha’ second in my buying and selling profession was after I realized that I may dramatically enhance my buying and selling outcomes by merely being extra affected person; by ready for less than high-probability ‘completely apparent’ buying and selling alternatives.

Many starting and struggling merchants don’t understand that buying and selling much less usually will sometimes improve their general revenue issue, and the extra affected person and exact you’re together with your trades, the extra management you will have over your buying and selling and which means you’ll be able to finally extract more cash from the market. One factor the ten% of profitable merchants sometimes do that you’re not doing, is again themselves and go in ‘exhausting’ once they spot one of many high-probability commerce indicators or occasions they’ve been ready so patiently for. They sometimes should not utilizing some foolish danger mannequin just like the 2% danger mannequin, they’re as an alternative centered on danger reward and {dollars} danger vs. {dollars} gained.

Understanding simple arithmetic will present you that making extra trades will improve your error price and reduce your general revenue issue. For an instance of this, checkout my article on low-frequency vs. high-frequency buying and selling. Being a extra affected person and exact dealer not solely means you’ll be eliminating lots of low-probability / shedding trades, however with that additionally comes apparent psychological advantages.

Keep in mind that all the opposite merchants are your opponents

So as to win at buying and selling, you should outsmart and out-think your opponents (different merchants). Every commerce takes cautious planning, and if you’re slicing corners or in search of ‘short-cuts’ and even simply being lazy, I promise you that someplace another dealer isn’t. You could be certain you’re doing every little thing you’ll be able to to put the buying and selling possibilities in your favor, that is the one approach you’ll be able to ‘outsmart’ and preempt your opponent, as a result of I can assure you the approximate 90% of shedding merchants are NOT doing every little thing they will to place the buying and selling possibilities of their favor.

It’s usually a recreation the place the contrarian dealer (one who does the other to what feels pure or appears logical) will make all the cash and persistently win. So, the subsequent time you suppose one thing is what it appears, have one other look, as a result of it’s in all probability not what it appears in any respect. The market is ready as much as deceive novice merchants, be conscious of this when making choices. All the time take a look at issues out of your opponents standpoint, as he’s betting in the other way that you’re…bear in mind there may be all the time someone on the other facet of your commerce, wanting the market to go in the other way and having equally robust convictions of their commerce as you will have in yours. Attempt to put your self of their sneakers and perceive why your opponent may need that alternate view, weigh all the chances earlier than committing to your view or commerce and see if it nonetheless is sensible, if it does then belief your self and proceed.

Should you don’t love the markets, you gained’t earn cash

All nice merchants love the markets and love buying and selling, it ought to by no means be a chore to take a look at charts or discover trades, and you must solely be on this career when you’ve got 100% true ardour for monetary markets and buying and selling normally. I’ve by no means met a profitable dealer that was not obsessive about the markets and completely liked what he/she was doing. They reside for these items, it’s a part of them, and if you wish to be within the 10% of profitable merchants it must be part of you too.

All nice merchants love the markets and love buying and selling, it ought to by no means be a chore to take a look at charts or discover trades, and you must solely be on this career when you’ve got 100% true ardour for monetary markets and buying and selling normally. I’ve by no means met a profitable dealer that was not obsessive about the markets and completely liked what he/she was doing. They reside for these items, it’s a part of them, and if you wish to be within the 10% of profitable merchants it must be part of you too.

Incorrect cease loss placement can destroy you

An important think about your long-term success as a dealer is CORRECT cease loss placement. While cease losses are a vital danger administration device, they’re additionally the rationale a dealer will get stopped out of a commerce for a loss; as a result of there cease loss will get hit. Many merchants misplace their cease losses by inserting them on the mistaken ranges, and they’re usually too broad or too tight.

Stops can’t simply be positioned randomly nor positioned based mostly on the place measurement you need to commerce, they should make sense and be within the context of the value motion commerce sign / setup and likewise within the context of the present market dynamics. I gained’t get into element right here, however as a basic information, most merchants place stops arbitrarily and don’t place them at logical areas of the chart with any actual although behind them. It will destroy even the best dealer with the most effective evaluation abilities. There’s extra in my course about cease placement for varied commerce setups…

The market will all the time go additional than you suppose

Nice traits are sometimes self-fulfilling, that means they have an inclination to proceed greater or decrease, usually simply by the actual fact that the longer they persist the extra merchants bounce on-board, till the very weakest arms are on-board proper earlier than the pattern comes crashing to an finish.

Individuals wish to guess towards traits for a wide range of causes; conceitedness from wanting to select the highest or backside, or believing one thing like: ‘what goes up should come down’ or ‘what goes down should come up’. It is a ridiculous factor to imagine, as a result of it’s apparent from taking a look at any value chart that markets merely don’t behave like that, but merchants appear to by no means study as a result of most of them proceed to struggle what’s logical and apparent available in the market.

If a market is trending and shifting in a single course for a sustained interval, the likelihood is clearly that it’s going to proceed in that course till it has clearly ended. Nevertheless, on account of their feelings in addition to the tendency to over-analyze the market, most merchants all the time attempt to struggle this likelihood.

Ever seen a chart that’s shifting up in a single course in a short time and simply once you suppose it’s about to swing again and retrace, it begins shifting up or down but once more? It is a self-fulfilling idea, in that the longer a pattern goes the extra momentum it has and the extra folks bounce on-board, till lastly the final and least skilled merchants bounce in proper when the pattern is coming to finish. The amateurs and ‘worst’ merchants we will say, have a tendency to leap in proper as traits are ending as a result of it’s at this level that they’re feeling the concern of “lacking out” on the transfer…as a result of it has come thus far and appears so good…however this normally about when it’s prepared to finish.

As markets pattern, they weed out cease losses and create place liquidation or place overlaying that pushes the pattern additional, it’s a pure phenomenon that contributes to the self-fulfilling facet of traits. In bull markets, when a market makes a brand new excessive persistently, daily a big heard of bearish merchants are getting stopped out of quick positions and liquidating, which fuels but extra shopping for.

Once more, going again to the contrarian idea…should you suppose the market is ‘too excessive’ or has gone ‘too far’…likelihood is it would truly maintain going additional…so as a rule, attempt to keep away from betting towards a freight prepare that’s headed in a single course. The one sure-fire strategy to know a pattern has ended is when the brand new course pattern is underway.

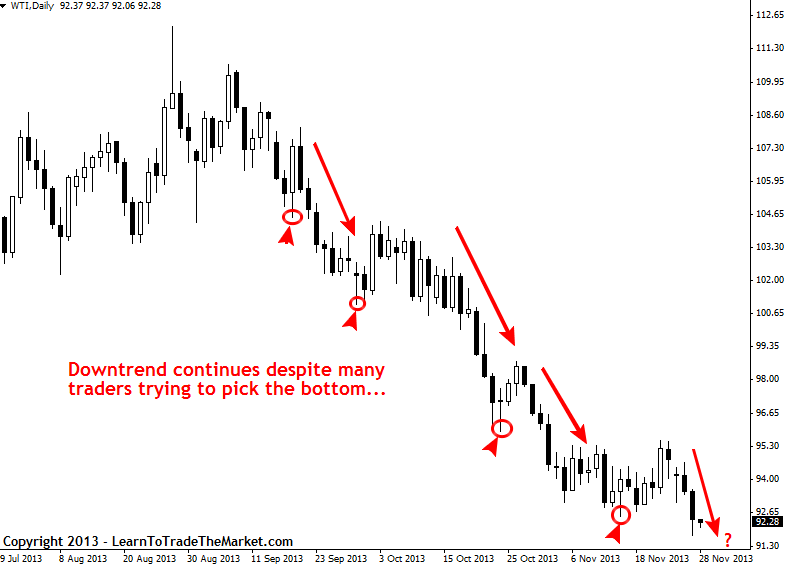

Listed below are some current examples of robust traits that acted like fast-moving ‘freight trains’ that saved shifting (and nonetheless are) principally in a single course, stopping many high and bottom-pickers out alongside the way in which:

Each day Crude Oil chart displaying a powerful downtrend and all of the “backside pickers” alongside the way in which…

Each day Dow Futures displaying displaying a powerful uptrend and all of the “high pickers” alongside the way in which…

Tackle danger and be assured (even should you don’t really feel it)

Nice merchants must again themselves and have the tenacity to take danger and deal with the feelings that include it. You possibly can’t earn cash except you’ll be able to deal with danger and the emotional ups and downs that include it, nobody ever stated buying and selling was for the fragile-minded or for these are weak emotionally. The highest 10% who’re persistently pulling cash out of the market don’t really feel ‘remorse’ over missed trades or losses, they aren’t chasing the market or making an attempt to ‘make again’ misplaced cash. They take the punches as they arrive, shake themselves off and stand up once more to struggle one other day.

To be a kind of 10% merchants who make it over the long-term, you need to attempt to be unemotional, again your self and act with conviction…even when you need to faux it within the early days (faux it until you make it). Begin believing optimistic outcomes have already occurred, inform your self and affirm to your self that you’re worthwhile and your about to make a large commerce. You will want to behave as should you’re already a seasoned skilled and imagine you’re residing the life-style you need, should you really need to attain it. Your thoughts is extraordinarily straightforward to coach should you repeat today in day trip. Quickly it would grow to be a part of you and the way you act naturally.

One factor I can promise you is that the market will chew you up extraordinarily quick should you don’t stroll into your buying and selling room each morning with a particularly assured mindset able to take in your opponents.

Commerce with sound methods and beliefs

In actuality, markets can do two issues, and should you’re in a commerce these two issues lead to a revenue or loss; the market can go up or it will probably go down…fairly easy actually.

Amazingly, merchants over-think this, and the entire business is designed to deceive you and attempt to make you imagine that buying and selling is complicated and complex. Thus, the ‘trick’ is to have a method and perception system that will probably be relevant to any market, on any timeframe at any level sooner or later. You could conduct evaluation on a chart that’s based mostly on value, as a result of should you can anticipate value motion you’ll be able to revenue from it. Once more that is all fairly logical actually, and for a few of you the penny has already dropped I hope.

It’s no secret my buying and selling profession is constructed on learning and buying and selling value motion, an extremely easy but immensely highly effective type of market evaluation which most of you have already got a primary understanding of hopefully. Your beliefs available in the market have to be logical but in addition easy. As I’ve stated, markets solely go up or down, so don’t make analyzing and buying and selling them harder than it must be.

It’s truly every little thing ‘in between’ that causes merchants to win or lose. The cease loss placement, the entry value, the goal value, the emotional curler coaster, self-doubt, and many others. The buying and selling technique actually is just one half, so don’t get caught up find the ‘holy grail system’, belief me, it doesn’t exist.

Should you can study to learn primary value motion, perceive the right way to plot key ranges on charts and perceive the final pattern of a market, you’re already on-track to be within the high 10% since you’re wanting on the actual market with out the hazy goggles that your competitors (different merchants) are wanting by means of. By combining this buying and selling method with the details now we have mentioned above, and making use of your self persistently, you stand an opportunity within the jungle we name the market. If you wish to begin pondering and performing like the highest 10% of profitable foreign exchange merchants, checkout my Skilled Buying and selling Programs for extra info.