After headlines like these, it would not be a foul thought to exhibit one thing. This actually is not clickbait. And it isn’t even a martingale.

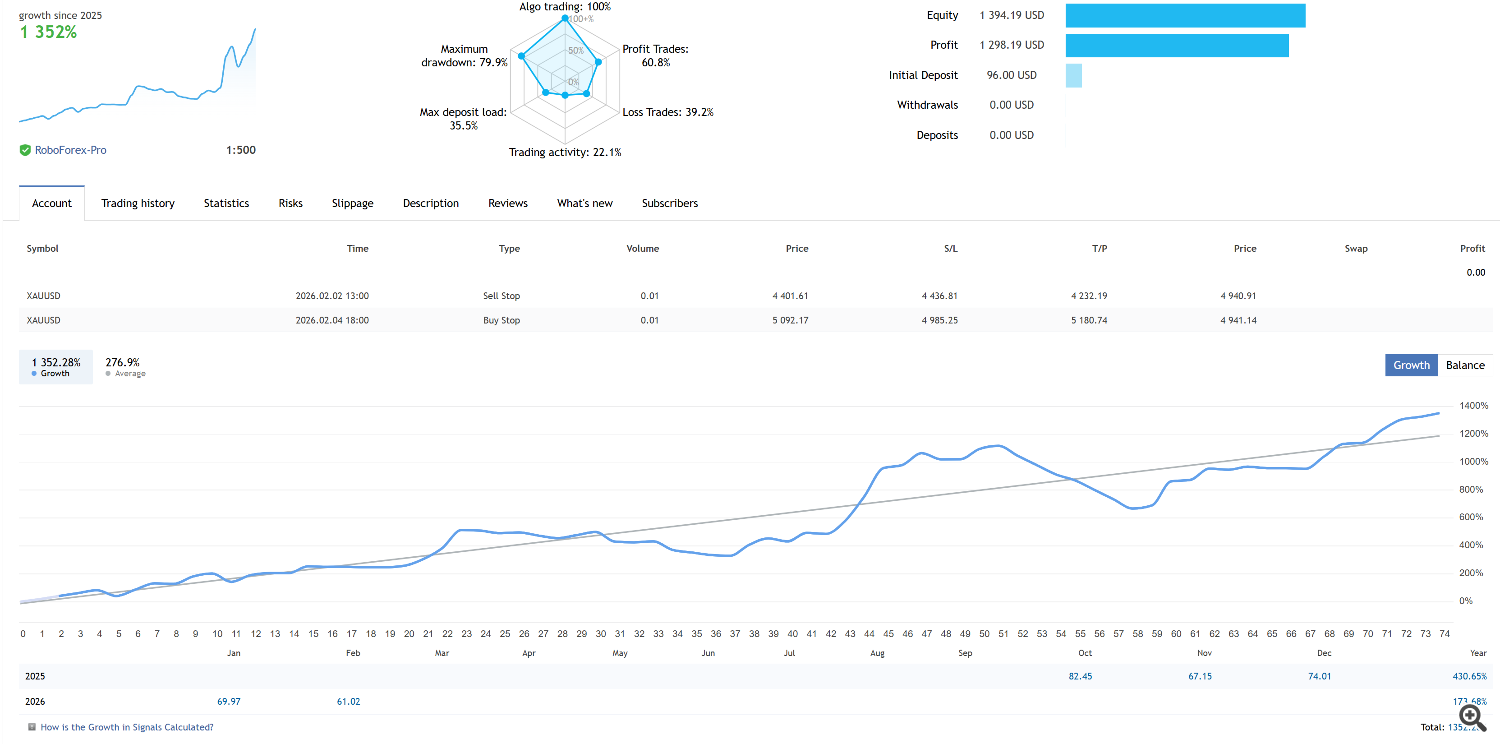

All the next discussions are primarily based on the outcomes and statistics of this account .

My 3 Steps to 13X

- Created a very new idea of information interpretation.

- I wrote an professional utilizing it.

- Did not intrude with the professional’s work (though typically he actually wished to).

In precept, I’ve all the time traded with a great revenue over the long run, however that is the primary time I’ve achieved such wonderful outcomes.

proceed incomes sooner or later

That is essentially the most elementary query in algorithmic buying and selling. Certainly, any system, irrespective of how good it could appear traditionally, faces the longer term, which all the time incorporates a component of the unknown. Shocks are inevitable. However that is the place the actual work begins—the work of reworking a profitable experiment right into a sustainable technique. Listed below are the primary ideas that got here to thoughts on this difficulty…

- The Self-discipline of Non-Interference vs. the Self-discipline of Improvement: I’ve already talked about essentially the most tough psychological barrier—”I did not intrude, although I actually wished to.” That is the golden rule. Nonetheless, “not interfering” does not imply “ignoring.”

- Actual-time diagnostics: Common evaluation of not solely earnings but in addition commerce high quality: drawdown-to-profit ratio, volatility adjustments, and the frequency and nature of shedding streaks. This offers alerts not for guide intervention, however for potential fine-tuning of parameters.

- Capital administration as a survival system: That is the place 90% of the reply to the query “how one can proceed” lies. Capital is the one useful resource that enables a system to outlive a interval of inefficiency.

- Symbiosis of man and algorithm : The way forward for profitability lies not in trying to find the “good system,” however in constructing an adaptive symbiosis. An algorithm is a robust however restricted software, working completely inside the framework of its established paradigm. The creator is a strategist, and so they should develop and adapt. this paradigm.

- The astonishing 13x consequence is not the end line , however relatively a major start line for a way more vital race—the race for resilience. Shocks aren’t a risk to a correctly ready system, however a supply of information for its subsequent evolutionary leap.

And the primary shock occurred in a short time…

The sharp spike in volatility on January 29, 2026, initially yielded glorious earnings, adopted by an analogous collection of losses. The scale of the hourly ranges elevated the drawdown by virtually 1.5 instances.

A brand new steadiness peak was reached only a week later. Nonetheless, such a collection of losses is alarming, and it is crucial to attempt to keep away from related conditions sooner or later.

From principle to follow

Based mostly on all the above, I’ve come to the next plan of motion:

1) Cut back the aggressiveness of capital administration.

2) Develop a volatility filter to cease buying and selling when abnormally robust actions happen.

3) Once more, be affected person and don’t intrude with the GoldBaron system.