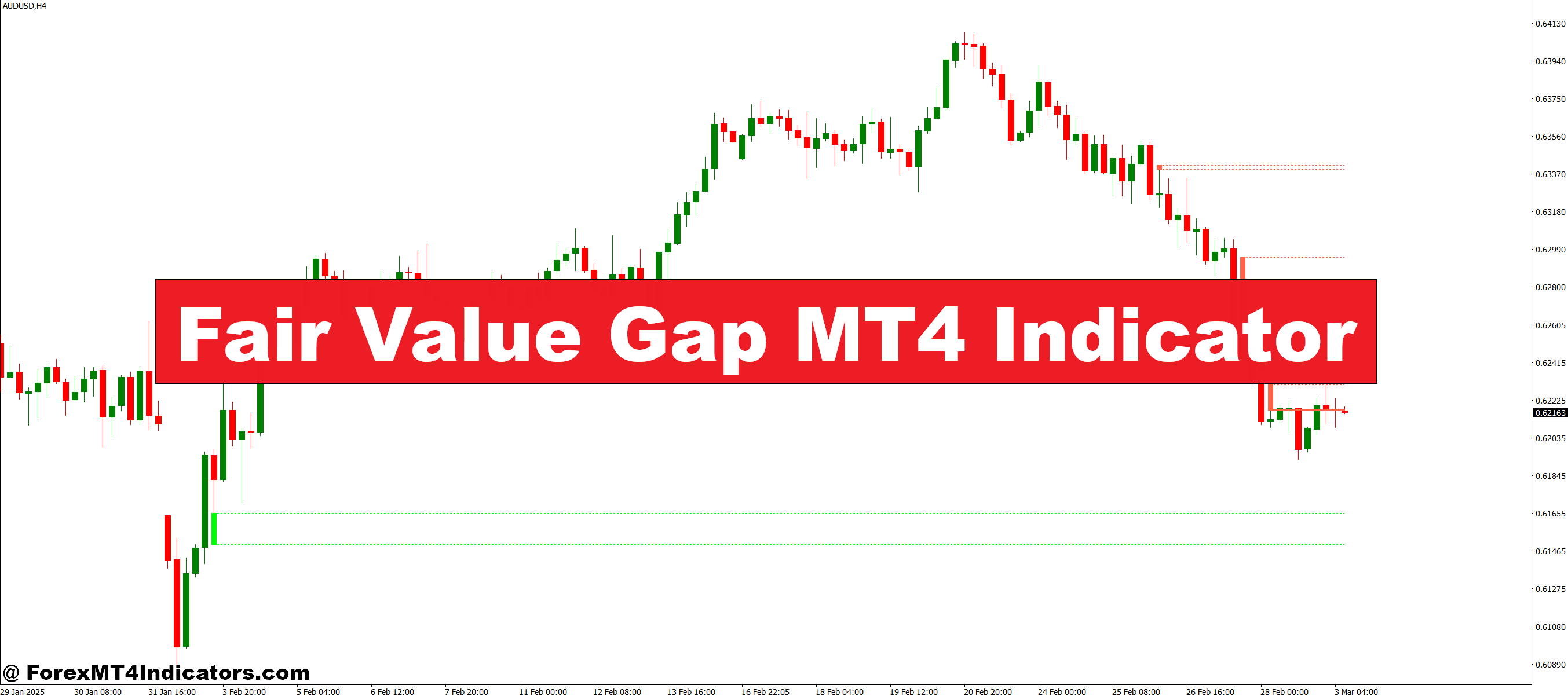

A Honest Worth Hole represents an imbalance out there the place shopping for or promoting stress was so aggressive that the worth left out sure ranges, forsaking minimal buying and selling exercise. In technical phrases, it’s a three-candle sample the place the wick of the primary candle doesn’t overlap with the wick of the third candle, creating a visual hole.

Consider it like this: when a big establishment executes a large order, they want liquidity. They don’t wait round—they blow by means of worth ranges, forsaking areas with few restrict orders stuffed. The market tends to return to those zones, much like how worth typically retests breakout ranges.

The MT4 indicator automates the detection of those patterns. As a substitute of manually scanning charts for the precise three-candle formation, the device identifies and marks these zones with coloured bins. Bullish FVGs (shaped throughout upward worth actions) sometimes seem in a single colour, whereas bearish FVGs present up in one other.

How the Indicator Calculates Honest Worth Gaps

The logic behind the calculation is easy. The indicator scans for cases the place:

- Candle 1 reveals directional motion (up or down)

- Candle 2 makes an aggressive transfer in the identical path

- Candle 3 continues the transfer, however leaves a niche between Candle 1’s excessive and Candle 3’s low (for bullish FVGs) or between Candle 1’s low and Candle 3’s excessive (for bearish FVGs)

The indicator measures the vertical distance of this hole and attracts a rectangle marking the zone. Some variations embrace filters to disregard gaps smaller than a sure pip worth—helpful for eliminating noise on larger timeframes just like the 4-hour or day by day charts.

What separates high quality FVG indicators from primary ones is their capability to trace whether or not gaps get stuffed. Superior variations will change the field colour or add markers as soon as worth revisits the zone, serving to merchants distinguish between recent alternatives and already-filled imbalances.

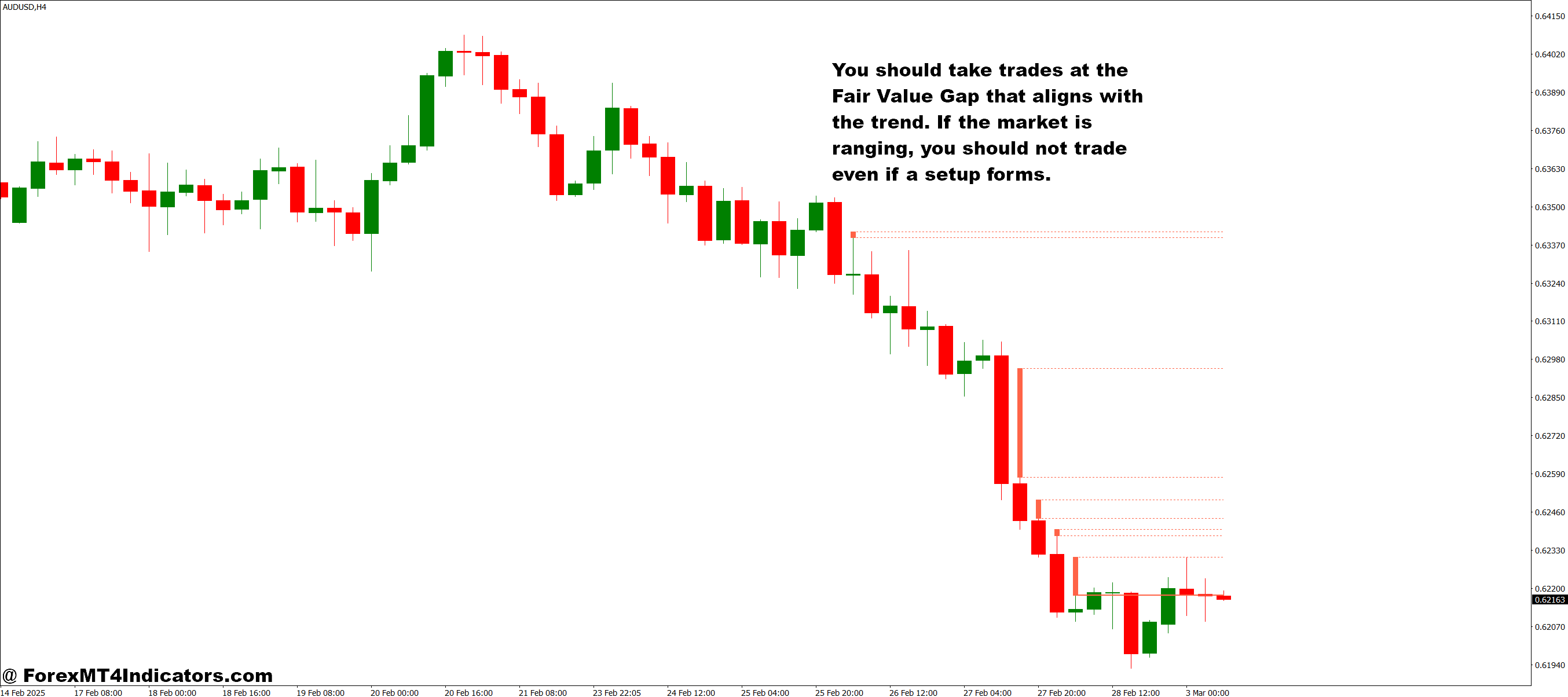

Buying and selling Honest Worth Gaps in Actual Market Situations

On a GBP/JPY 15-minute chart in the course of the Asian session, a dealer may spot a bearish FVG shaped across the 185.50 stage. Worth shortly dropped 60 pips, leaving a niche between 185.45 and 185.65. The indicator marked this zone robotically.

Right here’s the place it will get sensible. Many merchants watch for worth to retrace into this zone in the course of the London session overlap. When worth climbed again to 185.50, they entered quick positions with stops simply above the hole at 185.70—a decent 20-pip threat. The reward? Worth typically continues within the authentic path (down on this case), doubtlessly providing 80-100 pip strikes towards the Asian lows.

However not each hole fills instantly. Typically worth ignores an FVG and retains operating. That’s why combining this indicator with different affirmation helps. If an FVG aligns with a key Fibonacci retracement stage or a earlier support-turned-resistance zone, the chance will increase considerably.

For swing merchants utilizing day by day charts on USD/CAD, FVGs may symbolize zones spanning 100-150 pips. These bigger gaps don’t fill in hours—they may take days or perhaps weeks. The affected person dealer marks these zones and waits, understanding that institutional orders typically sit at these ranges.

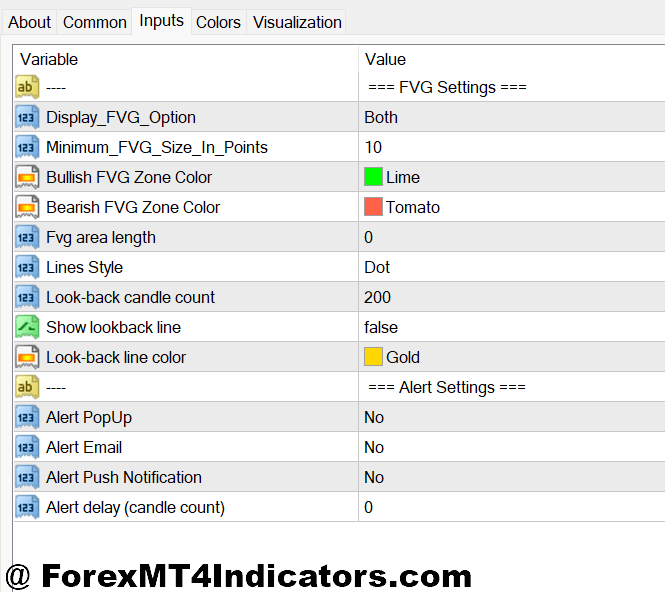

Customizing Settings for Completely different Buying and selling Types

Most Honest Worth Hole indicators provide adjustable parameters. The minimal hole dimension setting proves essential for filtering out insignificant imbalances. On a 1-minute chart, a 2-pip hole means nothing—noise from the unfold. Setting the minimal to 10-15 pips eliminates false indicators.

The lookback interval determines what number of candles the indicator scans backward. Scalpers may set this to 100-200 bars to maintain charts clear, focusing solely on current gaps. Place merchants analyzing weekly charts may prolong this to 500+ bars to trace main historic imbalances.

Colour customization issues greater than it sounds. When utilizing a number of indicators, having FVGs in distinct colours prevents visible litter. Some merchants favor semi-transparent bins to allow them to nonetheless see candlestick patterns throughout the hole zones.

An often-overlooked setting is the hole deletion choice. Ought to the indicator take away stuffed gaps from the chart, or preserve them seen? Newcomers profit from seeing stuffed gaps—it reinforces the idea and builds sample recognition. Skilled merchants normally allow auto-deletion to take care of clear charts.

Strengths and Practical Limitations

The Honest Worth Hole strategy excels at figuring out potential reversal or continuation zones with outlined threat parameters. Not like lagging indicators similar to transferring averages, FVGs are forward-looking—they mark the place worth may go, not the place it’s been.

The visible readability helps merchants keep away from emotional selections. As a substitute of guessing the place to position entries, the indicator actually attracts the zones. This goal strategy reduces the “ought to I enter right here?” paralysis that kills many buying and selling accounts.

That mentioned, FVGs aren’t magical. Throughout ranging markets with low quantity, gaps type always however hardly ever result in clear setups. The EUR/USD throughout quiet summer time buying and selling classes can create a dozen small gaps that worth chops by means of with out respect. Filtering by market session and volatility turns into important.

Whipsaw threat exists. Worth may enter an FVG zone by 5 pips, set off stops, then reverse with out actually filling the hole. This occurs often on uneven 5-minute charts throughout low-impact information releases. Merchants want confluence—ready for added indicators like candlestick patterns or quantity spikes throughout the hole.

One other actuality: not all FVGs are created equal. A spot shaped throughout a parabolic transfer after a serious financial shock holds extra weight than one created throughout in a single day skinny liquidity. Context issues, and the indicator can’t distinguish between them robotically.

How This Differs from Conventional Help and Resistance

Commonplace help and resistance ranges mark the place worth beforehand reversed. Honest Worth Gaps determine the place worth ought to reverse primarily based on market inefficiency fairly than historic worth motion alone. It’s a delicate however highly effective distinction.

Provide and demand zones share some similarities with FVGs—each spotlight imbalance areas. However provide/demand zones sometimes require extra complicated identification involving base formations and departure candles. FVGs provide an easier, extra mechanical strategy that’s simpler to backtest.

In comparison with pivot factors or Fibonacci retracements, FVGs adapt to present worth motion fairly than mathematical calculations. A Fibonacci stage doesn’t care about market construction—it’s simply math. An FVG represents precise buying and selling exercise (or lack thereof), making it dynamic and price-behavior-focused.

Buying and selling foreign exchange carries substantial threat of capital loss. Honest Worth Gaps, like several technical evaluation methodology, don’t assure worthwhile trades. Markets can stay irrational, and gaps could by no means fill or fill far later than anticipated. Correct threat administration and place sizing are non-negotiable.

The way to Commerce with Honest Worth Hole MT4 Indicator

Purchase Entry

- Bullish FVG kinds throughout uptrend – Look ahead to worth to create a niche above the 50-period EMA on EUR/USD 1-hour chart, then enter when worth pulls again into the hole zone with a 15-20 pip cease under the hole.

- Worth faucets FVG decrease boundary – Enter lengthy when the primary candle closes contained in the bullish hole on GBP/USD 4-hour chart, inserting stops 5 pips under the hole’s backside edge for tight threat administration.

- Quantity spike affirmation – Solely take the purchase if quantity will increase by 30%+ as worth enters the FVG zone on the 15-minute chart, indicating institutional curiosity in filling the imbalance.

- Align with larger timeframe development – Skip the setup if day by day chart reveals bearish construction; solely commerce bullish FVGs when the 4-hour and day by day charts each development upward to keep away from counter-trend traps.

- Hole dimension minimal of 20 pips – Ignore FVGs smaller than 20 pips on EUR/USD 1-hour charts as they typically symbolize noise fairly than true institutional imbalances value buying and selling.

- Look ahead to candlestick affirmation – Don’t enter instantly; look ahead to a bullish engulfing or hammer sample to type throughout the FVG zone earlier than going lengthy with a 2:1 reward-to-risk ratio.

- Keep away from buying and selling throughout high-impact information – Skip FVG entries half-hour earlier than and after NFP, FOMC, or central financial institution selections as volatility creates pretend fills and unpredictable worth motion.

- Mix with help ranges – Double your conviction when a bullish FVG aligns with a earlier day by day help zone on GBP/JPY, creating confluence for a higher-probability lengthy entry.

Promote Entry

- Bearish FVG kinds throughout downtrend – Enter quick when worth retraces into the hole on USD/CAD 4-hour chart, setting stops 20 pips above the hole’s higher boundary to restrict threat.

- Worth rejects FVG higher boundary – Go quick when worth touches the highest of a bearish hole on the EUR/USD 1-hour chart and kinds a bearish pin bar, concentrating on the subsequent help stage 60-80 pips away.

- Hole created throughout London open – Prioritize bearish FVGs shaped between 8:00-10:00 GMT on GBP/USD, as these typically carry institutional promote orders that drive worth decrease all through the session.

- Examine RSI under 50 – Solely take promote entries when the 14-period RSI stays under 50 on the 1-hour chart, confirming bearish momentum helps the FVG setup.

- Minimal 30-pip hole on 4-hour chart – Filter out weak indicators by requiring bearish FVGs to span no less than 30 pips on larger timeframes just like the 4-hour GBP/USD chart.

- Keep away from ranging markets – Skip promote setups when ATR (14-period) drops under 50 pips on the day by day EUR/USD chart, indicating low volatility circumstances the place gaps often fail to provide clear strikes.

- Look ahead to 50% hole fill – Enter quick positions solely after worth retraces to the center or higher portion of the bearish FVG, not on the first contact, to enhance entry high quality.

- No entries throughout Asian session – Keep away from taking bearish FVG indicators between 23:00-6:00 GMT on skinny liquidity pairs like EUR/GBP, as low quantity creates unreliable hole habits and extreme slippage.

Conclusion

The Honest Worth Hole MT4 indicator brings Good Cash Ideas into an accessible format for retail merchants. It automates sample recognition that may in any other case require fixed guide chart monitoring, releasing up psychological bandwidth for commerce administration and technique refinement.

Three issues make it work: combining FVG zones with affirmation indicators like trendline breaks or momentum shifts, adjusting settings to match your buying and selling timeframe and pair traits, and accepting that some gaps by no means fill—endurance and selectivity beat forcing each setup.

The actual edge isn’t simply marking gaps on a chart. It’s understanding why establishments go away these imbalances and the way market dynamics push costs again to fill them. That information transforms a visible indicator into a real buying and selling device.

Begin by marking historic FVGs in your favourite pairs. Monitor how typically they fill, how lengthy it takes, and what market circumstances surrounded one of the best setups. That hands-on expertise beats any theoretical understanding.

Really useful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90