Desk of Contents

1. Introduction

2. EA Overview

3. Set up

4. Enter Parameters

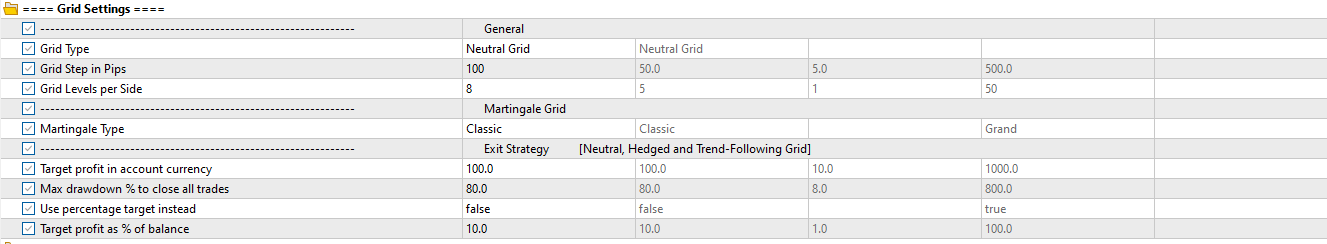

- Grid Settings

- Commerce Settings

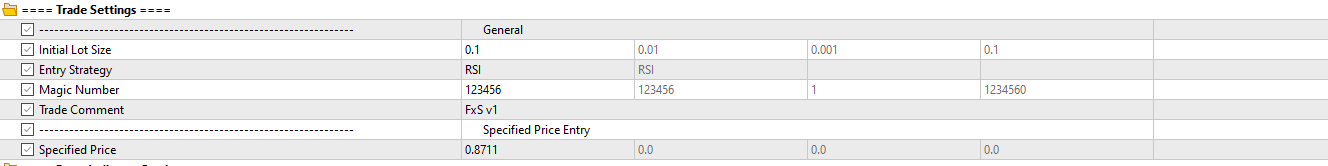

- Entry Indicator Settings

- Time Filters

- Dashboard Settings

4. Optimizing the EA

5. Troubleshooting

1. Introduction

Welcome to the Grid EA, your all-in-one resolution for grid-based buying and selling on MetaTrader 5. This information offers a step-by-step breakdown of set up, configure, and function your EA successfully.

2. EA Overview

Core Options:

- 4 Grid Buying and selling Modes: Impartial, Hedged, Pattern-Following, and Martingale

- 11 Entry Methods: RSI, Shifting Averages, ADX, Bollinger Bands, Ichimoku Cloud, Parabolic SAR, and extra

- Session-based Time Filters

- Constructed-in Dashboard Interface

- Handbook and price-level entries supported

- Danger Administration by way of Goal Revenue and Max Drawdown

3. Set up

For a detailed information of set up the EA, seek advice from this information set up handbook.

4. Enter Parameters

Parameter Clarification:

✅ Grid Sort: Choices (Traditional Grid, Hedged Grid, Pattern Following Grid, Martingale Grid)

Defines the construction and conduct of the restoration grid.

✅ Grid Step in Pips: Distance between grid ranges in pips.

✅ Grid Ranges per Facet: Variety of grid positions on both sides (purchase/promote).

✅ Martingale Sort: Choices (Traditional, Grand)

Controls lot sizing for Martingale Grid.

✅ Goal Revenue in account foreign money: Revenue purpose in account foreign money to shut all trades.

✅ Max Drawdown % to shut all trades: Closes all trades if drawdown exceeds this restrict.

✅ Use proportion goal as a substitute: Allow revenue closure based mostly on steadiness proportion.

✅ Goal revenue as % of steadiness: Revenue proportion (e.g. 10% of steadiness).

✅ Preliminary lot dimension: Base lot dimension of preliminary commerce.

✅ Entry Technique: Choices (RSI, Shifting Averages, Common Directional Index, Bollinger Bands, Ichimoku Cloud, Parabolic SAR, Specified Worth Purchase/Promote, Present Worth Purchase/Promote, Handbook)

Choose one among 11 entry strategies.

✅ Magic quantity: Distinctive quantity for commerce separation.

✅ Commerce remark: Label for commerce identification.

✅ Specified Worth: Utilized in ‘Specified Worth Purchase/Promote’ modes.

- Parameters of Entry Indicator Settings

Parameter Clarification:

a. RSI Settings

✅ RSI Interval: Units the interval of the RSI.

✅ RSI Overbought Degree: Units overbought degree for the RSI.

✅ RSI Oversold Degree: Units oversold degree for the RSI.

b. MA Settings

✅ Quick EMA interval: Units the interval of the quick EMA. A decrease worth makes the EMA extra delicate to cost adjustments (default: 50).

✅ Sluggish EMA interval: Units the interval of the sluggish EMA. Used at the side of the quick EMA to establish pattern path (default: 200).

✅ Minimal pip distinction between EMAs: Minimal pip distinction between the quick and sluggish EMA to substantiate a sound crossover sign. Helps filter out weak or false alerts (default: 15).

c. ADX Settings

✅ ADX interval: The lookback interval for calculating the ADX indicator (default: 14).

✅ ADX Pattern Degree: The brink worth above which the pattern is taken into account robust. Entries are filtered based mostly on whether or not the ADX worth exceeds this degree (default: 25).

d. Bollinger Bands Settings

✅ Bollinger Bands Interval: Variety of durations used within the Bollinger Bands calculation (default: 20).

✅ Bollinger Bands Customary Deviation: The variety of customary deviations from the transferring common used to kind the higher and decrease bands (default: 2.0).

e. Parabolic SAR Settings

✅ Step: The step increment of the SAR. Smaller steps make the indicator extra delicate to cost adjustments (default: 0.02).

✅ Most: The utmost worth that the step can attain, influencing how rapidly the SAR accelerates towards worth (default: 0.2).

f. Ichimoku_Cloud Settings

✅ Tenkan-sen (Conversion Line) interval: The interval used for the conversion line (Tenkan-sen), which reacts rapidly to cost motion.

✅ Kijun-sen (Base Line) interval: The interval for the bottom line (Kijun-sen), used as a pattern affirmation.

✅ Senkou Span B interval: The interval used to calculate one of many cloud boundaries (Senkou Span B), representing longer-term sentiment.

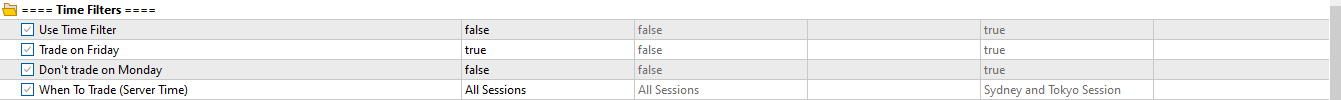

- Parameters of Time Filters

Parameter Clarification:

✅ Use time filters: Toggle to allow/disable utilizing time filters.

✅ Commerce on Friday: Toggle to allow/disable buying and selling on Friday.

✅ Do not commerce on Monday: Toggle to allow/disable buying and selling on Monday.

✅ When To Commerce (Server Time): Choose which session ought to buying and selling be allowed.

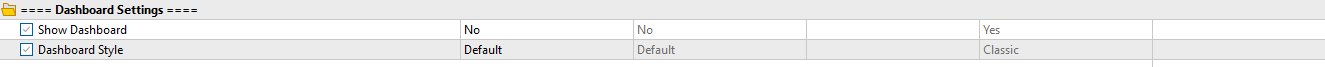

- Parameters of Dashboard Setting

Parameter Clarification:

✅ Present Dashboard: Present dashboard could be both Sure or No.

✅ Dashboard Type: Dashboard Type choices are Default, Darkish or Traditional.

4. Optimizing the EA

Problem Resolution / Repair EA not buying and selling Guarantee Algo Buying and selling is enabled and market is open. Dashboard Not Exhibiting Confirm that ‘Present Interface = Sure’ “No Entry” Recheck entry circumstances (RSI/MA filters, session time). Too Many Trades Scale back `Grid Ranges` or enhance `Grid Interval Pips`. Slippage or Requotes Use ECN/low-spread dealer; keep away from excessive information durations. Not Closing Trades Confirm `Goal Revenue` or `%Goal` is being reached.

Tip: Verify the Specialists and Journal tabs for detailed error logs.

- Regularly Requested Questions (FAQ)

- Regularly Requested Questions (FAQ)

Q1: Can I run a number of situations on completely different symbols?

A: Sure. Connect one FxS Grid EA per chart/image; guarantee every makes use of a singular Magic Quantity to keep away from commerce interference.

Q2: How do I load my optimized settings?

A: Save your optimized `.set` file in `MQL5Presets`. Within the EA’s Inputs tab, click on Load and choose your file.

Q3: Does the EA assist hedging accounts?

A: Sure. FxS Grid EA is appropriate with each hedging and netting account sorts.

This autumn: What timeframes work greatest?

A: Default methods carry out properly on H1–H4. Use optimization to check different timeframes in your image.

Q5: My dealer makes use of 5-digit pricing—do I want to regulate inputs?

A: The EA auto-detects digit format and adjusts pips accordingly. No handbook adjustments wanted.

Q6: What ought to I do if backtests look completely different from stay outcomes?

A: Guarantee backtest unfold, slippage, and execution mannequin mirror your dealer’s stay circumstances. Contemplate tick knowledge import for accuracy.

Q7: How typically will I obtain updates?

A: Updates are launched quarterly or as wanted for bug fixes and new options. Verify the MQL5 Market web page underneath Updates.