Fixing Gold Market Overfitting: A Predictive Machine Studying Strategy with ONNX and Gradient Boosting

Case Examine: The “Golden Gauss” Structure

Creator: Daglox Kankwanda

ORCID: 0009-0000-8306-0938

Technical Paper: Zenodo Repository (DOI: 10.5281/zenodo.18646499)

Contents

- Introduction

- The Core Issues in Algorithmic Buying and selling

- Methodology

- System Structure

- Characteristic Engineering

- Validation and Outcomes

- Commerce Administration

- Trustworthy Limitations

- Conclusion

- Implementation & Availability

- References

1. Introduction

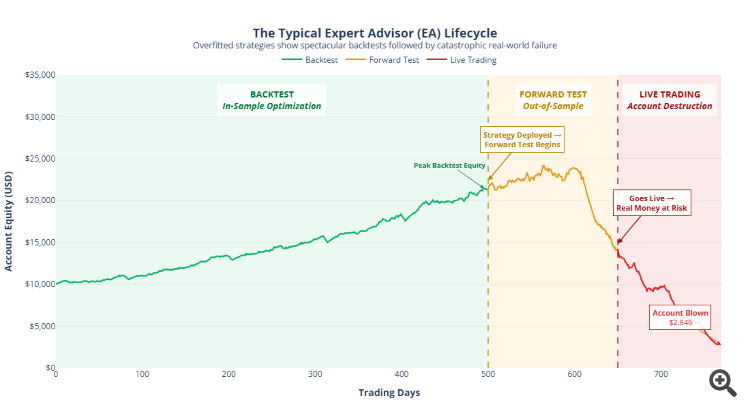

The algorithmic buying and selling house, significantly in retail markets, faces a basic credibility downside. The sample is predictable and pervasive: techniques show spectacular backtest efficiency, adopted by speedy degradation in ahead testing, culminating in account destruction throughout stay deployment. This failure mode stems from a single root trigger—optimization for in-sample efficiency with out rigorous out-of-sample validation.

The mathematical actuality is simple: given enough levels of freedom, any mannequin can “memorize” historic worth patterns. Such memorization produces spectacular backtest metrics whereas offering zero predictive energy for future market habits. The mannequin has discovered the noise, not the sign.

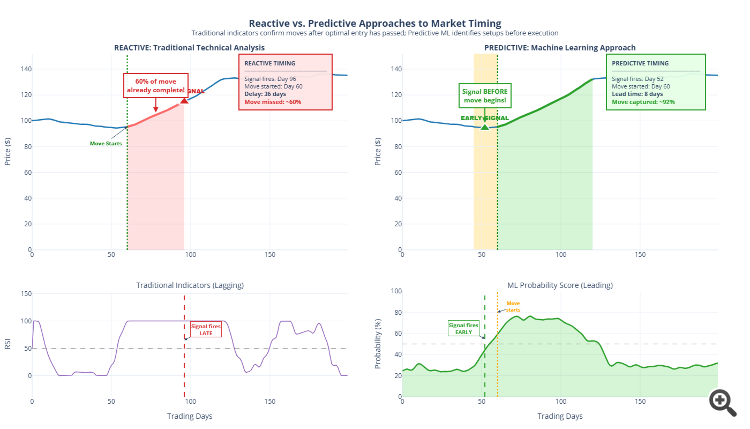

Past overfitting, conventional indicator-based approaches undergo from a basic timing deficiency. Technical indicators, by building, are reactive—they course of historic knowledge to generate indicators after worth actions have already begun.

Core Thesis: A very helpful buying and selling system should determine the situations previous vital worth exercise, not the exercise itself. The aim is prediction, not affirmation.

This text presents a technique that synthesizes machine studying analysis insights right into a sensible, deployable buying and selling system for XAUUSD (Gold) markets, demonstrated via the “Golden Gauss” structure.

2. The Core Issues in Algorithmic Buying and selling

2.1 The Overfitting Disaster

The proliferation of “AI-powered” buying and selling techniques in retail markets has created a credibility disaster, with most techniques exhibiting catastrophic failure when deployed on unseen knowledge attributable to extreme overfitting.

Determine 1: Conceptual illustration of the standard Knowledgeable Advisor lifecycle. Fashions optimized for historic efficiency incessantly fail catastrophically when deployed on unseen market situations.

2.2 The Latency Drawback in Technical Evaluation

Technical indicators are inherently reactive:

- By the point RSI crosses the overbought threshold, the worth has already moved considerably

- By the point a MACD crossover confirms, the optimum entry window has handed

- By the point a breakout is “confirmed,” stop-loss necessities have expanded considerably

Determine 2: Comparability of timing between reactive technical indicators and predictive machine studying approaches. Conventional indicators verify strikes after optimum entry has handed, whereas predictive techniques determine setup situations earlier than execution.

2.3 Literature Context

The applying of machine studying to monetary time-series prediction has developed considerably. A number of constant findings are related:

| Discovering | Implication |

|---|---|

| Gradient Boosting Dominance on Tabular Information | Regardless of advertising and marketing enchantment of “deep studying,” ensemble strategies persistently outperform neural networks on structured monetary knowledge |

| Characteristic Engineering Criticality | High quality of engineered options usually determines mannequin success greater than architectural selections |

| Temporal Validation Necessities | Commonplace cross-validation that shuffles knowledge is inappropriate for monetary time-series attributable to lookahead bias |

| Cross-Asset Data | Monetary devices don’t commerce in isolation; correlated devices present helpful context |

3. Methodology

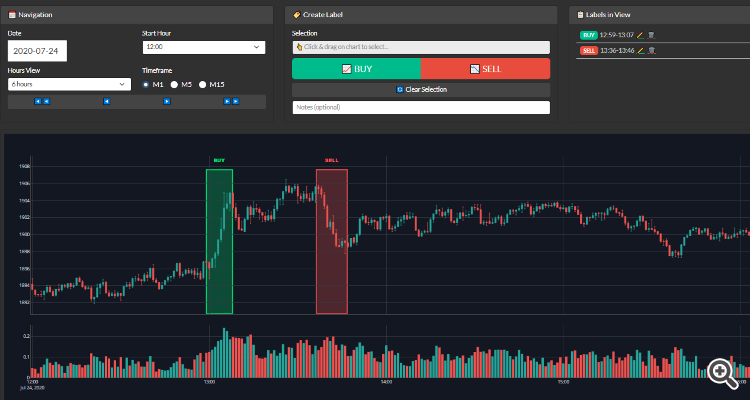

3.1 The Predictive Labeling Methodology

Commonplace approaches to coaching buying and selling fashions label knowledge on the level the place worth motion happens. This creates a basic downside: if the mannequin learns options calculated from the identical bars which can be labeled, it successfully learns to acknowledge strikes which can be already taking place relatively than strikes which can be about to occur.

The Golden Gauss structure employs a technique that maintains temporal separation between characteristic calculation and label placement:

- The labeling course of identifies worthwhile zones the place worth moved considerably in a particular path

- All options are calculated from market knowledge that occurred earlier than the labeled zone begins

Determine 3: Handbook labeling interface displaying XAUUSD worth motion with recognized directional zones. The labeled BUY and SELL areas characterize worthwhile strikes used as coaching targets; the mannequin learns to foretell these strikes utilizing options calculated from previous market knowledge.

Implications: This temporal separation ensures the mannequin learns to acknowledge preconditions—the market microstructure patterns that precede vital strikes—relatively than traits of the strikes themselves.

3.2 High quality-Filtered Coaching Labels

Not all worth actions are significant or tradeable. Many are:

- Too small to beat transaction prices (unfold + fee)

- Too erratic to execute cleanly

- A part of bigger consolidation patterns with out directional follow-through

The labeling course of applies strict filtering standards, figuring out solely zones the place worth moved with enough magnitude and directional consistency. This ensures the mannequin learns solely from setups that exceeded minimal profitability thresholds.

3.3 Twin-Mannequin Directional Structure

Market dynamics exhibit basic asymmetry between bullish and bearish habits:

- Accumulation patterns differ structurally from distribution patterns

- Concern-driven promoting usually executes quicker than greed-driven shopping for

- Help habits differs from resistance habits

- Quantity traits differ between advances and declines

To respect this asymmetry, the structure employs two unbiased binary fashions:

| Mannequin | Output | Coaching Information |

|---|---|---|

| BUY Mannequin | P(Bullish Transfer Imminent) | Skilled solely on bullish labels |

| SELL Mannequin | P(Bearish Transfer Imminent) | Skilled solely on bearish labels |

Every mannequin is a binary classifier detecting solely its respective directional setup. This prevents the confusion that happens when a single mannequin makes an attempt to study contradictory patterns concurrently.

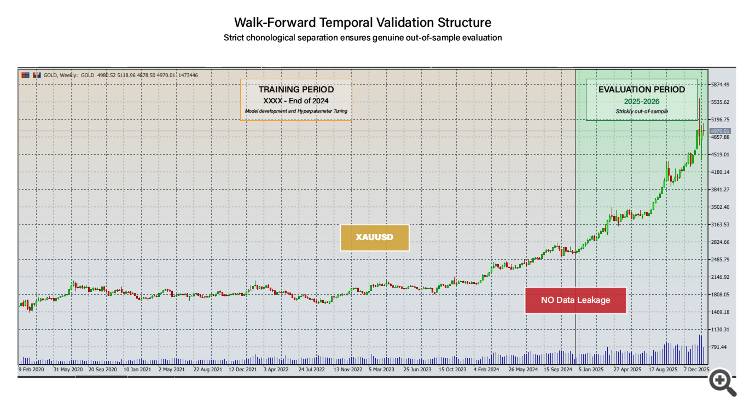

3.4 Stroll-Ahead Validation Protocol

Commonplace machine studying cross-validation, which shuffles knowledge randomly, is inappropriate for monetary time-series attributable to temporal dependencies and lookahead bias dangers.

The system makes use of strict walk-forward validation with full chronological separation:

- Coaching knowledge extends via December 31, 2024

- All architectural choices, hyperparameters, and have engineering selections had been finalized utilizing solely this knowledge

- The mannequin was then frozen and validated on a 13-month out-of-sample interval (January 2025 via January 2026)

Determine 4: Temporal knowledge separation for walk-forward validation. Coaching knowledge extends via finish of 2024; all 2025-2026 analysis represents strictly out-of-sample efficiency on knowledge not used for coaching.

Essential Guidelines:

- No shuffling of time-series knowledge

- Analysis interval evaluation solely in spite of everything mannequin choices finalized

- No iterative “peeking” at analysis outcomes to regulate parameters

4. System Structure

The system includes two distinct however built-in elements:

- Coaching Pipeline — applied in Python for mannequin improvement and validation

- Execution Engine — applied in MQL5 for real-time deployment inside MetaTrader 5

Determine 5: Excessive-level structure of the system. The coaching pipeline (high) processes historic knowledge via characteristic engineering and mannequin coaching, exporting through ONNX. The execution engine (backside) calculates options instantaneously, obtains chance scores, and applies commerce administration logic for place execution.

4.1 Mannequin Structure Choice

The selection of mannequin structure was pushed by empirical analysis in opposition to standards particular to monetary time-series prediction:

| Criterion | Precedence |

|---|---|

| Efficiency on structured/tabular knowledge | Essential |

| Robustness to noise and outliers | Essential |

| Dealing with of regime modifications | Excessive |

| Coaching knowledge effectivity | Excessive |

| Inference pace for stay deployment | Excessive |

| Interpretability (characteristic significance) | Medium |

Primarily based on in depth testing, Gradient Boosting Determination Timber (GBDT) had been chosen. This alternative aligns with constant findings within the machine studying literature that GBDT architectures outperform deep studying approaches on structured monetary knowledge.

Why Not Neural Networks?

Whereas “Neural Community” generates advertising and marketing enchantment, the technical actuality for tabular monetary knowledge:

- GBDTs deal with characteristic interactions naturally with out specific specification

- GBDTs are extra sturdy to noise and outliers in monetary knowledge

- GBDTs require considerably much less coaching knowledge

- GBDTs present interpretable characteristic significance rankings

- GBDTs prepare quicker, enabling extra in depth hyperparameter search

4.2 ONNX Deployment

The mannequin is exported through ONNX (Open Neural Community Trade) for platform-agnostic deployment, enabling Python-trained fashions to execute at C++ speeds inside MT5.

A important requirement is training-serving parity: characteristic calculations in MQL5 should be mathematically an identical to these carried out throughout Python coaching. Any discrepancy creates “training-serving skew” that degrades mannequin efficiency.

4.3 The MQL5-ONNX Interface

The bridge between Python coaching and MQL5 execution depends on the native ONNX API launched in MetaTrader 5 Construct 3600. The first engineering problem is guaranteeing the enter tensor form matches the Python export precisely, and accurately deciphering the classifier’s dual-output construction.

Under is the structural logic used to initialize and run inference with the Gradient Boosting mannequin throughout the Knowledgeable Advisor:

Mannequin Initialization

#useful resource "RecordsdataBULLISH_Model.onnx" as uchar ExtModelBuy[] lengthy g_onnx_buy; const int SNIPER_FEATURES = 239; bool InitializeONNXModels() { Print("Loading ONNX fashions..."); g_onnx_buy = OnnxCreateFromBuffer(ExtModelBuy, ONNX_DEFAULT); if(g_onnx_buy == INVALID_HANDLE) { Print("[FAIL] Didn't load BUY mannequin"); return false; } ulong input_shape_buy[] = {1, SNIPER_FEATURES}; if(!OnnxSetInputShape(g_onnx_buy, 0, input_shape_buy)) { Print("[FAIL] Didn't set BUY mannequin enter form"); return false; } Print(" [OK] BUY mannequin loaded efficiently"); return true; }

Likelihood Inference

The classifier outputs two tensors: predicted labels and sophistication chances. For probability-based execution, we extract the chance of the goal class:

bool GetBuyPrediction(const float &options[], double &chance) { chance = 0.0; if(g_onnx_buy == INVALID_HANDLE) { Print("[FAIL] BUY mannequin not loaded"); return false; } float input_data[]; ArrayResize(input_data, SNIPER_FEATURES); ArrayCopy(input_data, options); lengthy output_labels[]; float output_probs[]; ArrayResize(output_labels, 1); ArrayResize(output_probs, 2); ArrayInitialize(output_labels, 0); ArrayInitialize(output_probs, 0.0f); if(!OnnxRun(g_onnx_buy, ONNX_NO_CONVERSION, input_data, output_labels, output_probs)) { int error = GetLastError(); Print("[FAIL] BUY ONNX inference failed: ", error); return false; } chance = (double)output_probs[0]; return true; }

Key Implementation Particulars:

- Twin-Output Construction: Gradient Boosting classifiers exported through ONNX produce two outputs—the anticipated label and the chance distribution throughout courses. The chance output is used for threshold-based execution.

- Class Mapping: Class 0 represents the goal situation (BULLISH for the BUY mannequin). The chance output_probs[0] immediately signifies mannequin confidence in an imminent bullish transfer.

- Form Validation: Strict form checking at initialization catches training-serving mismatches instantly relatively than producing silent prediction errors throughout stay buying and selling.

4.4 Execution Configuration

| Parameter | Worth |

|---|---|

| Image | XAUUSD solely |

| Timeframe | M1 (characteristic calculation) |

| Lively Hours | 14:00–18:00 (dealer time, configurable) |

| Likelihood Threshold | 88% |

| Cease Loss | Mounted preliminary; dynamically managed |

| Take Revenue | Goal-based with ratchet safety |

| Prohibited Methods | No grid, no martingale |

5. Characteristic Engineering

The system processes 239 engineered options throughout a number of research-backed domains. These options had been developed via tutorial literature assessment, area experience in market microstructure, and iterative empirical testing with strict validation protocols.

5.1 Characteristic Classes Overview

| Class | Conceptual Focus |

|---|---|

| Volatility Regime | Market state classification, tradeable vs. non-tradeable situations |

| Momentum | Multi-scale fee of change, development persistence |

| Quantity Dynamics | Participation ranges, uncommon exercise detection |

| Worth Construction | Help/resistance proximity, vary place |

| Cross-Asset | Correlated instrument indicators, correlation regime shifts |

| Microstructure | Directional strain and short-horizon stress proxies |

| Temporal | Session timing, cyclical patterns |

| Sequential | Sample recognition, run-length evaluation |

5.2 Key Driving Options

The next options persistently ranked among the many most influential in line with international SHAP significance evaluation:

- ADX Pattern Power (14-period): Measuring development energy, unbiased of path

- VWAP Volatility Deviation: Distance of worth from intraday VWAP, normalized by current volatility

- Volatility Regime Classifier: ATR relative to its shifting common, indicating low-, normal-, or high-volatility states

- MACD Histogram Momentum: Capturing short-term momentum and potential reversals

- 60-minute Gold/DXY Rolling Correlation: Rolling correlation between XAUUSD and DXY returns

- 60-minute Gold/USDJPY Rolling Correlation: Rolling correlation between XAUUSD and USDJPY returns

- Directional Volatility Regime: Signed volatility characteristic combining EMA-based development energy with present ATR regime

- Order-Circulate Persistence: Proxy for a way lengthy directional strikes persist throughout current candles

- EMA Unfold Dynamics: Distances and slopes between quick and sluggish EMAs

The presence of well-known indicators (ADX, MACD) alongside proprietary regime and correlation options demonstrates that the mannequin enhances, relatively than replaces, established market relationships with higher-resolution timing indicators.

5.3 Cross-Asset Intelligence

Gold (XAUUSD) doesn’t commerce in isolation. Its worth motion is influenced by:

- US Greenback Dynamics: Usually inverse correlation; greenback energy typically pressures gold costs

- Protected-Haven Flows: Correlation with different safe-haven property throughout risk-off intervals

- Yield Expectations: Relationship with actual rate of interest proxies

The characteristic set incorporates lagged returns from correlated devices, rolling correlations at a number of time scales, divergence detection, and regime change indicators.

6. Validation and Outcomes

The validation strategy follows a single precept: show generalization, not memorization. Any mannequin can obtain spectacular outcomes on knowledge it has seen. The one significant analysis is efficiency on strictly unseen knowledge.

6.1 Out-of-Pattern Efficiency

All 2025 efficiency represents true out-of-sample (OOS) outcomes. The mannequin structure, hyperparameters, and have set had been frozen earlier than any 2025 knowledge was evaluated.

Determine 6: Backtest fairness and stability curves from Jan 2021 to Jan 2026. The interval Jan 2021–Dec 2024 represents knowledge included in mannequin coaching; the interval Jan 2025–Jan 2026 constitutes strictly out-of-sample analysis.

| Metric | Full Interval (Jan 2021– Jan 2026) | OOS Solely (Jan 2025–Jan 2026) |

|---|---|---|

| Win Price | 88.71% | 83.67% |

| Whole Trades | 1,030 | 319 |

| Revenue Issue | 1.77 | 1.50 |

| Sharpe Ratio | 9.90 | 13.9 |

| Max Drawdown (0.01 lot) | ~$500 | ~$313 |

| Restoration Issue | 11.57 | 3.66 |

| Avg Holding Time | 30 min 30 sec | 30 min 30 sec |

Interpretation: The out-of-sample interval demonstrates continued profitability with metrics that degrade gracefully from the coaching interval:

- Win fee decreases from 88.71% to 83.67%—a managed 5% discount indicating the mannequin generalizes relatively than memorizes

- Revenue issue stays above 1.50, confirming constructive expectancy on unseen knowledge

- The upper OOS Sharpe ratio (13.9 vs 9.90) supplies robust proof in opposition to overfitting

This efficiency hole is anticipated and wholesome. The managed degradation confirms real sample generalization.

6.2 Likelihood Threshold Evaluation

The mannequin outputs steady chance scores. Evaluation reveals the connection between chance ranges and commerce outcomes:

| Likelihood Vary | Trades | Win Price |

|---|---|---|

| 0.880 – 0.897 | 231 | 88.3% |

| 0.897 – 0.923 | 167 | 90.4% |

| 0.923 – 0.950 | 190 | 93.2% |

| 0.950 – 0.976 | 107 | 87.9% |

| 0.976 – 0.993 | 27 | 96.3% |

Why 88% Minimal Threshold? The 88% threshold was decided via systematic analysis because the optimum entry level balancing commerce frequency in opposition to high quality. Under this threshold, false-positive charges improve considerably.

6.3 Exit Composition Evaluation

| Exit Sort | Share | Interpretation |

|---|---|---|

| Ratchet Revenue (SL_WIN) | 87.1% | Dynamic revenue seize |

| Take Revenue (TP) | 3.2% | Full goal reached |

| Cease Loss (SL_LOSS) | 9.7% | Managed losses |

The overwhelming majority of successful trades exit through the ratchet system, capturing earnings dynamically relatively than ready for full TP.

6.4 Temporal Consistency

| Yr | Trades | Win Price | Standing |

|---|---|---|---|

| 2021 | 172 | 93.6% | Coaching |

| 2022 | 125 | 93.6% | Coaching |

| 2023 | 64 | 87.5% | Coaching |

| 2024 | 124 | 93.5% | Coaching |

| 2025 | 237 | 85.2% | Out-of-Pattern |

| 2026 | — | — | — |

All years worthwhile with constant efficiency patterns throughout coaching and out-of-sample intervals.

7. Commerce Administration

The system implements a complete commerce administration layer that extends past easy entry execution.

7.1 Likelihood-Primarily based Determination Making

Not like techniques that generate discrete “purchase” or “promote” indicators, the structure calculates chance scores instantaneously on every new bar:

- Entry Determination: Likelihood should exceed 88% threshold earlier than place opening

- Route Choice: Increased chance between BUY and SELL fashions determines path

- Exit Timing: Likelihood modifications inform place closure choices

- Maintain/Shut Logic: Steady chance monitoring throughout open positions

7.2 Entry Validation and Filtering

- Twin-Mannequin Affirmation: Each BUY and SELL mannequin chances are assessed to substantiate directional bias and filter ambiguous situations

- Regime Filtering: Further filters detect unfavorable market regimes (excessive volatility occasions, low liquidity intervals)

- Conditional Execution: Commerce execution proceeds solely after chance thresholds are happy and regime filters verify favorable situations

7.3 Ratchet Revenue Safety

Drawback Addressed: Worth could transfer 80% towards the take-profit stage, then reverse—with out lively administration, this unrealized revenue could be misplaced.

Ratchet Resolution: As worth strikes favorably, the system progressively locks in revenue by tightening exit situations, guaranteeing that vital favorable strikes are captured even when the complete take-profit just isn’t reached.

7.4 Ratchet Loss Minimization

Drawback Addressed: Even high-confidence predictions sometimes fail; ready for the mounted stop-loss leads to most loss on each dropping commerce.

Ratchet Resolution: When worth strikes adversely, the system actively manages the exit to attenuate loss relatively than passively ready for stop-loss execution, decreasing common loss per unsuccessful commerce.

8. Trustworthy Limitations

8.1 What This System Is NOT

- Not infallible: Roughly 15–18% of indicators lead to suboptimal entries relying on market situations

- Not common: Skilled solely for XAUUSD with its particular market microstructure and session dynamics

- Not static: Periodic retraining (3–6 months) is required as markets evolve

- Not assured: Out-of-sample validation demonstrates methodology soundness however doesn’t assure future efficiency

8.2 Recognized Threat Components

| Threat | Description | Mitigation |

|---|---|---|

| Regime Change | Market construction evolves via coverage shifts and geopolitical occasions | Periodic retraining protocol |

| Execution Threat | Slippage throughout volatility can degrade realized outcomes | Session-aware execution, lively hours restriction |

| Edge Decay | Predictive edges face decay as markets evolve | Retraining with methodology preservation |

| Focus | Unique XAUUSD focus supplies no diversification | Consumer duty for portfolio allocation |

8.3 Execution Assumptions

All reported outcomes are based mostly on historic simulations. No extra slippage mannequin has been utilized, and real-world execution could result in materially totally different efficiency. These statistics ought to be interpreted as estimates beneath ultimate execution situations.

9. Conclusion

This text introduced a technique for fixing two basic failures that characterize retail algorithmic buying and selling—overfitting to historic noise and reactive sign technology—via rigorous machine studying practices.

The core improvements demonstrated within the Golden Gauss structure embrace:

- Predictive labeling that permits real anticipation of worth strikes

- Twin-model directional specialization that respects market asymmetry

- Likelihood-driven execution that quantifies confidence earlier than commerce entry

- Clever commerce administration that minimizes losses when predictions show suboptimal

On strictly out-of-sample 2025 knowledge—collected in spite of everything mannequin choices had been finalized—the system demonstrates roughly 83.67% directional accuracy on the 88% chance threshold. The managed efficiency differential from coaching metrics signifies real sample studying relatively than memorization.

Key Takeaways for Practitioners

- By no means shuffle time-series knowledge throughout validation—this creates lookahead bias and knowledge leakage

- Out-of-sample efficiency is the one significant metric for evaluating stay buying and selling potential

- Likelihood thresholds allow accuracy/frequency tradeoffs—greater thresholds yield fewer however higher-quality indicators

- Twin binary fashions respect the asymmetry between bullish and bearish market dynamics

- Commerce administration amplifies edge—ratchet mechanisms maximize wins and decrease losses

- All techniques have limitations—sincere acknowledgment permits acceptable deployment and danger administration

The retail algorithmic buying and selling trade suffers from systematic misalignment between vendor incentives and person outcomes. The methodology introduced right here—strict temporal separation, documented efficiency degradation, bounded confidence claims—affords a template for sincere system analysis that prioritizes sustainable operation over advertising and marketing enchantment.

Knowledgeable critique of the validation methodology and underlying assumptions is welcomed. Progress in algorithmic buying and selling requires techniques designed to outlive scrutiny relatively than keep away from it.

10. Implementation & Availability

The structure described on this paper—particularly the predictive labeling engine and the ONNX chance inference—has been absolutely applied within the Golden Gauss AI system.

To help additional analysis and validation, the whole system is offered for testing within the MQL5 Market. The bundle consists of the “Visualizer” mode, which renders the chance cones and “Kill Zones” immediately on the chart, permitting merchants to look at the mannequin’s decision-making course of in real-time.

Threat Disclaimer: Buying and selling foreign exchange and CFDs entails substantial danger of loss and isn’t appropriate for all buyers. Previous efficiency, whether or not in backtesting or stay buying and selling, doesn’t assure future outcomes. The validation outcomes introduced characterize historic evaluation beneath particular market situations that will not persist. Merchants ought to solely use capital they’ll afford to lose and will contemplate their monetary scenario earlier than buying and selling.

References

- Cao, L. J. and Tay, F. E. H. (2001). Monetary forecasting utilizing help vector machines. Neural Computing & Functions, 10(2), 184-192.

- Chen, T. and Guestrin, C. (2016). XGBoost: A scalable tree boosting system. Proceedings of the twenty second ACM SIGKDD Worldwide Convention on Information Discovery and Information Mining, 785-794.

- López de Prado, M. (2018). Advances in Monetary Machine Studying. Wiley.

- Bailey, D. H. and López de Prado, M. (2014). The chance of backtest overfitting. Journal of Computational Finance, 17(4), 39-69.

- Pardo, R. (2008). The Analysis and Optimization of Buying and selling Methods (2nd ed.). Wiley.

- Krauss, C., Do, X. A., and Huck, N. (2017). Deep neural networks, gradient-boosted bushes, random forests: Statistical arbitrage on the S&P 500. European Journal of Operational Analysis, 259(2), 689-702.

- Baur, D. G. and McDermott, T. Ok. (2010). Is gold a secure haven? Worldwide proof. Journal of Banking & Finance, 34(8), 1886-1898.

- ONNX Runtime Builders (2021). ONNX Runtime: Excessive efficiency inference and coaching accelerator. Out there: https://onnxruntime.ai/