Reversal indicators for MT5 clear up this particular drawback by figuring out potential turning factors with mathematical precision. These instruments analyze worth exhaustion, momentum shifts, and structural breaks to pinpoint when tendencies may flip. They received’t remove losses—no indicator does—however they stack likelihood within the dealer’s favor when looking these high-reward turning factors.

Understanding Reversal Indicators

Reversal indicators function in another way than trend-following instruments. Whereas transferring averages and MACD work greatest throughout sustained directional strikes, reversal indicators shine at inflection factors. They measure when shopping for or promoting stress reaches unsustainable ranges.

The very best reversal instruments for MT5 mix a number of affirmation alerts. A single oscillator exhibiting oversold situations means little in a robust downtrend. However when RSI hits 25 whereas worth varieties a bullish divergence and quantity spikes on a hammer candle, the likelihood of reversal will increase considerably. That’s the sort of confluence profitable merchants hunt for.

How Reversal Detection Works

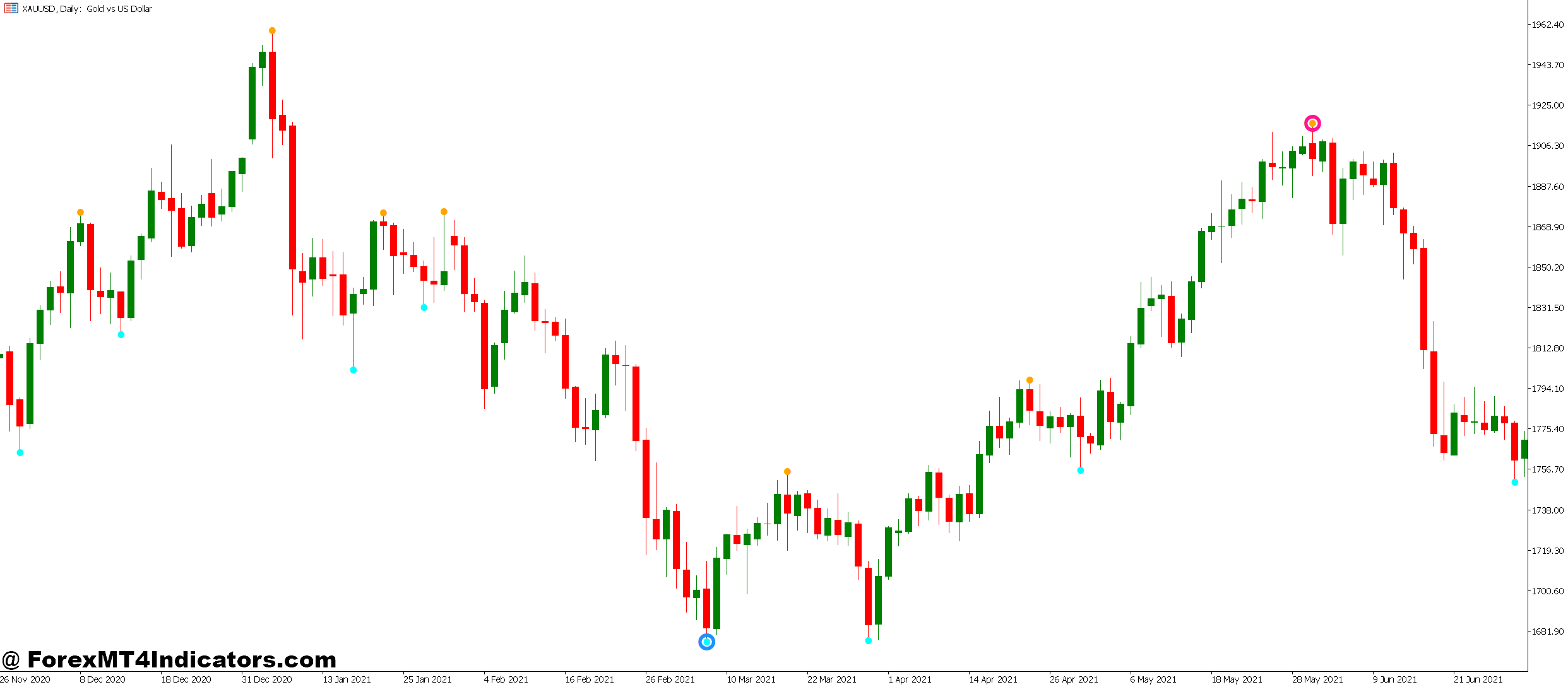

Most reversal indicators depend on momentum divergence and sample recognition. Right here’s what occurs below the hood: the indicator compares worth motion towards an oscillating worth derived from latest highs, lows, and closes. When worth makes a brand new excessive however the oscillator doesn’t, divergence happens—a traditional reversal setup.

Take the ZigZag indicator for example. It filters out worth noise by ignoring strikes smaller than a specified proportion. On EUR/USD’s 4-hour chart, setting ZigZag to 1.5% deviation may present clear swing highs and lows whereas eliminating minor retracements. Merchants then look ahead to failed breaks of those swings—when worth makes an attempt to push previous a latest excessive or low however snaps again sharply, it suggests exhaustion.

Quantity-based reversal indicators add one other layer. They monitor whether or not the amount supporting a transfer is growing or lowering. A downtrend shedding steam usually exhibits declining quantity on every decrease low. When quantity abruptly surges on a reversal candle, it signifies recent participation—consumers overwhelming the exhausted sellers.

Sensible Software and Settings

Actual-world utilization requires adjusting parameters to match buying and selling timeframe and forex pair volatility. Scalpers on 5-minute GBP/JPY charts want tighter settings than swing merchants analyzing each day EUR/USD.

Right here’s a sensible setup that many skilled merchants use: Mix a 14-period RSI with a customized MACD (12, 26, 9) and quantity evaluation. When buying and selling AUD/USD on the 1-hour timeframe, await these three situations: RSI crosses above 30 from oversold territory, MACD histogram exhibits growing bullish bars, and present bar quantity exceeds the 20-period transferring common of quantity by 30% or extra.

That particular instance performed out superbly in the course of the October 2024 selloff. AUD/USD dropped from 0.6700 to 0.6520 in 4 classes. On the 1-hour chart, RSI bottomed at 22, then crossed above 30 whereas MACD histogram printed its first inexperienced bar in 18 hours. Quantity spiked 47% above common on a bullish engulfing candle. Merchants getting into lengthy at 0.6535 caught a 90-pip bounce to 0.6625 inside 24 hours.

The identical setup requires completely different parameters on USD/JPY, which tends to pattern extra persistently. Tightening RSI thresholds to 25/75 as an alternative of 30/70 reduces false alerts in sturdy tendencies. Testing on the 4-hour chart from January by way of November 2024 confirmed this adjustment improved win charge from 52% to 61% on reversal trades.

Benefits and Life like Limitations

The first benefit of reversal indicators is timing optimization. As an alternative of getting into midway by way of a transfer, merchants place themselves on the flip, capturing the total reversal swing. This improves risk-to-reward ratios dramatically. A dealer risking 30 pips to catch a 120-pip reversal achieves a 1:4 R:R—the sort of edge that compounds account development.

These indicators additionally stop chasing. When EUR/GBP rallies 200 pips, FOMO tempts merchants to leap in late. Reversal indicators preserve self-discipline by exhibiting when momentum is overextended. The dealer waits for the pullback setup as an alternative of shopping for the excessive.

However limitations exist, and trustworthy merchants acknowledge them. Reversal indicators fail spectacularly throughout sturdy elementary shifts. When the Swiss Nationwide Financial institution shocked markets by eradicating the EUR/CHF ground in 2015, each technical indicator screamed “reversal” because the pair plunged—proper earlier than it dropped one other 2000 pips. No oscillator can predict central financial institution interventions or sudden geopolitical shocks.

Whipsaws are one other actuality. Uneven, range-bound markets generate a number of reversal alerts as worth bounces between assist and resistance. USD/CAD spent August 2024 grinding between 1.3650 and 1.3750 for 3 weeks. Reversal alerts fired at each ends repeatedly, however most strikes fizzled after 20-30 pips. Merchants want pattern filters to keep away from these range-bound losses.

Comparability with Various Approaches

Development-following indicators like transferring common crossovers provide extra constant, lower-stress buying and selling. They sacrifice early entries for increased likelihood. A 50/200 EMA cross received’t catch the precise reversal level, however it confirms the pattern has genuinely modified earlier than committing capital.

Worth motion purists argue pure assist/resistance ranges outperform indicators totally. They’ve some extent. A well-defined provide zone that rejected worth 3 times carries extra weight than an RSI studying. Sensible merchants use reversal indicators to verify what worth construction already suggests, not as standalone alerts.

Fibonacci retracements pair exceptionally properly with reversal indicators. When EUR/USD retraces to the 61.8% Fib stage of a previous swing and concurrently triggers RSI oversold plus MACD bullish divergence, the confluence creates a high-probability setup. Every ingredient alone is weak; mixed, they type a sturdy sign.

Threat Administration Stays Non-Negotiable

Buying and selling foreign exchange carries substantial danger. No indicator ensures earnings, and reversal buying and selling specifically calls for strict danger controls. The character of catching falling knives means some trades will blow by way of stop-losses earlier than reversing.

Place sizing should account for this actuality. Many professionals danger just one% of capital per reversal commerce versus 1.5-2% on trend-continuation setups. The logic is sound: reversals fail extra usually than continuations, so cut back publicity accordingly.

Cease-loss placement for reversal trades usually sits past the latest swing excessive plus a buffer for unfold and volatility. On a 1-hour chart reversal sign at 1.0850, if the latest swing low hits 1.0820, place the cease at 1.0810, giving 40 pips of respiratory room. Tight stops beneath 30 pips on main pairs not often survive regular market noise.

Tips on how to Commerce with Finest Reversal MT5 Indicator

Purchase Entry

- Verify RSI oversold beneath 30 – Await RSI to cross again above 30 on the EUR/USD 1-hour chart earlier than getting into, not whereas it’s nonetheless falling to keep away from catching a falling knife.

- Test bullish divergence on MACD – Worth makes a decrease low, however MACD histogram makes a better low, signaling weakening downward momentum on 4-hour GBP/USD charts.

- Quantity spike above 40% common – Present candle quantity should exceed the 20-period quantity MA by no less than 40% to verify real shopping for curiosity, not only a weak bounce.

- Establish swing low assist – Enter solely after worth assessments a earlier swing low inside 20-30 pips on each day timeframes, including structural confluence to the reversal sign.

- Set stop-loss 40-50 pips beneath entry – Place stops beneath the latest swing low plus 10-pip buffer to outlive regular volatility on main pairs like EUR/USD.

- Keep away from buying and selling throughout main information – Skip reversal alerts inside half-hour earlier than or after NFP, FOMC, or central financial institution bulletins when volatility invalidates technical setups.

- Goal 2:1 minimal risk-reward – If risking 40 pips, purpose for no less than an 80-pip revenue goal to compensate for reversal trades’ decrease win charge of 55-60%.

- Skip alerts in sturdy downtrends – Don’t take purchase alerts when worth trades beneath falling 200-period EMA on 4-hour charts, as pattern continuation overpowers reversal makes an attempt.

Promote Entry

- Await RSI overbought above 70 – Enter shorts solely after RSI crosses again beneath 70 on GBP/JPY 1-hour chart, confirming momentum shift quite than untimely entry.

- Spot bearish divergence – Worth prints a better excessive whereas the MACD histogram exhibits a decrease excessive on the 4-hour EUR/USD, indicating exhaustion at resistance ranges.

- Verify quantity surge on reversal candle – Search for 50%+ quantity improve on the bearish engulfing or capturing star candle that triggers the promote sign.

- Test resistance rejection – Worth should fail to interrupt above a examined resistance stage by no less than 15-20 pips earlier than reversing, seen on each day GBP/USD charts.

- Place stops 40-60 pips above entry – Place stop-loss above the latest swing excessive plus unfold and 10-pip buffer to keep away from untimely stop-outs on risky pairs.

- Threat just one% per reversal commerce – Counter-trend trades fail extra usually, so cut back place dimension in comparison with trend-following setups to guard capital throughout shedding streaks.

- Keep away from sells throughout charge minimize cycles – Skip bearish reversal alerts when central banks are dovish or slicing charges, as bullish bias overwhelms short-term technical reversals.

- Goal earlier assist as revenue zone – Set take-profit on the final important assist stage, usually 80-150 pips away on 4-hour charts, the place consumers doubtless re-enter.

Conclusion

Reversal indicators excel at figuring out potential turning factors by way of momentum divergence, quantity evaluation, and sample recognition. They work greatest when mixed with a number of affirmation alerts quite than utilized in isolation. Merchants ought to alter parameters based mostly on particular forex pairs and timeframes, with extra risky pairs requiring looser settings to keep away from false alerts. The very best-probability setups happen when reversal alerts align with key assist or resistance ranges, creating confluence that stacks odds favorably. Threat administration turns into vital since reversal trades inherently battle the present pattern, requiring tighter place sizes and wider stops than trend-continuation methods. Testing any setup throughout completely different market situations earlier than risking actual capital stays important—what works throughout range-bound summer season months could fail throughout risky autumn tendencies.

Really useful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90

(Free MT4 Indicators Obtain)

Enter Your E mail Deal with beneath, obtain hyperlink will probably be despatched to you.

Get Obtain Hyperlink