Right now’s article goes to offer you guys a “sneak-peak” into precisely how I resolve on my cease and revenue goal placements. I get a whole lot of emails asking how I resolve the place to position a cease or the place to position a goal, and whereas there isn’t a one-size-fits all reply to this query, there are specific issues that it is best to take into account earlier than coming into a commerce that may make figuring out the most effective cease and goal placement a lot simpler.

Right now’s article goes to offer you guys a “sneak-peak” into precisely how I resolve on my cease and revenue goal placements. I get a whole lot of emails asking how I resolve the place to position a cease or the place to position a goal, and whereas there isn’t a one-size-fits all reply to this query, there are specific issues that it is best to take into account earlier than coming into a commerce that may make figuring out the most effective cease and goal placement a lot simpler.

Earlier than we get began, let me first say that this subject of cease loss and revenue goal placement is known as a fairly broad subject that I may write quite a bit on. Whist at the moment’s lesson doesn’t cowl each element of cease loss and goal placement, it gives you normal overview of a very powerful issues that undergo my thoughts as I resolve the place to position my cease loss and my revenue goal on anybody commerce.

Putting cease losses

I’m beginning with cease loss placement for a few necessary causes. One, you all the time ought to take into consideration threat earlier than reward and you ought to be not less than two instances extra centered on threat per commerce than you’re on reward. Two, we have to decide our cease loss to then decide our place measurement on the commerce, potential greenback loss and achieve, and our R multiples. It will all change into clearer as you learn on should you had been confused by that final sentence.

Normal cease loss placement idea:

When putting stops, we need to place our cease loss at a logical degree, meaning a degree that may each inform us when our commerce sign is now not legitimate and that is smart within the context of the encircling market construction.

I prefer to all the time begin with the premise that I’ll ‘let the market take me out’, which means, I need the market to point out me that my commerce is invalid by transferring to a degree that nullifies the setup or modifications the near-term market bias. I all the time have a look at manually closing a commerce as possibility quantity 2, my first possibility is all the time to ‘set and neglect’ the commerce and let the market do the ‘soiled work’ with out my interference. The one time I manually exit a commerce earlier than my predetermined cease will get hit is that if the market exhibits me some convincing worth motion in opposition to my place. This may be a logic-based purpose to manually exit a commerce, fairly than an emotion-based purpose that the majority merchants use to exit on.

So to recap, there are mainly two logic-based strategies for exiting a commerce:

1) Let the market hit your predetermined cease loss which you positioned as you entered the commerce.

2) Exit manually as a result of the worth motion has fashioned a sign in opposition to your place.

Exits which are emotion-based:

1) Margin name since you didn’t use a cease and the market moved to this point in opposition to your place that your dealer mechanically closed your commerce.

2) Manually closing a commerce since you ‘suppose’ the market goes to hit your cease loss. You’re feeling emotional as a result of the market is transferring in opposition to your place. However, there isn’t a worth motion primarily based purpose to manually exit.

The aim of a cease loss is that can assist you keep in a commerce till the commerce setup and authentic near-term directional bias are now not legitimate. The aim of knowledgeable dealer when putting their cease loss, is to position their cease at a degree that each offers the commerce room to maneuver of their favor or room to ‘breathe’, however not unnecessarily so. Mainly, when you’re figuring out the most effective place to place your cease loss you need to take into consideration the closest logical degree that the market must hit to show your commerce sign incorrect. So, we don’t need to put our cease loss unnecessarily distant, however we don’t need it too near our entry level both. We need to give the market room to breathe but additionally preserve our cease shut sufficient in order that we get taken out of the commerce as quickly as attainable if the market doesn’t agree with our evaluation. So, you’ll be able to see there’s a ‘fantastic line’ that we have to stroll when figuring out cease placement, and certainly I take into account cease placement probably the most necessary points of putting a commerce and I give every cease loss placement a whole lot of time and thought earlier than I pull the set off.

Many merchants reduce themselves brief by putting their cease loss too near their entry level solely as a result of they need to commerce a much bigger place measurement. That is what I name “buying and selling account suicide” my buddies. While you place your cease too shut since you need to commerce a much bigger place measurement, you’re mainly nullifying your buying and selling edge, as a result of it is advisable to place your cease loss primarily based in your buying and selling sign and the encircling market circumstances, not on how a lot cash you need to make.

In the event you bear in mind just one factor from at the moment’s lesson, let it’s this: all the time decide your cease loss placement earlier than figuring out your place measurement, your cease loss placement must be decided by logic, not by greed. What meaning, is that you just shouldn’t purposely put a small cease loss on a commerce simply since you need to commerce a giant place measurement. Many merchants do that and it’s mainly like setting your self up for a loss earlier than the commerce even begins.

Examples of putting a cease loss primarily based on logic:

Now, let’s undergo some examples of probably the most logical cease loss placements for a few of my worth motion buying and selling methods. These cease placements are what I take into account to be the ‘most secure’ for the setups being mentioned, meaning they gave the commerce the most effective probability of understanding and that the market should transfer to a logical degree in opposition to your place earlier than stopping you out. Let’s have a look:

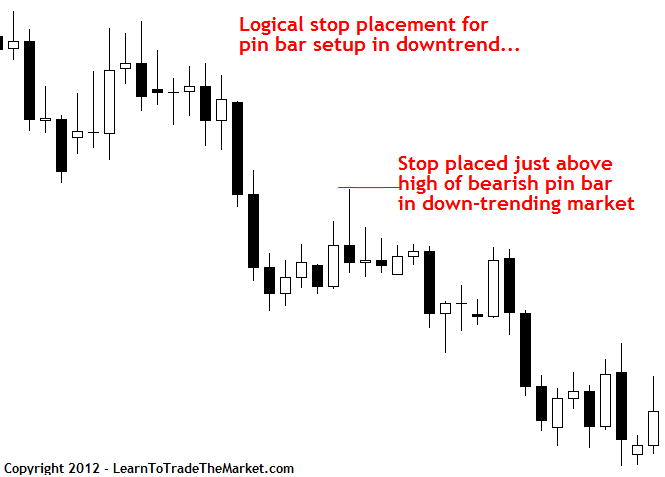

Pin bar buying and selling technique cease placement:

Probably the most logical and most secure place to place your cease loss on a pin bar setup is simply past the excessive or low of the pin bar tail. So, in a downtrend like we see under, the cease loss can be simply above the tail of the pin bar, after I say “simply above” that may imply about 1 to 10 pips above the excessive of the pin bar tail. There are different pin bar cease loss placements mentioned in my worth motion buying and selling course however they’re extra superior, the cease loss placement under is taken into account the ‘basic’ cease loss placement for a pin bar setup.

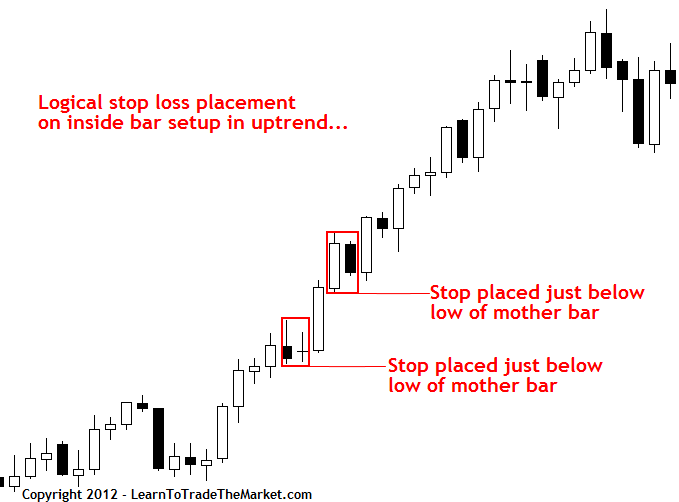

Inside bar buying and selling technique cease placement:

Probably the most logical and most secure place to place your cease loss on an inside bar commerce setup is simply past the mom bar excessive or low. In the event you don’t perceive inside bars but, please learn this text on buying and selling the within bar technique.

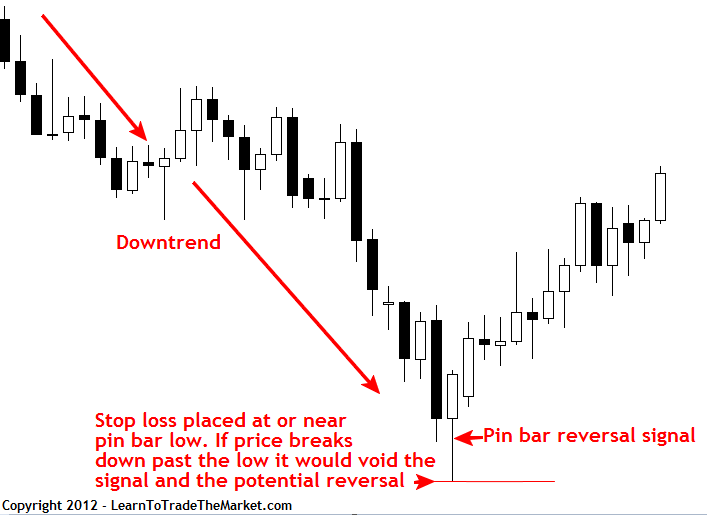

Counter-trend worth motion commerce setup cease placement:

For a counter-trend commerce setup, we need to place our cease simply past the excessive or low made by the setup that alerts a possible pattern change. Take a look at the picture under, we will see a downtrend was in place once we acquired a big bullish pin bar reversal sign. Naturally, we’d need to place our cease loss just under the tail of that pin bar to make the market present us that we had been incorrect a couple of backside being in place. That is the most secure and most obvious cease placement for any such ‘backside choosing’ worth motion commerce setup. For an uptrend reversal the cease can be positioned simply past the excessive of the counter-trend sign.

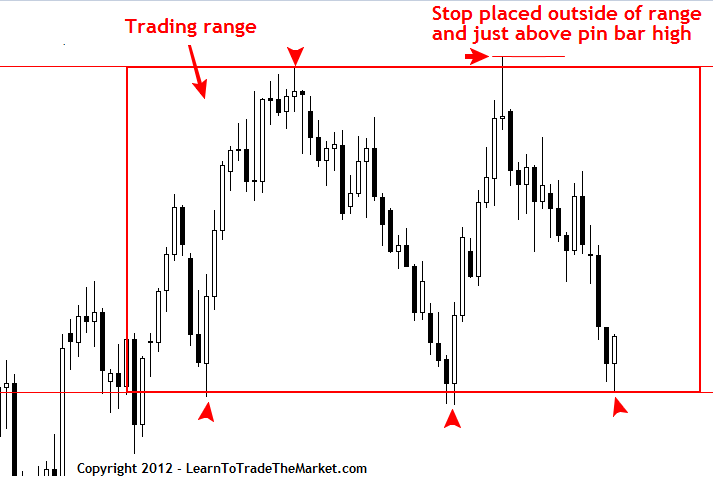

Buying and selling vary cease placement:

We regularly see high-probability worth motion setups forming on the boundary of a buying and selling vary. In conditions like these, we all the time need to place our cease loss simply above the buying and selling vary boundary or the excessive or low of the setup being traded…whichever is additional out. For instance, if we had a pin bar setup on the prime of a buying and selling vary that was simply just below the buying and selling vary resistance we’d need to place our cease a bit larger, simply exterior the resistance of the buying and selling vary, fairly than simply above the pin bar excessive. Within the chart under, we didn’t have this problem; we had a pleasant giant bearish pin bar protruding from the buying and selling vary resistance, so the most effective placement for the cease loss on that setup is clearly simply above the pin bar excessive.

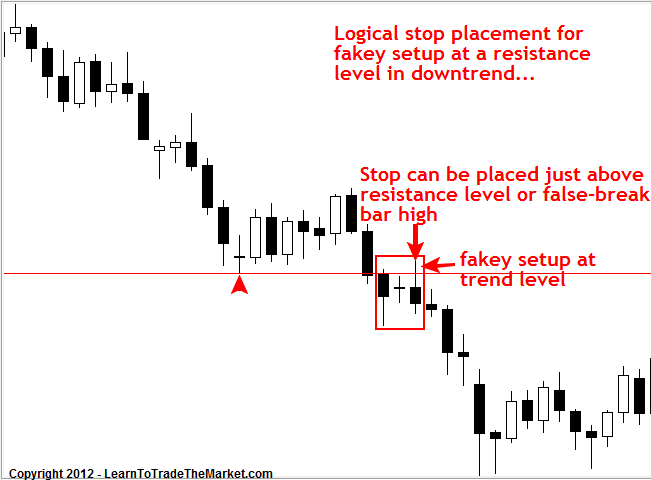

Cease placement in a trending market:

When a trending market pulls again or retraces to a degree inside the pattern, we often have two choices. One is that we will place the cease loss simply above the excessive or low of the sample, as we have now seen, or we will use the extent and place our cease simply past the extent. We are able to see an instance of this within the chart under with the fakey buying and selling technique protruding up previous the resistance degree within the downtrend. Probably the most logical locations for the cease can be simply above the false-break excessive or simply above the resistance degree.

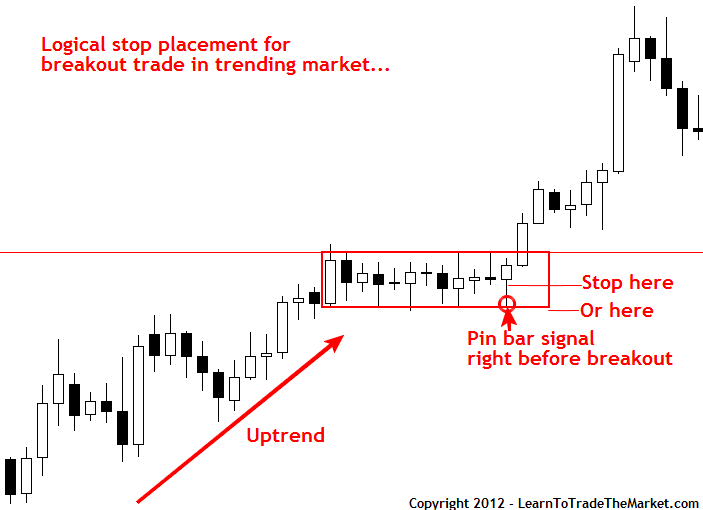

Trending market breakout play cease placement:

Typically, in a trending market, we are going to see the market pause and consolidate in a sideways method after the pattern makes a robust transfer. These consolidation intervals sometimes give rise to giant breakouts within the course of the pattern, and these breakout trades could be very profitable typically. There are mainly two choices for cease placement on a breakout commerce with the pattern. As we will see within the chart under, you’ll be able to place your cease loss close to the 50% degree of the consolidation vary or on the opposite facet of the worth motion setup; within the instance under it was a pin bar. The logic behind putting your cease loss close to the 50% degree of the consolidation vary is that if the market comes all the way in which again all the way down to that time the breakout might be not very robust and prone to fail. This cease placement offers you a tighter cease distance which will increase the potential threat reward on the commerce.

Be aware on putting stops:

So, let’s say we have now a worth motion buying and selling technique that’s very near key degree out there. Ordinarily, the best cease placement for the worth motion setup is simply above the excessive of the setup’s tail or the low of the setup’s tail, as we mentioned above. Nevertheless, for the reason that worth motion setup tail excessive or low could be very near a key degree out there, logic would dictate that we make our cease loss a bit bit bigger and place it simply past that key degree, fairly than on the excessive or low of the setup’s tail. This manner, we make the market violate that key degree earlier than stopping us out, thus displaying us that market sentiment has modified and that we must always maybe be on the lookout for trades within the different course. That is the way you place your stops in response to the market construction and logic, fairly than from feelings like greed or concern.

Putting revenue targets

Putting revenue targets and exiting trades is maybe probably the most technically and emotionally troublesome side of buying and selling. The trick is to exit a commerce while you’re up a decent revenue, fairly than ready for the market to return crashing again in opposition to you and exiting out of concern. The issue of that is that it’s human nature to not need to exit a commerce when it’s up a pleasant revenue and transferring in your favor, as a result of it ‘feels’ just like the commerce will proceed on in your favor and so that you don’t’ need to exit at that time. The irony is that not exiting when the commerce is considerably in your favor sometimes means you’ll make an emotional exit because the commerce comes crashing again in opposition to your place. So, what it is advisable to study is that it’s important to take respectable earnings of 1:2 threat:reward or higher when they’re out there, except you may have pre-determined earlier than coming into that you’ll attempt to let the commerce run additional.

Normal revenue goal placement idea:

After figuring out probably the most logical placement for our cease loss, our consideration ought to then shift to discovering a logical revenue goal placement and in addition to threat reward. We must be certain a good threat reward ratio is feasible on a commerce; in any other case it’s actually not value taking. Now, what I imply by that’s this; it’s important to decide probably the most logical place in your cease loss, as we mentioned above, after which decide probably the most logical place in your revenue goal. If after doing that, there’s a first rate threat reward ratio attainable on the commerce, it’s a commerce that’s most likely value taking. Nevertheless, it’s important to be sincere with your self right here, don’t get right into a sport of ignoring key market ranges or apparent obstacles which are in your method to reaching a good threat reward simply since you need to enter a commerce.

So, what are among the issues I take into account when deciding the place to position my revenue goal? It’s actually fairly easy, I’m mainly analyzing the general market circumstances and construction, issues like help and resistance ranges, main turning factors out there, bar highs and lows, and so forth. I attempt to decide if there’s some key degree that might make a logical revenue goal, or if there’s some key degree obstructing my commerce’s path to creating a good revenue.

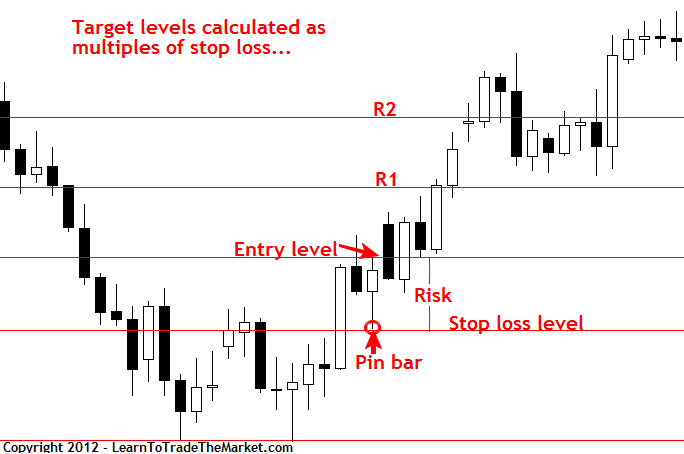

First off, let’s have a look at an instance of learn how to calculate revenue targets primarily based on a number of of threat:

Within the picture under, we will see a pin bar setup which fashioned after the market started transferring larger after a reversal of its earlier downtrend. The cease loss was positioned just under the low of the pin bar. So, at that time we have now what we name 1R, or just the greenback quantity we have now in danger from our entry degree to the cease loss degree. We are able to then take this 1R quantity (our threat) and prolonged it out to seek out multiples of it that we will use as revenue targets. In the event you don’t perceive threat reward it is best to learn this text on the energy of threat reward, it can clarify to you why it’s essential to correctly make the most of threat reward and to goal for threat reward ratios of 1:2 or higher.

Now, let’s take this a step additional and put the whole lot we’ve realized in at the moment’s lesson collectively. We’re going to analyze a commerce setup and talk about the cease placement on the commerce, the goal placement and the chance reward potential…

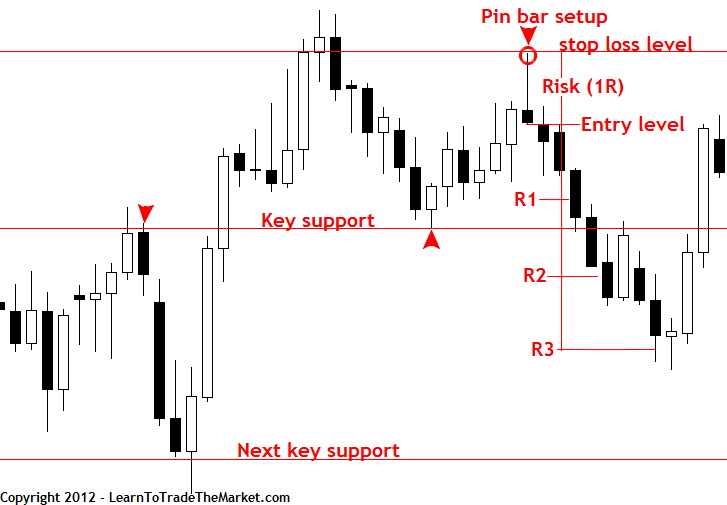

Within the chart under, we will see an apparent pin bar reversal setup fashioned close to a key market resistance degree, indicating {that a} transfer decrease was a robust chance. The very first thing I did was decide the place greatest to position my cease loss. On this case, I elected to position it simply above the pin bar excessive since I decided that I’d now not need to be brief if the market strikes as much as that degree.

Subsequent, I observed that there’s a key help a bit methods down under my entry, however for the reason that key help didn’t are available till nearly 1.5 instances my threat and past that there was no key help till a lot additional under, I made a decision the commerce was value taking. Given there was an opportunity of a reversal after the market hit that first key help degree, I pre-determined to path my cease all the way down to that R1 degree and lock in that revenue, if the market reached that degree. That approach I can not less than make 1R while avoiding the potential reversal off that key help.

Because it turned out, the market sailed proper by way of the primary key help after which continued transferring decrease to make 3R. Now, not each commerce goes to work out this nicely, however I’m making an attempt to point out you learn how to correctly place your cease loss, calculate what your 1R threat quantity is after which discover the potential reward multiples of that threat while contemplating the general surrounding market construction. The important thing chart ranges must be used as guides for our revenue targets, and when you have a key chart degree coming in earlier than the commerce can attain a 1R revenue, then you definately may need to take into account not taking that commerce.

After we are attempting to determine if a possible worth motion commerce setup is value taking, we have to work backwards to some extent. We do that by first calculating the chance after which the reward after which we take a step again and objectively view the buying and selling setup within the context of the market construction and resolve whether or not or not the market has an actual shot at hitting our desired goal(s). It’s necessary to recollect we’re doing all of this evaluation and preparation prior to coming into our commerce, once we are goal and unemotional.

Be aware: There are completely different entry prospects that I didn’t get into right here which may have an effect on the potential threat reward of a selected commerce setup. Right now’s lesson was simply meant as a normal information of learn how to logically and successfully place cease losses and targets on choose worth motion commerce setups, I talk about completely different entry eventualities and extra commerce setups in my buying and selling course and members’ group.

Ultimate notice:

A dealer is known as a enterprise particular person, and every commerce is a enterprise deal. Take into consideration Donald Trump doing a giant enterprise deal to purchase a brand new lodge improvement…he’s fastidiously weighing the chance and the reward from the deal and deciding if it’s value taking or not. As a dealer, that’s what we do too; we first take into account the chance on the commerce after which we take into account the potential reward, how we will receive the reward, and if it’s realistically attainable to acquire it given the encircling market construction, after which we make our last resolution in regards to the commerce. Whether or not you may have a $100 account or a $100,000 account, the method of weighing the potential threat vs. the potential reward on a commerce is precisely the identical, and that additionally goes for cease and goal placement; it’s the identical irrespective of how huge or small your account is.

Our number one concern as merchants is capital preservation. Meaning getting probably the most ‘distance’ out of our buying and selling capital. Skilled merchants don’t waste their buying and selling capital, they use it solely when the chance reward profile of a commerce setup is smart and is logical. We all the time need to justify the chance we’re taking up anybody commerce, that’s how it is best to take into consideration each commerce you’re taking; justify the cash you’re laying on the road, and should you can’t make case for risking that cash given the setup and market construction, then don’t take the commerce. Every commerce we take wants cautious planning and consideration and we by no means need to rush to enter a commerce as a result of it’s much better to overlook a chance than it’s to leap to a conclusion that we got here to emotionally fairly than logically. If you wish to study extra about planning cease loss placements, revenue targets and among the different ideas mentioned in at the moment’s lesson, take a look at my Foreign exchange worth motion buying and selling course.

Good buying and selling, Nial Fuller