Within the dynamic world of foreign currency trading, the EURCHF pair is at the moment exhibiting attention-grabbing patterns and traits. This evaluation delves into the latest Swiss CPI information, the Swiss Nationwide Financial institution’s (SNB) actions, and insights from the Eurozone Sentix Investor Confidence Index, shedding mild on the potential for a triple backside formation and divergence within the EURCHF pair.

Swiss CPI Knowledge and SNB’s Affect:

In November, Swiss CPI fell greater than anticipated, impacting the annualized price and core CPI figures. Regardless of the SNB’s resolution to take care of rates of interest at 1.75% in September, its continued efforts to promote international foreign money have positioned the Swiss franc because the strongest G10 foreign money. This transfer is predicted to persist, with the SNB prone to promote extra international foreign money within the coming months.

Eurozone Financial Insights:

The Eurozone Sentix Investor Confidence Index gives a combined however usually optimistic view of the area’s financial outlook. December witnessed an enchancment within the index, albeit barely beneath expectations. The Expectations Index confirmed a consecutive rise, hinting at a possible development reversal. Sentix, whereas cautious about over-optimism, foresees vital enchancment within the new 12 months, pushed by constructive modifications within the inflation outlook.

Eurozone client inflation expectations unchanged at a 5-month excessive. The newest ECB survey confirmed that median expectations for inflation over the following 12 months remained unchanged at 4.0%, whereas expectations for inflation three months forward held regular at 2.5%. These charges are nonetheless clearly above the ECB’s 2% restrict, even three years forward, though a minimum of there’s the sense that inflation is predicted to decelerate sharply. Expectations for nominal earnings progress in addition to nominal spending progress over the following 12 months decelerated barely.

Eurozone PPI inflation lifted to -9.4% y/y from -12.4% y/y within the earlier month. Annual PPI charges turned damaging in Might, as base results from the sharp rise in power costs began to fall out of the equation. Surveys counsel the choose up in wage prices is placing stress on producers to hike costs, though sluggish demand is limiting the room for corporations to go on larger prices.

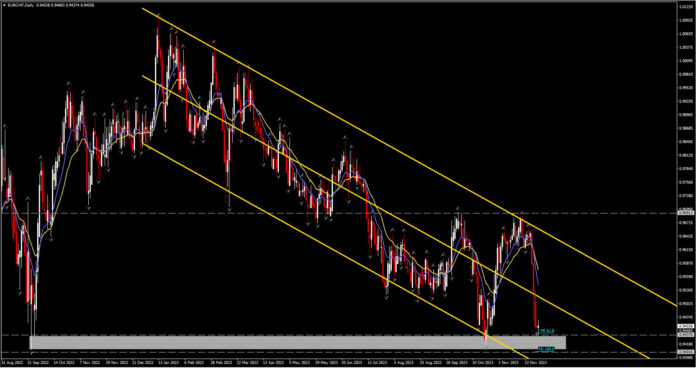

EURCHF Technical Evaluation:

Within the FX market, EURCHF has maintained its medium-term decline, dealing with resistance across the 0.9693 stage. The 0.9402 assist stage is essential, and a robust break might resume the long-term downtrend. The present outlook stays impartial throughout the 0.9417 – 0.9693 vary, with the formation of a triple backside and weekly divergence suggesting a possible reversal. Nonetheless, a decisive transfer above the 0.9693 resistance is important to verify a shift; in any other case, the bearish development might persist.

As we navigate the complexities of EURCHF buying and selling, maintaining a tally of Swiss CPI, SNB’s actions, and the Eurozone Sentix Index is essential. The potential triple backside formation and divergence add a layer of intrigue to the impartial outlook, making it crucial for merchants to remain knowledgeable and adapt their methods accordingly.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a normal advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or needs to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.