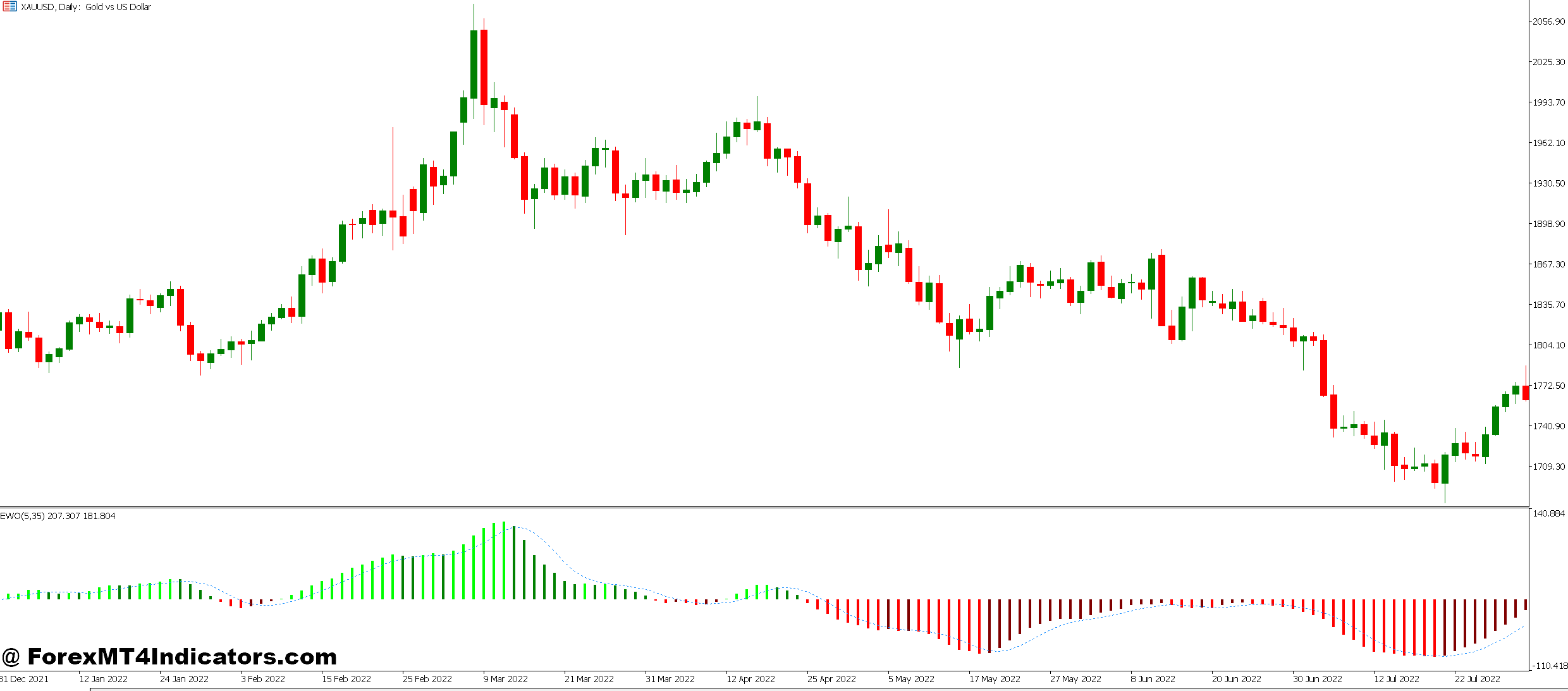

The Elliott Wave Indicator for MetaTrader 5 mechanically identifies and labels wave patterns on value charts based mostly on Ralph Nelson Elliott’s wave precept. As an alternative of manually counting impulse waves (1-2-3-4-5) and corrective waves (A-B-C), the indicator plots these constructions in real-time as the worth develops. It marks wave positions instantly on the chart with numerical labels or letters, relying on whether or not the sample is impulsive or corrective.

Right here’s the factor: Not all Elliott Wave indicators work the identical means. Some use zigzag calculations to determine swing highs and lows, then apply Elliott’s guidelines to label the construction. Others incorporate Fibonacci retracement ranges, since Elliott Wave idea depends closely on these ratios for projection targets and retracement zones. The MT5 model sometimes contains visible overlays displaying the place Wave 3 (often the strongest) would possibly prolong or the place Wave 4 ought to retrace to keep away from overlapping Wave 1.

The Calculation Logic Behind Wave Detection

Most MT5 Elliott Wave indicators use a mixture of swing level evaluation and fractal geometry. The algorithm scans for pivot factors—native highs and lows the place value reverses route. As soon as it identifies these pivots, it measures the gap and time between them, checking whether or not the construction suits Elliott’s particular guidelines.

As an example, Wave 3 can’t be the shortest impulse wave. Wave 2 shouldn’t retrace greater than 100% of Wave 1. Wave 4 sometimes retraces 38.2% to 50% of Wave 3. The indicator repeatedly validates these guidelines as new bars kind. When testing this on EUR/USD’s 4-hour chart through the September 2024 rally, the indicator accurately recognized the five-wave construction earlier than the corrective pullback, although it did repaint labels twice as Wave 4 developed.

That’s price noting: Many Elliott Wave indicators repaint. As new value knowledge arrives, the algorithm recalculates pivot factors and should relabel earlier waves. This isn’t a flaw—it’s how adaptive algorithms work—nevertheless it means merchants shouldn’t backtest these indicators with out accounting for hindsight bias.

Sensible Buying and selling Purposes

The actual worth emerges when combining wave counts with different affirmation instruments. Take a situation on USD/JPY in March 2024. The indicator labeled a accomplished five-wave decline on the every day chart, adopted by an ABC corrective bounce. Merchants waiting for Wave 5 completion may’ve entered lengthy positions round 146.50, focusing on the standard 61.8% Fibonacci retracement of your complete impulse wave. That setup delivered roughly 320 pips over two weeks.

But it surely doesn’t all the time work cleanly. Uneven markets create false wave counts. When Bitcoin crashed in August 2024, the indicator on BTC/USD struggled within the 1-hour timeframe, repeatedly relabeling waves as volatility spiked. The lesson? Elliott Wave evaluation shines in trending markets with clear impulse and corrective constructions. It struggles throughout consolidation or news-driven whipsaws.

Merchants usually use the indicator to identify divergence between wave counts and momentum. If the indicator exhibits Wave 5 extending increased however RSI is making decrease highs, that’s a basic exhaustion sign. On GBP/JPY’s every day chart in July 2024, this actual setup preceded a 450-pip reversal.

Configuring Settings for Completely different Markets

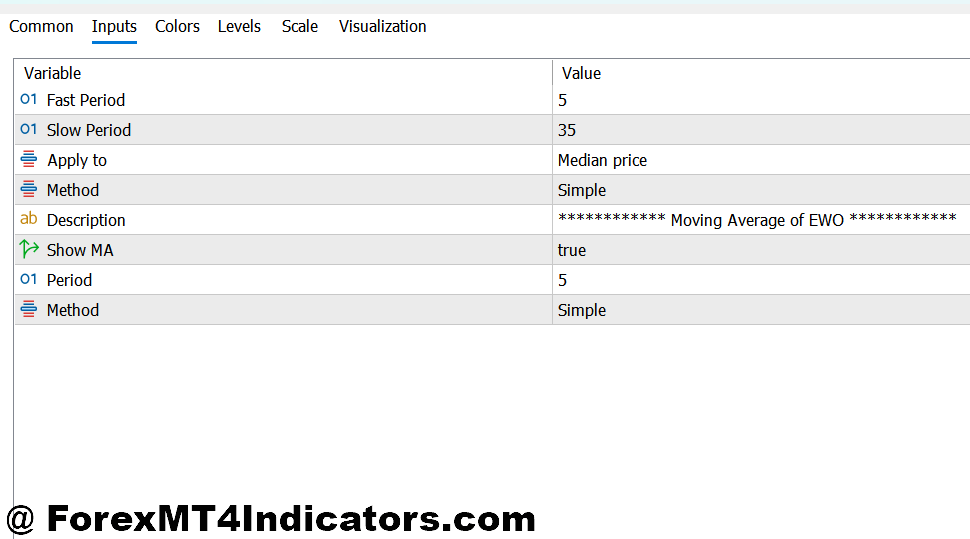

Most Elliott Wave indicators for MT5 embody adjustable parameters like swing energy, minimal wave size, and label show choices. The swing energy setting controls how delicate the indicator is to cost pivots. A decrease worth (3-5) catches extra waves however generates noise on decrease timeframes. The next worth (8-12) filters out minor swings, working higher on every day or weekly charts.

For scalping EUR/USD on the 15-minute chart, merchants would possibly scale back swing energy to 4 and set a minimal wave size to twenty pips. This captures intraday wave constructions with out extreme repainting. Swing merchants on every day charts ought to improve swing energy to 10 and minimal wave size to 150 pips, filtering out irrelevant fluctuations.

Foreign money pairs with easy developments—like AUD/NZD or EUR/GBP—reply nicely to straightforward settings. Risky pairs like GBP/JPY or unique crosses want increased swing energy to keep away from fixed relabeling. Commodities like gold (XAU/USD) work greatest on 4-hour or every day timeframes the place wave constructions develop extra clearly.

Strengths, Limitations, and Actuality Test

The indicator’s greatest benefit is velocity. Manually counting waves throughout a number of pairs and timeframes would devour hours every day. The automation lets merchants scan for setups shortly, specializing in commerce administration quite than sample identification. It additionally reduces emotional bias—the algorithm doesn’t “need” to see a sample, it calculates based mostly on mathematical guidelines.

That mentioned, no indicator replaces sound judgment. Elliott Wave idea itself is subjective. Two skilled analysts can produce totally different wave counts on the identical chart. An automatic indicator makes assumptions programmed by its developer, which can differ from these of conventional Elliott Wave practitioners. Some indicators prioritize alternate counts, others stick with probably the most possible situation.

Repainting stays probably the most important limitation. A wave labeled as “3” would possibly turn into “4” three bars later when the worth invalidates the earlier construction. Merchants utilizing these indicators for entry alerts want strict affirmation—anticipate the wave to finish and the following candle to verify route earlier than getting into.

The indicator can also’t predict black swan occasions or central financial institution interventions. In January 2015, the Swiss Nationwide Financial institution’s shock coverage change invalidated each Elliott Wave rely on CHF pairs inside minutes. Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and wave evaluation doesn’t get rid of the potential of whole capital loss.

How It Compares to Guide Wave Counting

Skilled Elliott Wave merchants usually argue that guide evaluation produces superior outcomes as a result of human judgment catches nuances algorithms miss. They’re not fully unsuitable. Computer systems battle with nested wave levels—counting waves inside waves—which expert analysts deal with intuitively.

However automated indicators provide consistency. They don’t get drained, distracted, or influenced by latest losses. For merchants studying Elliott Wave idea, these indicators function coaching wheels, displaying real-time examples of wave constructions as they kind. Over time, customers develop an eye fixed for patterns and should depend on the indicator much less.

In comparison with different trend-following instruments like transferring averages or MACD, Elliott Wave indicators present earlier alerts. A accomplished Wave 2 retracement gives entry earlier than most momentum indicators set off. Nonetheless, this comes with increased false alerts throughout consolidation phases when wave constructions break down.

Methods to Commerce with Elliot Wave Indicator MT5

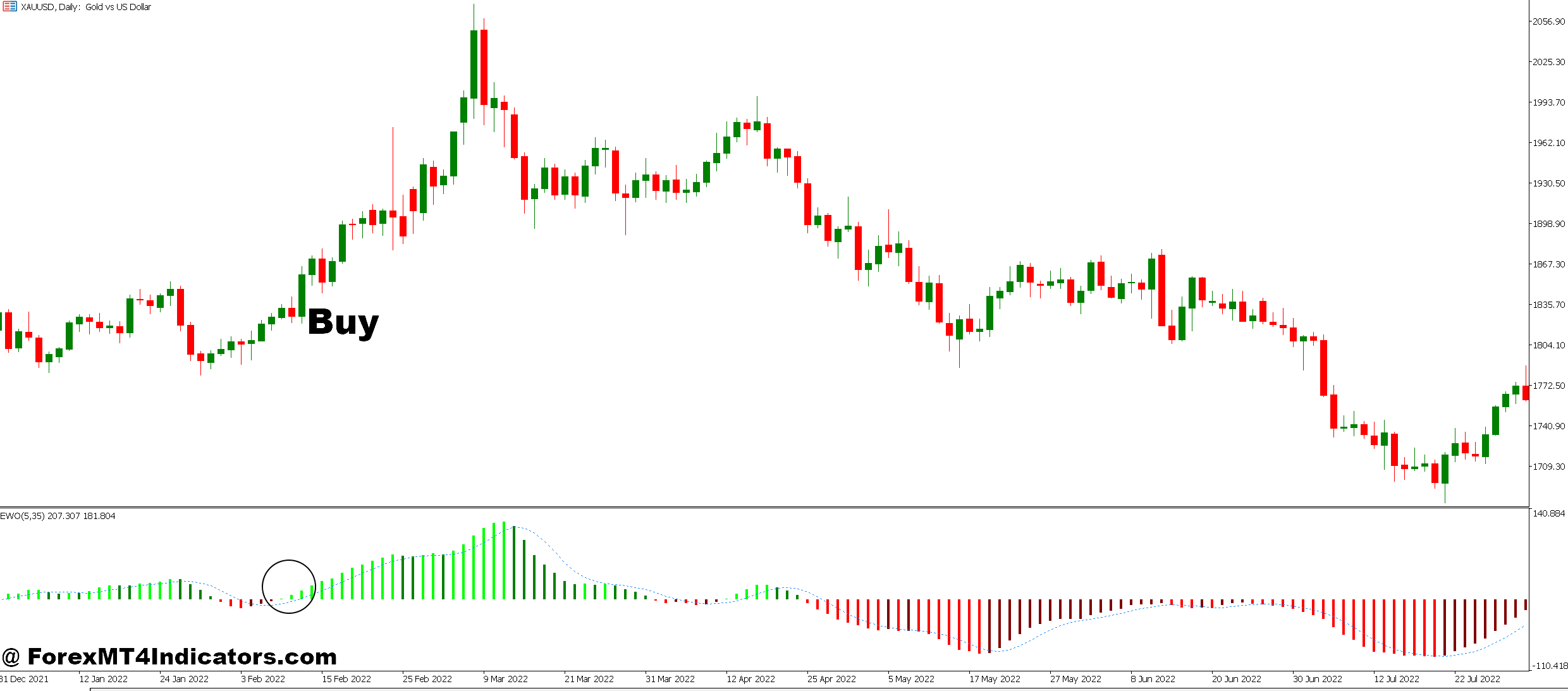

Purchase Entry

- Wave 2 completion at help – Enter lengthy when the indicator labels Wave 2, and value bounces from a key help stage with a bullish engulfing candle; perfect on EUR/USD 4-hour chart with 20-30 pip cease under the Wave 2 low.

- Wave 4 pullback entry – Purchase throughout Wave 4 retracement when value pulls again 38.2%-50% of Wave 3 on the GBP/USD every day chart; anticipate bullish reversal candlestick earlier than getting into to keep away from catching a falling knife.

- ABC correction completion – Go lengthy when the corrective ABC sample completes and value breaks above the Wave B excessive with quantity affirmation; threat 1-2% of account with cease under Wave C low.

- Wave 3 momentum breakout – Enter on Wave 3 label if it breaks above Wave 1 excessive with RSI above 50; that is sometimes the strongest wave, providing 100+ pip strikes on main pairs like EUR/USD.

- Skip uneven ranges – Don’t commerce if the indicator retains relabeling waves inside a 50-pip vary on the 1-hour chart; anticipate clear directional construction to develop earlier than committing capital.

- Fibonacci confluence affirmation – Solely take the purchase sign if Wave 2 retracement aligns with 61.8% or 78.6% Fibonacci stage; this doubles your likelihood on USD/JPY swing trades.

- Keep away from news-driven spikes – By no means enter throughout NFP or central financial institution bulletins, even when Wave 2 seems full; wait 2-4 hours post-news for the indicator to stabilize and keep away from repainting chaos.

- Set revenue at Wave 5 projection – Goal the 161.8% Fibonacci extension of Wave 1 on your take-profit on Wave 3 entries; sometimes yields 80-150 pips on GBP/USD 4-hour setups.

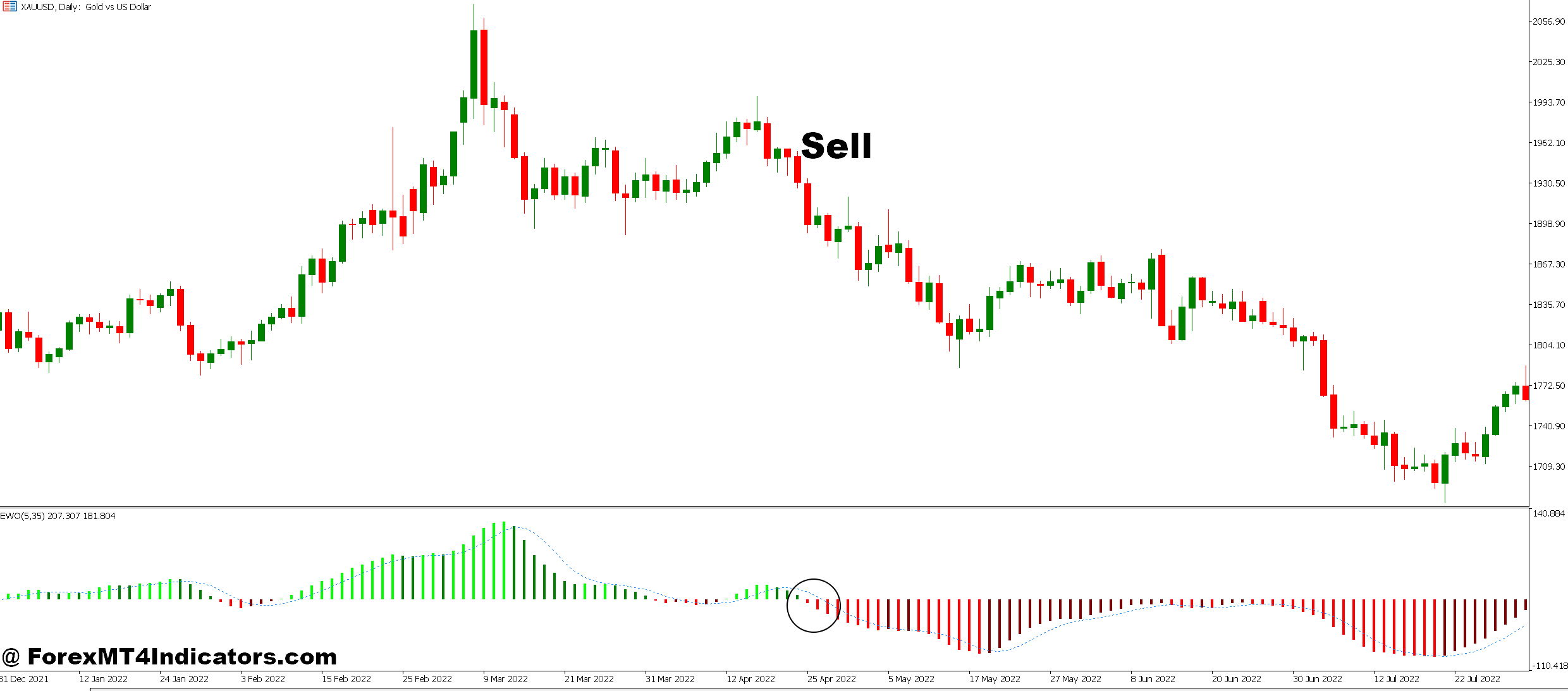

Promote Entry

- Wave 5 exhaustion at resistance – Brief when the indicator completes Wave 5 at a serious resistance zone with bearish divergence on RSI; use 25-35 pip cease above the Wave 5 excessive on the EUR/USD every day chart.

- Failed Wave 3 extension – Enter quick if value can’t break above Wave 3 and the indicator relabels it as a corrective construction; this alerts pattern weak spot price 60+ pips on GBP/JPY.

- Wave B rally fade – Promote when Wave B of a correction reaches 50%-61.8% retracement of the earlier decline; anticipate Wave C to push decrease for 100-200 pips on trending pairs.

- Break of Wave 1 low invalidation – Go quick if value violates the Wave 1 low after finishing what regarded like Wave 2; this invalidates the bullish rely and infrequently triggers 80+ pip drops.

- Don’t quick sturdy Wave 3s – By no means enter promote positions when the indicator exhibits Wave 3 forming with a steep angle and growing momentum; you’re combating the strongest a part of the pattern.

- Overbought Wave 5 divergence – Brief when Wave 5 makes new highs however RSI makes decrease highs on the 4-hour chart; mix with 1.5% threat and a couple of:1 reward ratio for stable setups.

- Keep away from range-bound markets – Skip promote alerts if value is chopping between 40-60 pips on the 1-hour chart with fixed wave relabeling; Elliott Wave wants trending situations to work correctly.

- Goal earlier Wave 4 low – Set take-profit on the Wave 4 low from the earlier impulse construction; this sometimes gives 70-120 pip reward on main pairs throughout ABC corrections.

Conclusion

Profitable merchants deal with the Elliott Wave indicator as one part in a broader system. They verify wave counts with help and resistance ranges, quantity evaluation, or candlestick patterns. If the indicator exhibits a accomplished Wave 5 at a serious resistance zone with bearish divergence on RSI, that’s a high-probability setup. The identical Wave 5 in the course of nowhere? Much less compelling.

Threat administration issues greater than wave counts. Even excellent wave identification fails if place sizing is reckless or cease losses are too tight. Sensible merchants threat 1-2% per commerce no matter how clear the Elliott Wave sample appears.

The indicator works greatest for merchants who already perceive Elliott Wave idea. With out that basis, the labels and numbers on the chart imply little. Studying Elliott’s unique work or learning trendy practitioners like Robert Prechter offers context that transforms the indicator from a complicated mess of numbers right into a sensible forecasting software.

Buying and selling foreign exchange carries substantial threat. No indicator, together with Elliott Wave instruments, ensures income. Markets can stay irrational longer than merchants can keep solvent, and automatic wave counts don’t get rid of the potential of catastrophic losses. Use correct place sizing, preserve lifelike expectations, and by no means threat capital you’ll be able to’t afford to lose.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90