In Monday’s buying and selling [09/10], the USDIndex was little modified. The greenback on Monday obtained help from safe-haven demand, after Israel declared warfare on Hamas, nonetheless, it gave up most of its good points after shares recovered from early losses and moved increased, lowering liquidity demand for the greenback. As well as, dovish feedback from Fed Vice Chair Jefferson and Dallas Fed President Logan weighed on the greenback once they mentioned the latest surge in long-term Treasury yields could imply much less want for the Fed to boost rates of interest once more.

US 10-year bond yields surged above 4.8% in October, a brand new 16-year excessive, after recent proof of a tightening labour market strengthened hypothesis that the Fed will lengthen its hawkish stance. Non-farm payrolls rose by 336k in September, essentially the most in eight months and nicely above expectations of a 170k improve. The outcomes strengthened proof that the US financial system stays resilient amidst a excessive inflation surroundings and the Fed’s aggressive tightening cycle, and in addition strengthened the consensus that impartial rates of interest have shifted a lot increased for the reason that 2008 recession, and consolidated increased bond yields in the long term. Bets that the Fed would chorus from considerably reducing rates of interest below regular situations fuelled a selloff in long-term authorities bonds all over the world, with 10-year Treasury bond yields surging practically 30bps on the week, whereas 30-year bond yields surpassed 5% for the primary time since August 2007. The bond market has been closed on Monday as a result of a Columbus Day vacation.

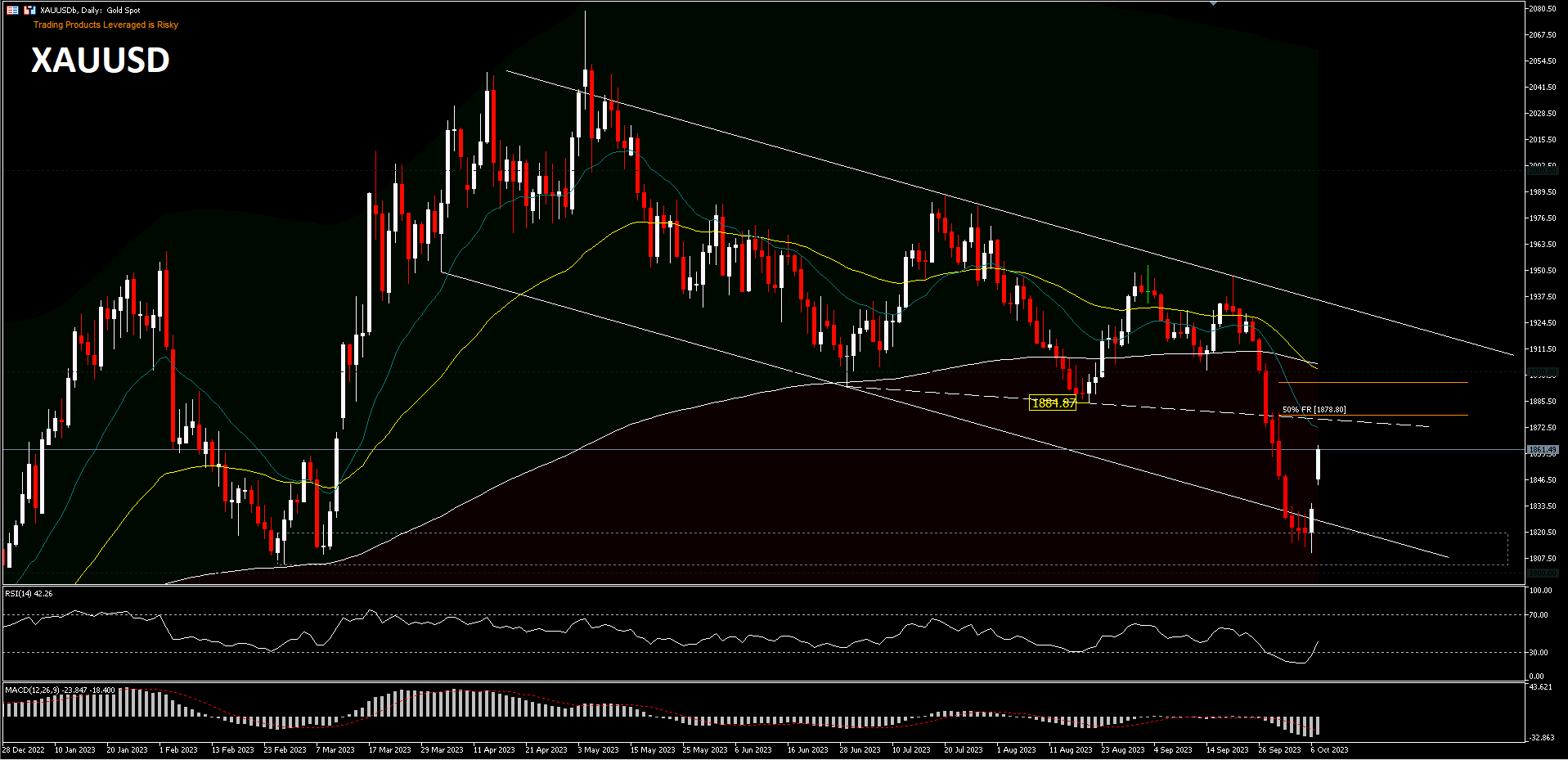

Gold traded increased yesterday, as patrons tried to get better a number of the vital losses incurred through the 9 consecutive crimson candles that pushed gold from the mid 1,900s all the way down to 1,800. The power of patrons to renew these good points is vital to gold’s near-term outlook.

Though gold has been on the rise as a result of flight to security, the momentum indicators will not be absolutely in favour of the present upside motion. The RSI moved up in direction of its midpoint, confirming the market’s barely diminished bearish development. MACD barely validated the latest rebound to the promote zone. Value stays beneath the 20-day exponential shifting common.

If the bulls regain management of the market, then an upside transfer may take a look at the 50% FR stage at 1878.80, however nonetheless stay restricted to the 1884.87 help which is now resistance. Alternatively, bears could be eager to proceed the present response, hoping for a miracle to shut the hole fashioned. To sum up, gold bulls have discovered the required energy to react after a substantial drop, however for the present rally to proceed, they should get sturdy help from momentum indicators, as presently the value motion remains to be triggered by geopolitical sentiment.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is offered as a normal advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.