Most of you realize I publish a day by day market commentary every day shortly after the day by day Foreign exchange market shut. What lots of you most likely have no idea is that making these commentaries every day is a part of my day by day chart evaluation and buying and selling routine. I truly began writing down my ideas concerning the markets every day properly earlier than I began this web site, and it’s one thing I’ve performed constantly each buying and selling day for concerning the final decade. It’s actually a ordinary a part of my day by day life…if I miss a day of commentary for some odd motive, like journey or a vacation, I actually really feel ‘unusual’, and like one thing is ‘lacking’.

Most of you realize I publish a day by day market commentary every day shortly after the day by day Foreign exchange market shut. What lots of you most likely have no idea is that making these commentaries every day is a part of my day by day chart evaluation and buying and selling routine. I truly began writing down my ideas concerning the markets every day properly earlier than I began this web site, and it’s one thing I’ve performed constantly each buying and selling day for concerning the final decade. It’s actually a ordinary a part of my day by day life…if I miss a day of commentary for some odd motive, like journey or a vacation, I actually really feel ‘unusual’, and like one thing is ‘lacking’.

My day by day buying and selling routine is the core basis that each one of my trades are constructed on, and it’s my opinion that each one aspiring merchants want such a basis to construct their buying and selling profession on in the event that they wish to have a severe likelihood at making constant cash within the markets. In immediately’s lesson, I’m going to indicate you the way I personally analyze the charts every day and provide you with a ‘peak’ into my day by day buying and selling routine. Hopefully, after studying immediately’s lesson you’ll have a greater understanding of WHY you want a day by day buying and selling routine and HOW to develop one.

The POWER of routine, self-discipline and behavior…

Information simply got here out during the last week that Invoice Gates, founding father of Microsoft, is as soon as once more the richest man on the planet. The one factor that you’ll by no means hear anybody saying about ultra-successful folks like Gates and others, is that they’re ‘lazy’ or have ‘unhealthy habits’. It’s fairly properly understood {that a} man like Invoice Gates should be a very disciplined particular person to have gone from school drop-out to richest man on the planet and founding father of the most important software program firm on earth. Most individuals would agree he has most likely developed some very efficient day by day habits which have introduced him to the purpose he’s at now in his skilled life.

This leads me to my subsequent level: How do YOU analyze your charts every day to seek out trades? Do you’ve gotten a routine that you simply undergo every day? Do you’ve gotten any construction behind your buying and selling methodology or do you principally simply “commerce on the fly”? Like success in some other discipline, buying and selling success is the results of growing efficient habits via self-discipline and correct process. What I imply is that this; in case you shouldn’t have the self-discipline to stay to your buying and selling technique and handle your danger correctly, you’ll by no means attain the buying and selling mindset and habits that it’s good to make constant cash within the markets.

At this level in my buying and selling profession, I’m very set in my day by day routine, sure it’s a bit ‘boring’ at instances, and repetitive, however I nonetheless do it as a result of it’s a behavior, and a really efficient one at that. Every day, I’m going via my ‘ritual’ of checking the markets, making notes, inserting trades if there any, wash and repeat. I received an e-mail not too long ago from somebody who insisted that there was some “secret to buying and selling” that I used to be not telling them, they really didn’t consider me the primary time I responded saying that there actually isn’t any “secret” apart from self-discipline and correct cash administration. The actual “secret” to buying and selling success, if there’s one, is that YOU must develop your self right into a profitable dealer by studying to commerce successfully and being disciplined lengthy sufficient to observe a buying and selling routine till it turns into a behavior that you simply don’t even have to consider anymore.

Right here’s how I do it…

The inspiration of my day by day buying and selling routine

My day by day buying and selling routine might be quite a bit easier than you may suppose…an important factor to recollect is that it has develop into a behavior for me, identical to it needs to be for you. The walk-through that follows is actually how I create my day by day market commentary for the members space every day, hopefully this offers you some perception into the best way to create a day by day buying and selling routine and buying and selling plan…

Ranges

The primary most important factor I do initially of every new buying and selling week in addition to every day, is map out the place the key chart ranges are and watch how the market is reacting round them. I first zoom out to the weekly chart and get a fast view of the place the important thing ranges are, at the moment I’ll draw them in on my charts.

Within the weekly EURUSD chart under, I’ve drawn in the important thing weekly help and resistance ranges as I do initially of every new buying and selling week. I’m searching for ranges that had been key turning factors out there after which drawing a horizontal line throughout these ranges, that is primarily how to attract help and resistance ranges:

After I’ve drawn in the important thing weekly chart ranges I’ll transfer all the way down to the day by day chart time-frame. Right here, I’ll most likely see among the similar key ranges I drew in on the weekly, however as a result of I’m not taking a look at as a lot information (time), among the weekly ranges gained’t be related on the day by day. There can be different ranges to attract in on the day by day chart; shorter-term ranges.

Within the day by day EURUSD chart under, you may see essentially the most related key help and resistance ranges that I’ve drawn in. Be aware that I truly adjusted the weekly stage that was at 1.3172 within the chart above, as much as about 1.3193 on the day by day chart, as a result of it’s a bit extra apparent that the ‘precise’ stage is up a bit extra when you drill all the way down to the day by day chart. Additionally word that I added in a stage on the day by day chart at 1.2955 that was probably not apparent on the weekly chart. You’ll add extra ranges as you turn from the weekly to day by day as a result of a few of them are merely not as apparent on the weekly.

Be aware how I’ve drawn in the important thing help and resistance ranges within the chart above. I didn’t attract each single little stage I may discover, moderately, I targeted on the degrees that had been CLEARLY essential, and by that I imply those that prompted value to make a big change of path. As you go decrease in time-frame you’ll naturally have extra key ranges to attract in, and discovering and drawing them is NOT a precise science, there’s discretion concerned and also you WILL get higher at it via training and display screen time.

Listed here are among the key issues I’m searching for at these ranges:

- How is the market reacting across the stage…what’s the value motion doing on the stage?

- Which ranges broke and which of them held?

- Have been there any false breaks or failures at ranges?

- Most significantly, did any apparent value motion buying and selling setups kind on the key stage?

Figuring out market situation

The subsequent I do after discovering the important thing chart ranges and analyzing what’s occurring round them, is decide the situation of the market; is it a trending market, range-bound, or chopping sideways with no path? This is essential as a result of it principally decides how you’ll strategy the market and the way you’ll commerce it.

The very first thing I do is take a look on the weekly chart once more and I’ll be aware of the final path the market has been transferring in latest weeks. This may be referred to as the “long-term pattern”, and I’m actually simply making an attempt to get a common really feel right here for what the market has been doing during the last 12 months and whether or not or not there’s a clear pattern.

Within the weekly AUDUSD chart under, we are able to clearly see how helpful and essential it’s to take a look at the weekly chart earlier than drilling all the way down to decrease time frames. The AUDUSD weekly chart exhibits us that the market was not too long ago buying and selling inside a really lengthy 9-month buying and selling vary and no actual long-term pattern was in place. Nonetheless, when the market lastly broke down and out from this buying and selling vary it primarily ‘confirmed’ {that a} new downtrend was getting began, and this can be a crucial piece of data to know as we drill-down and search for value motion buying and selling methods on the day by day, 4 hour charts and 1 hour charts…

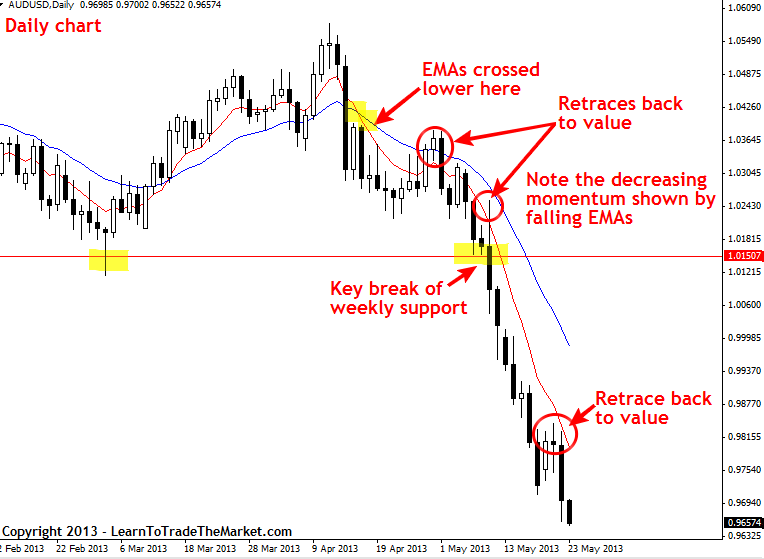

Now, let’s take a look at the AUDUSD once more however this time we’re trying on the day by day chart time-frame. Within the chart under, we are able to clearly see that the 8 and 21 day EMAs present a possible pattern change quite a bit sooner than you may detect it on a weekly chart. After we see the EMAs (purple is 8, blue is 21) cross one another, it’s a sign the pattern may be altering and is one thing to be aware of. You usually must see a sample of decrease highs and decrease lows or greater highs and better lows to “verify” the pattern change, however the EMAs are “early-warning” system that the pattern may be altering. Learn extra about pattern buying and selling in my article on the best way to commerce traits.

It’s essential to notice the retraces again to “worth” within the chart under. In a downtrend, “worth” means resistance, in an uptrend it means help. These shouldn’t have to be strict ranges, they are often “zones” and even the “layer” between the 8 and 21 day EMAs, like we see within the chart under. When the market retraces again to those worth areas, it means we have to pay further shut consideration and search for value motion alerts to commerce with the dominant day by day chart pattern. I search for alerts on the 1 hour, 4 hour and day by day charts.

Worth motion alerts

Lastly, after I’ve drawn in and analyzed the important thing chart ranges and decided the present market situation, I’ll search for value motion entry alerts. A value motion sample is my most important entry set off and I cannot usually commerce if there’s not a value sample ‘confirming’ a high-probability entry into the market.

The first factor I’m searching for are day by day chart value motion alerts, as these are the strongest and greatest ones to commerce for my part. I all the time undergo the markets and search for value motion alerts as soon as on the shut of the buying and selling day after which once more a bit afterward within the day.

I’m principally simply searching for apparent PA alerts which might be well-formed and that ‘agree’ with the present market dynamics. Meaning an apparent PA sign that’s close to a key stage or within the context of a trending market. I’m additionally searching for value motion rejection / reversal alerts at key chart ranges or at “worth” as described beforehand.

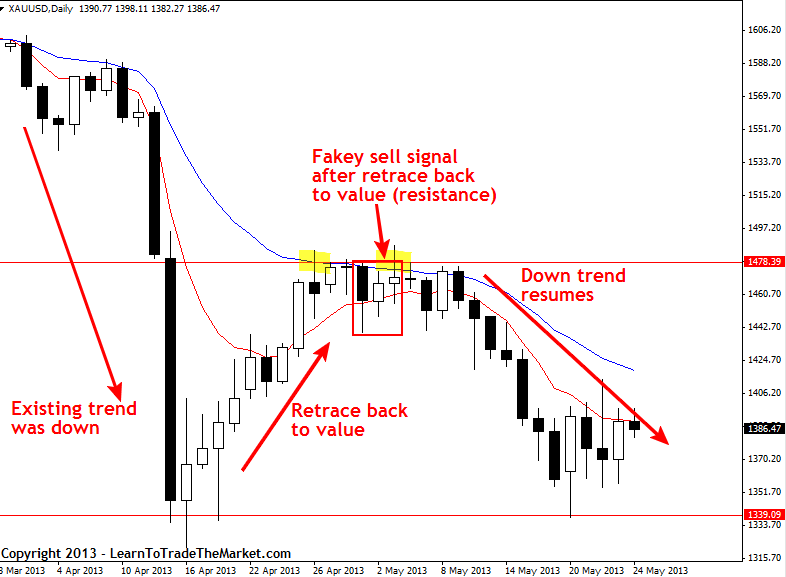

Within the day by day Spot Gold chart under, we’re taking a look at an instance of a fakey sign that shaped after a retrace and subsequent false-break of worth / resistance close to $1,480.00. We mentioned this setup not too long ago in our Could seventh Commentary and it exhibits instance of the best way to commerce in-line with a pattern (downtrend on this case) after the market has made a retrace again to a key stage of resistance in addition to the 8 / 21 day EMA resistance layer.

Conclusion:

Hopefully, you’ve gotten realized a couple of issues from immediately’s lesson. The first issues it’s best to have realized are that: 1) You NEED a ordinary day by day buying and selling routine that’s easy but logical and efficient, and a couple of) Making a day by day buying and selling routine will not be tough, the rules I mentioned above are actually about all you want every day to investigate the charts.

I strongly suggest you begin doing your personal day by day market evaluation and maintain your notes in a diary. This ‘buying and selling diary’ would look similar to the day by day chart commentary I create for my members day-after-day. You may get began by simply following the three most important steps I described on this article. Retaining a ‘day by day buying and selling diary’ has benefited me vastly over time as a result of it permits me to trace the market every day and stay “within the zone” because the market ebbs and flows.

A useful studying device that can assist you develop into an knowledgeable at analyzing your charts is my day by day market commentary publication. You’ll be able to try my day by day chart evaluation publication within the members’ space and observe alongside every day as I talk about key ranges, market circumstances and value motion setups that will have shaped that day. For extra data on my day by day buying and selling publication, buying and selling programs and merchants neighborhood, click on right here.