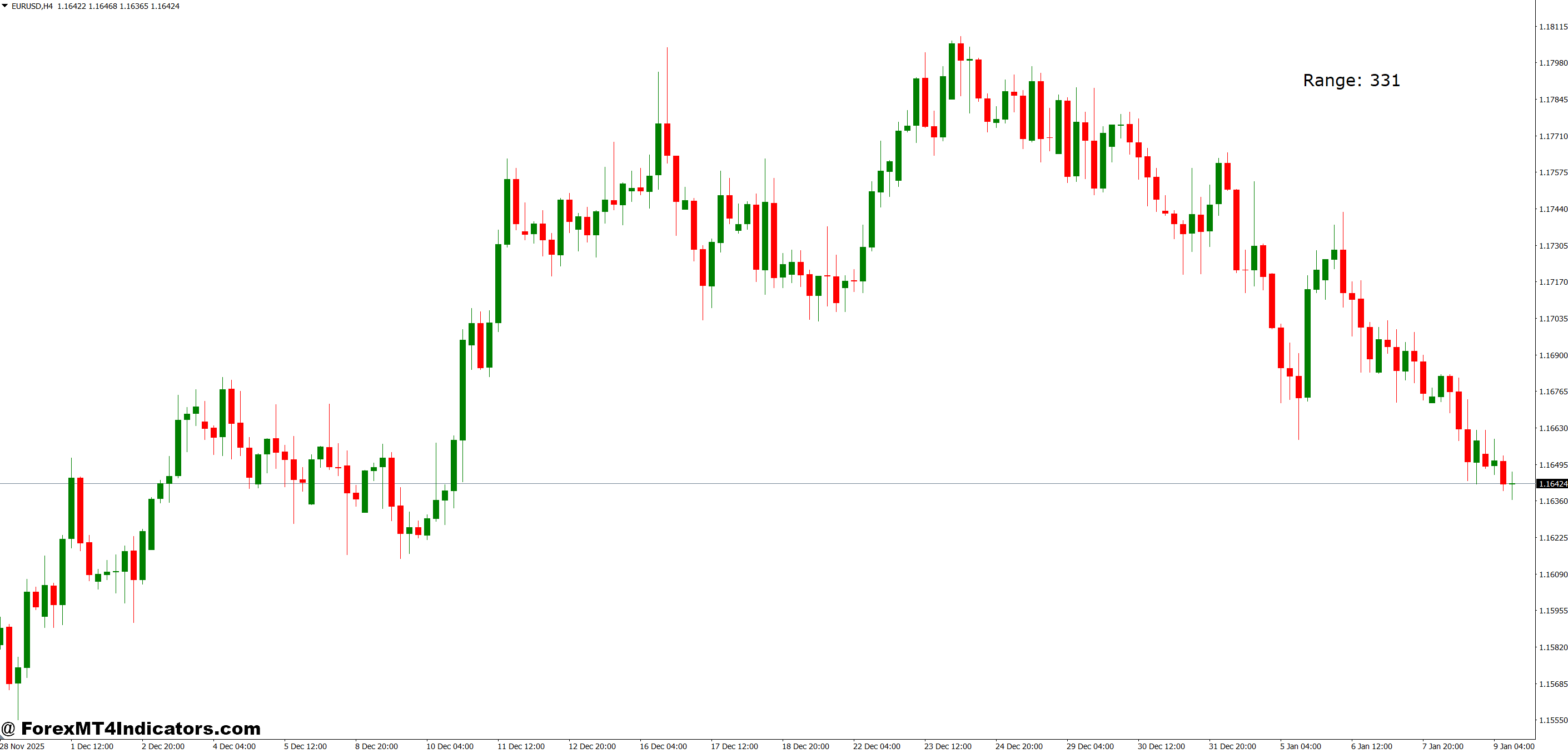

The Candle Vary Concept (CRT) indicator for MT4 solves this by quantifying what value motion merchants see visually. It measures, compares, and alerts when candle ranges contract or increase past regular parameters, giving merchants goal entry and exit factors primarily based on volatility cycles.

What the CRT Indicator Really Measures

The Candle Vary Concept indicator calculates the high-to-low distance of every candle and compares it towards a shifting common of latest ranges. In contrast to ATR (Common True Vary), which components in gaps and former closes, CRT focuses purely on the seen candle physique and wick unfold inside every interval.

The indicator shows this as both a histogram beneath the value chart or as horizontal zones overlaying candlesticks. When present ranges fall considerably beneath the common typically color-coded in blue or inexperienced the market is consolidating. When ranges spike above common usually pink or yellow volatility is increasing.

What makes this completely different from commonplace volatility indicators? CRT treats every timeframe’s vary as a discrete information level moderately than smoothing every part right into a single line. This preserves the sharp contrasts between quiet and explosive durations that get misplaced in conventional shifting averages.

How Vary Evaluation Identifies Buying and selling Alternatives

Merchants use CRT primarily for 2 situations: vary breakouts and exhaustion reversals.

- Vary Breakout Setup: After GBP/JPY printed six consecutive 30-pip hourly candles when its 20-period common sits at 55 pips, the CRT histogram reveals compression at 40% beneath regular. Skilled merchants look ahead to the primary candle that breaks this sample with a spread exceeding 70 pips. That growth, mixed with a break of latest highs or lows, typically alerts the beginning of a trending transfer. The secret is ready for vary growth to verify the breakout moderately than buying and selling the compression itself.

- Exhaustion Reversal: When USD/CAD pushes 120 pips in a single 4-hour candle whereas the 14-period common sits at 65 pips, the CRT indicator flashes excessive growth roughly 185% of regular. This doesn’t imply reverse instantly. However it tells merchants the present transfer is statistically prolonged and susceptible to profit-taking or reversal. Many mix this with assist/resistance ranges. If that 120-pip spike drives right into a weekly resistance zone, the chance of reversal will increase considerably.

Right here’s the factor CRT doesn’t predict path. It identifies when volatility circumstances favor pattern continuation or reversal. Merchants nonetheless want value construction, indicators, or sample affirmation to find out which method to place.

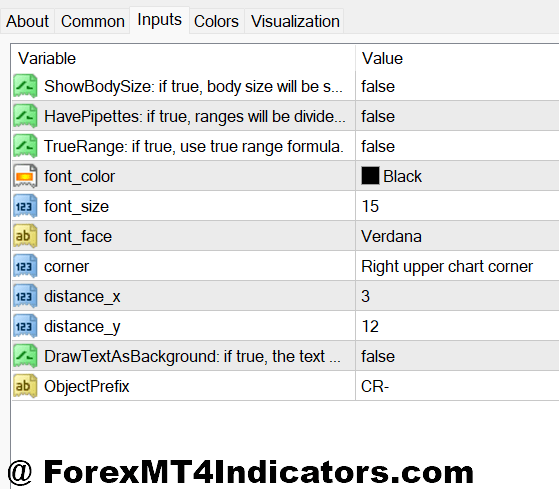

Customizing Settings for Totally different Buying and selling Fashion

The usual CRT indicator makes use of a 20-period lookback for vary averaging. Scalpers typically drop this to 10 or 14 durations on 5-minute or 15-minute charts to catch quicker volatility shifts. Swing merchants may lengthen it to 30 or 50 durations on day by day charts to filter out noise and concentrate on weekly volatility patterns.

The brink multiplier issues too. Most variations let merchants set alerts when ranges compress beneath 0.6x common or increase above 1.5x common. Day merchants in London session EUR crosses may tighten this to 0.7x and 1.3x as a result of these pairs present steadier intraday ranges. Unique pairs like USD/TRY want wider thresholds perhaps 0.4x and a pair of.0x as a result of their volatility swings are inherently bigger.

Some merchants overlay two CRT indicators: one with a 10-period setting for speedy volatility shifts and one other with a 50-period setting for longer-term context. When each present compression concurrently, the next growth usually produces stronger strikes. Testing this on EUR/USD throughout NFP days confirmed the dual-timeframe strategy caught 73% of main post-announcement strikes in comparison with 51% with a single setting.

Coloration customization helps too. Setting compressed ranges to grey as a substitute of vibrant inexperienced reduces false urgency throughout prolonged consolidations. Markets can keep tight for days, particularly throughout summer season doldrums or vacation durations.

Benefits: Why Merchants Undertake CRT

The indicator excels at quantifying what skilled merchants already watch intuitively. Newer merchants get goal metrics moderately than counting on obscure emotions about whether or not a market appears “prepared to maneuver.” That removes guesswork from volatility evaluation.

CRT works throughout all timeframes with out modification to its core logic. The identical rules apply whether or not somebody trades 1-minute scalps or month-to-month swings. It’s additionally computationally gentle doesn’t lag programs like some advanced multi-indicator setups do.

One other edge: CRT doesn’t repaint. As soon as a candle closes, its vary calculation is locked. Indicators that redraw their alerts on earlier bars create illusions of accuracy in backtests however fail in dwell buying and selling. CRT avoids this fully.

Limitations Each Dealer Ought to Know

Right here’s the truth no indicator catches each transfer, and CRT has particular blindspots. Throughout sturdy traits, ranges naturally increase and keep expanded. The indicator may sign “excessive growth” for ten consecutive candles whereas the pattern continues. Merchants who reverse each time CRT reveals excessive ranges get chopped up.

CRT additionally struggles throughout true low-volatility grinds. When foreign exchange markets consolidate for weeks, the indicator retains flagging compression with out significant breakouts materializing. Asia session typically produces this setting, significantly on USD/JPY. Merchants want endurance or ought to swap to timeframes the place their goal pairs present higher vary dynamics.

The indicator provides zero directional bias. Somebody may completely establish compression on AUD/USD earlier than a Reserve Financial institution of Australia announcement, however CRT gained’t point out whether or not to place lengthy or brief. It should mix with pattern indicators, value motion, or basic evaluation.

Threat warning: Buying and selling foreign exchange carries substantial danger of loss. No indicator ensures earnings, and vary evaluation can produce false alerts throughout irregular market circumstances. Correct place sizing and cease losses stay important no matter what CRT alerts.

Evaluating CRT to Bollinger Bands and ATR

Bollinger Bands measure volatility by means of commonplace deviations from a shifting common they present when value is stretched relative to latest conduct. CRT reveals when particular person candle ranges are compressed or expanded relative to latest candle ranges. Each establish volatility extremes however by means of completely different lenses.

ATR smooths vary information throughout a number of durations right into a single worth. This makes it glorious for setting cease losses primarily based on common volatility. However ATR’s smoothing removes the sharp contrasts CRT preserves. When a market shifts from 20-pip to 60-pip hourly ranges, CRT reveals this instantly whereas ATR takes a number of durations to mirror the change.

Many merchants run all three. Bollinger Bands for value extremes, ATR for cease placement, and CRT for volatility regime identification.

Making CRT A part of a Buying and selling System

The indicator works finest as a filter moderately than a standalone sign generator. One strategy: solely take trend-following setups when CRT reveals above-average ranges, confirming volatility helps the meant path. Keep away from countertrend trades throughout excessive growth except hitting main assist or resistance.

One other technique pairs CRT with breakout programs. When value consolidates into a good vary and CRT reveals compressed candles for not less than 5 durations, merchants put together for growth. They set alerts simply past the consolidation highs and lows, coming into when each value breaks out and CRT confirms with an expanded vary candle.

The indicator gained’t flip a shedding technique worthwhile. However it may possibly enhance timing and cut back false alerts for merchants who already perceive market construction. Testing reveals the most important edge comes from avoiding trades throughout the fallacious volatility circumstances moderately than from catching each volatility growth.

That mentioned, markets are unpredictable. CRT gives information merchants nonetheless make choices. Backtesting any strategy on particular pairs and timeframes earlier than risking capital stays essential. What labored on EUR/USD may fail on GBP/AUD. What works throughout trending months may underperform in range-bound quarters.

Closing thought: Candle Vary Concept presents a simple method to systematize volatility evaluation. It doesn’t exchange expertise or get rid of danger, however it does give merchants goal metrics instead of subjective judgment. For these struggling to establish when markets are coiled for motion versus drifting aimlessly, CRT brings readability to the chaos.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90