What’s the Correlation Filter?

The Correlation Filter is a threat administration function in a buying and selling robotic (Professional Advisor). It screens the relationships between foreign money pairs (or different buying and selling devices) when the bot considers new trades. Particularly, it checks how intently two devices transfer collectively over time utilizing a statistical correlation measure. When the filter is enabled, the EA calculates the correlation between the image it desires to commerce and every image of any open positions. If any of those correlations exceeds the user-defined threshold, the brand new commerce is just not opened.

Correlation is expressed as a price between –100% and +100%. Values close to +100% imply the 2 pairs have a tendency to maneuver in the identical route, whereas values close to –100% imply they have a tendency to maneuver in reverse instructions. A worth round 0% signifies little to no linear relationship. The person’s threshold is in comparison with these values: for instance, if the brink is ready to 80%, any correlation above 80% (constructive or unfavorable) will block the commerce.

How the Correlation Filter Works

When enabled, the buying and selling robotic calculates a correlation coefficient for every potential new commerce in opposition to every at present open place. This calculation makes use of latest historic value knowledge (for instance, closing costs during the last N bars or days). After computing the correlations, the EA compares every end result to the brink:

If absolutely the correlation is above the brink (for instance, 90% above a threshold of 80%), the brand new commerce is blocked.

If the correlation is beneath the brink, the commerce proceeds usually.

This test happens each time the EA makes an attempt to open a brand new commerce. If there aren’t any open positions, or if all calculated correlations are beneath the brink, the filter doesn’t cease the commerce. In impact, the bot will solely open new trades when doing so doesn’t create positions which might be too extremely correlated with its present portfolio.

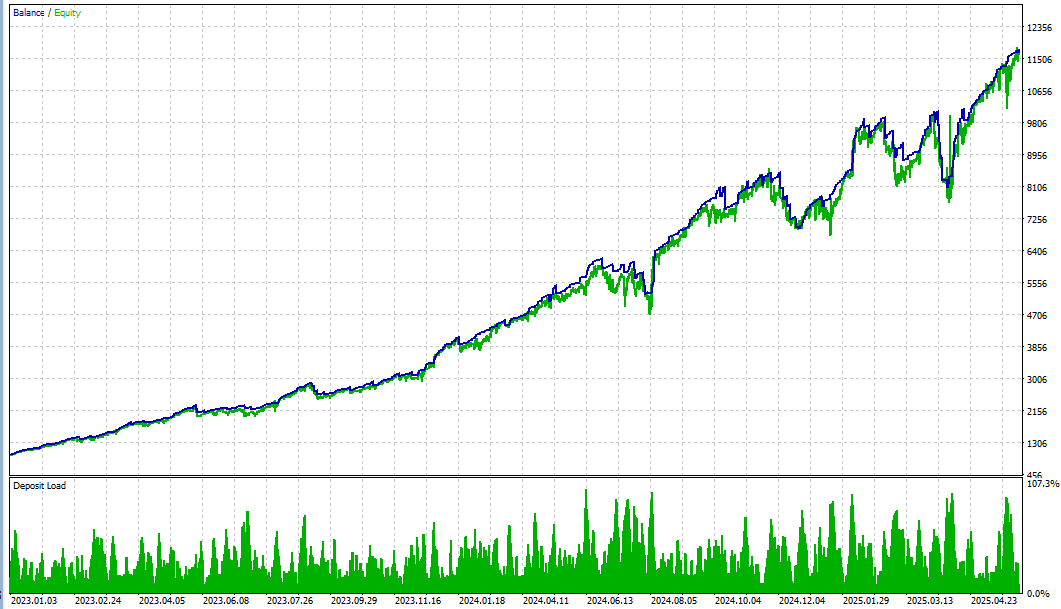

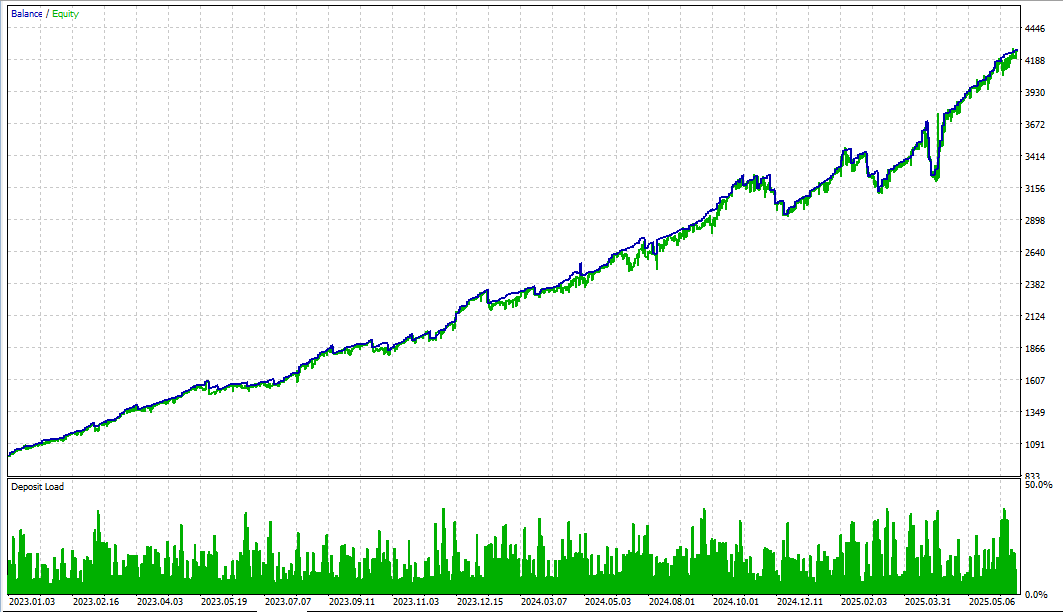

Operational Variations: Filter Off vs On

Filter Disabled: The robotic opens trades based mostly purely on its core technique. There aren’t any checks for the way related or totally different the brand new commerce is relative to present trades. The EA treats every image independently.

Filter Enabled: Earlier than opening a brand new commerce, the robotic evaluates the correlation with every open place. It then solely opens the commerce if all correlations are throughout the allowed restrict. Consequently, extremely correlated trades are skipped, decreasing overlapping publicity between symbols.

Configuring the Correlation Filter

Customers can customise the Correlation Filter with a number of parameters:

Enabled: An on/off change to activate or deactivate the correlation test.

Correlation Threshold (%): A proportion worth (0 to 100) defining how sturdy a correlation should be to dam a commerce. For instance, setting this to 80% means the filter blocks trades with correlations above 80%.

Calculation Interval: The variety of previous value knowledge factors (bars or days) used to compute the correlation. An extended interval (extra knowledge factors) smooths out short-term noise, whereas a shorter interval makes the filter reply quicker to latest market modifications.

Timeframe: The chart timeframe (equivalent to 1 hour, 4 hours, or each day) used for the value knowledge within the correlation calculation.

Symbols to Monitor: A listing of buying and selling symbols the filter checks in opposition to. This would possibly embody all symbols your EA trades or a particular subset.

Ignore Adverse Correlation (optionally available): Some implementations permit treating constructive and unfavorable correlations in a different way. By default, most filters use absolutely the worth of the correlation, so each strongly constructive and strongly unfavorable correlations can set off the filter in the event that they exceed the brink.

These settings are usually discovered within the EA’s enter or choices panel. Adjusting the brink and different parameters modifications how conservative the filter is. For instance, a better threshold (like 95%) means solely extraordinarily related pairs will probably be blocked, whereas a decrease threshold (like 50%) will block even reasonably correlated pairs.

Instance Utilization

Contemplate that the bot has an open purchase place in EURUSD. If the robotic tries to open a place in GBPUSD on the identical time, the filter will compute the historic correlation between EURUSD and GBPUSD.

If their correlation is, say, 90% and the brink is 80%, the filter will forestall the GBPUSD commerce as a result of 90% exceeds 80%.

If the brink have been set to 95%, the GBPUSD commerce can be allowed, since 90% is beneath 95%.

In sensible phrases:

With the filter off, the bot would possibly open trades on EURUSD and GBPUSD concurrently if its technique indicators achieve this, even when the pairs transfer collectively more often than not.

With the filter on (for instance, threshold 90%), it might skip a type of trades if their historic correlation is above 90%, avoiding two very related positions directly.

These choices permit merchants to tailor how strictly the EA avoids correlated trades. There aren’t any ensures both means, the filter merely prevents opening trades that exceed the required correlation standards.