The Comply with Line indicator affords an easy answer. This MT4 device tracks value momentum and plots a dynamic line that adjustments coloration when development path shifts. As a substitute of juggling a number of indicators or second-guessing each candle, merchants get a transparent visible sign for entries and exits. Let’s discover how this indicator works and whether or not it deserves a spot in your charts.

What Is the Comply with Line Indicator?

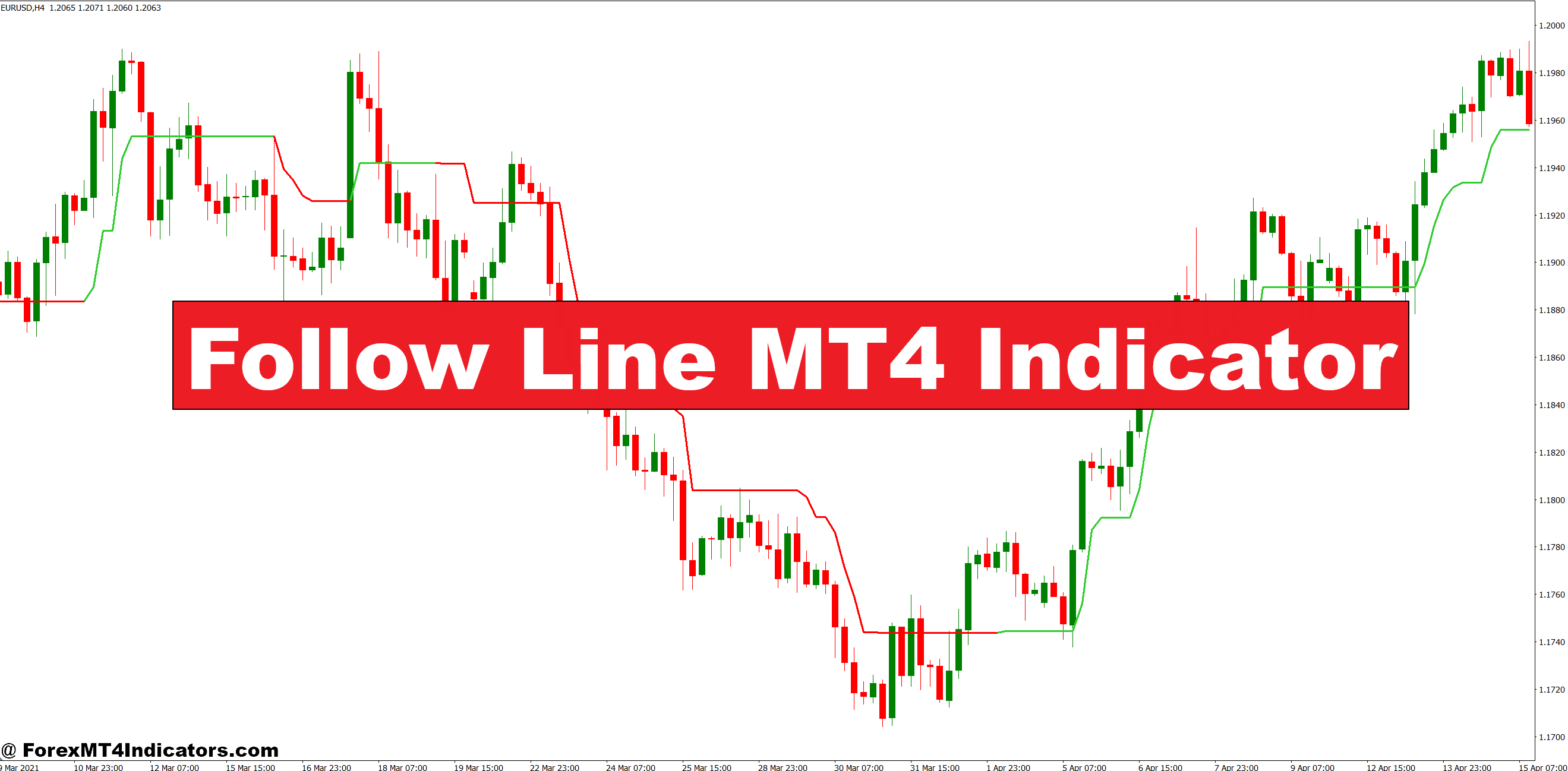

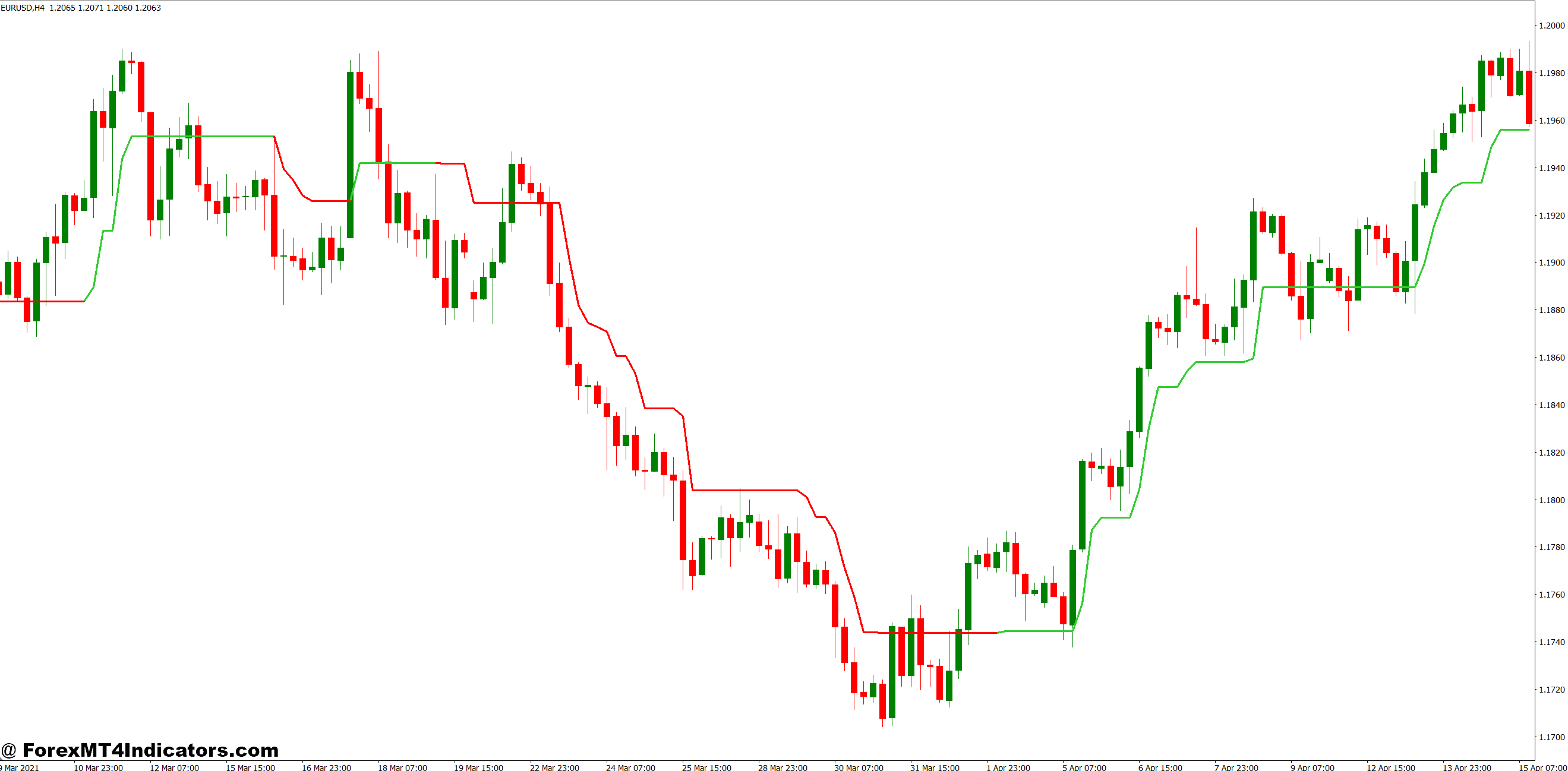

The Comply with Line is a trend-following indicator that seems as a single line beneath or above value motion, much like a transferring common however with extra responsive conduct. When the market tendencies upward, the road usually shows in a single coloration (typically blue or inexperienced) and positions itself under the candles. When bearish momentum takes over, the road switches coloration (generally crimson) and flips above value.

What separates this device from customary transferring averages is its algorithm’s concentrate on swing factors fairly than easy value averaging. The indicator identifies latest highs and lows, then plots a line that adapts shortly to momentum shifts. Merchants use it primarily for 2 functions: confirming development path and recognizing potential reversal factors when the road adjustments coloration and place.

The indicator works throughout all timeframes, from 1-minute scalping charts to each day trend-following setups. That versatility makes it in style amongst totally different buying and selling types, although its effectiveness varies relying on market situations.

How the Comply with Line Calculates Alerts

The Comply with Line makes use of a mixture of latest swing highs, swing lows, and a proprietary smoothing issue to generate its plot. Whereas the precise components varies relying on the model, most implementations observe this normal logic:

Throughout uptrends, the indicator tracks the bottom low inside a specified lookback interval (generally 14 intervals) and provides an offset primarily based on latest Common True Vary (ATR). This creates a buffer zone that forestalls untimely sign adjustments throughout minor pullbacks. The road stays under value and maintains its bullish coloration till value closes under the road itself.

When value breaks under this line, the calculation flips. The indicator switches to monitoring the best excessive inside the lookback interval, subtracts an ATR-based offset, and repositions above value. The colour change serves because the visible alert.

This strategy differs from transferring averages as a result of it doesn’t merely clean value information it actively hunts for swing factors that matter. Consider it as a dynamic help and resistance degree that adjusts to present volatility fairly than historic value averages.

Sensible Utility in Actual Buying and selling Eventualities

Let’s get particular. On GBP/USD’s 1-hour chart in the course of the August 2024 volatility spike, the Comply with Line caught a significant development reversal that many merchants missed. Value had been grinding sideways between 1.2750 and 1.2800 for 3 days. The indicator line sat flat beneath value, often flipping colours in the course of the chop.

Then got here the breakout. GBP/USD surged to 1.2850 on sturdy quantity. However right here’s the place the Comply with Line proved its price it didn’t flip inexperienced instantly. Why? The ATR part saved the road affected person, ready for real momentum affirmation. Two candles later, after value held above 1.2840, the road turned bullish and positioned itself close to 1.2825.

Merchants who entered on that coloration change rode the transfer to 1.2920 over the subsequent 18 hours, banking roughly 80 pips. Those that jumped in on the preliminary spike typically received shaken out in the course of the minor pullback to 1.2835.

That mentioned, ranging markets expose the indicator’s weak point. USD/JPY spent most of September 2024 trapped between 143.50 and 145.00. The Comply with Line flipped colours six instances in two weeks, producing false indicators that may’ve stopped out aggressive merchants. This isn’t a failure of the indicator it’s doing precisely what it’s designed to do in uneven situations. Good merchants merely step apart or change to range-bound methods.

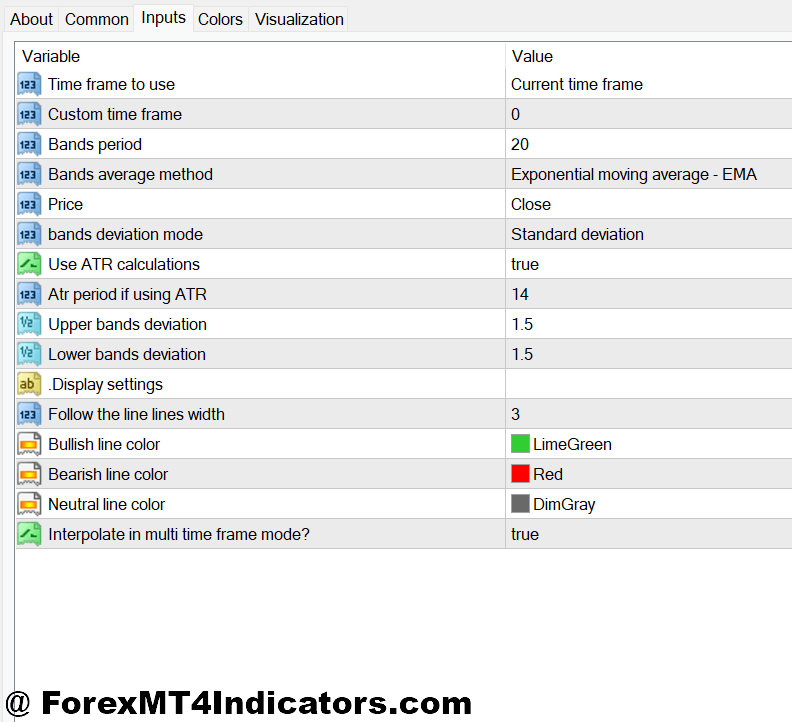

Customizing Settings for Completely different Markets

The default settings work fairly nicely, however tailoring parameters to your buying and selling fashion makes a distinction. The 2 important changes contain the lookback interval and ATR multiplier.

For scalpers working 5-minute or 15-minute charts, decreasing the lookback interval from 14 to eight or 10 creates quicker indicators. This catches fast strikes however will increase false indicators in uneven classes. Day merchants on 1-hour charts usually follow the default 14 interval, which balances responsiveness with reliability.

The ATR multiplier controls how a lot respiratory room the indicator offers value earlier than switching indicators. A multiplier of two.0 (widespread default) means the road sits two ATRs away from the swing level. Rising this to three.0 reduces whipsaws however delays entries. Lowering to 1.5 catches strikes earlier however triggers extra false indicators.

Forex pairs matter too. EUR/USD and GBP/USD, with their comparatively clean tendencies, work nicely with customary settings. Unique pairs like USD/ZAR or USD/TRY, which hole and spike erratically, profit from wider ATR multipliers to filter noise.

Benefits and Trustworthy Limitations

The Comply with Line’s greatest energy is visible simplicity. One look tells you the development path no advanced calculations or a number of indicator crossovers wanted. It’s significantly helpful for part-time merchants who can’t stare at charts all day. Set alerts for coloration adjustments, and also you’ll catch main strikes with out fixed monitoring.

The ATR-based buffering additionally filters out minor pullbacks that plague conventional transferring averages. This retains you in sturdy tendencies longer and reduces untimely exits.

However let’s be straight concerning the limitations. This indicator lags by design. It confirms tendencies after they’ve began, not earlier than. Merchants looking absolutely the low or excessive of a reversal will discover this irritating. You’ll typically enter 10-20 pips into a brand new development fairly than catching the precise turning level.

Ranging markets, as talked about earlier, create uneven indicators. There’s no means round this trend-following instruments wrestle when tendencies don’t exist. Combining the Comply with Line with a volatility filter (like ADX under 25) helps keep away from these intervals, however that requires monitoring further indicators.

Additionally price noting: the Comply with Line gives entry and exit indicators however affords no goal ranges. Merchants want separate strategies for setting take-profit ranges, whether or not that’s earlier swing factors, Fibonacci extensions, or risk-reward ratios.

How It Compares to Parabolic SAR and Supertrend

The Comply with Line shares DNA with Parabolic SAR and Supertrend indicators, however key variations exist. Parabolic SAR plots dots that speed up as tendencies lengthen, ultimately catching as much as value and triggering reversals. The Comply with Line doesn’t speed up it maintains constant spacing primarily based on volatility, which prevents a few of SAR’s untimely exits throughout sturdy tendencies.

Supertrend makes use of ATR calculations much like Comply with Line however usually plots with channel boundaries. The Comply with Line simplifies this to a single line, decreasing visible muddle for merchants preferring clear charts.

In side-by-side testing on EUR/JPY throughout October 2024, the Comply with Line stayed in a bullish development 12% longer than Parabolic SAR, capturing a further 35 pips on a swing commerce. Nevertheless, Supertrend’s channel boundaries supplied clearer stop-loss placement, a bonus for danger administration.

None of those indicators is objectively “higher.” The selection depends upon your buying and selling psychology and system necessities. Merchants who need acceleration options want SAR. These needing outlined channels select Supertrend. The Comply with Line fits merchants wanting easy development affirmation with out additional complexity.

Tips on how to Commerce with Comply with Line MT4 Indicator

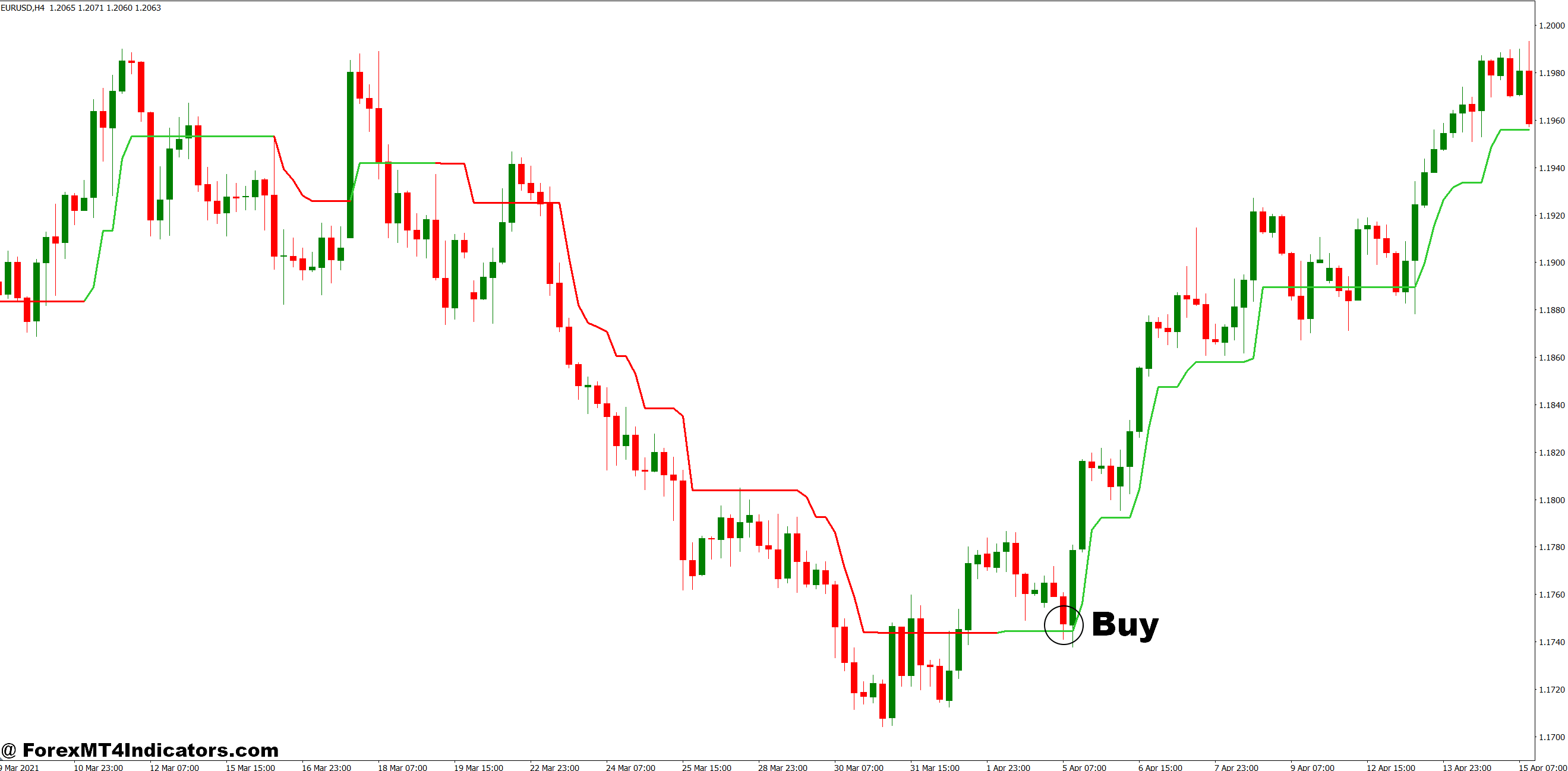

Purchase Entry

- Look ahead to coloration flip from crimson to blue/inexperienced – Enter lengthy when the road switches under value and adjustments to bullish coloration, confirming momentum shift fairly than leaping in in the course of the transition candle.

- Verify with candle shut above the road – Value should shut a minimum of 5-10 pips above the Comply with Line in your timeframe (1-hour or 4-hour charts work finest for swing trades) to keep away from false breakouts.

- Test the previous downtrend energy – Search for a minimum of 3-5 consecutive bearish candles earlier than the reversal; weak downtrends produce unreliable indicators that usually fail inside 20-30 pips.

- Place stop-loss 10-15 pips under the Comply with Line – This provides the commerce respiratory room whereas retaining danger contained; on EUR/USD 1-hour charts, this usually equals 0.5-1% account danger per commerce.

- Keep away from entries throughout main resistance zones – Skip the sign if value is inside 20 pips of earlier swing highs or psychological ranges (1.3000, 1.2500); the road doesn’t account for overhead provide.

- Goal earlier swing excessive or 2:1 risk-reward minimal – Set take-profit on the final main resistance degree or goal for twice your cease distance; on GBP/USD 4-hour tendencies, this typically means 60-80 pip targets.

- Skip uneven classes utterly – If the road has flipped colours 3+ instances up to now 10 candles, the market is ranging; look ahead to clearer directional motion or change pairs.

- Confirm with quantity improve on breakout candle – Real development reversals present 30-50% larger quantity than the typical of the earlier 5 candles; weak quantity indicators seemingly fail.

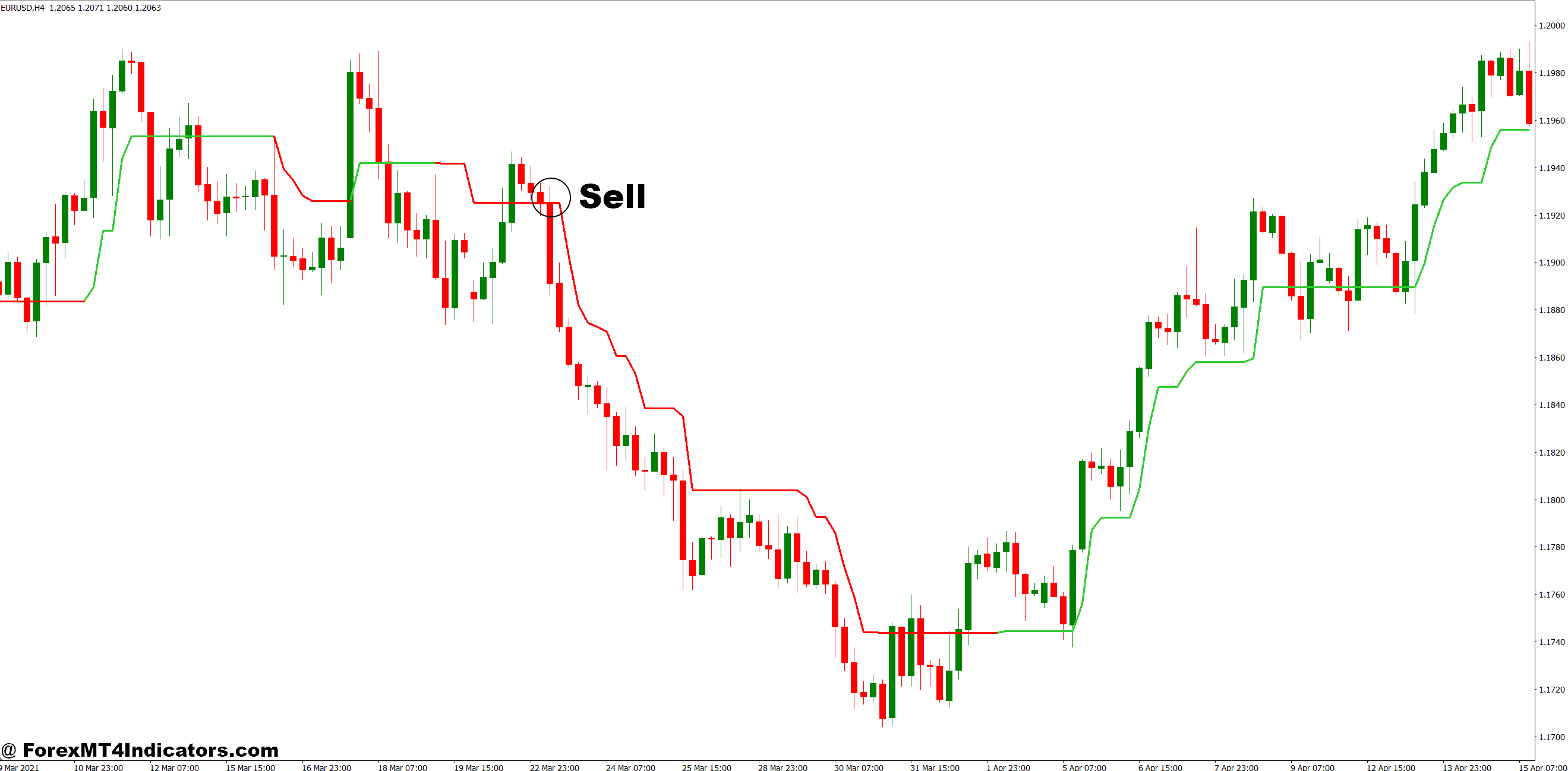

Promote Entry

- Enter brief when line flips from blue/inexperienced to crimson – Look ahead to the road to reposition above value and alter to bearish coloration, confirming downward momentum has taken management.

- Require candle shut under the Comply with Line – Value should settle 5-10 pips beneath the road at candle shut; wicks touching the road with out closing under produce false indicators roughly 60% of the time.

- Search for sturdy previous uptrend – The reversal wants a minimum of 40-60 pips of prior bullish motion on 1-hour charts; shallow pullbacks in ranging markets generate shedding trades.

- Set stop-loss 10-15 pips above the road – Place your cease simply past the Comply with Line with buffer for regular volatility; on EUR/USD this usually gives 15-20 pip respiratory room.

- Skip entries close to main help ranges – Don’t brief if value is inside 20 pips of earlier swing lows, spherical numbers (1.2000, 1.1500), or each day help zones that would bounce value.

- Keep away from Friday afternoon indicators solely – Weekend gaps can blow by your cease; any Comply with Line promote sign after 12:00 PM EST Friday needs to be ignored no matter how clear it appears to be like.

- Goal latest swing low or 2:1 reward-risk – Goal for earlier help ranges or minimal 40-50 pips on GBP/USD 4-hour charts in case your cease is 20-25 pips; don’t maintain by the revenue goal hoping for extra.

- Exit instantly if line flips again bullish – Lower losses quick when the indicator reverses coloration inside 3-5 candles of entry; this indicators you caught a fake-out and staying in usually provides 20-30 pips of pointless loss.

Remaining Ideas on the Comply with Line Indicator

The Comply with Line MT4 indicator delivers what it guarantees: clear development identification by a single, color-coded line. It received’t catch each reversal on the excellent value, and it’ll frustrate you throughout sideways markets. However for merchants who settle for these trade-offs, it gives dependable trend-following indicators with out overwhelming your charts.

The bottom line is understanding what you’re getting a affirmation device, not a crystal ball. Use it to validate directional bias, mix it with correct danger administration, and keep away from the temptation to chase each coloration change. Check it on historic information on your most popular pairs and timeframes earlier than committing actual capital.

Buying and selling foreign exchange carries substantial danger of capital loss. No indicator, together with the Comply with Line, ensures worthwhile trades. Your success depends upon danger administration, self-discipline, and lifelike expectations greater than any technical device. That mentioned, when correctly utilized to trending markets with applicable place sizing, this indicator can make clear decision-making and take away a number of the emotional burden from entries and exits.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90