South Africa is grappling with financial challenges, marked by persistent energy outages, social unrest, and structural constraints hindering progress. The newest information from Statistics South Africa reveals a 1.2% quarter-on-quarter GDP progress in Q2 2023, pushed by mining, finance, and commerce, whereas agriculture, manufacturing, and development contracted. Yr-on-year, GDP contracted by 17.2% in Q2.

Inflation, measured by the buyer worth index (CPI), rose to five.4% year-on-year in September, reaching a three-month excessive. Meals, non-alcoholic drinks, housing, utilities, and transport prices had been main contributors. Whereas nonetheless throughout the South African Reserve Financial institution’s (SARB) goal vary of three% to six%, it moved farther from the 4.5% midpoint that the SARB goals to anchor.

Inflation, measured by the buyer worth index (CPI), rose to five.4% year-on-year in September, reaching a three-month excessive. Meals, non-alcoholic drinks, housing, utilities, and transport prices had been main contributors. Whereas nonetheless throughout the South African Reserve Financial institution’s (SARB) goal vary of three% to six%, it moved farther from the 4.5% midpoint that the SARB goals to anchor.

The upcoming SARB rate of interest choice on November 23 is essential. Having maintained the repo charge at 8.25% in September, the SARB is using a cautious, data-dependent strategy, balancing financial assist and inflation containment. The SARB’s Quarterly Projection Mannequin suggests a possible 25 foundation factors charge hike in 2023, adopted by two extra hikes in 2024, contingent on inflation outlook and danger evaluation.

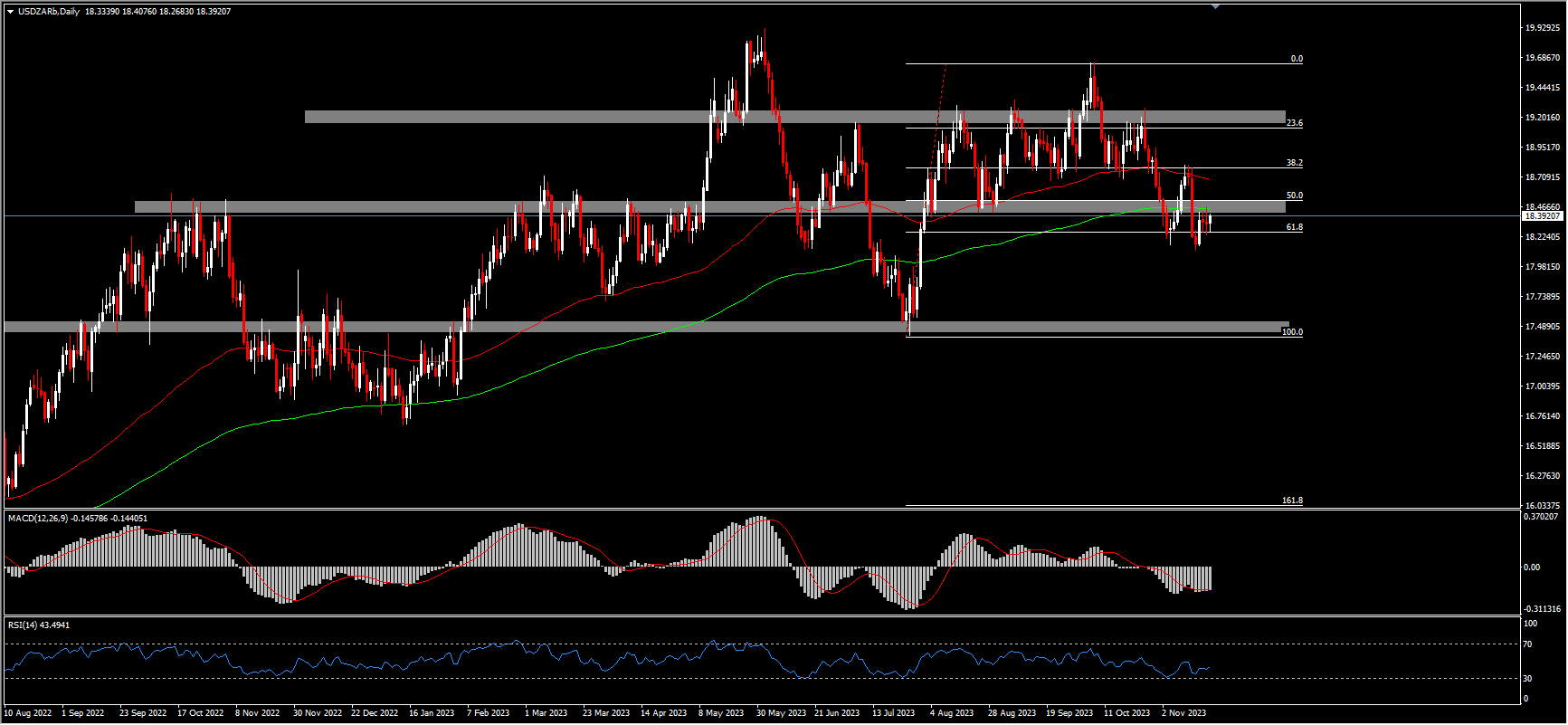

Analyzing the USDZAR technical evaluation on the day by day chart, the pair broke down the assist at 18.40 and the 200-day shifting common, buying and selling simply above the 61.8% Fibonacci stage at 18.39. A break beneath 18.25 might result in additional declines in the direction of 18.00 and probably 17.50. Conversely, a bounce may encounter resistance at 18.52 and 18.78. The momentum indicators RSI and MACD are offering combined indicators, with RSI close to the impartial 50 stage, indicating a impartial bias, whereas MACD above the sign line suggests a bullish bias.

Click on right here to entry our Financial Calendar

Francois du Plessis

Market Analyst

Disclaimer: This materials is supplied as a normal advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.