BoE and SNB left rates of interest on maintain, in opposition to expectations for extra tightening in each the UK and Switzerland. Each central banks maintained a tightening bias, however the BoE particularly is now anticipated to peak a lot sooner than thought simply a few months in the past.

Norges Financial institution and Riksbank Keep the Course

Each Norges Financial institution and Riksbank took the anticipated path by elevating rates of interest by 25 foundation factors. These central banks indicated that additional price will increase is perhaps essential to fight rising inflation.

The banks’ selections have been pushed by their dedication to holding inflation in test, citing persistently excessive wage development and providers inflation as main issues. They acknowledged indicators of weakening financial exercise however pointed to a good labor market and the opportunity of an increase within the medium-term equilibrium price of unemployment.

Financial institution of England and Swiss Nationwide Financial institution: Maintained a tightening bias

In distinction, the SNB and BoE stored the door to additional tightening huge open. Nevertheless, SNB within the central state of affairs is prone to preserve present coverage settings for the foreseeable future. The subsequent coverage overview is barely due in December, and by then the outlook ought to be clearer, not only for development throughout Europe, however for the US and China as nicely. CHF bought off, and if that is maintained it received’t assist the central financial institution, particularly if oil costs choose up once more.

The BoE’s determination got here as no shock following a weaker-than-expected month-to-month GDP report for July and an sudden decline in headline inflation for August. Regardless of ongoing inflation overshoot and persistently excessive meals costs, the BoE opted to keep up its present coverage settings, marking the primary pause after 14 consecutive price hikes since December 2021. This determination leaves the Financial institution Price at 5.25%.

Nevertheless, in the long run 5 MPC members, together with Governor Bailey and chief economist Capsule, argued in favor of sustaining present coverage settings, whereas 4 opted for one more price hike.

BoE Governor Bailey emphasised that “inflation has fallen lots in latest months, and we predict it is going to proceed to take action,” however he cautioned in opposition to complacency. He said that additional tightening in financial coverage can be crucial if there have been indicators of extra persistent inflationary pressures. This means that UK charges might have already peaked until inflation unexpectedly surges once more.

Markets had been anticipating a firmer dedication to a different hike within the case of a pause, so the BoE was altogether extra dovish than economists and markets had been anticipating. The MPC did vote in favor of dashing up the tempo of its quantitative tightening program, from GBP 80 bln in 2022-23 to GBP 100 bln in 2023-24, though the BoE pressured that rates of interest stay the principle coverage software, whereas suggesting that the impact of asset gross sales on borrowing prices was prone to be “modest”.

The minutes to the assembly confirmed that the minority arguing in favor of one other 25 foundation level hike admitted that there are actually some indicators of weakening financial exercise, however flagged that “the labour market was nonetheless comparatively tight, according to a doable rise within the medium-term equilibrium price of unemployment”. Additionally they pointed to persistently excessive wage development and providers inflation.

Nonetheless, all MPC members appear to agree that there are actually indicators that the financial coverage stance is more and more weighing on financial exercise. This, coupled with indicators that confidence in future development is eroding, appears to have been the principle cause for the surprisingly dovish message from the BoE. The “greater for longer” message stays firmly in place.

Market Reactions

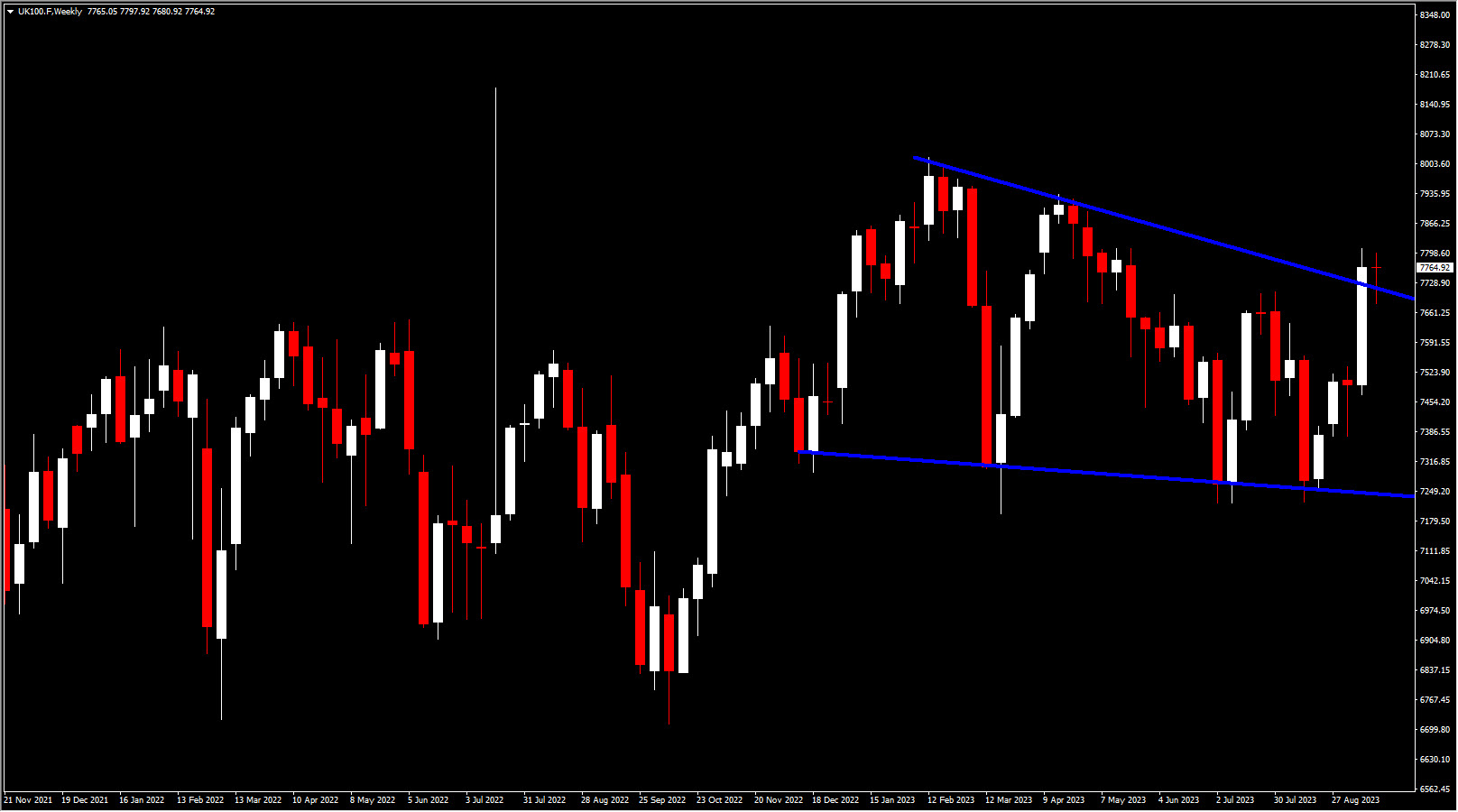

Gilts didn’t profit from the BoE determination, and the 10-year price rebounded from the 2-month low of 4.2% seen within the wake of the weaker than anticipated inflation print. Sterling bought off, which won’t make the BoE’s activity any simpler, because it boosts the dangers of imported inflation. UK100, in the meantime, broke its 9-month triangle greater, extending to 7800 territory, elevating questions for a doable return above 8000.

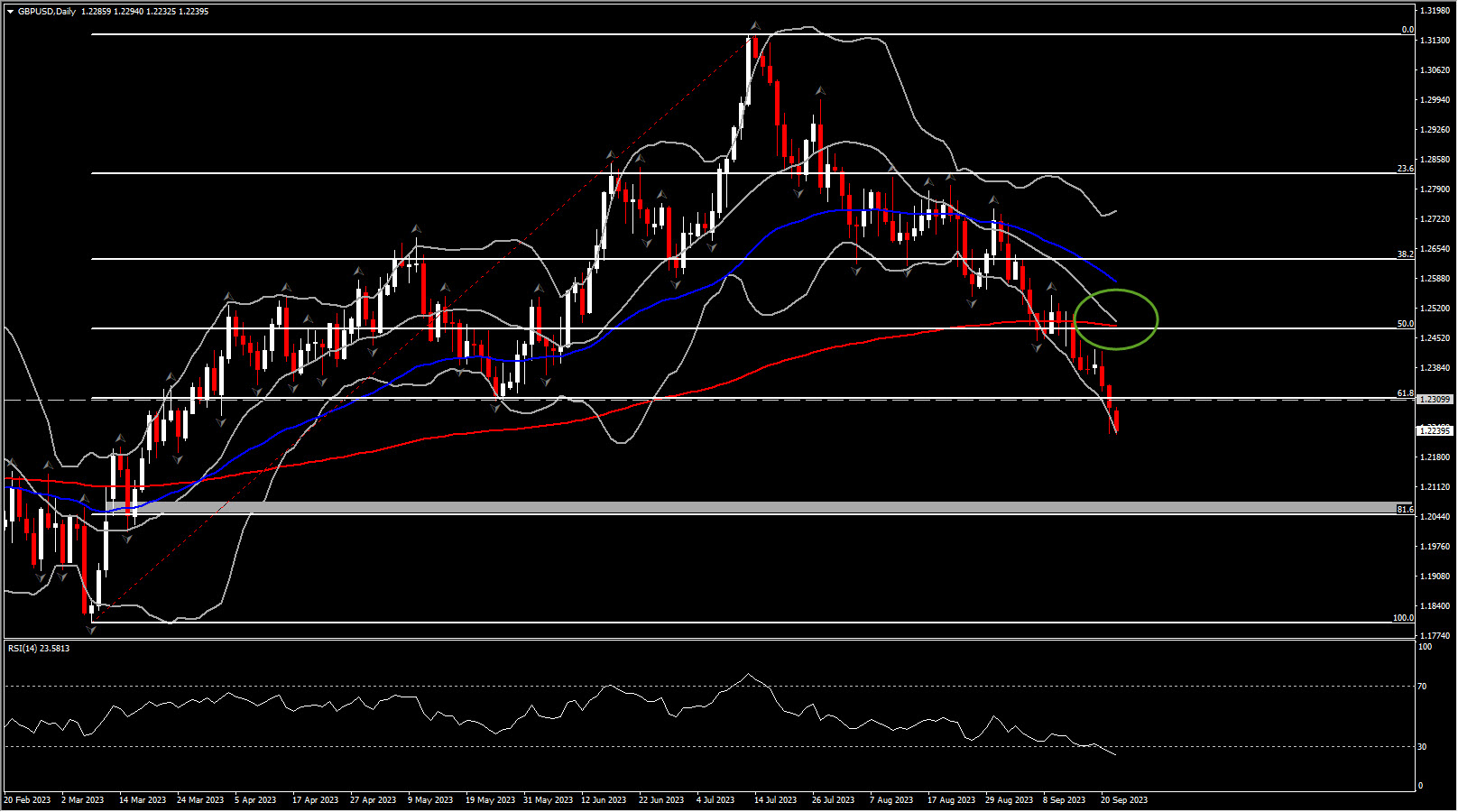

Cable has dropped greater than 1% over the week, on the BoE’s dovish flip. Right this moment’s worrying PMI report (Composite PMI dropped to a 32-month low) goes some approach to explaining the central financial institution’s determination to sign that charges might have peaked. Bets on further hikes have been scaled again sharply and we agree that if development information doesn’t enhance, the probabilities are that UK charges have peaked already.

Cable drifted to a low of 1.2240 across the lowest stage in 5 months. Wider energy within the USD, the dovish shock from the BoE and weak development numbers out of the UK have been holding a lid on the forex. Cable is prone to stay capped as confidence in a tender touchdown within the US strengthens. Therefore consideration turns to the 1.21 and 1.20 space.

As we transfer ahead, all eyes might be on development indicators within the coming weeks, and the BoE’s up to date forecasts in its subsequent financial coverage report in November will present a clearer image of the speed outlook. The central banks’ actions, whereas seemingly divergent, all underscore the complexity and unpredictability of world financial panorama.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or ought to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.