A cease loss and take revenue indicator mechanically calculates and shows exit ranges on your trades based mostly on customizable danger parameters. Not like manually putting stops, this instrument makes use of mathematical formulation—sometimes ATR (Common True Vary), percentage-based calculations, or mounted pip distances—to find out the place your protecting cease and revenue goal ought to sit.

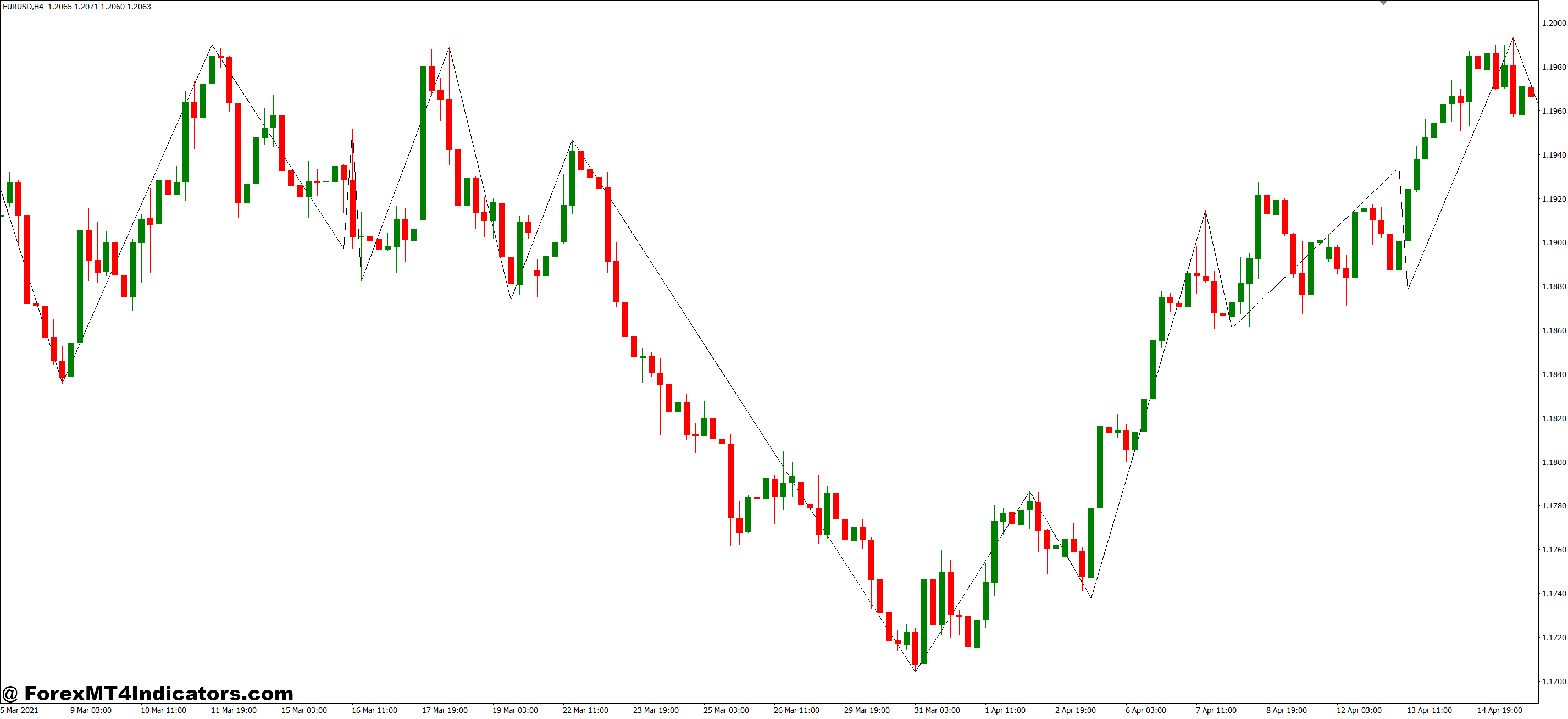

The indicator plots these ranges as horizontal traces or zones in your chart. While you enter a commerce, you may immediately see the place to put your cease loss order to restrict potential injury and the place to set your take revenue to safe beneficial properties. Some superior variations regulate these ranges dynamically as worth strikes, trailing your cease to guard collected income.

Right here’s what separates it from fundamental guide cease placement: the calculations think about present market volatility. A 20-pip cease on GBP/JPY throughout Tokyo session is perhaps affordable, however that very same 20 pips throughout London open? You’ll get stopped out by regular noise. This indicator adapts.

How the Calculations Work Behind the Scenes

Most cease loss and take revenue indicators use certainly one of three calculation strategies:

- ATR-based calculation measures current worth volatility. If the 14-period ATR on EUR/USD is 45 pips, the indicator may place your cease at 1.5x ATR (67.5 pips) from entry. Take revenue sometimes sits at 2x or 3x the cease distance, supplying you with a positive risk-to-reward ratio. Once I examined this on uneven Friday afternoons, the broader ATR-based stops stored me in trades that will’ve hit mounted 30-pip stops 3 times over.

- Proportion-based strategies use account danger as a substitute of worth motion. Set it to danger 2% of your account, and the indicator calculates the precise pip distance wanted based mostly in your lot measurement. Your cease on a 0.5 lot place will differ from a 1.0 lot place—even on the identical forex pair.

- Mounted pip distance works precisely the way it sounds. You inform the indicator “50 pips cease, 100 pips goal” and it plots them out of your entry. Easy however rigid. This strategy ignores whether or not you’re buying and selling the sleepy August doldrums or a risky central financial institution announcement day.

The higher indicators mix these strategies. You may use ATR for cease placement however set take revenue at a set 2:1 ratio no matter volatility.

Actual Buying and selling Utility: The place It Really Helps

Let’s get sensible. You notice a bullish pin bar rejection on USD/CAD on the 1.3500 help stage on the 4-hour chart. You enter lengthy at 1.3515.

With out the indicator, you’re guessing. “Possibly a 40-pip cease? Or 50 to be secure?” You verify the earlier swing low, eyeball some house, and hope for one of the best. Your take revenue? “I’ll shut when it feels proper.”

With a cease loss and take revenue indicator utilizing 1.5x ATR, right here’s what occurs: The 14-period ATR reads 32 pips. Your cease calculates to 48 pips beneath entry at 1.3467—just under that help zone the place your commerce concept truly invalidates. Take revenue, set at 3:1, plots at 144 pips above entry (1.3659). Now you’ve acquired clear ranges backed by volatility knowledge, not intestine feeling.

The actual worth exhibits up throughout information occasions. I as soon as held a USD/JPY place by means of a Fed announcement utilizing static 30-pip stops. Received whipsawed out on the preliminary spike earlier than worth moved my route for 150 pips. An ATR-based indicator would’ve widened that cease to 65 pips that day—sufficient buffer to outlive the fake-out.

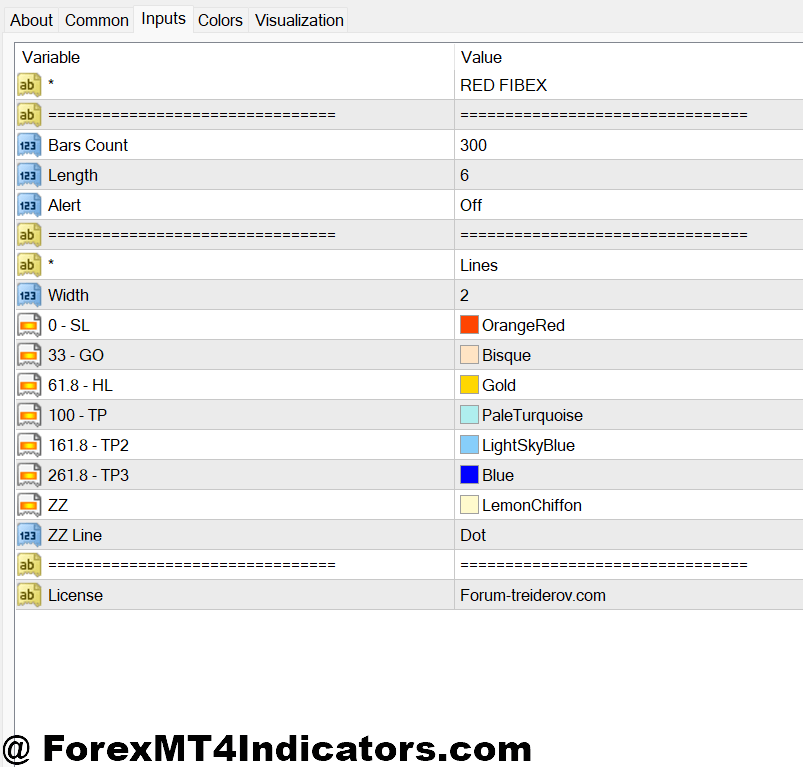

Customization Settings That Really Matter

The usual 14-period ATR works nice for swing buying and selling, however day merchants ought to drop it to 7 or 10 durations for extra responsive ranges. Longer timeframes like every day charts can stretch to 20-period ATR with out getting too sluggish.

Your risk-to-reward ratio setting determines take revenue placement. Conservative merchants persist with 2:1 (danger 50 pips to make 100). Aggressive scalpers may use 1.5:1 however commerce larger chance setups. I’ve discovered 2.5:1 hits the candy spot on trending pairs—excessive sufficient to seize meaty strikes however real looking sufficient to really fill.

The ATR multiplier wants adjustment based mostly on market situations. Quiet Asian session buying and selling on EUR/USD? Use 1.2x ATR for tighter stops. Wild commodity forex swings throughout risk-off occasions? Bump it to 2x ATR otherwise you’ll donate cash to random noise.

Some indicators embody a trailing cease function. As soon as worth strikes X pips in your favor, the cease shifts to breakeven or locks in partial income. This works brilliantly on sturdy developments however chops you out of ranging consolidations earlier than the actual transfer occurs. Check it completely earlier than counting on it.

The Trustworthy Evaluation: What It Gained’t Do

This indicator gained’t repair dangerous commerce entries. Should you’re longing resistance in a downtrend, completely calculated stops simply imply you lose cash extra effectively. Your directional bias and entry timing nonetheless matter most.

It can also’t predict black swan occasions. A 1.5x ATR cease appears good till your dealer widens spreads to 50 pips throughout a flash crash and also you get stopped out 30 pips past your supposed stage. Slippage exists. Account for it.

The automated calculations generally battle with apparent chart construction. Your indicator may place a cease at 1.3467, however there’s an enormous help zone at 1.3480. Blindly following the indicator’s stage ignores important market context. Use it as a information, not gospel.

That stated, the benefits outweigh these limitations. You remove emotional exit selections. You get constant danger administration throughout all trades. You save psychological power for the necessary stuff—like analyzing setups and managing total portfolio publicity. And also you cease leaving cash on the desk by closing winners too early.

How It Stacks Up Towards Guide Cease Placement

Manually setting stops provides you full management and allows you to think about help/resistance ranges the indicator may miss. Nevertheless it additionally invitations inconsistency. Your risk-per-trade jumps round based mostly on how aggressive or conservative you are feeling that day.

In comparison with static pip-based stops, the ATR strategy adapts to market situations. A hard and fast 40-pip cease will get wrecked on GBP pairs throughout UK knowledge releases however is perhaps too extensive on USD/CHF throughout quiet hours. The indicator adjusts mechanically.

Different indicators like Parabolic SAR or Chandelier Exit additionally present dynamic cease ranges, however they’re primarily designed for trailing stops in established developments. The cease loss and take revenue indicator works from the second you enter, whether or not you’re catching a reversal or using a pattern.

The best way to Commerce with Cease Loss and Take Revenue MT4 Indicator

Purchase Entry

- Affirm uptrend construction – Solely enter longs when worth is making larger highs and better lows on the 4-hour or every day chart, not throughout uneven sideways motion.

- Look forward to pullback completion – Enter after worth touches a help stage or transferring common and exhibits bullish rejection, sometimes a pin bar or engulfing candle on EUR/USD or GBP/USD.

- Set cease beneath swing low – Place your cease 5-10 pips beneath the newest decrease wick or help zone, normally 30-50 pips relying on ATR readings.

- Goal 2:1 minimal ratio – If risking 40 pips, your take revenue ought to sit no less than 80 pips above entry, ideally close to earlier resistance or psychological ranges.

- Keep away from buying and selling throughout main information – Skip BUY indicators inside half-hour earlier than or after NFP, FOMC, or central financial institution bulletins when spreads widen and slippage will increase.

- Test every day timeframe bias – Don’t take 1-hour BUY indicators if the every day chart exhibits a robust downtrend; commerce with the bigger pattern, not in opposition to it.

- Use 1-2% account danger most – Calculate lot measurement so your cease loss equals precisely 1-2% of account steadiness, by no means danger extra even when the setup appears good.

- Exit partial at 1:1 – Shut half your place when worth reaches revenue equal to your danger, then path the cease on remaining place to breakeven.

Promote Entry

- Establish downtrend affirmation – Enter shorts solely when worth creates decrease lows and decrease highs on 4-hour charts, avoiding sideways consolidation zones.

- Look forward to resistance rejection – Search for bearish engulfing or taking pictures star patterns at earlier resistance on GBP/USD or USD/JPY earlier than coming into.

- Place cease above swing excessive – Place cease loss 5-10 pips above the current higher wick or resistance stage, sometimes 35-60 pips on risky pairs.

- Set real looking revenue targets – Take revenue needs to be 2-3 instances your cease distance, putting it close to help ranges or earlier swing lows for larger fill chance.

- Skip throughout low liquidity hours – Keep away from SELL indicators between 5 PM – 8 PM EST when spreads widen and worth motion turns into unreliable on most pairs.

- Confirm with momentum indicators – Don’t promote simply because the indicator plots ranges; affirm with RSI beneath 50 or MACD exhibiting bearish crossover in your timeframe.

- By no means transfer cease farther away – If worth approaches your cease loss, settle for the loss; widening stops turns small losses into account-damaging drawdowns.

- Keep away from promoting at main help – Skip SELL indicators inside 20 pips of every day or weekly help zones the place institutional patrons sometimes defend worth aggressively.

Ultimate Ideas on Automated Exit Planning

It forces self-discipline you most likely lack in any other case. That alone makes it invaluable. You’ll nonetheless blow trades on dangerous entries and miss alternatives from hesitation, however no less than your exits develop into systematic.

The ATR-based calculation provides you volatility-adjusted ranges that really make sense for present situations. Your risk-to-reward stays constant. You cease second-guessing whether or not to shut positions early or allow them to run.

However bear in mind—buying and selling foreign exchange carries substantial danger, and no indicator ensures income. This instrument manages exits, not win charges. You continue to want stable evaluation, correct place sizing, and real looking expectations about what markets can ship.

Begin by testing it on a demo account. See how the calculated stops evaluate to your guide placements. Discover the place it saves you from emotional closes and the place it conflicts with apparent chart ranges. Then regulate the settings till it enhances your technique as a substitute of combating it.

The objective isn’t perfection. It’s consistency and eradicating emotional interference from a course of that needs to be mechanical. That’s the place most merchants fail, and the place a easy indicator could make the most important distinction.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90