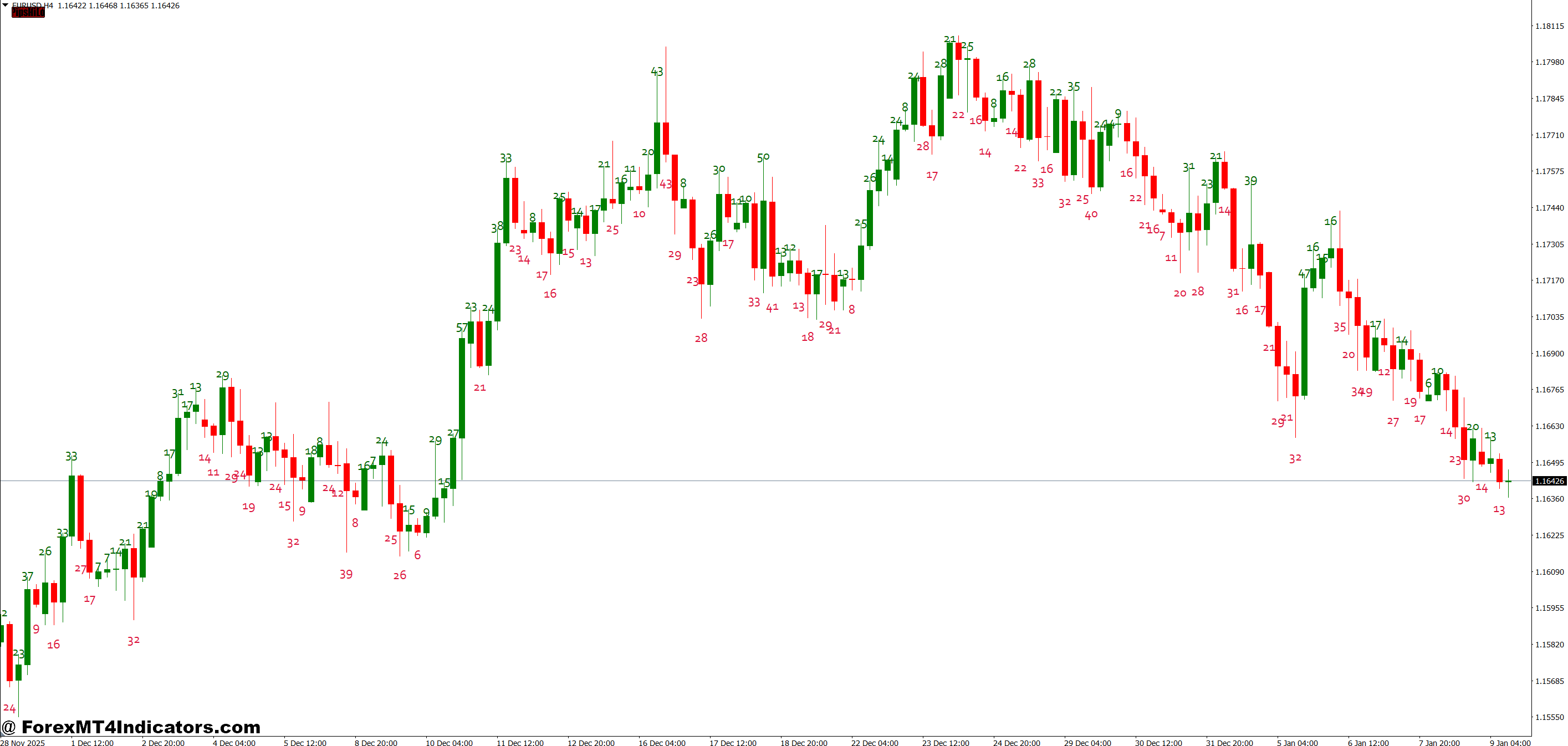

What separates this from eyeballing charts is precision. A candle would possibly look giant on a compressed every day chart however solely signify 20 pips, whereas a tiny-looking candle on a 1-minute chart throughout London open might span 15 pips important for scalpers. The indicator eliminates guesswork by labeling every candle with its measurements, sometimes displayed close to the candle excessive or as an overlay.

Most variations permit customization of what information seems. Some merchants solely need physique dimension proven, whereas others choose full breakdowns together with wick ratios. The calculations use the usual pip definition: for pairs like EUR/USD, one pip equals 0.0001, whereas for JPY pairs, it’s 0.01.

How Merchants Apply It in Actual Setups

Right here’s the place concept meets observe. Swing merchants on the every day chart use physique dimension to filter momentum. If EUR/GBP prints three consecutive 40-pip our bodies in a single route, that alerts stronger conviction than six 15-pip candles protecting the identical distance. The distinction? Within the first situation, sellers (or patrons) managed value constantly with out main pushback.

Scalpers take a special strategy. On the 5-minute GBP/USD chart throughout New York session, they look ahead to candles with small our bodies (5-8 pips) however giant wicks (20+ pips). This sample typically alerts indecision or absorption giant orders absorbing momentum. Sensible scalpers fade these strikes, coming into counter-trend when the subsequent candle confirms rejection.

One particular instance: GBP/JPY on the 15-minute chart kinds a bullish candle with a 35-pip physique and solely 5-pip wicks on each ends. That’s a excessive conviction transfer patrons stepped in decisively. A dealer would possibly enter on a pullback to that candle’s shut, inserting stops under the low. Examine this to a candle with a 20-pip physique however 30-pip decrease wick. The latter reveals bulls confronted critical resistance, making continuation much less dependable.

Vary merchants flip the script. When USD/CAD on the 1-hour chart reveals common candle ranges dropping from 25 pips to 10 pips, the market’s coming into consolidation. These merchants watch for enlargement when candle ranges immediately spike again to 30+ pips, a breakout’s possible brewing.

Customization and Settings That Matter

The indicator sometimes contains a number of adjustable parameters. Pip show location comes first customers can place measurements above candles, under them, or at a set nook of the chart. This prevents muddle on multi-indicator setups.

Colour coding is one other key setting. Some variations let merchants set thresholds: candles with our bodies above 30 pips would possibly show in inexperienced, whereas these under 10 pips present in grey. This prompt visible suggestions helps sample recognition. Throughout a GBP/USD development, seeing a string of inexperienced labels (giant our bodies) adopted by grey ones (small our bodies) suggests momentum’s fading.

Timeframe filtering issues for multi-chart merchants. The indicator may be set to solely show information on particular timeframes every day and 4-hour for place merchants, or 1-minute and 5-minute for day merchants. Operating it on all timeframes concurrently creates info overload.

A much less apparent adjustment: wick-to-body ratio alerts. Some superior variations spotlight candles the place wicks exceed physique dimension by a sure multiplier. If a candle’s higher wick is 3x bigger than its physique, that’s a possible rejection setup. EUR/USD forming this sample at a resistance degree provides merchants a concrete, measurable sign moderately than subjective “it seems to be prefer it received rejected” evaluation.

Strengths and Actual Limitations

The largest benefit is objectivity. Two merchants wanting on the similar chart would possibly disagree on whether or not a candle reveals “sturdy momentum,” but when the Candle Pips Indicator shows a 45-pip physique, that’s inarguable information. This removes emotion from evaluation and creates constant entry standards.

It excels throughout risky durations. When the NFP report drops and USD pairs go haywire, watching pip measurements in real-time helps merchants distinguish real strikes from knee-jerk spikes. A 70-pip candle with a 60-pip physique suggests sustained strain. A 70-pip vary with a 15-pip physique and large wicks? That’s chaos most likely greatest to take a seat out.

However right here’s the fact verify: pip measurements alone don’t predict route. A 50-pip bearish candle seems to be spectacular till the subsequent candle prints a 60-pip bullish physique, fully reversing the transfer. The indicator quantifies motion however doesn’t clarify why it occurred or what comes subsequent.

One other limitation surfaces with totally different account varieties. Brokers utilizing 5-digit pricing (pipettes) may cause confusion for the reason that indicator should modify its calculations. A dealer switching from a 4-digit dealer would possibly see measurements that appear off by an element of 10 till they recalibrate settings.

The indicator additionally provides visible noise to charts. Having pip counts on each candle creates muddle, particularly on decrease timeframes the place tons of of candles fill the display screen. That’s why selective show exhibiting solely the latest 50-100 candles is essential.

How It Stacks Up Towards Comparable Instruments

In comparison with ATR (Common True Vary), the Candle Pips Indicator offers prompt, per-candle suggestions moderately than an averaged worth. ATR tells merchants “the pair sometimes strikes 80 pips per day,” whereas this indicator reveals “this particular candle moved 42 pips.” Each have worth, however for entry timing, per-candle information wins.

The indicator differs from conventional value labels too. MetaTrader’s built-in OHLC information shows open, excessive, low, and shut costs helpful info however requiring psychological math to calculate pip motion. The Candle Pips Indicator does that calculation robotically, saving cognitive bandwidth for precise buying and selling selections.

Towards quantity indicators, it’s apples and oranges. Quantity reveals what number of contracts traded; pip measurements present value displacement. Ideally, merchants mix each giant pip motion with excessive quantity confirms actual curiosity, whereas huge candles on low quantity would possibly sign skinny liquidity or cease hunts.

Closing Ideas on Sensible Use

The Candle Pips Indicator MT4 brings measurable construction to candlestick evaluation. Merchants achieve concrete information a 35-pip bullish physique with 8-pip wicks versus a 12-pip physique with 40-pip wicks tells two fully totally different tales. That specificity helps construct constant buying and selling methods primarily based on quantified patterns moderately than intestine feeling. The indicator works greatest when paired with value motion ideas, not as a standalone answer. Danger administration nonetheless trumps any single software, and buying and selling foreign exchange carries substantial danger no matter indicator accuracy. No indicator ensures income, and drawdowns occur even with good pip measurements. That stated, for merchants who worth precision and wish clear, goal candle information, this software delivers precisely what its identify guarantees.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90