Everybody needs to get probably the most doable cash for his or her time spent at work, and buying and selling isn’t any totally different; we wish to take advantage of cash doable given the finite period of time we now have to work together with the market every day. Sadly, most merchants lose cash as a result of they don’t perceive methods to correctly use their time out there. How will you get probably the most out of your time analyzing and buying and selling the market?

Everybody needs to get probably the most doable cash for his or her time spent at work, and buying and selling isn’t any totally different; we wish to take advantage of cash doable given the finite period of time we now have to work together with the market every day. Sadly, most merchants lose cash as a result of they don’t perceive methods to correctly use their time out there. How will you get probably the most out of your time analyzing and buying and selling the market?

For a lot of merchants, it appears pure to imagine that being out there as usually as doable is what provides them the most effective likelihood of earning money. Nonetheless, at present I’m going to problem this widespread perception and I’m going to point out you that you simply don’t have to react to each little bar or sample that “would possibly” be an entry sign. As an alternative, you must get “in-tune” with the general market construction and dynamics and study to anticipate high-probability buying and selling situations…that is the way you get probably the most cash out of your time out there.

“Give me six hours to cut down a tree and I’ll spend the primary 4 sharpening the axe.”

― Abraham Lincoln

I not too long ago wrote an article on growing a day by day buying and selling routine which mentioned the significance of performing weekly and day by day market evaluation in a structured and methodical method. Many merchants simply get up every day and go on the lookout for an entry sign in a really random and haphazard method. As an alternative, whenever you sit down at your laptop to research the market, you must have already got a good suggestion of the place you’re on the lookout for indicators and what markets are “sizzling” proper now…try to be anticipating indicators in confluent areas and ranges out there based mostly on earlier evaluation you’ve already finished.

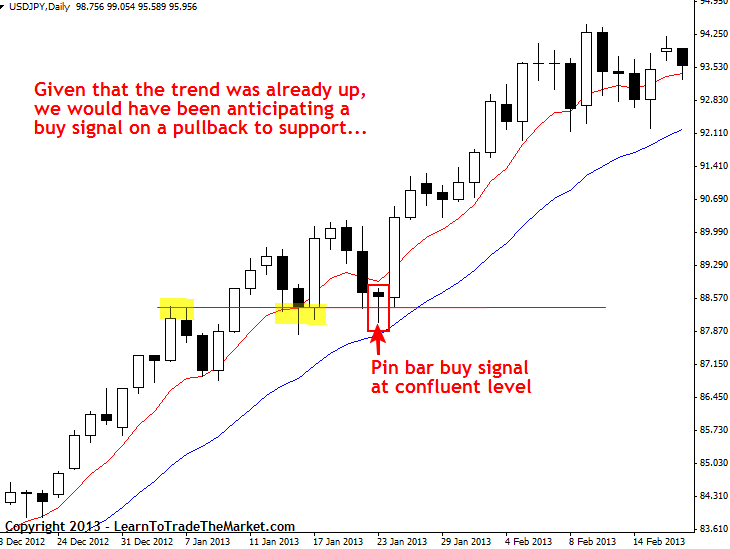

For instance, within the chart under, we now have analyzed the market and located probably the most confluent space to search for a sign, now we simply want to attend in ambush; patiently ready for a sign to kind within the space or degree we’re watching. We’ve anticipated a commerce situation by analyzing the chart dynamics, figuring out market bias and discovering the important thing areas out there, in addition to latest value motion occasions….

On this USDJPY chart under, we’d have been anticipating a value motion purchase sign to kind after a pullback to assist on condition that the pattern was up. Observe that we could have needed to await one or two weeks for this sign, however it led to a big transfer greater and a continuation of the pattern, so it was properly well worth the wait. Many merchants had been in all probability getting chopped up on the low time-frame charts as a substitute of ready for this sign to kind, and misplaced cash because of this, as a substitute they may have simply been preserving danger capital and observing the market every day, patiently ready for a purchase sign from assist…

It’s crucial to grasp the roles that anticipation and response play in buying and selling the market. Anticipation can usually be considered a higher-level mind operate, for it’s the flexibility to anticipate future occasions that actually does separate us from different species. Reactions are rather more primitive and customary amongst all animals; a monkey will react to its surroundings, however most of us know that it doesn’t actually anticipate some occasion one week out into the longer term.

In my expertise, most struggling merchants are too busy reacting to the market to have sufficient time to catch their breath and make a plan to anticipate what it’d do subsequent. It might sound harsh or merciless, however being the frank person who I’m, I’m going to offer it to you straight; merchants who solely react to the market are behaving extra animalistic, and therefore they lose cash. Skilled merchants anticipate, they management themselves slightly than permitting the market to regulate them.

Latest examples of methods to anticipate trades

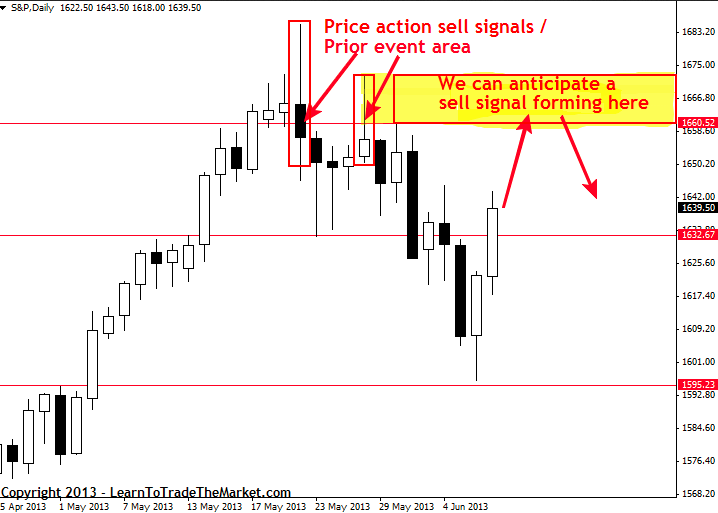

For a newer instance of methods to anticipate commerce indicators, we are able to take a look at the day by day S&P 500 (USA) Index chart. As we mentioned in our latest commentary on the S&P 500, the 1660 – 1670 resistance space was clearly a high-probability resistance space to look at for value motion promote indicators. We will draw this conclusion based mostly on the truth that two latest value motion occasions have occurred at that degree and led to giant strikes decrease. Due to this fact, we all know there’s numerous promoting curiosity up at that resistance and if the market retraces again as much as it and varieties an apparent value motion promote sign, it could clearly be a really high-probability commerce…

Observe on anticipating trades: The market is not going to ALWAYS do what you need it to or what you anticipate it’d do. It gained’t at all times transfer into the high-probability / confluent zones that you simply spotlight in your charts…however generally it would, and when it does you’ll be prepared and assured, and that’s the level. The purpose of anticipating trades is that you’ve a plan of motion for the way you’ll react if XYZ occurs…it is a rather more skilled technique to conduct your self out there than merely “operating and gunning” with no logic or technique behind your trades.

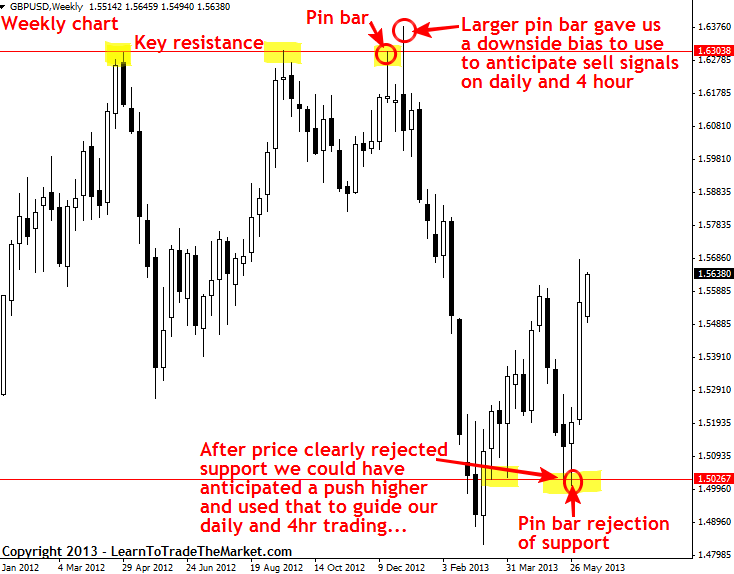

Within the subsequent instance, we’re wanting on the present view of the GBPUSD weekly chart. By analyzing the weekly time-frame and holding in-tune with what it’s doing, we are able to use it as a information to anticipate trades on the day by day, 4 hour or 1 hour chart. Within the chart under, we are able to see that the massive down transfer which occurred the primary three months of this yr was preceded by two bearish pin bars rejecting a key degree of resistance. Merchants who had been following this market and analyzing its value motion would have been conscious that the longer-term weekly bias was altering from bullish to bearish and will have begun anticipating promote indicators on the day by day, 4 hour or 1 hour time-frame because of this. After the down transfer occurred, we are able to see that bullish value motion on the weekly chart gave us the flexibility to anticipate the present transfer greater that this market is experiencing.

Right here’s an instance of figuring out the weekly chart bias and utilizing it to anticipate commerce indicators on the day by day, 4 hour or 1 hour charts:

One other instance of anticipating commerce indicators is when an apparent pin bar reversal sign varieties and we anticipate a 50% retrace entry. This pin bar entry approach is one thing I train in additional in-depth in my programs, however for the needs of this lesson, we are able to see that’s an anticipatory entry approach. Figuring out when to anticipate a 50% entry on a pin bar sign is one thing that takes some “intestine really feel” to get good at it, however you’re going to get higher at it by means of coaching and apply.

Right here’s an instance of how we are able to anticipate a promote entry on the 50% retrace degree of a bearish pin bar promote sign. This can be a good instance of utilizing anticipation and persistence to enter the market, as a substitute of simply “reacting” to the preliminary sign:

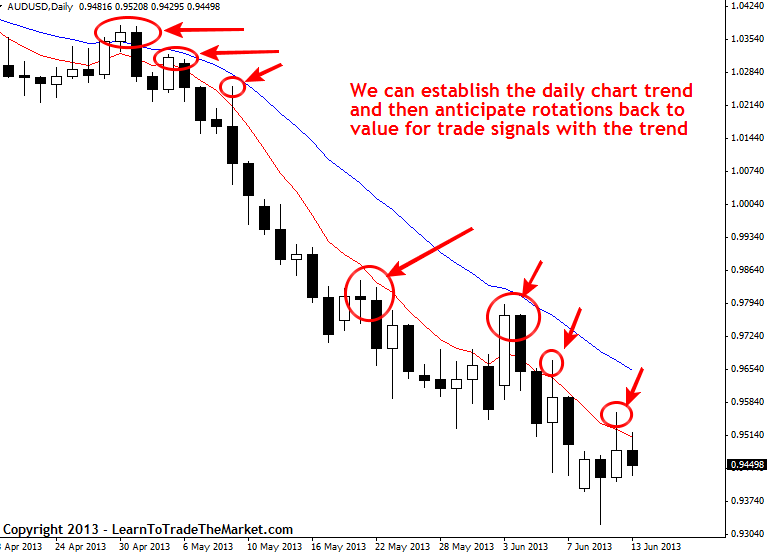

Figuring out the near-term day by day chart pattern after which on the lookout for value motion indicators as value rotates again to “worth” (assist or resistance) inside that pattern, is without doubt one of the strongest makes use of for persistence and anticipation.

Within the chart under, we are able to see an instance of first establishing that the day by day chart pattern was down within the AUDUSD (observe the 8 and 21 day EMAs had been falling) after which as value retraced again as much as the 8 / 21 day EMA resistance layer (worth) we might anticipate value motion promote indicators on the 1 hour, 4 hour or day by day chart time-frame to commerce again in-line with the downtrend:

WHY you NEED to study to anticipate trades

Take into consideration your iPhone or iPad for a minute. It’s frequent information that Apple has turn out to be probably the most beneficial firm in the US, however what you won’t know is that Apple’s founder, Steve Jobs, was a really anticipatory particular person. Mr. Jobs anticipated what folks would need and like, and the Apple electronics that so many people love and now appear to “want”, are the results of this anticipation. In actuality, all good concepts are usually not simply “instantaneous”…concepts require time, planning, considering and anticipation. As merchants, we are able to take the truth that anticipation is a key ingredient in virtually each huge enterprise or private success story and apply it to our buying and selling. To place it merely, we have to plan, anticipate after which pull the set off as soon as market circumstances meet our anticipated standards. To study extra about methods to anticipate high-probability commerce indicators, checkout my buying and selling course and members space for extra.