BTC Vortex Nexus makes use of volatility-adapted value engines and multi-layer security filters to enter trades solely when market situations validate construction and liquidity.

At key reference factors, the EA evaluates sign integrity, anticipated slippage, and execution price earlier than producing orders.

The system prompts solely when:

Volatility patterns match statistically outlined ranges

Threat publicity stays aligned with predefined thresholds

Unfold and slippage are inside secure execution bands

The EA prepares each bullish and bearish eventualities, confirming value construction earlier than engagement. There may be no martingale, grid, or unsanctioned averaging logic embedded.

ARCHITECTURE OVERVIEW — SAFETY FIRST

BTC Vortex Nexus incorporates layered protections:

Dynamic lot sizing tied to steadiness and free margin

Unfold/slippage thresholds to keep away from poor fills

Dealer rule validation (cease ranges, freeze ranges)

Quantity and price-action filters to make sure high quality situations

Computerized cleanup of out of date pending orders

Commerce requests are rejected earlier than execution if any security situation fails.

This strategy prevents:

RISK MANAGEMENT FRAMEWORK

Threat is managed throughout three dimensions:

1. Lot Calculation

Lot sizes scale primarily based on account, danger profile, and up to date volatility to protect fairness.

2. Commerce Construction

Each commerce makes use of outlined Cease Loss and Take Revenue, supplemented by volatility-adjusted targets.

3. Publicity Caps

Limits forestall extreme margin allocation for a single commerce or image cluster.

This design makes the EA appropriate for small, medium, and institutional accounts operating BTCUSD.

INPUT PARAMETERS — WHAT YOU CAN ADJUST

Core Threat Settings

Auto Lot Threat % Max Unfold Allowed Slippage

Technique Controls

Volatility Filter Directional Bias Threshold Cease Loss (pips) Take Revenue (pips) Trailing Cease

Execution Protections

Max Unfold Filter Dealer Compliance Examine Free Margin Threshold

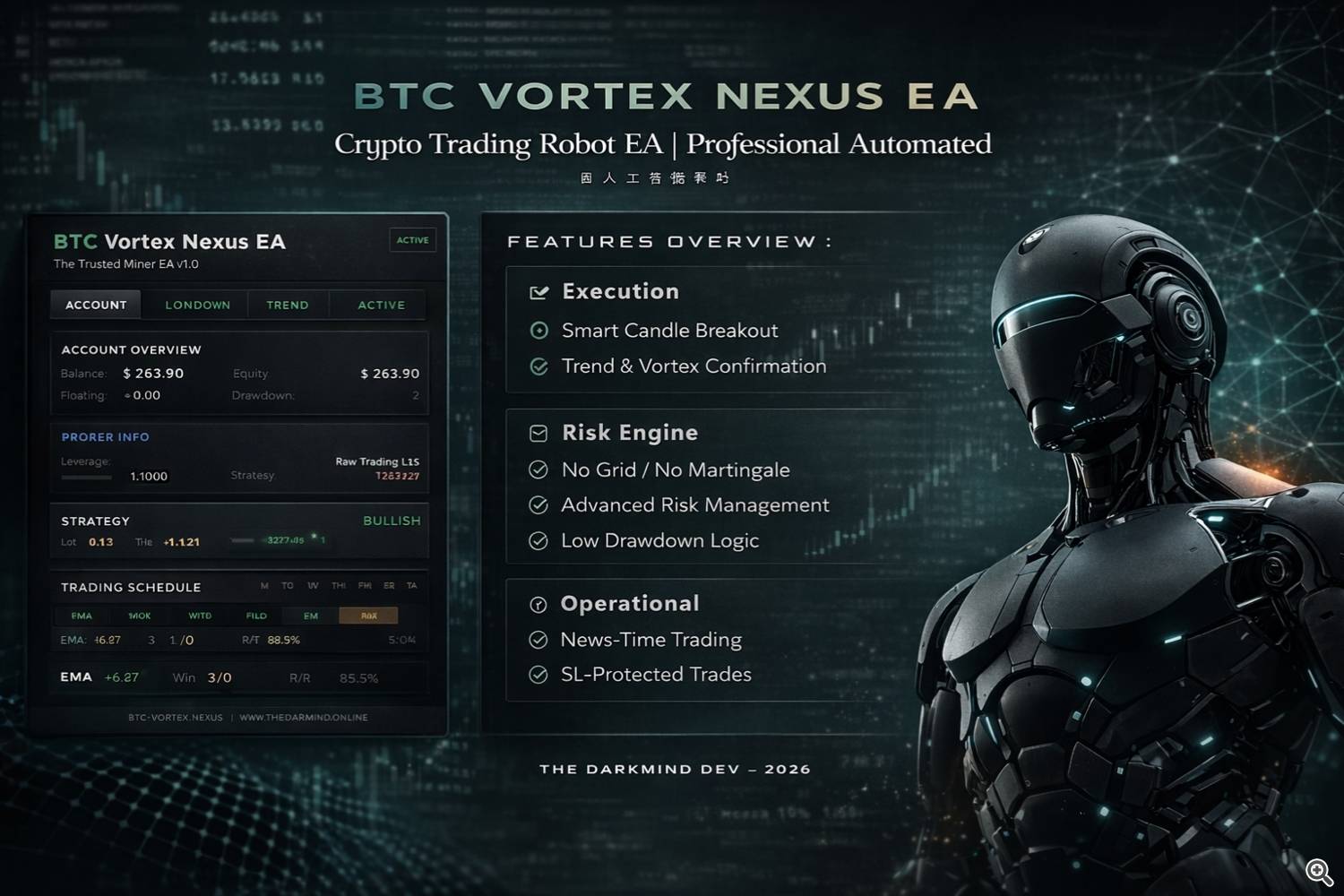

EA PANEL — HOW TO READ IT

Header Space

Exhibits EA identify, model, market regime sign, and commerce state.

Dealer Card

Shows dealer identify, leverage, and unfold standing.

Account Metrics

Stability, fairness, floating P/L, and drawdown proven in actual time.

Technique Metrics

Exhibits calculated lot measurement, chosen danger profile, and energetic filters.

Directional Card

Exhibits stress bias affirmation — used as affirmation, not prediction.

Efficiency Card

Weekly trades, wins/losses, revenue, drawdown %, and win fee.

WHAT THIS EA IS DESIGNED FOR

Merchants prioritizing capital preservation and self-discipline

BTC merchants in search of rule-based automation

Accounts requiring strict danger controls

Automation with out fixed oversight

WHAT THIS EA IS NOT

NEWS AND VOLATILITY HANDLING

BTC Vortex Nexus does not pause throughout key occasions.

Design relies on market response, not prediction.

Makes use of pending logic and affirmation gates

Auto-blocks trades when execution situations deteriorate

Treats information volatility as one other market state, not a set off

Throughout spikes:

Extreme spreads → commerce blocked

Margin danger will increase → commerce blocked

Dealer limits triggered → commerce blocked

FINAL NOTE

BTC Vortex Nexus is a software, not a assure.

Efficiency will depend on dealer situations, account measurement, leverage, and danger configuration.

The EA enforces self-discipline mechanically — with out emotion, with out improvisation, and with out chasing losses.