Options:

This scanner will present:

- NRTR Development route

- Final NRTR Swap (breakout) – variety of bars and if it was a excessive quantity bar

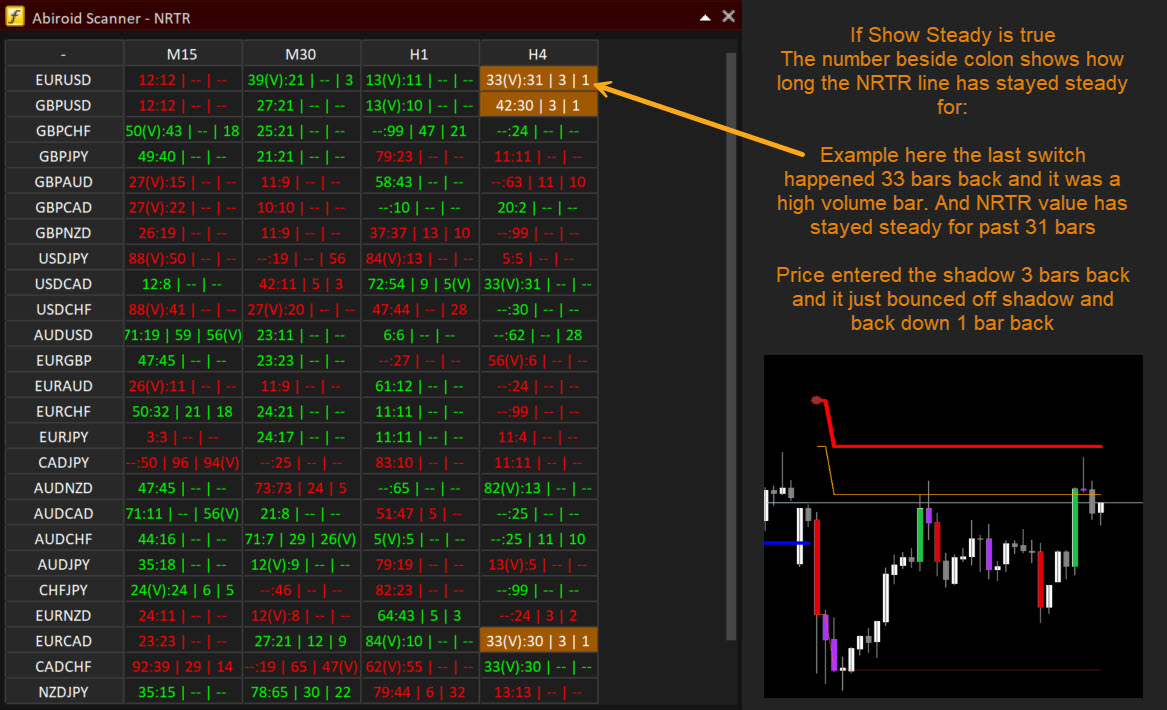

- What number of bars has the SR stayed regular for

- When worth final entered an NRTR shadow

- When worth bounced off the NRTR shadow again inside

- Basket Commerce setups

NRTR Defined:

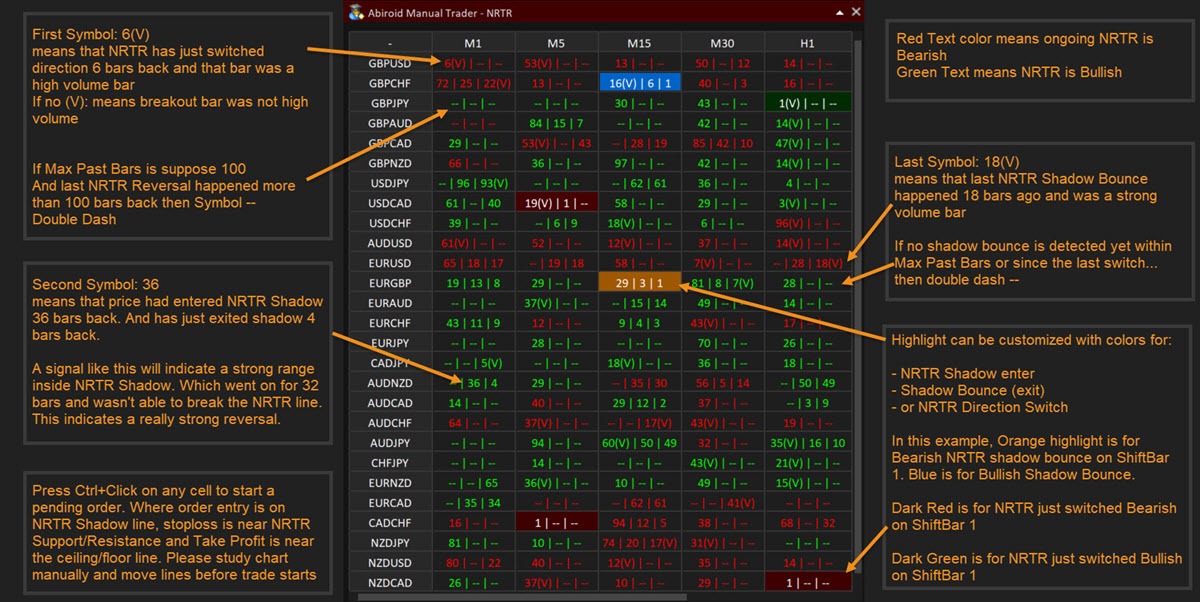

Symbols Defined:

So, utilizing simply the numbers on the sprint, one can see how a specific pair has been doing.

Basket Buying and selling

If you happen to prefer to basket commerce, then you possibly can set a number of scanners in separate baskets and see how the general foreign money is doing:

JPY is rising and AUD is falling.

It’s also possible to set which pairs must be reversed. To permit basket settings to work. E.g. If it is a USD basket, then you will have EURUSD indicators to be reversed. So it aligns with USD basket indicators. All reversed pairs can have an exclaimation like: “!EURUSD”. Non-reversed pairs will simply be like “EURUSD”.

You may specify your personal customized pairs listing. Make it possible for pair title is strictly like in market watch. And pair is accessible in Market watch. If Customized pair listing is clean, it can use all pairs accessible in Market watch.

So, suppose in the event you see that AUD is in an general downtrend, then it will not be a good suggestion to commerce any BUY indicators at this level.

E.g:

If Customized Listing is: EURUSD,GBPUSD,USDJPY,AUDUSD,USDCAD,USDCHF

And Reverse Pair Listing is: 1,1,0,1,0,0

0 is regular values. And 1 means reverse values.

So it can reverse: EURUSD and GBPUSD and AUDUSD:

This exhibits that USD is generally falling.

If you happen to use a foreign money power meter like a Pair Energy Analyzer, then you possibly can cross test:

So, with basket buying and selling, indicators turn into extra legitimate. And can give higher outcomes.

At this stage, wanting on the GBPUSD Purchase Sign was excellent. It was a excessive quantity candle reversal, and basket development signalledthat USD was falling:

——>

——>

Utilizing Pending Orders:

There are 2 methods to commerce indicators:

Traits or Reversals

Traits:

Suppose you wish to simply do fast scalping alongside the route of general development, then simply await worth to breakout NRTR SR areas with a robust quantity bar:

Instance AUDUSD M15:

Total AUD foreign money is bearish. And had been gradual and ranging. However worth picks up and has a excessive quantity breakout downwards.

Since breakout bar was too sturdy, worth will often self appropriate by retracing a bit. So, it is at all times a good suggestion to position a pending SELL order a bit inside that breakout bar. And have a look at the previous bars to discover a good take revenue.

In case you are scalping, regulate the value and see when it begins slowing and ranging. At all times place a really shut cease loss when scalping.

Reversals:

When worth enters the NRTR Shadow, however would not breakout.. as a substitute it varieties a spread, then that is a superb place to attend. Particularly if NRTR has stayed regular.

In case you are buying and selling conservatively, then search for a excessive quantity bar reversing out of the shadow:

Maintain a pending SELL restrict order with entry on the shadow line. And cease loss a bit above the NRTR pink line. And take revenue ought to be at the very least 2-3 occasions that. Someplace above the pink ground line.

Take a look at the previous bars, to see how the pair has been doing. If it often reaches the ground or ceiling strains or not. And place take revenue accordingly.

Additionally use one thing for volatility like BBSqueeze, and commerce solely when good volatility. Very gradual ranging market won’t give good reversals.

Settings:

Candles Settings and Pairs/Timeframes:

If you wish to create a basket Listing of a number of completely different scanner home windows on chart, then use a singular prefix.

Instance: “ABC” is prefix of window1 and “ABCD” is prefix of Window2. These usually are not distinctive as a result of the letters “ABC” are repeated. So when Window1 is deleted, the objects on Window2 may also get deleted.

So watch out to not repeat prefixes. And whenever you place a window on chart, transfer it earlier than inserting the following window. If home windows overlap, then whenever you transfer the highest window, the underside one may also transfer with it.

NRTR Particular:

Retaining a bigger ATR Interval or multiplier will give longer tendencies. So use that for long run buying and selling.

And retaining kATR (ATR Multiplier) to decrease like 2 or 3 will probably be higher if fast scalping.

Shadow ATR Interval and Multiplier will preserve the shadow at a distance. To test if worth certainly has entered a shadow, use the Value Kind In Shadow.

NRTR States:

- Swap: Value has damaged by the NRTR SR line and development has switched. Blue line to Crimson line swap signifies bearish transfer and Crimson to Blue swap signifies Bullish transfer.

- In Shadow Begin: Value has entered the NRTR Shadow and is in a spread now

- Shadow Bounce: Value has exited the NRTR shadow inwards. That means worth has revered the SR areas and has bounced off the shadow line.

Value Kind In Shadow: For locating out if worth is inside Shadow or not, it can use this setting. It may be Open, or Shut or Excessive/Low. Beneficial is Value Near guarantee that worth certainly has entered the shadow correctly.

Present Quantity:

It’s going to present (V) image if the NRTR breakout bar or the Shadow bounce bar is a excessive quantity bar. It makes use of VolumeCandles.ex4 to search for excessive/medium quantity bars.

Filters:

Notice that filters are for Alerts solely, Highlights will nonetheless be seen.

Regular Bars Extra Than Num:

It will solely present an Alert if NRTR line has stayed regular for a minimal variety of bars

Vary Inside Shadow greater than Bars:

As soon as worth enters the Shadow, it can vary for someday after which bounce. This setting will test that vary has been for at the very least a minimal variety of bars.

That is essential as a result of it offers higher reversal indicators. If worth has been ranging, means it has been attempting to interrupt the NRTR SR line, however in the end it hasn’t damaged by. Making it a robust reversal space.

Tolerance in Shadow Bars:

Generally worth comes out of shadow for 1-2 very small bars, however goes again in to proceed the vary. So, you possibly can outline a tolerance which is able to ignore a bounce sign if worth goes proper again into shadow inside this tolerance.

Alerts and Highlights:

Scanner highlights and alerts will be programmed primarily based in your technique:

Default background spotlight colours are a bit darker so they do not distract you from the essential indicators.

For instance when buying and selling NRTR Shadow bounces, preserve simply the shadow bounce highlights extra seen like this:

Suppose you’re scalping simply the NRTR Breakouts, then you possibly can preserve shadow indicators false and get a extra minimalist scanner like this:

Right here it solely highlights NRTR Swap and what number of bars has NRTR stayed regular for after final swap. You may flip off the regular bars indicators too.

Conclusion:

Greatest timeframes will probably be at the very least M15+. Ideally H1 or H4. As a result of in decrease timeframes there may be a number of noise. And reversals aren’t at all times predictable. Decrease timeframes ought to be for fast scalping solely. And you must preserve an in depth eye on commerce.

However advisable timeframe is H1.

Identified Points:

If a brand new scanner window is created, it can turn into the highest window. Once you transfer a botton window, the chart scrolls when shifting it. This has to do with MT4 chart occasions. It appears just one window will be on the prime.

NRTR could be a bit heavy, particularly when you’ve got too many pairs, timeframes and Max Previous bars. When the scanner refreshes first time, it can take 6-7 seconds relying on what number of pairs/TFs and many others. So chart may freeze throughout a refresh.

So, it is suggested to not use it too closely when you’ve got a number of charts open. It’s going to additionally rely in your system RAM.

Changelog:

v1.0 Base model

v1.1 Added Filters for Alerts