I get emails nearly on daily basis from folks asking me questions on how one can correctly determine and draw help and resistance ranges on their charts. This tells me there’s a number of confusion and doubtless misinformation on the market about help and resistance ranges and the way greatest to attract them.

I get emails nearly on daily basis from folks asking me questions on how one can correctly determine and draw help and resistance ranges on their charts. This tells me there’s a number of confusion and doubtless misinformation on the market about help and resistance ranges and the way greatest to attract them.

So, on this lesson, I wish to offer you guys my skilled perception into how I strategy figuring out and drawing in help and resistance ranges by supplying you with 9 straightforward suggestions to make use of…

1. Take away EVERYTHING however the value motion out of your charts

You don’t need something distracting your eye whenever you’re on the lookout for crucial help and resistance ranges on a chart, you need the clearest and ‘purest’ view of the chart you may get. Because of this, I take off any shifting averages that I’ll use on my charts and I HIGHLY suggest you do too.

As you already know for those who’ve adopted my weblog for some time, something apart from a pair shifting averages shouldn’t be in your charts in any case. When you don’t but know why, then please learn my article on why indicators will destroy your buying and selling account.

Simply bear in mind: A transparent chart with solely value bars (candlesticks) goes to provide the greatest view of the market and the important thing ranges you want to discover and draw on it.

2. Begin on the weekly chart, draw within the long-term ranges

The weekly chart is what I contemplate the very best place to start out in studying to attract in help and resistance ranges, as a result of it supplies you with the clearest view of probably the most vital long-term key ranges you want to have in your charts.

For instance’s sake, I’m going to take you thru how I might draw within the help and resistance ranges on the identical market (GBPJPY), ranging from the weekly view.

You’ll discover within the instance under, I’ve zoomed out a good way on the weekly chart (about 2 years) and positioned horizontal traces at what are the clearest and most blatant value factors or areas available in the market the place priced modified course…

3. What to do on the every day chart…

After you’ve recognized and drawn in the important thing long-term ranges on the weekly chart time-frame, it’s time to drop right down to what I contemplate crucial time-frame; the every day chart.

At this level, you are actually on the lookout for any apparent / key ranges that weren’t clearly seen on the weekly chart and that you might have over-looked. You might be additionally going to attract in any apparent nearer / near-term ranges. These near-term ranges usually tend to come into play than the additional out key ranges, so they’re necessary to determine and attract.

Let’s have a look at an instance…

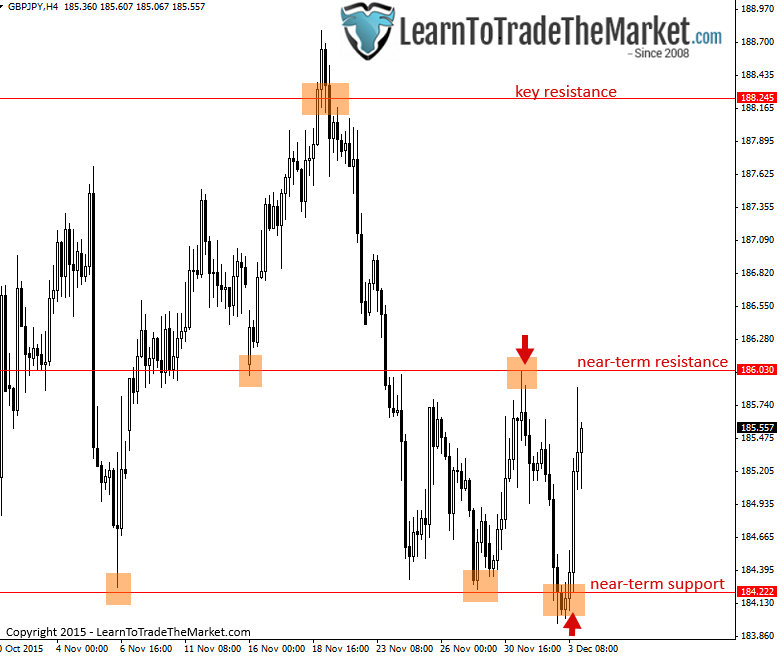

Discover on the every day chart above, I’ve drawn in a brand new stage at 184.22, I contemplate this a near-term stage and spot it was not apparent to me on the weekly, however clearly it’s an necessary stage so I drew it on the every day.

Additionally discover I’ve adjusted the important thing help and resistance ranges that we drew on the weekly up or down barely. I did this as a result of after viewing them on the every day chart it made sense to me, primarily based on the place of the extent relative to the bar highs / lows, to regulate the extent barely. That is completely superb and you can see that as you view weekly ranges on a every day chart you generally will see a purpose to regulate them barely as I did within the above instance. I’m not speaking ‘massive’ changes; for those who discover I adjusted mine by about 20 to 30 pips or so.

4. What to do on the intraday (4 hour and 1 hour charts)

The 4 hour and 1 hour charts are going to be principally for ‘evaluate’ functions. Which means, you’ll evaluate the place the important thing weekly / every day and any every day near-term ranges are at, as a result of these ranges are crucial on the intraday time frames.

More often than not, I’m specializing in every day chart ranges as I have a look at the 4 hour or 1 hour time frames, not often do I discover myself believing I would like to attract in any additional ranges on these intraday charts. However, every so often, there will likely be a stage or two you wish to attract, extra seemingly on the 4 hour than 1 hour.

Let’s have a look at an instance of this under…

Discover on the 4 hour chart above, I did attract a brand new near-term stage at 186.03. This stage appeared necessary to me from the 4 hour view, that’s the reason I drew it in, however on the every day and weekly chart it didn’t look vital or apparent.

For in-depth instruction on how I commerce the 4 hour and 1 hour charts with the every day and weekly time frames, take my superior value motion buying and selling course.

5. The distinction between ‘key ranges’ and ‘near-term ranges’

You’ll discover in factors 3 and 4 above, I labeled a few of the every day chart ranges ‘near-term ranges’. These differ from the ‘key ranges’ primarily as a result of they aren’t apparent on the weekly chart and they’re nearer or ‘nearer’ to the present market value.

A key chart stage will sometimes be apparent on a weekly chart and a big or vital transfer could have occurred from it, both up or down. Key ranges are crucial ranges to look at for alerts at and to look to commerce from, however near-term ranges are necessary as properly.

There are clearly some subtleties concerned with drawing in help and resistance ranges, and this distinction between key and near-term ranges is definitely one in all them. You’ll need to make use of some discretion, and you’ll enhance at figuring out which ranges are ‘key’ and that are ‘near-term’ by means of coaching, time and expertise. One great way to enhance is to see how I draw within the ranges in my members every day commerce setups newsletters every day.

6. How far again ought to I search for ranges?

One query I usually get from merchants on the e mail help line, is “how far again ought to I draw my ranges?”

It’s a sound query, and one that’s simply answered by merely trying on the instance charts above. Discover on the weekly chart I went again about two to a few years, and on the every day about six months to at least one yr, the 4 hour and 1 hour will sometimes be about 3 months of knowledge or much less. Have in mind, these are solely estimates, however typically talking, you don’t must get again extraordinarily far in time.

I consider that typically talking, the additional again in time you go the much less related the degrees develop into, so I put extra give attention to ranges over the past 3 to six months than over the past 1 to 2 years for instance.

7. Don’t cloud up your charts with ranges

I generally see merchants with charts so stuffed with traces that it seems like a 3 yr outdated scribbled throughout it. You don’t want to attract in each single little stage you see in your charts, you solely must give attention to the important thing ranges and the obvious near-term ranges, as I confirmed you within the examples above.

Usually talking, much less is extra in buying and selling and that applies to ranges as properly. When you attract too many help and resistance ranges, you’ll start over-analysing the market, complicated your self and getting ‘evaluation paralysis’. Studying to attract solely crucial chart ranges, each key and near-term ranges, isn’t too tough and is one thing you’ll enhance at by means of training / coaching, time and expertise.

8. You gained’t at all times be capable to draw the traces precisely at highs or lows

Do not forget that you don’t at all times want to attract the road completely touching the highs or lows of every bar, nor will you be capable to in lots of instances. Your traces can and infrequently ought to intersect the physique or center of the tails of a few of the value bars they join

On the finish of the day, you want to use your discretion to find out the place probably the most logical place to attract the extent is. It’d imply you hit a pair bar highs precisely and a pair are intersected by means of the candle’s physique; that is OK.

Let’s have a look at an instance….

9. Assist and resistance ranges vs. zones

One other key level to recollect about help and resistance, is that they usually are usually not ‘actual’ ranges. Typically, it would be best to draw in additional of a ‘zone’ of help or resistance, you’ll be able to consider these as ‘worth’ areas on a chart; the place value most well-liked to commerce lately and consolidated or stayed at for a while.

This will likely be simpler so that you can be taught by taking a look at an instance of it, try this text for some instance of help and resistance zones.

One of the simplest ways so that you can be taught and to enhance your talents to determine and draw help and resistance, is to take my buying and selling course and comply with my every day members commerce setups publication and see how I draw the within the ranges there. After you do that, figuring out and drawing within the ranges will develop into second-nature for you.