A easy and up to date information to taxation of gold and silver in India in 2026 protecting bodily, digital, ETF, mutual funds and SGB.

Once we spend money on gold or silver, we normally take a look at costs, returns, and security. However there may be one factor that silently impacts our returns and is commonly ignored — tax. Understanding the Taxation of Gold and Silver in India in 2026 is extraordinarily essential as a result of the principles have modified lately and lots of older articles on-line are outdated.

On this article, I’ll clarify in easy language, as if explaining to a toddler:

- how gold and silver are taxed in 2026,

- what has modified just lately,

- which kind is extra tax-efficient, and

- what errors it is best to keep away from.

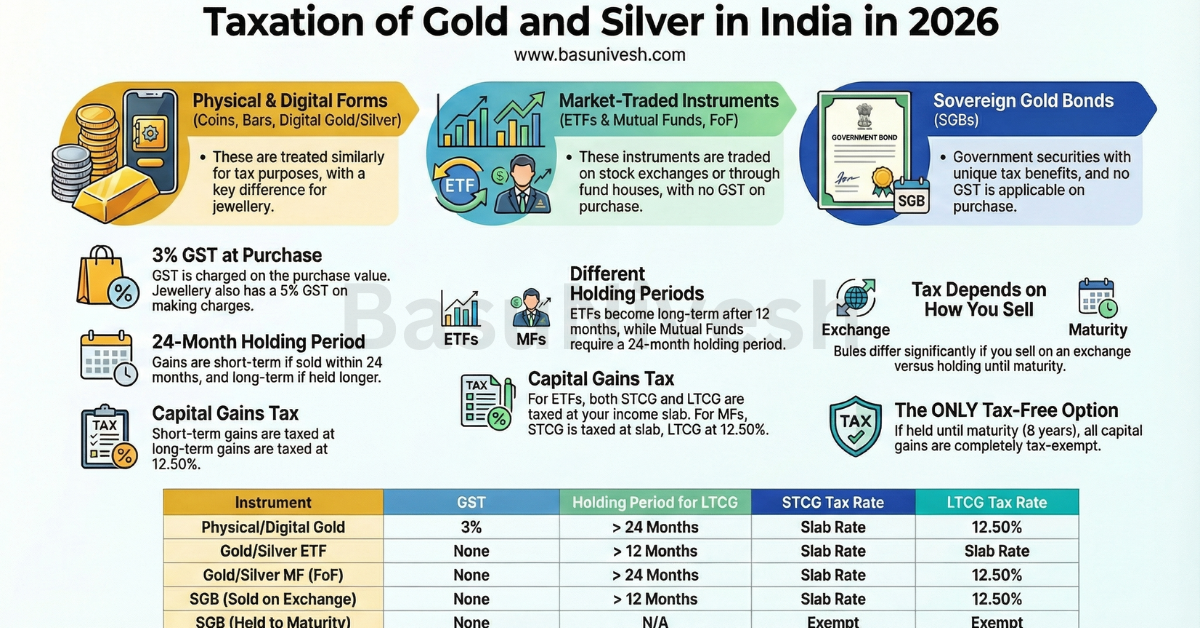

Taxation of Gold and Silver in India in 2026

1. Other ways to spend money on gold and silver

You may spend money on gold and silver in lots of types as we speak.

Gold:

- Bodily gold (cash, bars, jewelry)

- Digital gold

- Gold ETFs

- Gold mutual funds / FoF

- Sovereign Gold Bonds (SGB)

- Gold futures

Silver:

- Bodily silver (cash, bars, jewelry)

- Digital silver

- Silver ETFs

- Silver mutual funds / FoF

- Silver futures

Every of those is taxed in a different way.

2. GST on buy

Everytime you purchase bodily or digital gold and silver, GST applies.

| Kind | GST |

| Bodily gold/silver | 3% |

| Jewelry | 3% on steel + 5% on making |

| Digital gold/silver | 3% |

| ETF / MF / SGB / Futures | Nil |

So bodily and digital types have the next upfront value due to GST.

3. Capital beneficial properties — fundamental concept

Tax is paid if you promote gold or silver and make a revenue.

Three components matter:

- How lengthy you held it

- What sort of instrument it’s

- Listed or unlisted

Holding interval guidelines:

| Instrument | STCG | LTCG |

| Bodily/Digital gold & silver – Unlisted | Lower than or equal to 24 months | Greater than 24 months |

| Gold/Silver ETF – Listed | Lower than or equal to 12 months | Greater than 12 months |

| Gold/Silver MF (FoF) – Unlisted | Lower than or equal to 24 months | Greater than 24 months |

| SGB – Listed | Lower than or equal to 12 months | Greater than 12 months |

You seen that for the listed devices, the holding interval to reach at LTCG or STCG is 12 months. However for unlisted devices, it’s 24 months.

4. Tax charges in 2026

Bodily & Digital Gold and Silver

- STCG – taxed as per your revenue slab.

- LTCG – taxed at 12.5% with out indexation.

Gold & Silver ETFs

- STCG – slab fee.

- LTCG – slab fee (no concessional profit).

Gold & Silver Mutual Funds / FoF

- STCG – slab fee.

- LTCG – 12.5% with out indexation.

Sovereign Gold Bonds (SGB)

- Bought on trade – STCG slab / LTCG 12.5%.

- Redeemed with RBI at maturity – Absolutely tax-free capital acquire.

- Yearly curiosity of two.5% is taxable as per your slab fee

Futures

- Handled as enterprise revenue.

- Taxed at slab charges.

5. Abstract desk

| Instrument | GST | STCG if Bought Inside | LTCG if Bought After | STCG Tax | LTCG Tax | Indexation | Notes |

|---|---|---|---|---|---|---|---|

| Bodily Gold / Silver | 3% | 24 months | Greater than 24 months | Slab | 12.5% | No | Contains cash, bars |

| Jewelry (Gold / Silver) | 3% + 5% on making costs | 24 months | Greater than 24 months | Slab | 12.5% | No | Making costs additional |

| Digital Gold / Silver | 3% | 24 months | Greater than 24 months | Slab | 12.5% | No | Identical as bodily |

| Gold / Silver ETF | No | 12 months | Greater than 12 months | Slab | Slab | No | Listed safety |

| Gold / Silver Mutual Fund (FoF) | No | 24 months | Greater than 24 months | Slab | 12.5% | No | Non-equity MF |

| SGB (bought on trade) | No | 12 months | Greater than 12 months | Slab | 12.5% | No | Market sale |

| SGB (held until maturity) | No | — | — | — | Exempt | — | Solely true tax-free gold |

| Gold / Silver Futures | No | — | — | Slab (enterprise revenue) | — | No | Buying and selling revenue |

6. Easy examples

Instance 1 — Bodily gold

You purchase gold for Rs.5 lakh and promote after 1 yr for Rs.7 lakh.

Revenue = Rs.2 lakh – Tax = taxed as per your tax slab.

Instance 2 — Gold ETF

Identical numbers however by means of ETF. You’ll be taxed at 12.5%

Tax = 30% of Rs.2 lakh = Rs.60,000.

Instance 3 — SGB

Purchase at Rs.5 lakh, redeem at maturity for Rs.8 lakh.

Revenue = Rs.3 lakh – Tax = Rs.0.

Contemplating all these, SGBs are the best choice for Gold. However sadly as no information points can be found, it’s important to discover the prevailing SGBs by means of the secondary market. The subsequent greatest choices are ETFs, Mutual Funds, and Fund Of Funds. Exploring Gold and Silver in bodily kind just isn’t a greater means (when it comes to tax, secure keepin,g and furthermore for those who look into the purity, making costs, and wastage).