In an setting the place buyers more and more search stability, predictability, and tax effectivity, government-backed financial savings devices proceed to play a essential function in long-term monetary planning. Amongst these, the Public Provident Fund (PPF) and the Voluntary Provident Fund (VPF) stay two of essentially the most generally thought of choices, significantly for people prioritising capital safety.

As we transfer into 2026, buyers are reassessing conventional financial savings avenues in gentle of adjusting rate of interest cycles, evolving tax laws, and a renewed deal with retirement preparedness. This reassessment has introduced the comparability of PPF vs VPF into sharper focus. Whereas each devices provide tax benefits and sovereign backing, their construction, accessibility, liquidity, and suitability differ meaningfully.

This text presents an in depth and balanced analysis of PPF vs VPF, serving to buyers perceive not solely how these devices operate, but in addition which one aligns higher with particular monetary objectives, earnings profiles, and time horizons.

Understanding PPF and VPF: Overview

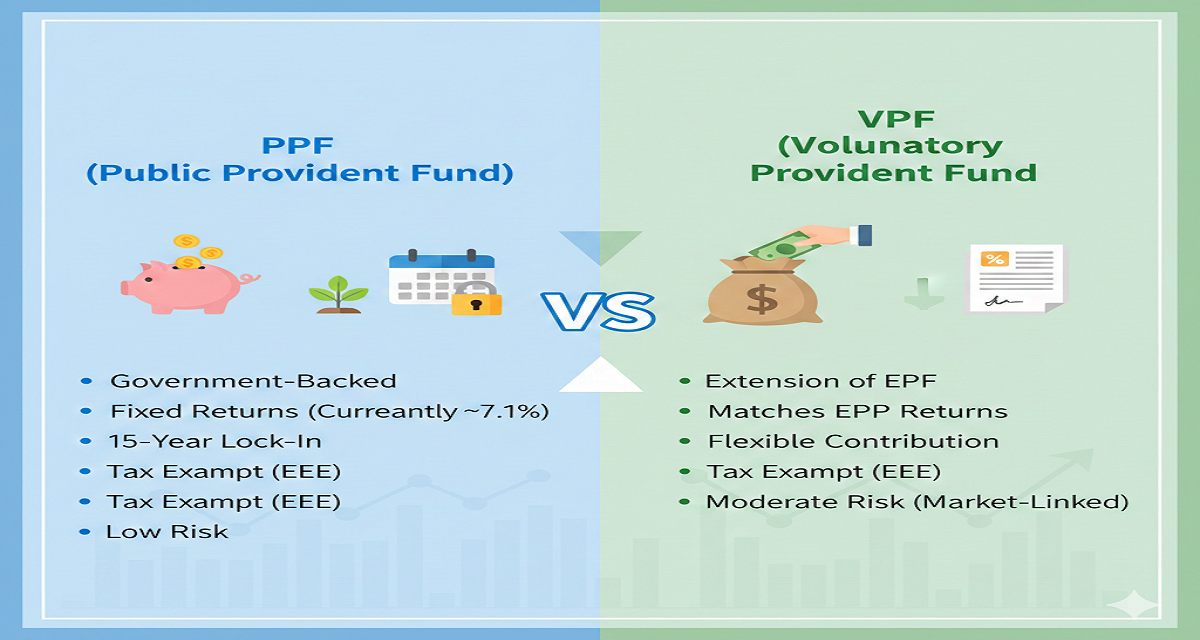

Public Provident Fund (PPF) is a long-term financial savings scheme backed by the Authorities of India and is on the market to all resident people. It’s designed to encourage disciplined, long-term financial savings with tax effectivity and capital security as its core options.

Voluntary Provident Fund (VPF), alternatively, is an extension of the Staff’ Provident Fund (EPF). It permits salaried workers to voluntarily contribute greater than the necessary EPF contribution towards their provident fund account, incomes the identical rate of interest as EPF.

PPF vs VPF: Key Variations at a Look

Whereas each PPF and VPF each serve long-term targets, their design caters to totally different investor classes. The desk under highlights the important thing parameters throughout which the 2 devices differ.

| Parameter | Public Provident Fund (PPF) | Voluntary Provident Fund (VPF) |

| Eligibility | Any resident particular person | Solely salaried workers with EPF |

| Nature of Scheme | Authorities-backed financial savings scheme | Extension of EPF |

| Contribution Restrict | Minimal ₹500, most ₹1.5 lakh per yr | No statutory cap (topic to employer coverage) |

| Contribution Flexibility | Lump sum or instalments | Wage-linked, month-to-month deductions |

| Lock-in Interval | 15 years (extendable in 5-year blocks after maturity) | Until retirement or exit from employment |

| Curiosity Fee | Declared quarterly by the federal government | Identical as EPF, notified yearly |

| Danger Profile | Just about risk-free | Just about risk-free |

| Liquidity | Partial withdrawals permitted from the seventh monetary yr onwards, topic to prescribed limits | Restricted liquidity earlier than retirement. Partial withdrawals are permitted just for particular functions similar to dwelling buy, medical remedy, and many others. |

| Tax Deduction on Contribution | Obtainable underneath Part 80C (solely underneath previous tax regime) | Obtainable underneath Part 80C (solely underneath previous tax regime) |

| Tax Remedy | EEE, the curiosity earned and maturity proceeds are tax-free. | Typically EEE, however curiosity on worker contributions above INR 2.5 lakh in a yr is taxable. |

| Very best For | Self-employed, non-salaried, conservative buyers | Salaried workers with surplus earnings |

This comparability highlights that whereas each devices are structurally comparable in security, their usability and suppleness range considerably within the PPF vs VPF determination.

Returns Comparability: PPF vs VPF in 2026

Returns stay a central consideration when evaluating PPF vs VPF, significantly for buyers centered on long-term compounding.

PPF rates of interest are decided by the federal government and reviewed quarterly. Whereas the speed could change over time, it usually displays broader rate of interest traits and prioritises stability over aggressive development. PPF returns have a tendency to stay average however predictable, making them appropriate for conservative, long-term planning.

VPF, against this, earns the identical rate of interest as EPF, which is said yearly by the Staff’ Provident Fund Organisation (EPFO). Traditionally, EPF charges have typically been greater than PPF charges, particularly during times of beneficial financial circumstances. Because of this, VPF can doubtlessly ship superior long-term returns, significantly for buyers who stay employed for prolonged intervals and preserve constant contributions.

As of January 2026, PPF is providing an rate of interest of seven.1% each year (relevant for the January-March 2026 quarter), whereas VPF/EPF affords 8.25% each year for FY 2025-26. This represents a distinction of 1.15 share factors in favor of VPF, which may translate to significant features over prolonged funding horizons.

Nevertheless, greater returns in VPF include a trade-off in liquidity and suppleness. In contrast to PPF, VPF contributions are intently tied to employment continuity, making them much less adaptable for buyers who anticipate profession modifications or require interim entry to funds.

In the end, even from a return perspective, PPF vs VPF just isn’t a query of which instrument performs higher universally, however quite which aligns extra successfully with the investor’s employment stability and liquidity preferences.

Tax Remedy and Advantages

Each PPF and VPF fall underneath the Exempt–Exempt–Exempt (EEE) class, which considerably enhances their attractiveness for long-term buyers.

- Funding Stage: Contributions to each PPF and VPF qualify for deduction underneath Part 80C underneath the previous tax regime, topic to the general restrict.

- Accumulation Stage: Curiosity earned is tax-free, throughout the relevant regulatory framework.

- Maturity Stage: Withdrawals upon maturity are exempt from tax, offered prescribed circumstances are met.

Regardless of comparable tax remedy, sensible variations come up attributable to contribution constructions. PPF permits higher management over annual investments, whereas VPF contributions improve taxable wage deductions upfront however speed up retirement corpus accumulation.

Traders typically search steerage from an funding marketing consultant or interact skilled funding advisory companies to strike an applicable steadiness between tax effectivity and money circulate wants.

PPF vs VPF: Which Is the Higher Funding For You in 2026?

When buyers evaluate PPF vs VPF, the query is normally easy: Which possibility fits my state of affairs higher proper now and over the long run? However the reply isn’t one-size-fits-all. Each PPF and VPF are dependable, low-risk devices, however they serve totally different functions relying on the way you earn, save, and plan for the longer term.

PPF is usually higher suited to:

- Self-employed professionals and enterprise house owners

- People with out entry to EPF

- Traders looking for flexibility in annual contributions

- These prioritising liquidity over marginally greater returns

VPF is extra appropriate for:

- Salaried workers with secure employment

- People in greater tax brackets looking for long-term tax effectivity

- Traders with surplus month-to-month earnings

- These prioritising doubtlessly greater returns over liquidity

In apply, many buyers profit from combining each devices as a part of a diversified long-term technique.

Can You Put money into Each PPF and VPF?

Sure, buyers can legally and strategically spend money on each PPF and VPF concurrently. This strategy permits people to diversify their fixed-income allocation whereas maximising tax effectivity.

Utilizing each devices permits:

- Higher money circulate administration by means of staggered contributions

- Diversification throughout totally different lock-in constructions

- Enhanced retirement corpus with out extreme publicity to market-linked volatility

Such methods are generally really helpful by skilled funding advisory companies, significantly for mid- to high-income earners looking for stability alongside long-term development.

Widespread Errors Traders Make When Selecting Between PPF and VPF

Regardless of their simplicity, buyers typically make avoidable errors when evaluating PPF vs VPF:

- Overlooking liquidity wants and emergency necessities

- Overcommitting to VPF with out assessing employment stability

- Assuming greater rates of interest mechanically suggest higher outcomes

- Ignoring long-term inflation-adjusted returns

- Treating tax advantages as the only determination criterion

Avoiding these pitfalls requires disciplined planning and, in lots of instances, steerage from an skilled funding planner who understands each regulatory nuances and private monetary constraints.

Conclusion

The talk surrounding PPF vs VPF in 2026 underscores a broader fact about investing: suitability issues greater than superiority. Each devices provide sturdy foundations for long-term financial savings, capital safety, and tax effectivity, however serve totally different investor profiles.

A well-informed determination considers earnings construction, profession stability, retirement horizon, and liquidity wants. Traders looking for readability and customisation typically profit from participating a professional funding marketing consultant or structured funding advisory companies to combine these devices right into a cohesive monetary plan.

When chosen thoughtfully, each PPF and VPF can contribute meaningfully to long-term monetary stability and retirement preparedness.

Incessantly Requested Questions (FAQs)

Q: Is VPF risk-free?

A: Sure, VPF carries minimal threat as it’s backed by the identical framework as EPF.

Q: Can rates of interest change after investing?

A: Sure, each PPF and VPF rates of interest are topic to periodic revisions.

Q: Is PPF higher for non-salaried people?

A: Sure, PPF is particularly designed to accommodate non-salaried buyers.

Q: What occurs to VPF if I alter jobs?

A: VPF balances usually switch together with EPF, topic to compliance.

Q: Which is healthier for long-term wealth creation: PPF vs VPF?

A: The reply is determined by employment stability, earnings stage, and liquidity wants quite than returns alone.

Disclaimer: This text is meant for instructional and informational functions solely and doesn’t represent monetary, funding, or tax recommendation. Data offered is correct as of January 2026 and is topic to vary.