What are the most recent Put up Workplace Small Saving Schemes Rates of interest Oct – Dec 2023? What are the rates of interest of PPF, SSY, SCSS, NSC, and MIS rates of interest for October to December 2023?

As at present, the inflation price remains to be excessive, the federal government retained the identical rates of interest for all of the schemes (aside from the 5-year Put up Workplace Recurring Deposit or RD).

Updates –

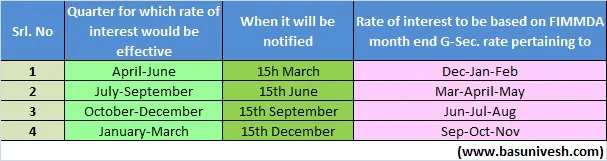

Earlier the rates of interest was introduced yearly as soon as. Nonetheless, from 2016-17, the speed of curiosity might be fastened quarterly. I already wrote an in depth submit on this. I’m offering the hyperlink to that earlier submit beneath.

Under is the timetable for change in rates of interest for all Put up Workplace Financial savings Schemes.

As per the above schedule, the Authorities introduced the rate of interest relevant to all Put up Workplace Financial savings Schemes from 1st October 2023 to thirty first December 2023.

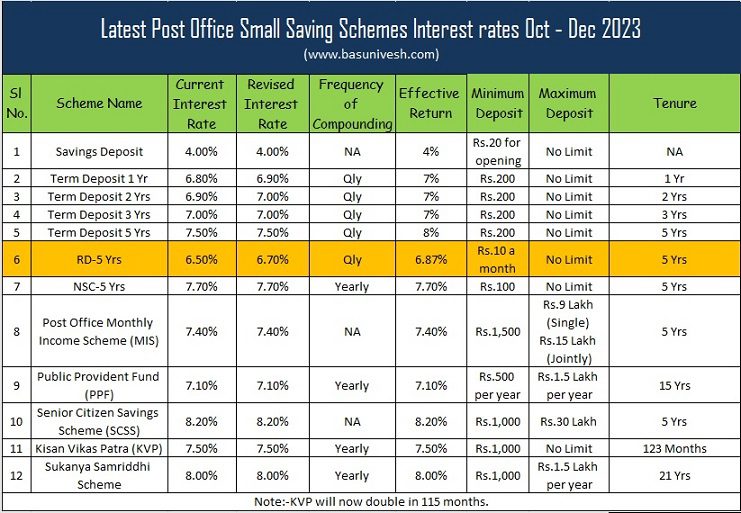

Newest Put up Workplace Small Saving Schemes Rates of interest Oct – Dec 2023

As per the notification from the Division of Financial Affairs, Ministry of Finance, the beneath rates of interest are relevant for the third quarter of this monetary yr (2023-24).

As I’ve talked about above, all different scheme charges had been unchanged besides 5 years of RD. Earlier the 5-year RD used to fetch 6.5% and now it’s elevated to six.7%. Therefore, the efficient price of return for RD is 6.87%. I’ve highlighted the identical with yellow color within the above desk.

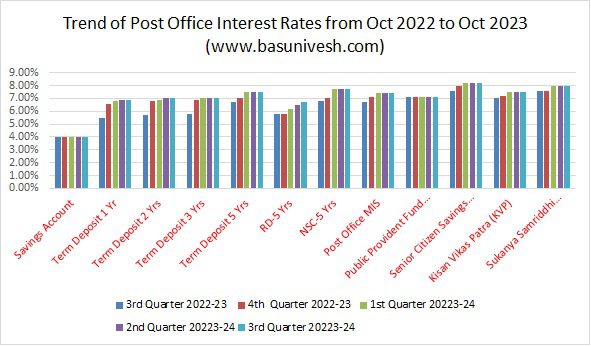

The development of Put up Workplace Curiosity Charges from July 2022 to July 2023

Now allow us to have a look at the development of Put up Workplace Small Financial savings Rates of interest of final yr. They’re as beneath.

You seen that for a lot of schemes the speed which we’re getting now could be highest since 2-3 quarters. It’s primarily due to excessive inflation and a high-interest price regime.

Options of Put up Workplace Financial savings Schemes

Now allow us to look the Put up Workplace Small Financial savings Schemes options. This will provide you with extra readability on selecting the best product for you.

# Put up Workplace Financial savings Account

Like Financial institution Account, Put up Workplace additionally gives you the financial savings account to its prospects. The few options are as beneath.

- Minimal Rs.500 is required to open the account.

- Account may be opened single, collectively, Minor (above 10 years of age), or a guardian on behalf of a minor.

- Minimal stability to be maintained in an account is INR 500/- , if stability Rs. 500 not maintained, a upkeep payment of 100 (100) rupees shall be deducted from the account on the final working day of every monetary yr and after deduction of the account upkeep payment, if the stability within the account turns into nil, the account shall stand robotically closed.

- Cheque facility/ATM facility can be found

- Curiosity earned is Tax-Free as much as INR 10,000/- per yr from the monetary yr 2012-13

- Account may be transferred from one submit workplace to a different

- One account may be opened in a single submit workplace.

- At the least one transaction of deposit or withdrawal in three monetary years is critical to maintain the account energetic, else account turned silent (Dorment).

- Intra Operable Netbanking/Cellular Banking facility is accessible.

- On-line Fund switch between Put up Workplace Financial savings Accounts/Cease Cheque/Transaction View facility is accessible by means of Intra Operable Netbanking/Cellular Banking.

- The power to hyperlink with IPPB Saving Account is accessible.

- Funds Switch (Sweep in/Sweep out) facility is accessible with IPPB Saving Account.

# Put up Workplace Fastened Deposits (FDs)

- Minimal of Rs.1,000 and in multiples of Rs.100. There is no such thing as a most restrict.

- FD tenure at present out there is 1 yr, 2 Yrs, 3 Yrs and 5 Yrs.

- Account may be opened single, collectively, Minor (above 10 years of age) or a guardian on behalf of minor.

- Account may be opened by money /Cheque and in case of Cheque the date of realization of cheque in Govt. account shall be date of opening of account.

- Account may be transferred from one submit workplace to a different

- Single account may be transformed into Joint and Vice Versa .

- Any variety of accounts may be opened in any submit workplace.

- Curiosity shall be payable yearly, No extra curiosity shall be payable on the quantity of curiosity that has develop into due for cost however not withdrawn by the account holder.

- The annual curiosity could also be credited to the financial savings account of the account holder at his possibility.

- Untimely encashment not allowed earlier than expiry of 6 month, If closed between 6 month to 12 month from date of Opening, Put up Workplace Saving Accounts rate of interest might be payable.

- 5 Yrs FD is eligible for tax saving functions below Sec.80C.

# Put up Workplace Recurring Deposit (RD)

- Minimal is Rs.100 a month and in a number of of Rs.10. There is no such thing as a most restrict.

- Account may be opened single, collectively, Minor (above 10 years of age) or a guardian on behalf of minor.

- Tenure of RD is 5 years.

- Account may be opened by money / Cheque and in case of Cheque the date of deposit shall be date of clearance of Cheque.

- Untimely closure is allowed after three years from the date of opening of the account.

- Account may be transferred from one Put up Workplace to a different Put up Workplace.

- Subsequent deposit may be made as much as fifteenth day of subsequent month if account is opened as much as fifteenth of a calendar month and as much as final working day of subsequent month if account is opened between sixteenth day and final working day of a calendar month.

- If a subsequent deposit is just not made as much as the prescribed day, a default payment is charged for every default, default payment @ 1 Rs for each 100 rupee shall be charged. After 4 common defaults, the account turns into discontinued and may be revived in two months but when the identical is just not revived inside this era, no additional deposit may be made.

- If in any RD account, there’s a month-to-month default quantity, the depositor has to first pay the defaulted month-to-month deposit with default payment after which pay the present month deposit.

- There may be rebate on advance deposit of a minimum of 6 installments, Rs. 10 for six month and Rs. 40 for 12 months Rebate might be paid for the denomination of Rs. 100.

- One mortgage as much as 50% of the stability allowed after one yr. It might be repaid in a single lumpsum together with curiosity on the prescribed price at any time throughout the foreign money of the account.

- Account may be prolonged for one more 5 years after it’s maturity.

# Put up Workplace Month-to-month Revenue Scheme (MIS)

- Most funding is Rs.9 lakh in a single account and Rs.15 lakh collectively (It’s revised throughout the Funds 2023). Earlier it was Rs.4.5 lakh for a single account and Rs.9 lakh for joint accounts.

- Account may be opened single, collectively, Minor (above 10 years of age) or a guardian on behalf of minor.

- Any variety of accounts may be opened in any submit workplace topic to most funding restrict by including stability in all accounts (Rs. 4.5 Lakh).

- Single account may be transformed into Joint and Vice Versa.

- Maturity interval is 5 years.

- Curiosity may be drawn by means of auto credit score into financial savings account standing at similar submit workplace,orECS./In case of MIS accounts standing at CBS Put up workplaces, month-to-month curiosity may be credited into financial savings account standing at any CBS Put up workplaces.

- May be prematurely en-cashed after one yr however earlier than 3 years on the low cost of two% of the deposit and after 3 years on the low cost of 1% of the deposit. (Low cost means deduction from the deposit.).

- Curiosity shall be payable to the account holder on completion of a month from the date of deposit.

- If the curiosity payable each month is just not claimed by the account holder such curiosity shall not earn any extra curiosity.

# Put up Workplace Senior Citizen Financial savings Scheme (SCSS)

I’ve written an in depth submit on this. Confer with the identical at ” Put up Workplace Senior Citizen Scheme (SCSS)-Advantages and Curiosity Price“.

Notice – Efficient from 1st April 2023, the utmost restrict is at present Rs.30 lakh. Earlier it was Rs.15 lakh. This variation occurred throughout Funds 2023.

# Public Provident Fund (PPF)

I’ve written numerous posts on PPF. Refer the identical:-

# Nationwide Financial savings Certificates NSC (VIII Subject)

- Minimal Rs.1,000 and in a number of of Rs.100.

- No most restrict.

- Account may be opened single, collectively, Minor (above 10 years of age) or a guardian on behalf of minor.

- Tax Profit below Sec.80C is accessible.

- Tenure is 5 years.

# Kisan Vikas Patra (KVP) Account

- Minimal Rs.1,000 and in multiples of Rs.100. There is no such thing as a most restrict.

- Account may be opened single, collectively, Minor (above 10 years of age) or a guardian on behalf of minor.

- The cash might be double at maturity. Nonetheless, because the rate of interest modifications on a quarterly foundation. The maturity interval additionally varies as soon as in 1 / 4.

# Sukanya Samriddhi Account Yojana (SSY)

I’ve written numerous posts on this. Refer the identical:-

Conclusion:- As once more the inflation slowly inching up on account of crude worth enhance, draught in lots of components of the international locations, and better inflation, this time authorities retained the identical curiosity for almost all of the schemes.