Perceive the brand new NPS exit and withdrawal guidelines 2025, increased lump sum limits, decrease annuity guidelines, and what these modifications imply on your retirement planning.

Just lately, PFRDA launched new NPS (Nationwide Pension System) Exit and Withdrawal guidelines. These modifications in some ways, are sport changers. Allow us to talk about these modifications intimately on this submit.

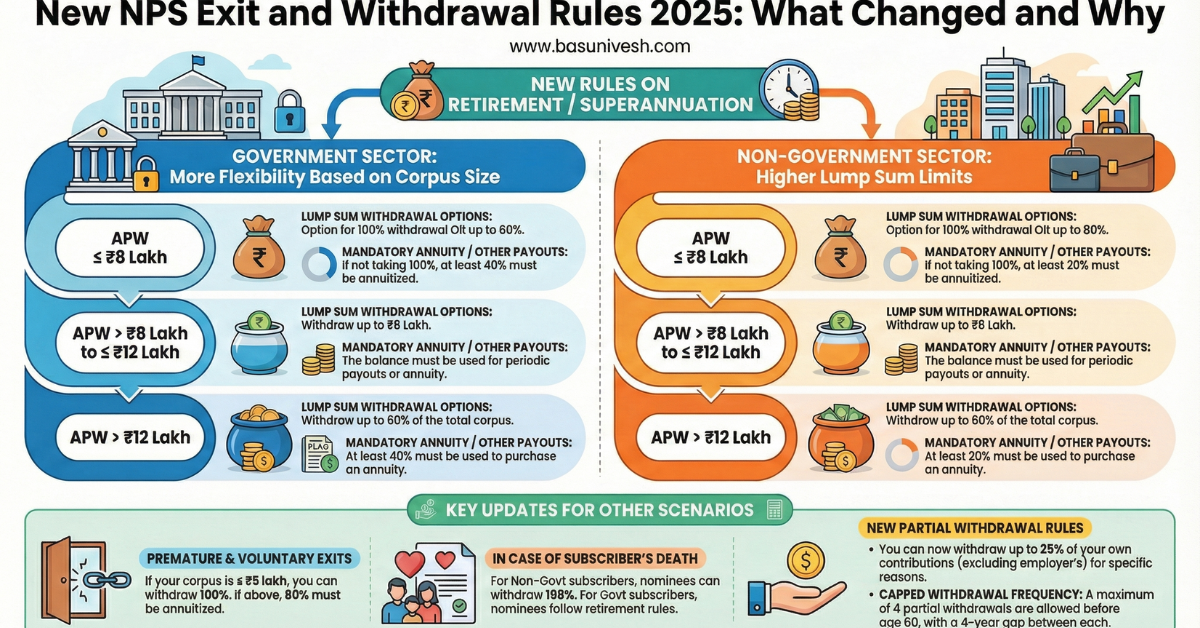

New NPS Exit and Withdrawal Guidelines 2025: What Modified and Why

The PFRDA (Exits and Withdrawals underneath the Nationwide Pension System) (Modification) Laws, 2025, characterize a major shift in how pension wealth is managed and accessed in India. By changing the 2015 framework, these amendments modernise terminology, lengthen the participation interval, and introduce extra versatile payout choices similar to systematic withdrawals.

1. Revised Terminology and Core Definitions

The 2025 Laws introduce a number of terminological modifications to offer higher readability. The time period “pension investments collected within the Everlasting Retirement Account” has been changed by “investments which have collected in every particular person pension account“. This shift acknowledges {that a} subscriber would possibly maintain a number of accounts, and the laws now explicitly state that the exit and closure of every particular person pension account have to be dealt with individually. Allow us to take an instance to grasp this in higher manner.

Think about a subscriber named Rahul who has been a part of the Nationwide Pension System (NPS) for a number of years. Over his profession, he has ended up with two distinct accounts:

1. Account A (Authorities Sector): From his earlier years working in a authorities division.

2. Account B (All Citizen Mannequin): A voluntary account he opened later to avoid wasting additional for his retirement.

How the New Laws Apply

Underneath the 2015 guidelines, these had been usually considered underneath the umbrella of 1 “Everlasting Retirement Account.” Nonetheless, the 2025 Laws now explicitly state that these have to be handled as particular person pension accounts.

• Separate Exits: If Rahul decides to retire from his present position, he doesn’t have to shut each accounts without delay. The laws specify that the exit and closure of every account shall be separate.

• Completely different Guidelines for Every: As a result of they’re separate, the foundations for withdrawal would possibly differ. For his Authorities account (Account A), he could also be required to make use of 40% of the wealth for an annuity. For his voluntary account (Account B), the obligatory annuity requirement would possibly solely be 20%.

• Unbiased Selections: Rahul may select to exit and shut Account B to fund a selected want whereas selecting to stay within the system with Account A till he reaches the age of 85.

This implies a personal sector staff NPS administration will flip simple than earlier.

Abstract of the Change

Earlier than this modification, the system primarily checked out your whole “pot” of pension cash. Now, the system seems to be at your particular jars of cash. You probably have two jars, you’ll be able to open one, shut one, or change how you utilize one with out it mechanically affecting the opposite. Every account’s wealth and withdrawal choices are decided independently in line with the class (Authorities, Non-Authorities, or NPS-Lite) it belongs to.

The brand new one other definition is “Defer” or “Deferment,” which refers back to the postponement of a lump sum withdrawal or the acquisition of an annuity by a subscriber. Moreover, the phrase “corpus” has been universally changed with “wealth“. To align with fashionable Indian authorized requirements, all references to the Indian Proof Act, 1872, have been up to date to the Bharatiya Sakshya Adhiniyam, 2023.

That is fantastic transfer and extra flexibility to deal with every corpus independently quite than linking to a single individual.

2. Subscriber Categorisation

For the needs of exit and withdrawal, the laws formally categorise subscribers into three distinct teams:

- Authorities Sector: Workers of central or state governments.

- Non-Authorities Sector: Consists of the All Citizen Mannequin (voluntary subscribers) and the Company Sector.

- NPS-Lite and Swavalamban: Aimed toward economically deprived or particular teams.

3. Prolonged Participation and Deferment

Subscribers in each the Authorities and Non-Authorities sectors at the moment are permitted to stay throughout the Nationwide Pension System (NPS) till the age of eighty-five years. This permits for continued funding development even after conventional retirement. Subscribers can defer the acquisition of an annuity or a lump sum withdrawal till this age by submitting a request to the NPS Belief. If a subscriber dies throughout this deferment interval:

- Within the Authorities sector, a default annuity have to be bought by members of the family in a selected sequence.

- Within the Non-Authorities sector, the collected wealth is paid to nominees or authorized heirs.

In lots of instances, this extension or deferment is ineffective. I’m uncertain what number of retirees want to increase as much as 85 years of age.

4. Sector-Particular Exit Frameworks

Authorities Sector (Regulation 3)

Upon superannuation or retirement, a minimum of 40% of the collected wealth have to be used for an annuity. The remaining steadiness may be taken as a lump sum or by periodic payouts similar to Systematic Lump Sum Withdrawal (SLW) or Systematic Unit Redemption (SUR).

New wealth thresholds have been launched:

- Wealth lower than or equal toRs.8 lakh: The subscriber could withdraw the complete quantity as a lump sum or periodic payouts.

- Wealth higher than Rs.8 lakh however lower than or equal toRs.12 lakh: The subscriber can withdraw as much as Rs.6 lakh as a lump sum, whereas the steadiness have to be used for an annuity or SUR for a minimum of six years.

- Resignation/Removing: If a subscriber resigns or is dismissed, 80% should go towards an annuity until whole wealth is lower than or equal toRs.5 lakh, wherein case 100% may be withdrawn.

Non-Authorities Sector (Regulation 4)

Customary exit happens after 15 years of subscription or at age 60. At this stage, a minimum of 20% have to be utilised for an annuity, with the steadiness obtainable as a lump sum or periodic payouts.

Wealth thresholds for this sector embody:

- Wealth lower than or equal toRs.8 lakh: Choice for 100% lump sum withdrawal.

- Wealth higher than Rs.8 lakh however lower than or equal toRs.12 lakh: As much as Rs.6 lakh as a lump sum, with the steadiness utilised for an annuity or SUR for a minimum of six years.

- Late Entrants (becoming a member of at age 60+): If wealth is lower than or equal toRs.12 lakh, the complete quantity may be withdrawn as a lump sum.

- Bodily Incapacity: If a subscriber is over 75% disabled (as licensed by a authorities surgeon), the exit is handled underneath customary retirement phrases quite than untimely exit phrases.

Essential factors to notice listed below are that to avail 80% withdrawal, your NPS account have to be a minimum of 15 years previous OR reached 60 years of age, and the corpus have to be greater than 12 lakh!! Not directly assume that you’re retiring at 50 years, then you should have began your NPS account at an age properly earlier than 35 years. In any other case, you aren’t eligible to avail this facility.

Furthermore, as per the present tax guidelines, solely 60% is tax-free, however not the entire 80%. If sooner or later the Authorities modifications and will increase the tax-free withdrawal to 80%, then it might appear like a greater choice. However as of now, we’ve got to imagine that solely 60% is tax-free however not the entire 80%.

Nonetheless, one benefit with out taking a look at taxation or 15-year locking means the entire 80% corpus is free on your utilization, and solely 20% is locked for purchasing an annuity.

This can be helpful for these personal sector staff who’ve began their NPS account at their early age and are planning to retire earlier than 60 years of age.

As I at all times level out, ILLIQUID merchandise are a boon for the fickle minds. If you’re following the systematic retirement method, then I strongly counsel that you simply steer clear of such lock-in merchandise.

NPS-Lite and Swavalamban (Regulation 5)

The first change for this sector is the rise of the lump sum withdrawal threshold. For each customary exits (age 60) and untimely exits, if the wealth is equal to or lower than Rs.2 lakh (elevated from Rs.1 lakh), the subscriber can withdraw 100% as a lump sum.

5. Particular Exit Eventualities

- Renunciation of Citizenship (5A): If a person ceases to be an Indian citizen, they’ve the choice to shut their account and withdraw the complete wealth as a lump sum.

- Lacking Individuals (5B): For a subscriber reported lacking, nominees can obtain 20% of the wealth as an interim reduction after submitting an FIR and offering an indemnity bond. The remaining 80% is paid out solely after a reliable court docket declares the subscriber presumed useless underneath the Bharatiya Sakshya Adhiniyam, 2023. If the subscriber is discovered alive earlier than this declaration, the account continues, and the 20% interim reduction is adjusted towards future withdrawals.

6. Partial Withdrawals and Monetary Leveraging

The 2025 Laws introduce extra flexibility for accessing funds earlier than full exit.

Allowed Functions for Partial Withdrawal:

- Medical Therapy: Hospitalisation or remedy for self, partner, youngsters (together with legally adopted), or dad and mom.

- Housing: A one-time withdrawal for buying or setting up a residential home or flat (individually or collectively with a partner).

- Monetary Help: Subscribers can now use their NPS account as collateral. They might assign, pledge, or mark a lien on their account to hunt monetary help from regulated establishments. A partial withdrawal is permitted to settle such monetary obligations.

Frequency and Limits:

- Earlier than Age 60/Retirement: A most of 4 withdrawals are allowed, with a minimal interval of 4 years between them.

- After Age 60/Retirement: If a subscriber stays within the system, they’ll make partial withdrawals with a minimal interval of three years, capped at 25% of their contributions.

Abstract of Payout Choices (Lump Sum vs. Annuity)

| State of affairs | Wealth Threshold | Lump Sum/Periodic Restrict | Annuity Requirement |

| Govt. Retirement | lower than or equal to Rs.8 Lakh | 100% | 0% |

| Govt. Retirement | higher than Rs.12 Lakh | 60% | 40% |

| Non-Govt. (Age 60) | lower than or equal to Rs.8 Lakh | 100% | 0% |

| Non-Govt. (Age 60) | higher than Rs.12 Lakh | 80% | 20% |

| Untimely Exit (All) | higher than Rs.5 Lakh | 20% | 80% |

| NPS-Lite (Age 60) | lower than or equal to Rs.2 Lakh | 100% | 0% |

Conclusion – In essence, these amendments rework the NPS from a inflexible retirement fund right into a extra dynamic wealth administration instrument, offering subscribers with higher management over their belongings whereas guaranteeing long-term monetary safety by obligatory annuities for bigger balances.

Nonetheless, counting on NPS as in case your sole retirement corpus just isn’t the appropriate manner, particularly contemplating its portfolio litter (which nobody talks about) and lock-in options. Nonetheless, you should utilize NPS as your retirement product if you’re certain of retiring at 60 years of age (which is unlikely for a lot of personal sector staff).