Lively inventory buying and selling requires much more effort and time than a typical buy-and-hold investing strategy. To extend your probabilities of success, it’s important to spend hours monitoring positions and researching potential shopping for alternatives.

That’s the place a superb stock-picking funding publication can turn out to be useful.

I subscribe to a number of of the finest funding newsletters to see what shares and funds are being highlighted to maximise funding returns within the present market. I additionally get plenty of hands-on communications for a aggressive subscription charge.

Motion Alerts PLUS from TheStreet is without doubt one of the extra well-liked funding newsletters. On this Motion Alerts PLUS overview, I’ll let you understand how the publication could make it simpler to identify funding concepts that you should use in your portfolio. I’ll share the important thing options, execs and cons, and a few options that can assist you decide if Motion Alerts PLUS is value signing up for.

Desk of Contents

- What Is Motion Alerts Plus from TheStreet?

- What Occurred to Jim Cramer Motion Alerts Plus?

- Motion Alerts Plus Pricing

- Motion Alerts Plus Portfolio

- Motion Alerts Efficiency

- Buying and selling Alerts

- Motion Alerts Plus Analysis Research

- Professionals and Cons

- Alternate options to Motion Alerts Plus

- Is Motion Alerts PLUS Value It?

- FAQs

What Is Motion Alerts Plus from TheStreet?

Motion Alerts Plus (AAP) is a premium stock-picking publication from TheStreet. It follows a medium to long-term funding technique, so it’s best to count on to carry your positions for a number of months to over a yr.

Veteran inventory analysts Bob Lang and Chris Versace run the publication and suggest a number of mannequin portfolio actions every week, which may embody:

- Open a brand new place

- Shut a place

- Add to an present place

- Trim an present place

Along with receiving funding concepts from a mannequin portfolio, you’ll be able to learn day by day articles concerning the newest market information. There are additionally movies, podcasts, and subscriber-only convention calls with the editors.

What Occurred to Jim Cramer Motion Alerts Plus?

CNBC persona Jim Cramer based the Motion Alerts Plus Investing Membership and TheStreet. The stock-picking service started in 2001, however Cramer stopped contributing in late 2021 when the present editors (Lang and Versace) took over the mannequin portfolio.

Cramer additionally bought his stake in TheStreet in 2019 and is now not affiliated with the platform. Nevertheless, the Motion Alerts Plus funding technique remains to be much like the Cramer days with an lively funding technique of worth and progress shares.

Motion Alerts Plus Pricing

New subscribers can take a look at drive the platform throughout a 14-day free trial earlier than selecting a month-to-month or annual subscription:

- Month-to-month: $29.99 per thirty days

- Annual: $199.99 due upfront ($16.67 per thirty days)

- Two Years: $299.99 due upfront ($12.50 per thirty days)

There isn’t a free model of Motion Alerts Plus, though you’ll be able to learn 5 articles totally free every month with no subscription. Keep in mind that the five-article restrict additionally applies to analysis from TheStreet’s different premium publications.

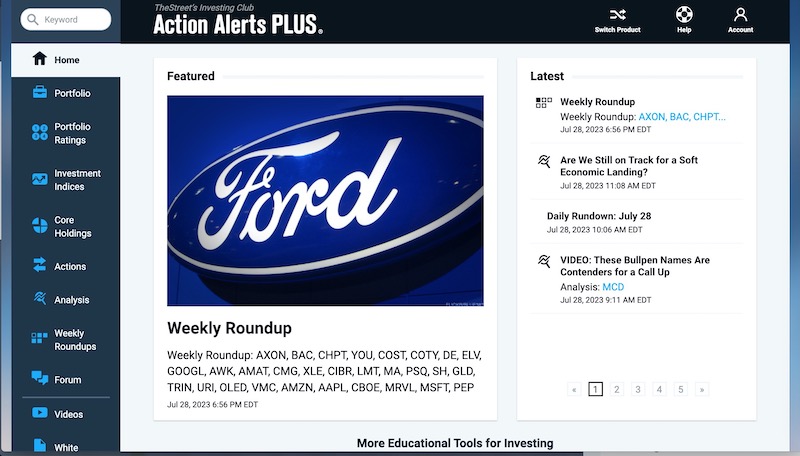

Motion Alerts Plus Portfolio

The mannequin portfolio makes use of an lively technique to purchase shares on weak point (worth investing) or when an organization seems to have loads of upside (progress investing), even when shares are comparatively costly to the market. The portfolio has roughly 30 lively holdings plus a handful of names on the Bullpen watchlist.

Periodically, the service recommends ETFs to maximise the momentum of a selected sector (i.e., power) or market index (i.e., S&P 500 or Nasdaq). There are occasional suggestions for inverse ETFs as properly, which might be simpler than shorting a inventory, which this service doesn’t do.

Open positions embody corporations from many business sectors, reminiscent of:

- Amazon

- Apple

- Axon

- ChargePoint

- Chipotle

- Costco

- Lockheed Martin

- PepsiCo

- SPDR Gold Shares ETF

- United Leases

- Vulcan Supplies

The holding interval varies by place, however most shares are held for one yr or much less. As of July 29, 2023, solely 5 of the approximate 30 open positions have been held for not less than 12 months.

So, you should be comfy with short-term capital features or losses and a probably prolonged year-end tax type should you make these trades in a taxable brokerage account. You would possibly think about a Roth IRA for optimum tax remedy.

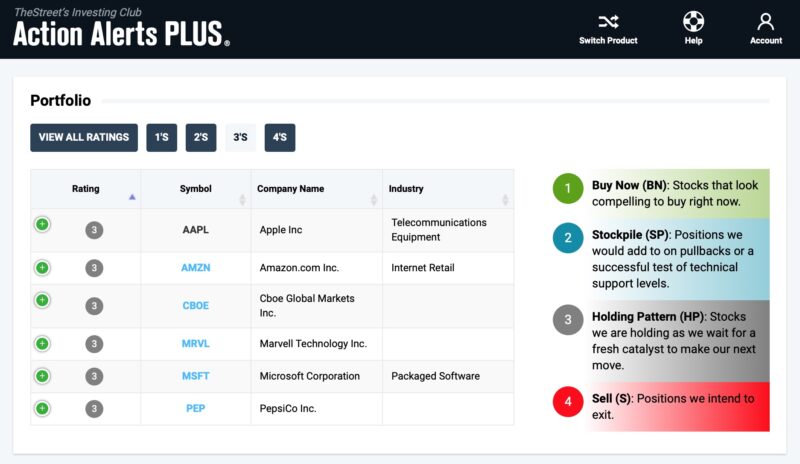

Portfolio Rankings

Every inventory within the mannequin portfolio is assigned a ranking from one to 4:

- 1: Purchase Now – Shares that look compelling to purchase proper now.

- 2: Stockpile – Add shares throughout pullbacks or a profitable take a look at of technical patterns.

- 3: Holding Sample – Market-neutral holdings ready for a recent catalyst earlier than shopping for or promoting.

- 4: Promote – Shut your full place as quickly as sensible.

You possibly can faucet the “Portfolio Rankings” button within the member dashboard and click on the ranking degree to filter shares by their scores, 1, 2, 3, or 4.

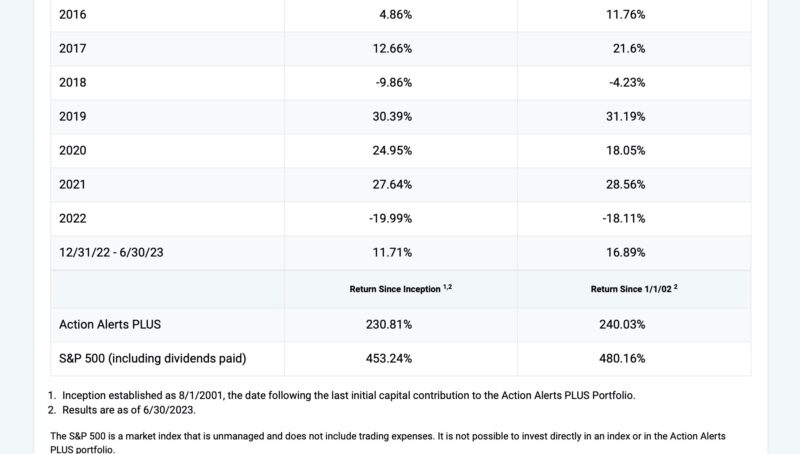

Motion Alerts Efficiency

The portfolio benchmark is the S&P 500, which is the usual for many newsletters and inventory mutual funds.

I discover that the Motion Alerts Plus portfolio is extra clear concerning its historic efficiency than most competing publications. You possibly can view the open positions, closed positions, buying and selling log, and portfolio efficiency by yr.

From its inception on August 1, 2001, by June 30, 2023, the full efficiency is 230.81% vs. 453.24% for the S&P 500 (together with dividend payouts). Whereas getting cash utilizing this service is feasible, the lifetime efficiency considerably trails the market. This efficiency hole will almost certainly deter informal traders preferring the simplicity of index funds and passive funding methods.

From 2016 to 2022, Motion Alerts Plus from TheStreet has solely outperformed the S&P 500 as soon as. That was in 2020, with a efficiency of 24.95% vs. 18.05%. Admittedly, the final decade has been one of many S&P 500’s finest intervals, and it’s been more durable to beat the inventory market.

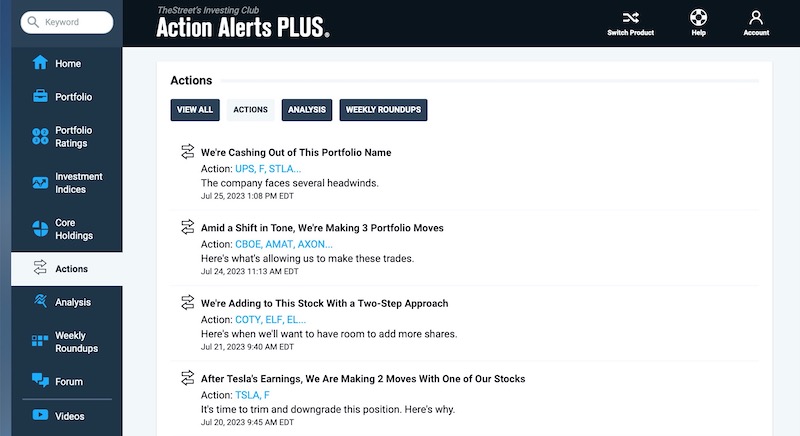

Buying and selling Alerts

You need to count on to obtain a number of weekly commerce alerts with purchase and promote suggestions. Beneath is an instance of buying and selling ideas, which embody the goal buying and selling worth and place measurement.

“After you obtain this Alert, we are going to make the next trades:

— Promote 235 shares of CBOE at or close to $142.75. Following the commerce, CBOE shares will account for roughly 2.0% of the portfolio.

— Purchase 120 shares of AMAT at or close to $137.45. Following the commerce, AMAT shares will make up about 1.0% of the portfolio.

— Purchase 80 shares of AXON at or close to $177.90. Following the commerce, AXON shares will account for round 3.4% of the portfolio.”

Every alert additionally features a temporary synopsis about why it may be an opportune time to purchase or promote shares. Nevertheless, the publication doesn’t present an in-depth report like month-to-month publications. I like to recommend performing your personal basic evaluation and taking the time to learn inventory charts to find out your finest buy-in worth and your assist and resistance ranges.

A important distinction between Motion Alerts Plus and most inventory newsletters is that this platform doesn’t make the most of cease losses as draw back safety. You might resolve to make use of a cease loss matching your private threat tolerance, reminiscent of 5% for conservative appetites or low-conviction trades.

You can see the most recent portfolio actions within the “Strikes” tab.

Motion Alerts Plus Analysis Research

Along with funding concepts, the inventory publication analysts produce day by day and weekly analysis content material that sheds extra gentle on the mannequin portfolio strikes. Right here’s a more in-depth take a look at what’s included.

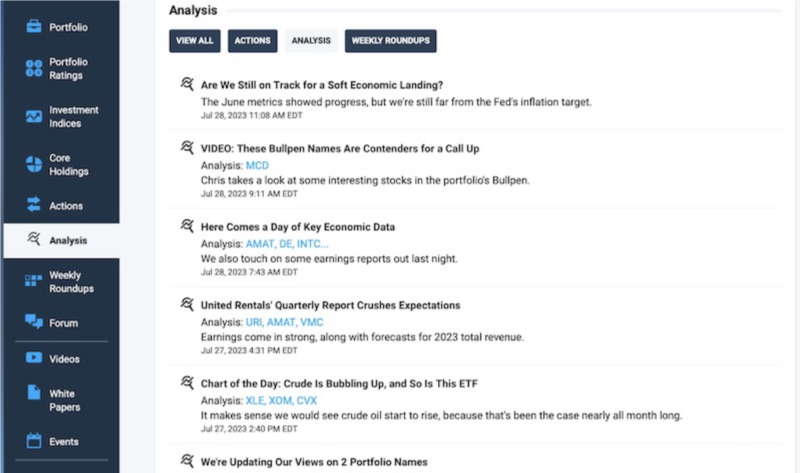

Evaluation

At the least one brief article or video is revealed every buying and selling day analyzing main market developments or bulletins from inventory suggestions.

You possibly can learn every article inside a couple of minutes to be taught extra about quarterly earnings from a sure holding or how the most recent Fed charge hike would possibly affect the funding membership’s mannequin portfolio and the monetary markets typically.

Premium members can even watch day by day movies which are shorter than 5 minutes and spotlight which shares to keep watch over.

Weekly Roundup

You might not have time to learn the day by day portfolio updates, which is the place the Weekly Roundup turns out to be useful.

This content material is considerably prolonged, however you’ll be able to rapidly leap to the elements you need to learn. A few of the sections can embody:

- A short synopsis of what occurred within the markets final week

- Notable strikes inside the AAP portfolio

- Hyperlinks to the Each day Rundown movies and portfolio podcasts

- Key international financial readings

- Chart of the week

- Key occasions to concentrate to within the upcoming week

- Updates on choose portfolio holdings

Relating to updates on the portfolio suggestions, you’ll be able to learn why the editorial staff is highlighting the inventory this week. The abstract additionally contains the funding thesis, goal worth, and dangers. Readers can even discover hyperlinks to related commentary and the corporate’s web site.

Convention Name

Members can even take part in a month-to-month convention name the place Chris Versace or Bob Lang reply reader-submitted questions. Replays can be found later within the day should you can’t attend the dwell stream.

This can be a good characteristic, as most newsletters don’t allow you to work together with the publication editors this carefully.

Boards

You may get your funding questions answered exterior of the month-to-month calls by visiting the group boards. Browse present inquiries and responses about particular positions and macroeconomics. It’s a useful instrument while you’re making an attempt to analysis potential investments or rebalance your portfolio.

Professionals and Cons

Motion Alerts PLUS is filled with useful instruments, however like several funding publication, it’s not for everybody. Right here’s my checklist of execs and cons:

Professionals

- Each day portfolio updates

- A number of funding concepts

- Can view closed positions

- Interactive convention calls and boards

- Inexpensive

- 14-day free trial

Cons

- Requires frequent shopping for or promoting (12 months or much less)

- Doesn’t use cease losses to reduce draw back

- Has considerably underperformed the S&P 500

- Data overload for rare merchants

Alternate options to Motion Alerts Plus

The next funding analysis providers could also be higher for getting particular person shares should you want a long-term technique or need completely different instruments.

Motley Idiot Inventory Advisor

Lengthy-term traders could want Motley Idiot Inventory Advisor because it gives two month-to-month funding concepts and has much less portfolio turnover. The goal holding interval is three to 5 years, and the advisory staff considers shares with the potential to outperform the S&P 500.

Much like Motion Alerts Plus, you’ll be able to view the funding efficiency of each open and closed place. There are weekly portfolio updates plus plenty of day by day content material. Learn our Motley Idiot overview to search out out extra.

Motley Idiot Inventory Advisor can be $89 for the primary yr, making it less expensive than Motion Alerts PLUS. The common worth is comparable although.

*Billed yearly. Introductory worth for the primary yr for brand new members solely. First yr payments at $89 and renews at $199.

Study Extra About The Motley Idiot Inventory Advisor

Oxford Communique

The Oxford Communique presents one month-to-month inventory decide and 5 mannequin portfolios with conservative to aggressive funding methods. Most holdings have a minimal 12-month funding horizon, though it’s not unusual for inventory picks to be bought earlier to take features or reduce losses.

Annual pricing begins at $49 yearly, and you’ll get pleasure from a 365-day satisfaction assure. For extra info, take a look at our Oxford Communique overview.

Study Extra About Oxford Communique

Searching for Alpha

Analysis-hungry traders could admire Searching for Alpha Premium, which offers bullish and bearish commentary from impartial contributors on practically each publicly traded inventory and fund.

You received’t see a mannequin portfolio, however the platform assigns proprietary rankings that may assist basic and technical traders display screen shares. A free membership can be obtainable for rare traders who could solely must analysis one or two corporations per thirty days. Our Searching for Alpha overview offers extra particulars concerning the inventory analysis instruments.

Study Extra About Searching for Alpha

Zacks Funding Analysis

Zacks gives free and premium analysis instruments. A free membership allows you to view the Zacks Rating, which is a proprietary ranking estimating a inventory’s potential of outperforming the market over the close to future.

You may as well learn fundamental analysis studies, however a paid subscription is critical to entry the inventory screener and a long-term mannequin portfolio.

Study Extra About Zacks Funding Analysis

Is Motion Alerts PLUS Value It?

Motion Alerts PLUS from TheStreet might be invaluable should you get pleasure from buying and selling shares with a goal holding interval of a number of weeks or months. You received’t must spend as a lot time monitoring your positions as you’ll with swing buying and selling, which has a holding interval of a number of days. Nonetheless, day by day or weekly portfolio upkeep might be needed while you purchase into a number of concepts.

You might need to attempt paper buying and selling among the funding concepts earlier than allocating onerous cash to resolve should you can sustain with the buying and selling frequency if this funding technique is new to you.

Additional, different short-term investments with larger yield potential can require much less effort.

Take into account subscribing to Motion Alerts Plus from TheStreet should you’re comfy with routinely shopping for or promoting shares each few weeks or months. Utilizing a inventory buying and selling app makes it straightforward to get correct place sizing with fractional buying and selling and no buying and selling charges. Nevertheless, it’s best to keep away from this service should you solely need a single month-to-month thought or solely purchase shares a number of occasions every year.

Study Extra About Motion Alerts PLUS

FAQs

You possibly can cancel your subscription anytime by contacting the Motion Alert Plus Buyer Service Division at 1-866-321-8276 throughout enterprise hours (Monday-Friday, 8 AM-6 PM).

For those who cancel your subscription through the free trial interval, you’ll not be billed. For those who cancel a month-to-month or quarterly subscription, you’ll not be refunded for the newest subscription charge. Annual subscribers will solely be eligible for a refund in the event that they cancel their subscription inside 30 days of the tip of the free trial interval.

Funding newsletters can assist traders with inventory selecting, saving them hours of analysis. They’re additionally a terrific academic useful resource. Nevertheless, it’s necessary to make sure the publication you’re subscribing to aligns together with your funding model. Additionally, be sure to’re getting your cash’s value. Some funding publication subscriptions value lots of of {dollars} yearly and might not be well worth the funding.