Guardianship accounts play a important function in safeguarding the monetary pursuits of minors, senior residents, and disabled people, requiring strict court docket oversight, clear reporting, and prudent asset administration from appointed guardians.

Tright here comes a time when minors, senior residents, or disabled individuals would possibly want somebody to handle their cash. In these instances, a guardian will likely be appointed by the court docket to manage guardianship of the person’s accounts.

When you wish to assume that everybody who’s appointed a guardian of an account is reliable and can handle the accounts ethically and properly, that isn’t all the time the case.

That’s the reason there are guidelines governing the management of guardian accounts. From who has entry to the account, to who owns it, and the way cash is spent, courts monitor these accounts.

Youngsters and Guardianship Accounts

Youngsters should not legally allowed to open a checking account or handle their very own cash in an account. Typically a guardian or guardian would possibly collectively open an account for a kid to get monetary savings for faculty or to only assist to educate the kid about saving.

On this case, the guardian is the precise proprietor of the account has management over the cash, and will do what they need with the funds.

That is completely different than a guardianship account. With a guardianship account, the cash does belong to the kid. The guardian of the account manages the cash for a kid however doesn’t have any possession over that cash.

The most typical purpose for a kid to have an account with guardianship is that the mother and father are deceased and have left cash or property for the kid and somebody, the guardian, wants to manage that account till the kid is of authorized age.

Aged or Disabled People and Guardianship Accounts

Typically adults do not need the bodily or psychological capability to handle their funds and a guardian must be appointed. As with kids, the guardian doesn’t achieve any possession of the particular person’s funds, they only handle the account.

The court docket chooses an acceptable guardian for somebody who has been deemed unable to handle their funds.

Forms of Guardianship Accounts

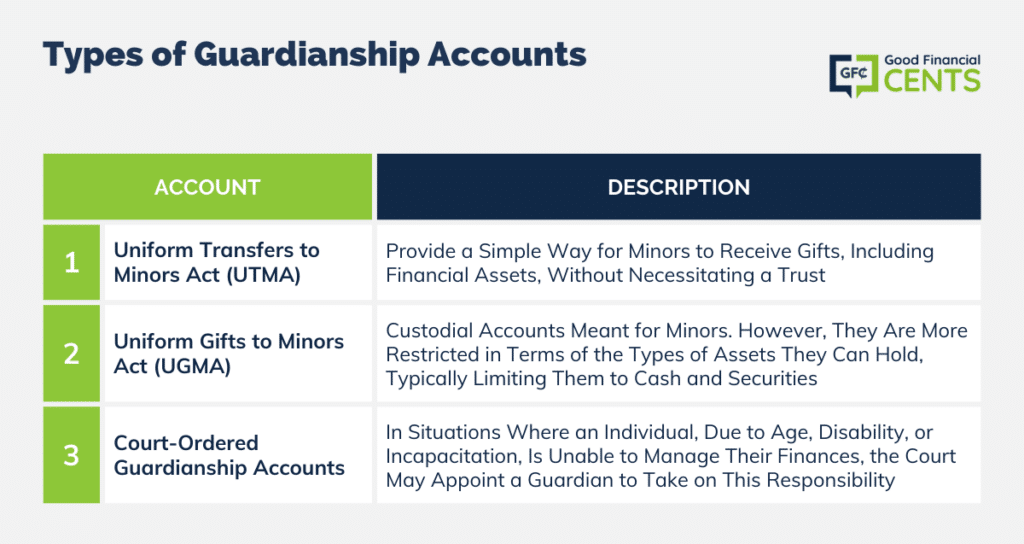

Guardianship accounts may be broadly categorized into a number of varieties, every serving particular wants and conditions.

1. Uniform Transfers to Minors Act (UTMA) Accounts

UTMA accounts present a easy manner for minors to obtain items, together with monetary belongings, with out necessitating a belief. The custodian, who could possibly be a guardian or a authorized guardian, manages the account on behalf of the minor till they attain the age of majority.

2. Uniform Items to Minors Act (UGMA) Accounts

UGMA accounts, like UTMA accounts, are custodial accounts meant for minors. Nonetheless, they’re extra restricted when it comes to the sorts of belongings they will maintain, usually limiting them to money and securities.

3. Court docket-Ordered Guardianship Accounts

In conditions the place a person, as a result of age, incapacity, or incapacitation, is unable to handle their funds, the court docket could appoint a guardian to tackle this accountability. Any such guardianship account is strictly regulated to guard the pursuits of the person in want.

The Guidelines and How It All Works

As talked about, the guardian of an account controls the funds and should report all receipts and disbursements to the court docket on a periodic foundation. The guardian handles the account however has no possession of the account, which means the cash or property within the account.

- All guardianship accounts have a beneficiary or a “ward”, often a baby, aged, or disabled particular person.

- The guardian of the account can’t appoint a beneficiary of the account. In different phrases, the guardian can’t change who the account is for and who receives the disbursements.

- With the intention to open a guardianship account, the guardian should present a licensed copy of a court docket order appointing them the guardian of a person’s account.

- If a person can not function guardian of an account, due to demise or another purpose, the court docket will appoint a brand new guardian for the account.

- As a result of the guardian doesn’t personal the funds within the account, the cash cannot be used to settle the debt of the guardian – which means it might probably’t be garnished or seized.

Duties and Liabilities of Guardians

The guardian’s function is pivotal, and it comes with a set of duties and potential liabilities.

1. Prudent Asset Administration

The guardian is predicted to handle the belongings prudently, making sound funding selections to make sure the protection of the principal whereas additionally aiming for development.

2. Clear Reporting

Common, clear reporting to the court docket is essential. The guardian should element all receipts, and disbursements, and supply updates on the standing of the investments.

3. Avoiding Conflicts of Curiosity

Sustaining a transparent boundary between private funds and the guardianship account is paramount. The guardian should keep away from any investments or selections that would probably profit them on the expense of the beneficiary.

4. Making certain the Beneficiary’s Effectively-being

The guardian is tasked with utilizing the belongings within the account to cater to the beneficiary’s wants, following the rules and prerequisites laid out by the court docket order.

Safeguarding the Beneficiary’s Pursuits

The system has built-in checks and balances to make sure the moral administration of guardianship accounts.

1. Strict Court docket Oversight

Courts play a important function in monitoring guardianship accounts, making certain common reporting, and offering oversight to guard the beneficiary’s pursuits.

2. Clear Possession Boundaries

The belongings within the guardianship account belong solely to the beneficiary. The guardian has management however doesn’t have any possession rights, making certain that the beneficiary’s pursuits are paramount.

Sensible Elements of Managing Guardianship Accounts

1. Opening and Closing Accounts

To provoke a guardianship account, the guardian must current a licensed copy of the court docket order that appoints them because the guardian.

If a guardian is unable to proceed their duties, or if the beneficiary reaches the age outlined by the court docket for asset switch, the court docket will intervene to both shut the account or appoint a brand new guardian.

2. Safety from the Guardian’s Money owed

The belongings in a guardianship account are shielded from the guardian’s private money owed, making certain that collectors can’t seize these belongings.

3. Prohibition of Unilateral Choices

Guardians should not allowed to alter the beneficiary of the account or make selections that serve their pursuits on the expense of the beneficiary.

Conclusion

Guardianship accounts are important instruments that play a vital function in safeguarding the monetary pursuits of minors, senior residents, and disabled people.

Understanding the varied sorts of guardianship accounts, together with the duties, liabilities, and protections in place, is significant.

This ensures that the accounts fulfill their supposed function, offering monetary stability, help, and peace of thoughts for many who want it most.

By adhering to strict guidelines and sustaining transparency, we will uphold the moral administration of those accounts, making certain that the belongings are used solely for the good thing about the people they’re meant to guard.