Seeking to profit from your $200,000 funding? Study the methods and alternatives that may show you how to flip your financial savings into a considerable return for a safe monetary future.

When on the level of questioning learn how to make investments $200,000, that’s undoubtedly a superb signal. In spite of everything, having this quantity to take a position means you’re on the quick path to constructing long-term wealth.

That is very true if you happen to can make investments $200,000 and go away it alone for a decade or two, giving compound curiosity loads of time and area to do its job.

However, how a lot can you find yourself with if you happen to make investments $200,000 properly, immediately?

That actually is dependent upon how you make investments your cash and the common return you get. Should you discovered a solution to make investments $200,000 and will go away it to earn a 6% return for 20 years, you’d have $641,427.09 after 20 years of progress.

Should you can handle to get a ten% return, alternatively, you’d finish the following 20 years with $1,345,499.99.

The right way to Make investments $200,000 Beginning Immediately

Nonetheless, the true drawback is determining how to take a position a whole bunch of hundreds of {dollars}. As a monetary advisor, I recommend spreading out a $200,000 funding into a number of completely different buckets. That approach, you possibly can diversify your $200,000 funding and enhance publicity inside completely different areas of finance which have the potential to develop.

Though your private funding allocation can — and will — differ relying in your age, your investing objectives, and what you hope to realize, listed below are some fundamental tips and allocations to contemplate.

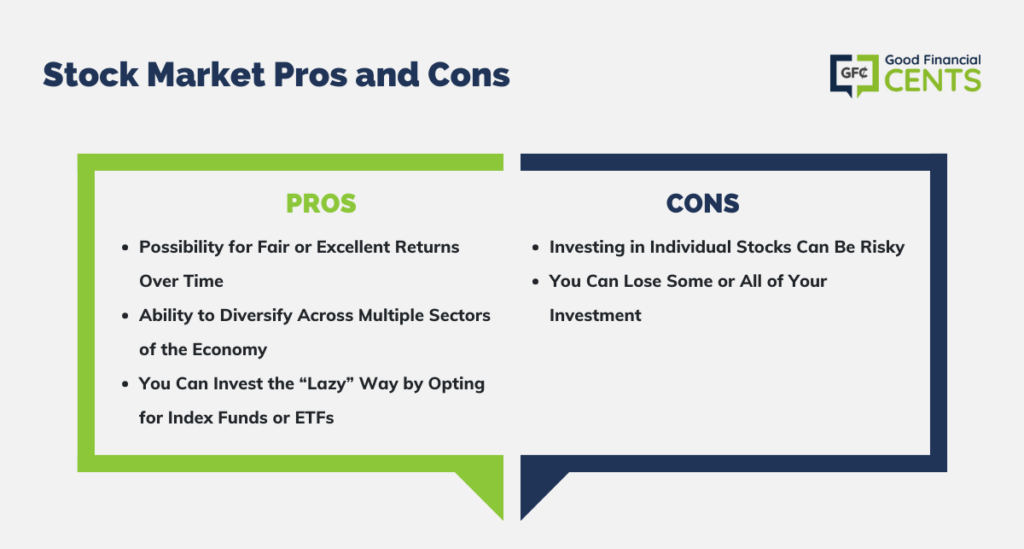

1. Put money into the Inventory Market

Urged Allocation: 40% to 50%

Danger Degree: Varies

Investing Objective: Lengthy-term progress

The inventory market is the place most of us save for retirement already, principally by way of the usage of tax-advantaged retirement plans, like a 401(ok), SEP IRA, or Solo 401(ok). But, you can even spend money on shares, bonds, index funds, and another kind of securities with the assistance of a brokerage account.

Though brokerage accounts don’t provide any upfront tax benefits, you get the possibility to spend money on any variety of shares, ETFs, and extra. Additionally, the brokerage account you open is significantly extra liquid than any tax-advantaged retirement plan.

The place most retirement accounts cost penalties if you should make a withdrawal earlier than retirement age, you possibly can promote shares and different securities and entry your cash with out penalty everytime you need. You’ll simply must account for capital beneficial properties taxes if you do.

The right way to Get Began: M1 Finance is a well-liked app that makes investing in shares, bonds, and ETFs a breeze. You’ll be able to arrange computerized trades, and you may unfold your authentic funding quantity far and huge because of the provision of fractional shares.

It additionally permits you to select an expertly curated “pie” of investments which are already designed to fulfill a particular investing aim. The most effective half? If you open an M1 Finance account, you possibly can make investments with none commissions or platform charges.

Who It’s Greatest For:

Investing in shares, bonds, ETFs and different securities can work properly for any investor, however particularly those that can go away their cash to develop over time.

Additionally, think about trying out Stash to check your choices.

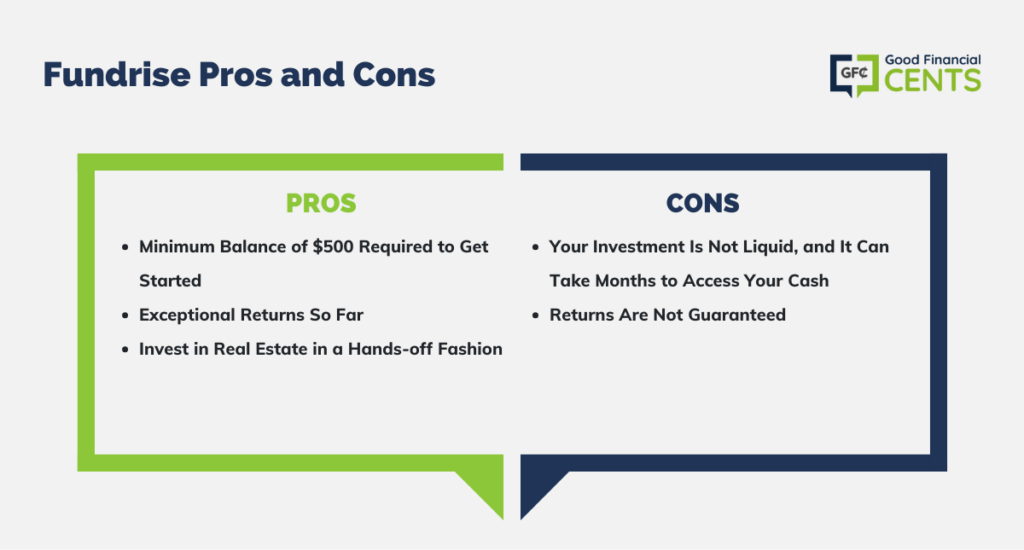

2. Put money into Actual Property

Urged Allocation: 10% to fifteen%

Danger Degree: Varies

Investing Objective: Development and revenue

Investing in actual property could make a ton of sense, however that’s very true if you happen to don’t want entry to your money immediately. You should buy funding properties and let your tenants repay your mortgage over time, after which their month-to-month hire funds would work as a passive stream of revenue. And the returns assist that with historic returns of residential properties at 10.6%.

You may as well spend money on any variety of actual property platforms, or in Actual Property Funding Trusts (REITs). Actual property funding platforms allow you to get among the upsides of actual property investing with out the work of a landlord.

The right way to Get Began: A platform often called Fundrise makes it simple to spend money on actual property with out taking out a mortgage or searching for new tenants. With Fundrise, you possibly can spend money on a starter portfolio with as little as $10. Your investments are unfold throughout varied industrial and residential properties which are expertly chosen by platform managers.

| I’ve been investing with Fundrise since 2018. Disclosure: if you enroll with my hyperlink, I earn a fee. All opinions are my very own. |

Who It’s Greatest For:

Fundrise is good for anybody who needs to realize publicity to the true property market with out having to do the work of a landlord.

Realty Mogul is another choice to contemplate trying out when evaluating firms.

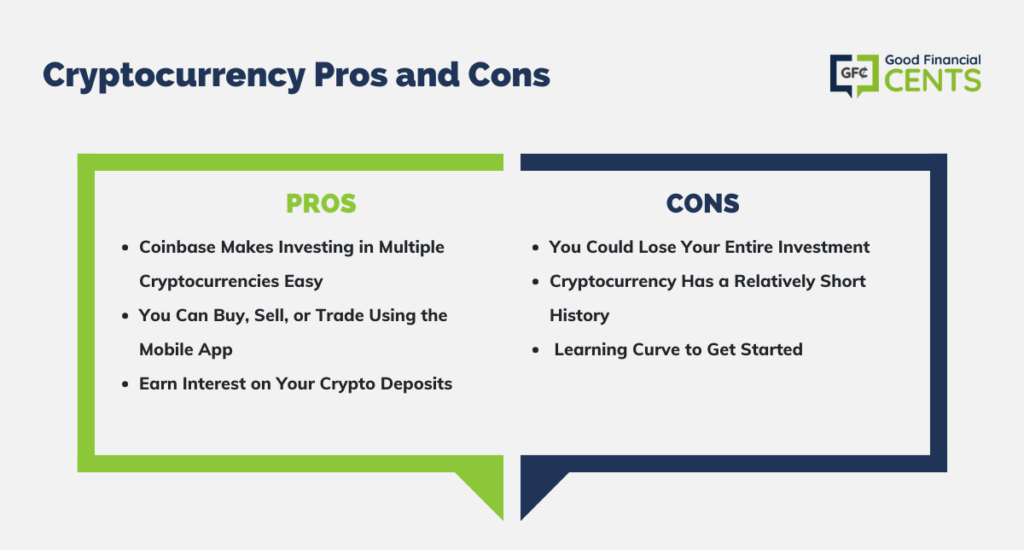

3. Put money into Cryptocurrency

Urged Allocation: 5%

Danger Degree: Excessive

Investing Objective: Lengthy-term progress

Though many thought cryptocurrencies would by no means acquire mainstream acceptance, it seems this isn’t the case. You need to use cryptocurrency, like Bitcoin, to make funds at extra locations than ever earlier than, and Bitcoin ATMs are popping up internationally.

Due to the large-scale adoption of Bitcoin, specifically, some trade consultants have recommended a single Bitcoin shall be value $1,000,000 or extra inside years.

Anybody can spend money on Bitcoin or different cryptocurrencies, like Ethereum or LiteCoin by way of a cryptocurrency app. These apps safely retailer your crypto till you’re able to commerce or promote.

The right way to Get Began: Coinbase is a high platform for getting cryptocurrencies, however it additionally permits you to earn curiosity in your crypto deposits by way of staking. Curiosity on crypto deposits accrues day by day and is paid out month-to-month, and a few sorts of crypto provide a return of as much as 5.75%.

Who It’s Greatest For:

Cryptocurrency is an funding choice for anybody who needs to diversify outdoors of conventional investments. Nonetheless, you’ll want the abdomen for loads of ups and downs since cryptocurrency is extremely risky.

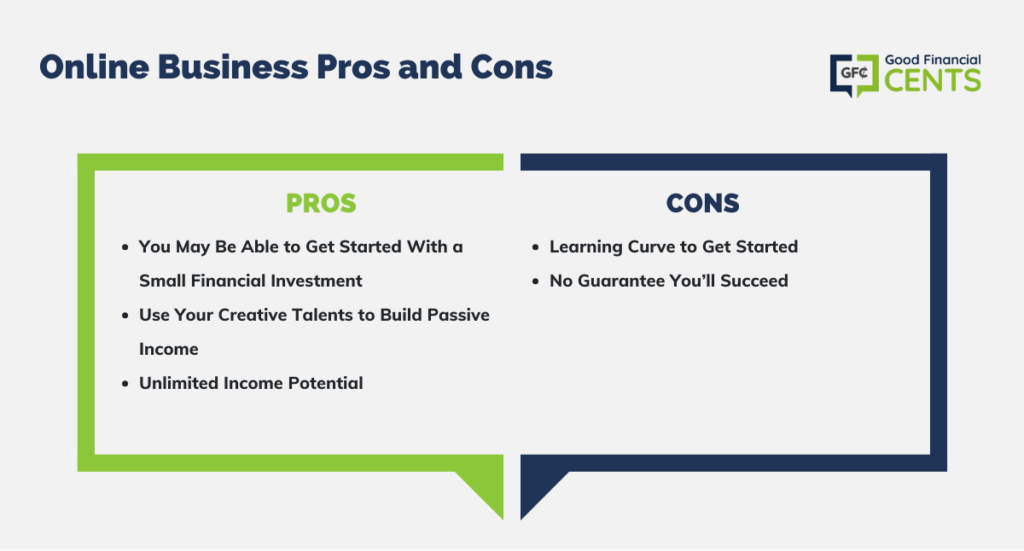

4. Purchase a Enterprise

Urged Allocation: Varies

Danger Degree: Excessive

Investing Objective: Revenue

Shopping for a enterprise is unquestionably not for everybody, and it’s true this funding technique is much more “hands-on” than others. Nonetheless, investing in a enterprise offers you the possibility to construct one thing that might usher in long-term revenue for years or many years to return.

You’ll be able to even construct what you are promoting up sufficient so different folks can run it in your behalf. At that time, you could possibly oversee the big-picture planning and revel in a passive revenue stream for all times.

The right way to Get Began: Though you should purchase a franchise or purchase an area enterprise in your space, I recommend trying into shopping for an internet enterprise by way of Flippa. This web site permits you to select fully-developed web sites, domains, and different on-line companies. You’ll be able to then use these websites to construct a passive revenue by way of advertisements, internet online affiliate marketing, product gross sales, and extra.

Higher but, you may get began with your personal on-line enterprise with as little as $1,000 in some instances. This feature requires important analysis to seek out an internet enterprise you could work with and monetize over time.

Don’t suppose you are able to do it? I actually imagine anybody can discover a approach to herald not less than some revenue by way of net visitors and varied on-line advertising and marketing methods. My information on learn how to generate income running a blog explains all the completely different monetization methods that may be executed from house and by yourself time.

Who It’s Greatest For:

Shopping for an internet enterprise is a brilliant choice for anybody who doesn’t thoughts placing in some work to get began. From there, on-line companies are glorious for passive revenue or for individuals who hope to construct one thing they’ll promote for revenue in a while.

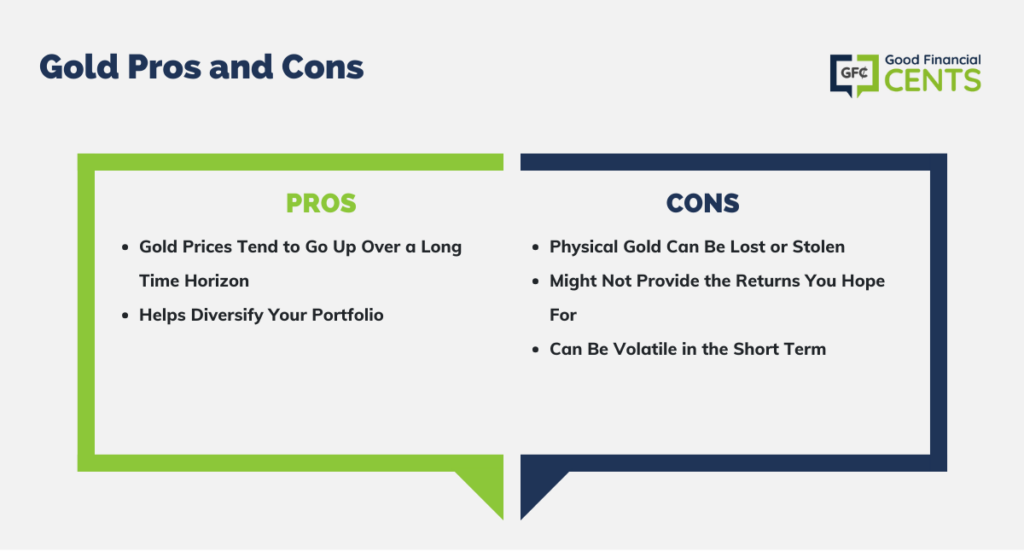

5. Put money into Gold

Urged Allocation: 10% to fifteen%

Danger Degree: Medium

Investing Objective: Diversification

Loads of consultants imagine that investing in gold and different valuable metals is essential, principally as a result of these choices present a hedge towards inflation. Many traders additionally flip to gold throughout financial downturns, which raises its value and will increase the worth of your funding.

The right way to Get Began: There are many on-line platforms that make it simple to spend money on bodily gold, and you may even bundle your gold purchases inside an IRA. For instance, Orion Metallic Alternate permits you to spend money on gold inside an IRA. Different distributors like Oxford Gold Group, Lear Capital, and Goldco additionally let clients purchase bodily gold.

Who It’s Greatest For:

Investing in gold could make sense for anybody who’s frightened about market turmoil. Buyers who wish to buy worthwhile commodities which have stood the check of time must also think about gold.

With the current considerations of banks changing into bancrupt, investing in gold carries extra danger to many. A current report from CBS Information shares learn how to spend money on gold in immediately’s local weather.

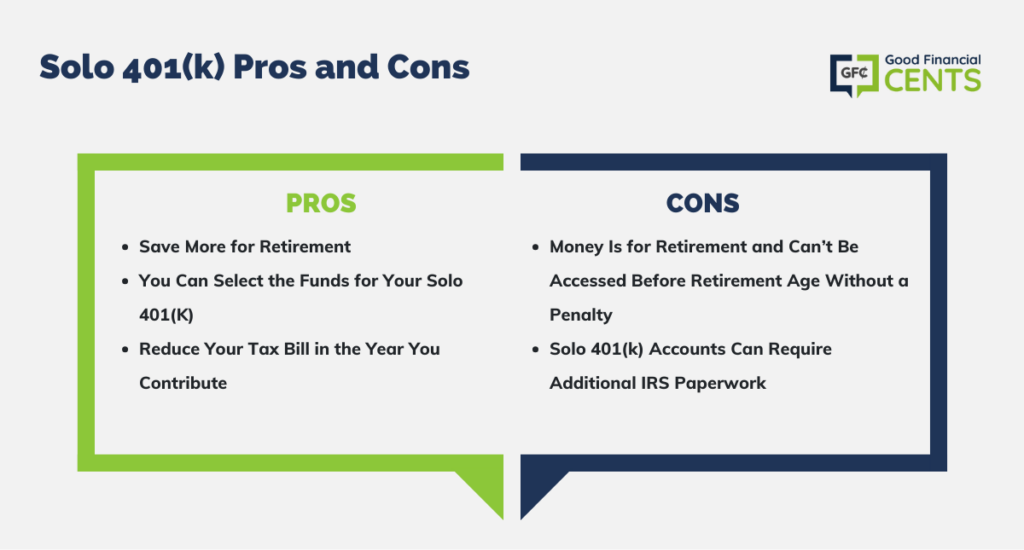

6. Open a Solo 401(ok)

Urged % Allocation: Varies

Danger Degree: Varies

Investing Objective: Lengthy-term progress

Should you personal your personal enterprise or have any type of self-employment revenue, you possibly can stash away a big chunk of revenue for retirement utilizing a Solo 401(ok). Such a account lets traders save much more for retirement than is feasible with a 401(ok). Contributions are additionally made on a tax-advantaged foundation, so you possibly can decrease your tax invoice within the yr you contribute.

The Solo 401(ok) lets small enterprise house owners and self-employed employees defer as much as 100% of their compensation as much as a most of $23,000 in 2025 (or $30,500 if you happen to’re 50 or older).

In the meantime, you can even contribute as much as 25% of compensation as your personal employer with a most whole cap of $69,000 in contributions for most individuals in 2025 (not counting catch-up contributions).

The right way to Get Began: You’ll be able to open a Solo 401(ok) with the finest on-line brokerage corporations. High choices embrace Constancy and Charles Schwab.

Who It’s Greatest For:

Investing in a Solo 401(ok) is sensible for anybody who can qualify primarily based on self-employment revenue.

Your Funding Fashion

Though any of those funding choices could be a sensible choice to your $200,000, suppose lengthy and arduous about what you hope to perform.

Do you wish to make investments for the long run and never have to fret about altering up your technique over time? Are you hoping to show a fast revenue as an alternative? Additionally, think about how quickly you’ll want entry to your preliminary funding quantity or if you happen to plan to let your $200,000 funding journey for 10 or 20 years.

If you wish to make investments for the long-term, then choices like investing in a Solo 401(ok) or a brokerage account could be smart. Nonetheless, the identical may very well be true for actual property cryptocurrency, and even shopping for your personal enterprise.

Should you want entry to your cash inside the subsequent few years, nevertheless, I most likely would go a unique route. As an alternative, think about opening a high-yield financial savings account and stashing your cash there. You gained’t get an ideal return in your funding, however you possibly can simply entry your money with out the danger of dropping it.

The Backside Line on Investing $200k

Having $200,000 to take a position means you’re in your solution to a financially profitable future, however your work isn’t completed but. Investing your $200,000 in a strategic approach will help you construct your nest egg over the following few years or many years.

That’s so much higher than letting all of your cash languish in a checking account the place it should probably fail to maintain up with inflation, not to mention develop. Take into account your age, and life objectives, and be taught extra about your danger tolerance to land on an funding technique that’s tailor-made to your wants. Should you in the end determine to take a position solely a portion of your cash, think about exploring the finest methods to take a position $100,000.

FAQs on Greatest Methods to Make investments $200k

The most effective place to take a position 200k would rely in your particular person objectives and danger tolerance. Some choices may embrace investing in a shares and bonds portfolio, actual property, and even cryptocurrency. For these searching for one thing safer, they need to think about income-producing property over choices extra dangerous. It’s vital to analysis all of your decisions and ensure you perceive the dangers earlier than investing.

listed below are a number of methods you could possibly make investments $200,000 to generate month-to-month revenue, relying in your funding objectives and danger tolerance. Some choices to contemplate embrace:

Dividend-paying shares or mutual funds: Dividend-paying shares or mutual funds can present a stream of standard revenue within the type of dividend funds.

Renting out a property: Should you personal a rental property, you possibly can generate month-to-month revenue by gathering hire from tenants.

Investing in a crowdfunding actual property platform: Crowdfunding actual property is another financing mannequin that enables folks to spend money on actual property tasks and obtain a return on their funding. It permits traders to pool their assets to fund bigger actual property tasks, reminiscent of residences or workplace buildings, with out requiring them to make giant investments individually.

Investing in an annuity: An annuity is a monetary product that gives a stream of month-to-month revenue in change for an upfront cost.

Investing in a bond ladder: A bond ladder is a technique through which you spend money on a sequence of bonds with completely different maturity dates, permitting you to obtain common revenue funds out of your bond investments.

You will need to fastidiously think about your funding objectives and danger tolerance earlier than selecting an funding and to fastidiously assessment the phrases of any funding you’re contemplating.

It’s doable to turn out to be a millionaire with an preliminary funding of 200K. To take action, you’ll need to formulate a plan and spend money on high-yield property reminiscent of shares, bonds, and actual property, or begin a enterprise. Additionally, you will must funds properly and set up objectives you could work in the direction of over time. Persistence and self-discipline are key when aiming to turn out to be a millionaire — it takes time and dedication, however with the correct method, you possibly can maximize your assets and obtain success.