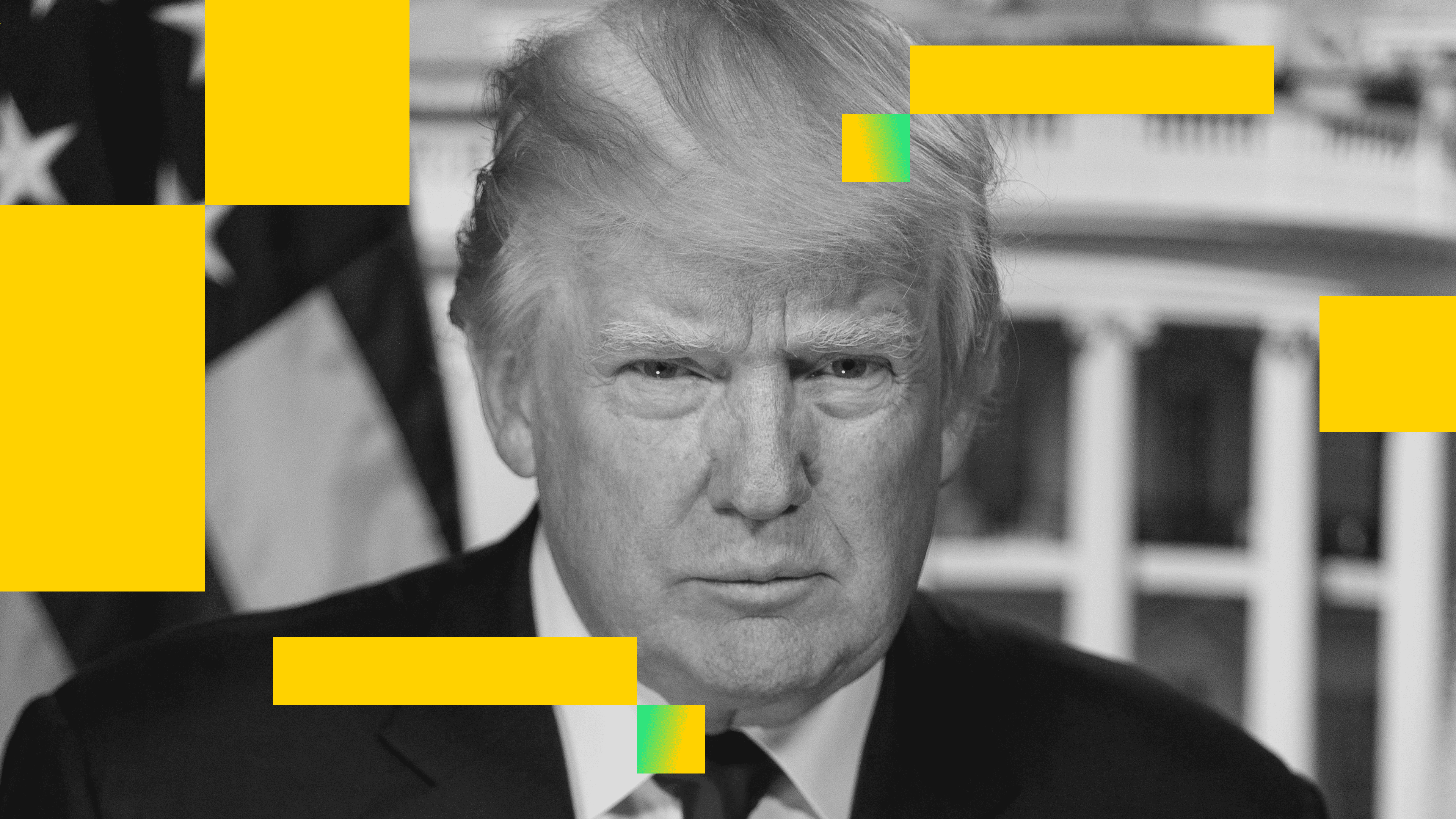

Some of the controversial options of President Donald Trump’s second time period is his relentless criticism of Federal Reserve (Fed) Chair Jerome Powell for sustaining elevated rates of interest – a stance Trump argues is unnecessarily pricey to the American financial system.

However that is extra than simply rhetoric. Trump is aggressively trying to undermine the Fed’s board, threatening an establishment lengthy identified for its political independence. Mockingly, this very assault dangers backfiring, deepening what Trump and others describe as a Fed that’s “behind the curve,” doubtlessly resulting in a deeper sell-off within the U.S. greenback.

“Political pressures make it robust to credibly shift to an overtly dovish footing. That leaves coverage information pushed (thus late) moderately than pre-emptive. That is dangerous for the USD,” the market insights crew at Lloyds Financial institution led by Nicholas Kennedy, stated in a word to shoppers on Sept. 18.

Trump’s Assault on the Fed

Final Thursday marked a brand new chapter in Trump’s marketing campaign towards the central financial institution, as his administration took the unprecedented step of petitioning the U.S. Supreme Court docket to permit the firing of Federal Reserve Governor Lisa Cook dinner. This could be the primary compelled removing of a sitting Fed governor for the reason that establishment’s founding in 1913.

The transfer adopted a brief judicial block issued by U.S. District Choose Jia Cobb, who prevented the ousting of Cook dinner, a Biden appointee, pending additional authorized proceedings.

Based on the Lloyds Financial institution market insights crew, such assaults are more likely to improve as Powell enters the ultimate months of his time period as Chairman. Trump’s current appointee on the Fed, Stephen Miran, is already calling for rapid-fire charge cuts and needs the financial institution to cut back the benchmark borrowing value by 50 foundation factors within the lately concluded assembly.

Behind the Curve

At its core, Trump’s marketing campaign displays a want for a Fed extra aware of his financial worldview, which calls for ultra-low charges round 1%, down considerably from the current 4%.

Trump has argued that present charges preserve mortgage prices prohibitively excessive for a lot of People, hindering homeownership and imposing billions in pointless debt refinancing bills. He frames this as a staggering missed alternative on an in any other case “phenomenal” financial system. In the meantime, many economists agree that charges stay too excessive given indicators of weakening labor markets and client well being.

Thus, the Federal Reserve is extensively perceived as “behind the curve” – a technical time period that means it’s too gradual to chop charges in response to evolving financial situations.

But, Trump’s insistence on forcing quicker charge cuts dangers pushing the Fed additional behind this curve.

Damned in the event that they do, damned if they do not

Think about holding the reins of the world’s strongest central financial institution, accountable not just for the world’s largest financial system, however the destiny of the worldwide reserve foreign money, the USD. Now think about the political strain to chop charges rapidly, towards the worry of showing politically compromised. This leaves policymakers damned in the event that they act and damned in the event that they don’t.

So, not like typical policymakers who regulate with measured calm in response to information, Powell and his colleagues now function below intense political strain and public scrutiny from the White Home. They face a traditional catch-22: face accusations of succumbing to political strain in case of fast charge cuts (even when they accomplish that independently); wait too lengthy and danger the potential deepening of an financial slowdown.

This dynamic might breed reflexive stubbornness. To keep away from accusations of capitulating to political strain, the Fed might instinctively lean in the direction of warning – ready longer and preserving charges elevated. Nonetheless, this posture can exacerbate the issue: delayed charge cuts preserve financial coverage out of sync with financial situations, very similar to a affected person who resists delicate treatment solely to require drastic doses as soon as a fever spikes.

The next excessive doses of charge cuts might be interpreted by markets as an indication of panic, resulting in elevated volatility in monetary markets, together with cryptocurrencies.

Greenback in danger

The catch-22 scenario might additionally weigh on the U.S. greenback, a bullish growth for dollar-denominated property like gold and bitcoin.

The greenback index, which measures the dollar’s worth towards main currencies, has dropped almost 10% this yr to 97.64. In the meantime, bitcoin’s value has rallied by 24% to $115,600.