DigitalX Restricted, an Australian digital Funding supervisor, has made headlines with a brand new Bitcoin (BTC) acquisition, signaling renewed institutional confidence out there. The ASX-listed crypto fund supervisor has expanded its Bitcoin treasury by a whopping 74.7 BTC, marking a big addition to its already present holdings.

DigitalX Buys 74.7 BTC

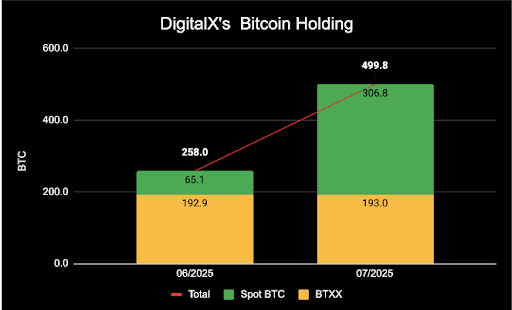

In a current X social media put up on July 23, DigitalX confirmed the addition of 74.7 BTC to its treasury. The acquisition, accomplished at a mean value of $117,293 per BTC, displays the corporate’s ongoing dedication to its Bitcoin-led technique. This newest buy has raised the crypto fund supervisor’s whole Bitcoin holdings to 499.8 BTC, valued at roughly $91.3 million.

Associated Studying

Notably, the corporate additionally introduced and expanded on the small print of this large-scale Bitcoin buy in an official assertion on Investorhub. Of its whole 499.8 BTC holdings, 306.8 BTC are held immediately by DigitalX, whereas the remaining 193 cash are held not directly by 881,000 items in its ASX-listed Bitcoin ETF, BTXX.

The current addition of 74.7 Bitcoin follows an earlier acquisition of 57.5 BTC disclosed by the corporate on July 18, 2025. These back-to-back purchases show a continued reallocation of DigitalX’s digital asset treasury towards Bitcoin. The agency’s whole treasury, excluding money, now exceeds $104.4 million.

As a part of its long-term crypto technique, DigitalX’s focused portfolio adjustment reinforces its function as a number one institutional-grade Bitcoin funding automobile on the Australian Securities Trade. The crypto fund supervisor highlights its newest acquisition as a key step in its ongoing effort to determine Bitcoin as its core treasury reserve asset.

Shareholder Focus Sharpens As Bitcoin Treasury Worth Rises

In response to its official assertion, DigitalX’s technique goes past merely rising its BTC reserve. It additionally goals to boost shareholder worth by constant and clear reporting. The crypto fund supervisor now tracks its Bitcoin holdings per share in Satoshis (Sats), the smallest unit of BTC.

Associated Studying

As of the newest replace, DigitalX’s BTC per share stands at 33.88 Sats, marking a 58% enhance in its Bitcoin treasury worth since June 30, 2025. This determine displays the affect of current acquisitions and gives a considerably measurable benchmark for buyers assessing publicity to the corporate’s appreciable portfolio.

By prioritizing Bitcoin accumulation and optimizing its treasury construction, DigitalX continues to place itself as a outstanding crypto-centric agency—one which views shareholder worth as immediately tied to the energy and development of its BTC holdings. The corporate can also be doubling down on its long-term imaginative and prescient of leveraging the flagship cryptocurrency as a strategic monetary basis.

Leigh Travers, former CEO and current Non-Govt Chairman of DigitalX, reaffirmed the corporate’s dedication to its digital asset objectives, stating that it goals to steadily develop its BTC portfolio all year long and effectively into the long run.

Featured picture from Pixabay, chart from Tradingview.com