Welcome to The Market’s Compass Rising Market’s Nation ETF Examine, Week #579. As all the time, it highlights the technical adjustments of the 20 EM Nation ETFs that I monitor on a weekly foundation and publish each third week. Paid subscribers will obtain this week’s unabridged Rising Market’s Nation ETF Examine despatched to their registered e-mail. Previous publications could be accessed by paid subscribers by way of The Market’s Compass Substack Weblog. Subsequent week I will probably be publishing The Market’s Compass Developed Markets Nation ETF Examine. On Sunday I revealed the newest version of The Market’s Compass Crypto Candy Sixteen Examine which I publish on a weekly foundation and tracks the technical adjustments of sixteen of the bigger capitalized Cryptocurrencies.

This morning’s Market’s Compass Rising Markets Nation ETF Examine is being despatched to free subscribers in addition to my common paid subscribers in a not so vailed try and lure free subscribers to help the work executed within the three ETF Research and the Weekly Crypto Candy Sixteen Research.

To grasp the methodology utilized in establishing the target EM Nation ETF Particular person Technical Rankings go to the mc’s technical indicators web page at www.themarketscompass.com and choose “em nation etfs”. What follows is a Cliff Notes model* of the total rationalization of the methodology I take advantage of…

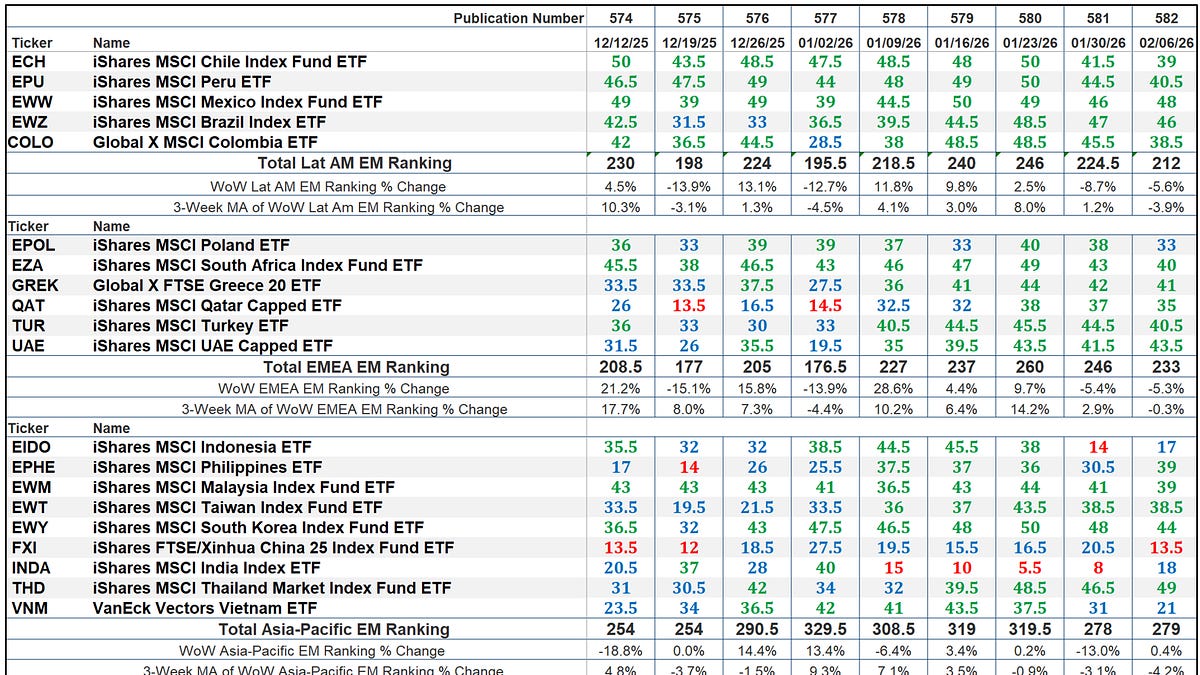

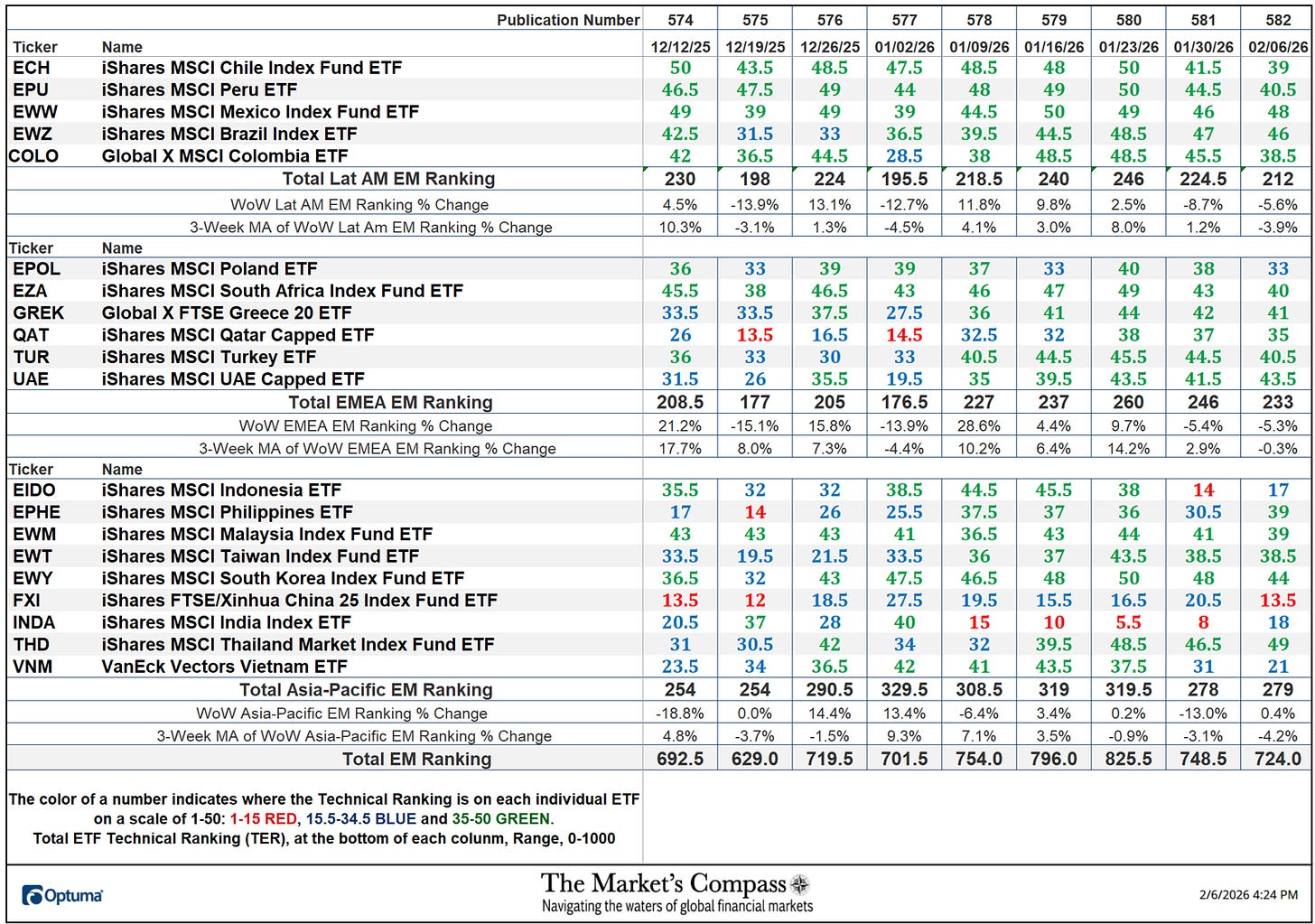

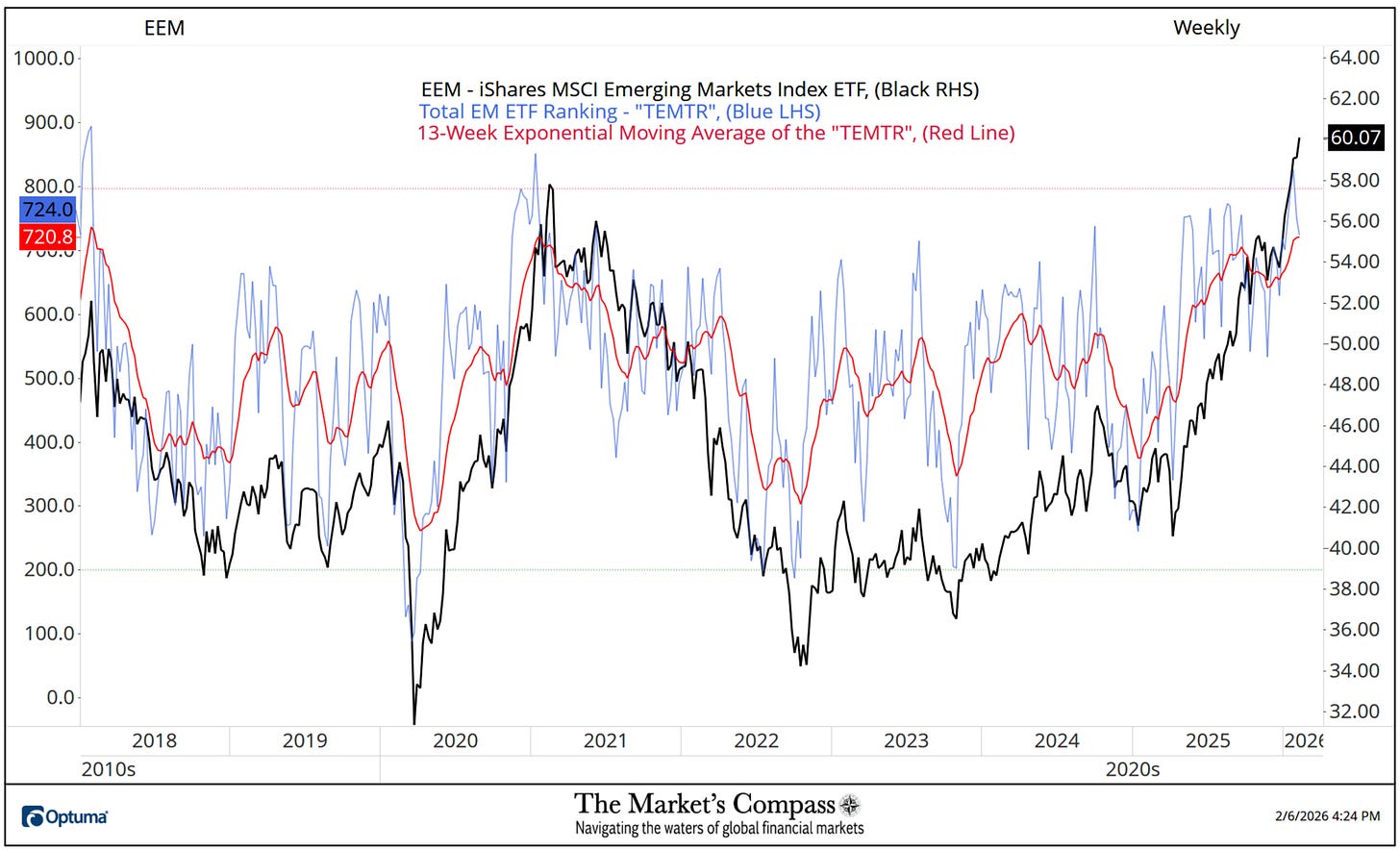

*The technical rating system is a quantitative method that makes use of a number of technical concerns that embrace however aren’t restricted to pattern, momentum, measurements of accumulation/distribution and relative energy of every particular person 20 EM Nation ETFs that may vary between 0 and 50. The Whole EM Technical Rating or “TEMTR” is the sum of the twenty particular person TRs and could be considered as an overbought / oversold indicator in addition to a affirmation / non-confirmation indicator. There may be additionally a Whole Rating for every geographic area that may be considered as a relative measurement on every week over week foundation.

This previous week The Whole EM Technical Rating or “TEMTR” fell -3.27% to 724 from 748.5 the earlier week which was down from the 825.5 studying three weeks in the past for the week ending 2/23, which was the best “TEMTR” since January 2021. The Whole Lat Am EM Rating fell the many of the three geographic areas, down -5.6% to 212 from 224.5 the week earlier than. The Whole EMEA EM Rating fell -5.3% to 233 from 246. The Whole Asia-Pacific EM Rating rose barely, up 0.4% to 279 from 278 the earlier week.

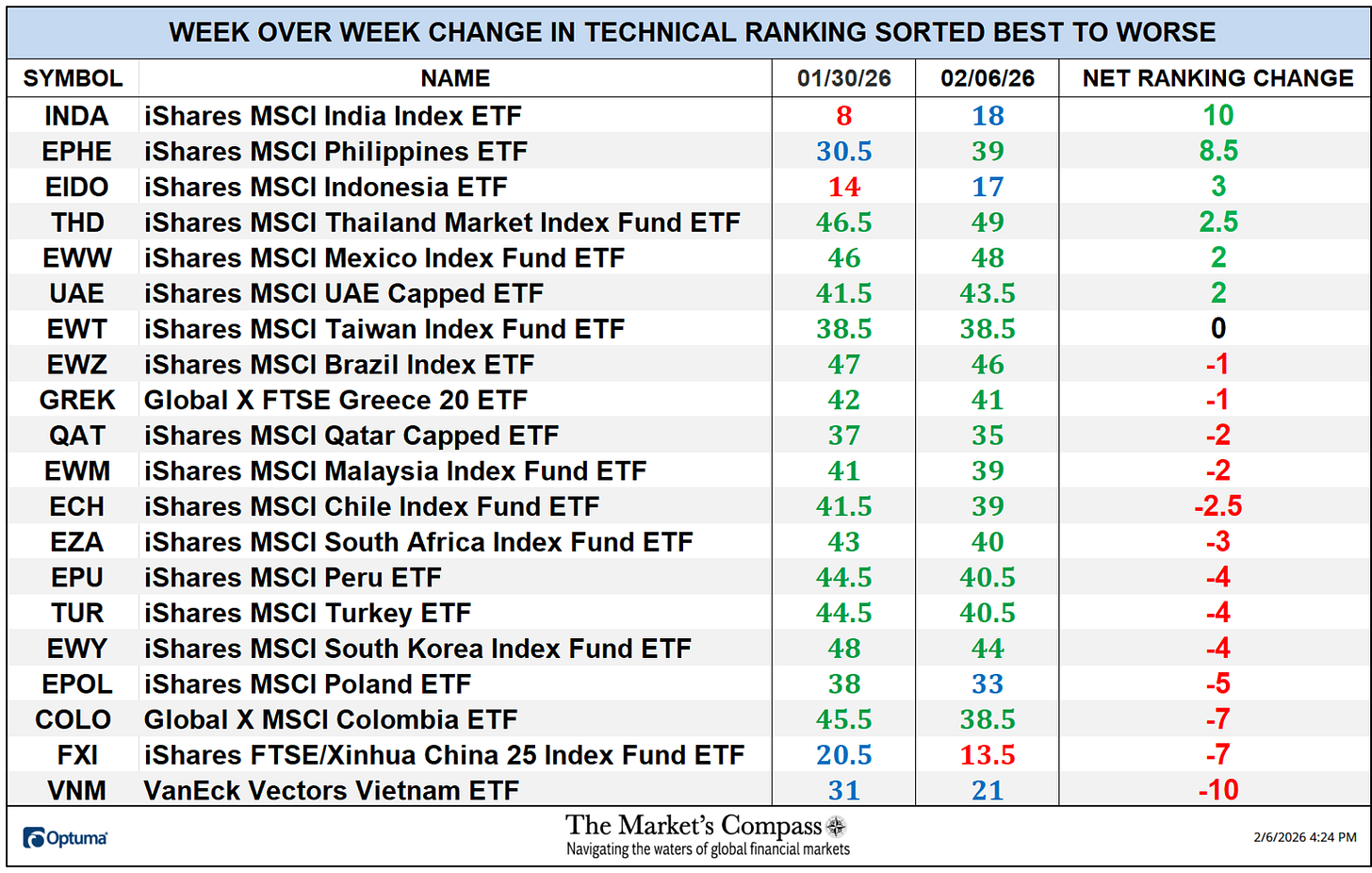

Six of the twenty EM Nation ETFs I monitor in these pages registered a achieve of their Technical Rankings or TRs over the previous week; one was unchanged and 13 had TRs that fell. Final week fifteen TRs have been within the “inexperienced zone” (TRs between 34.5 and 50), 4 have been within the “blue zone” (TRs between 15.5 and 34), and two have been within the “crimson zone” (TRs between 0 and 15). The typical TR loss was -1.23 vs the typical TR loss the earlier week of -3.85 when solely two TRs rose and 18 moved decrease. For the week ending 2/23, eighteen of the EM Nation ETF TRs ended the week within the “inexperienced zone”, one was within the “blue zone”, and one was within the “crimson zone”.

*To grasp the development the of The Technical Situation Components go to the Market’s Compass web site www.themarketscompass.com and go to the mc’s technical indicators web page and choose “em nation etfs”.

A brief model of the how the Technical Situation Components are calculated follows…

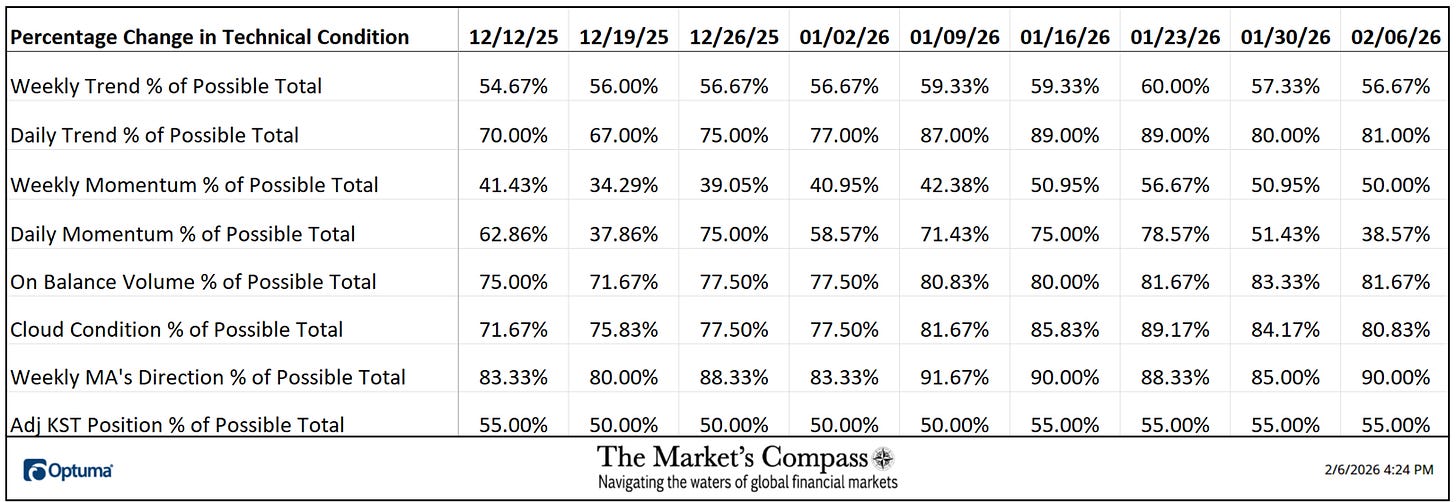

There are eight Technical Situation Components (“TCFs”) which can be a summation of the twenty ETFs TRs technical situation of every TCF query. The eight Technical Situation Components don’t ask the identical variety of questions. That’s the reason it’s calculated as a share. If a TCF particular person studying is 100% that may imply that each one Twenty ETFs fullfilled that exact TCF criterior.

This previous week a studying of 38.57% was registered within the Every day Momentum Technical Situation Issue (”DMTCF”) or 54 out of a potential whole of 140 optimistic factors.

As a affirmation instrument, if all eight TCFs enhance on a week-over-week foundation, extra of the 20 ETFs are bettering internally on a technical foundation, confirming a broader market transfer larger (consider an advance/decline calculation). Conversely if all eight TCFs fall on a week-over-week foundation it confirms a broader market transfer decrease. Final week, two TCFs rose, 5 fell, and one was unchanged.

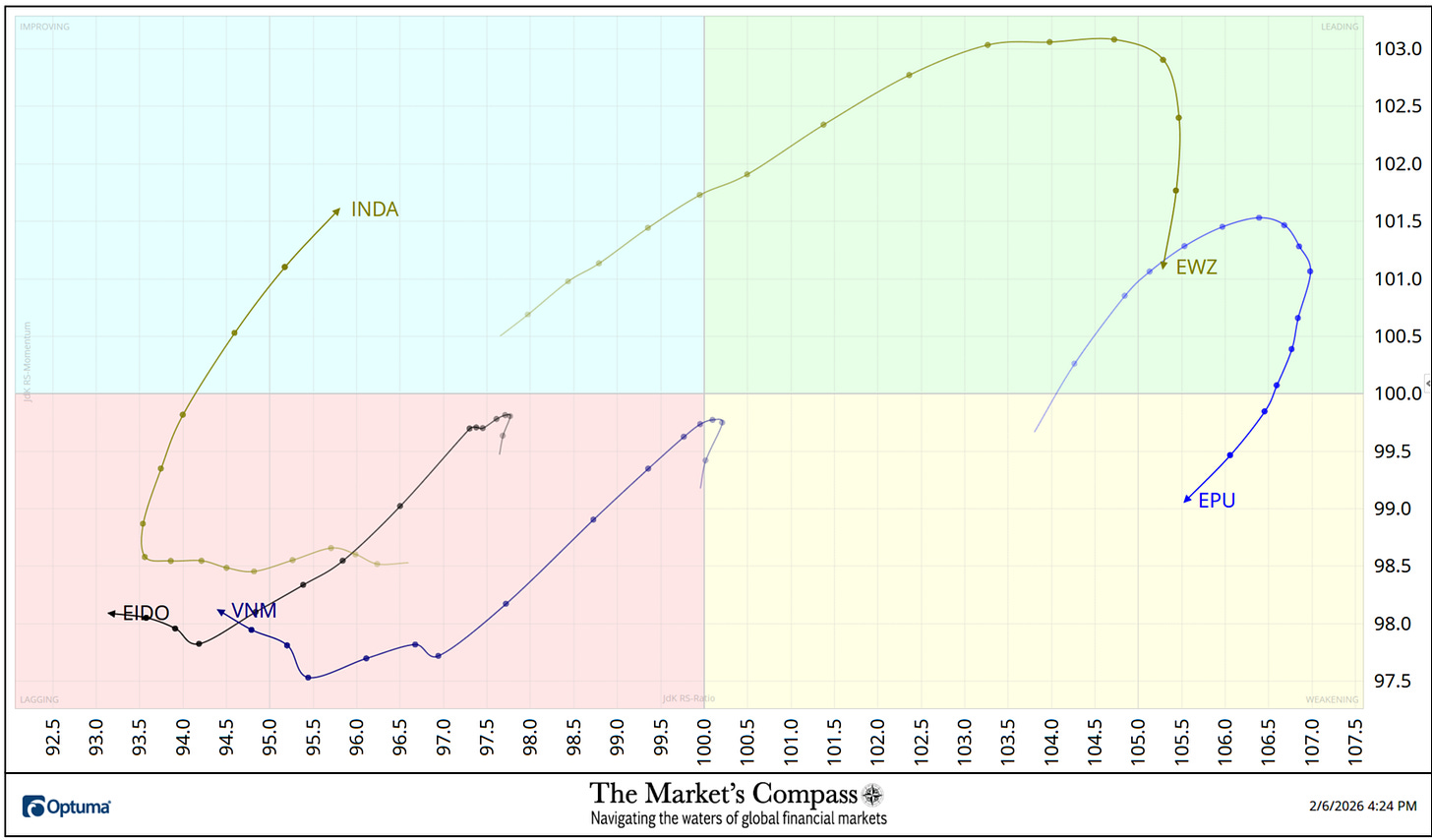

The Relative Rotation Graph, generally known as RRGs have been developed in 2004-2005 by Julius de Kempenaer. These charts are a novel visualization instrument for relative energy evaluation. Chartists can use RRGs to investigate the relative energy developments of a number of securities towards a standard benchmark, (on this case the EEM) and towards one another over any given time interval (within the case beneath, every day) over the previous three weeks. The facility of RRG is its potential to plot relative efficiency on one graph and present true rotation. All RRGs charts use 4 quadrants to outline the 4 phases of a relative pattern. The Optuma RRG charts makes use of, From Main (in inexperienced) to Weakening (in yellow) to Lagging (in pink) to Enhancing (in blue) and again to Main (in inexperienced). True rotations could be seen as securities transfer from one quadrant to the opposite over time. That is solely a quick rationalization of learn how to interpret RRG charts. To be taught extra, see the put up scripts and hyperlinks on the finish of this Weblog.

Not all 20 ETFs are plotted on this RRG Chart. I’ve executed this for readability functions. These which I consider are of upper technical curiosity stay.

After weeks of bettering Relative Energy and Relative Energy Momentum each the iShares MSCI Brazil Index ETF (EWZ) the iShares MSCI Peru ETF (EPU) rolled over within the Main Quadrant with EPU main the cost decrease however as could be seen within the Tabulation Desk beneath the EPU nonetheless sports activities one of the best Relative Energy vs. the EEM regardless of the contraction in each Relative Energy and Momentum even with the truth that it has entered the Weakening Quadrant. Firstly of the yr the iShares MSCI India Index Fund ETF (INDA) fell into the Lagging Quadrant and struggled there till every week in the past final Friday when it hooked larger and moved into the Enhancing Quadrant exhibiting spectacular Relative Energy Momentum towards the tip of week (observe the space between the every day nodes). Each the VanEck Vectors Vietnam ETF (VNM) and the iShares Indonesia ETF (EIDO) fell deeper within the Lagging Quadrant till each started to stabilize and hook larger final week.

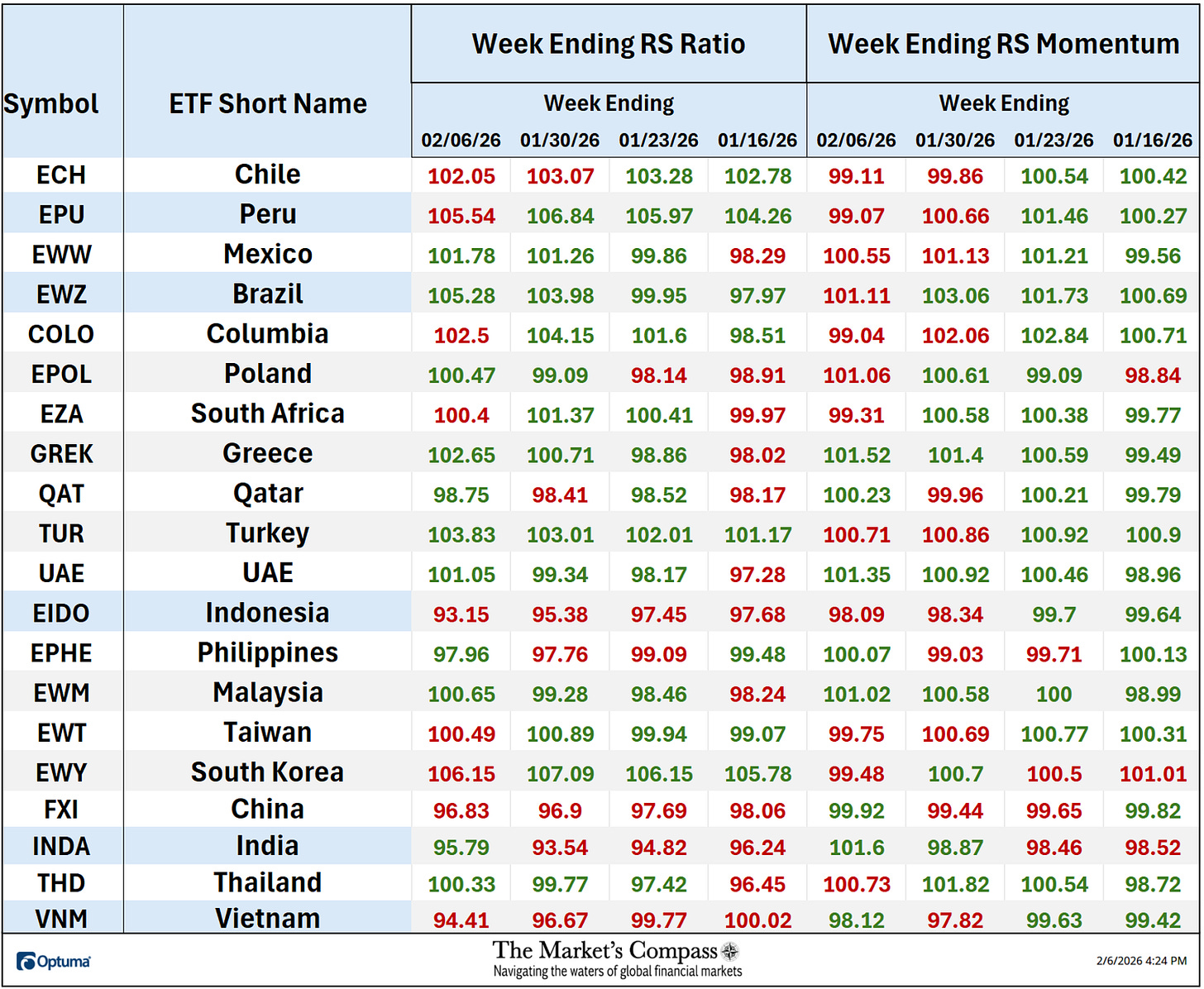

The “Tabulation Desk” beneath marks the Relative Energy and Relative Energy Momentum readings vs. the iShares MSCI Rising Markets Index ETF or EEM. It begins with the readings on the finish of final week adopted by the trailing three weeks that features the readings from the final Examine for the week ending 1/16. If there was an enchancment in both the Relative Energy Ratio or the Relative Energy Momentum studying on a week-over-week foundation I’ve highlighted it in inexperienced. If there was a contraction in both, it’s highlighted in crimson and an unchanged studying in both will stay black. The colour-coding system serves as a warmth map over the previous 4 Friday’s readings highlighting both the continued enchancment, deterioration, or stasis vs. the benchmark, the EEM. The ETFs which can be displayed on the RRG chart above are highlighted in blue.

*The “TEMTR” is the sum of the 20 Particular person Goal EM ETF Technical Rankings. It serves as an overbought or oversold in addition to a affirmation / non-confirmation indicator.

The EEM closed the week at a brand new weekly closing value excessive at 60.07 however as will probably be seen within the shorter-term Weeky Candle Chart and Every day Candle Chart that comply with, the longer-term Weekly shut Line Chart above doesn’t inform a full value motion image. One factor that may be seen above, after the TEMTR confirmed the brand new closing value highs it has pulled again from overbought territory and on the finish of final week it was testing help on the nonetheless rising 13-Week Exponential Shifting Common of the TEMTR (crimson line). Nonetheless the Shifting Common continues to be rising. Extra particulars to comply with…

*The “ATR” just like the “TEMTR” serves as an overbought or oversold in addition to a affirmation / non-confirmation indicator.

As I identified in feedback on the Weekly Line Chart, two weeks in the past the EEM rose to an all-time intra-week excessive at 60.95 however failed to carry above Higher Warning Line 2 (violet dotted line) of the longer-term Commonplace Pitchfork (violet P1-P3) and costs closed close to the on the lows of the week. Final week costs opened decrease however reversed and superior again above the Median Line (gold dotted line) of the shorter-term Schiff Modified Pitchfork (gold dotted line) however was capped on the UWL2 on the shut of the week. The Rising Markets Whole Situation Issue Oscillator has pulled again for the second week in a row from overbought territory and has fallen beneath the 5-Week Movin Common (crimson line) The Common EM Technical Rating (backside panel) has executed the identical though it stays above each Shifting Averages.

Find out about Pitchforks and their applacation within the three-part Pitchfork tutorial within the Market’s Compass web site, www.themarketscompass.com

Extra on the technical situation of the EEM in Ideas on the Quick-Time period Technical Situation of the EEM however first…

*Doesn’t embrace dividends if any.

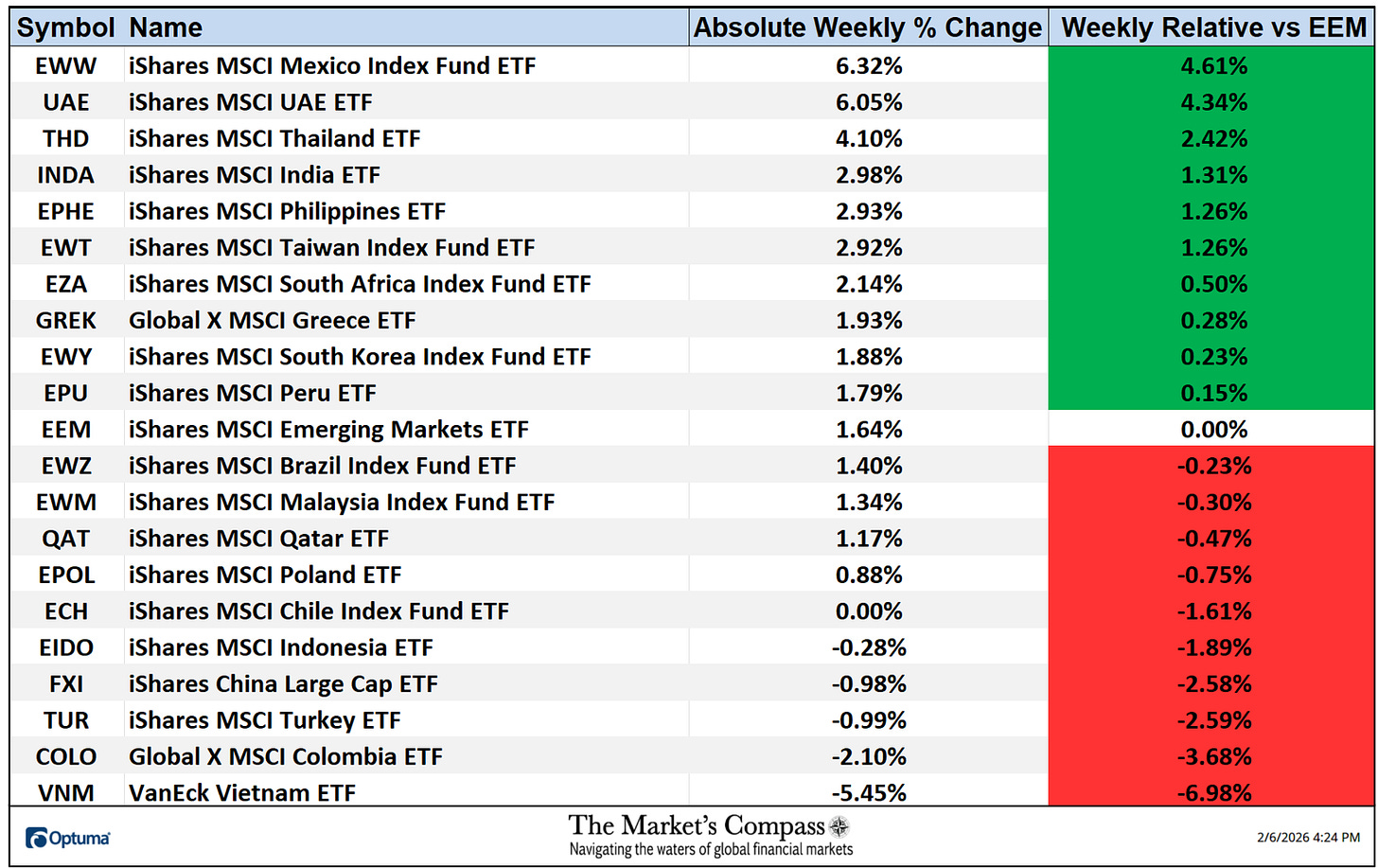

Fourteen of the twenty EM Nation ETFs have been up on an absolute foundation final week; one was unchanged and 5 traded decrease over the week. Ten EM ETFs outperformed the +1.64% achieve within the EEM on a relative foundation and ten underperformed. The typical five-day absolute achieve within the EM ETFs was +1.40% vs. a +1.64% achieve within the EEM. The earlier week the typical absolute loss was -0.47% vs. de minimis +0.05 achieve within the EEM.

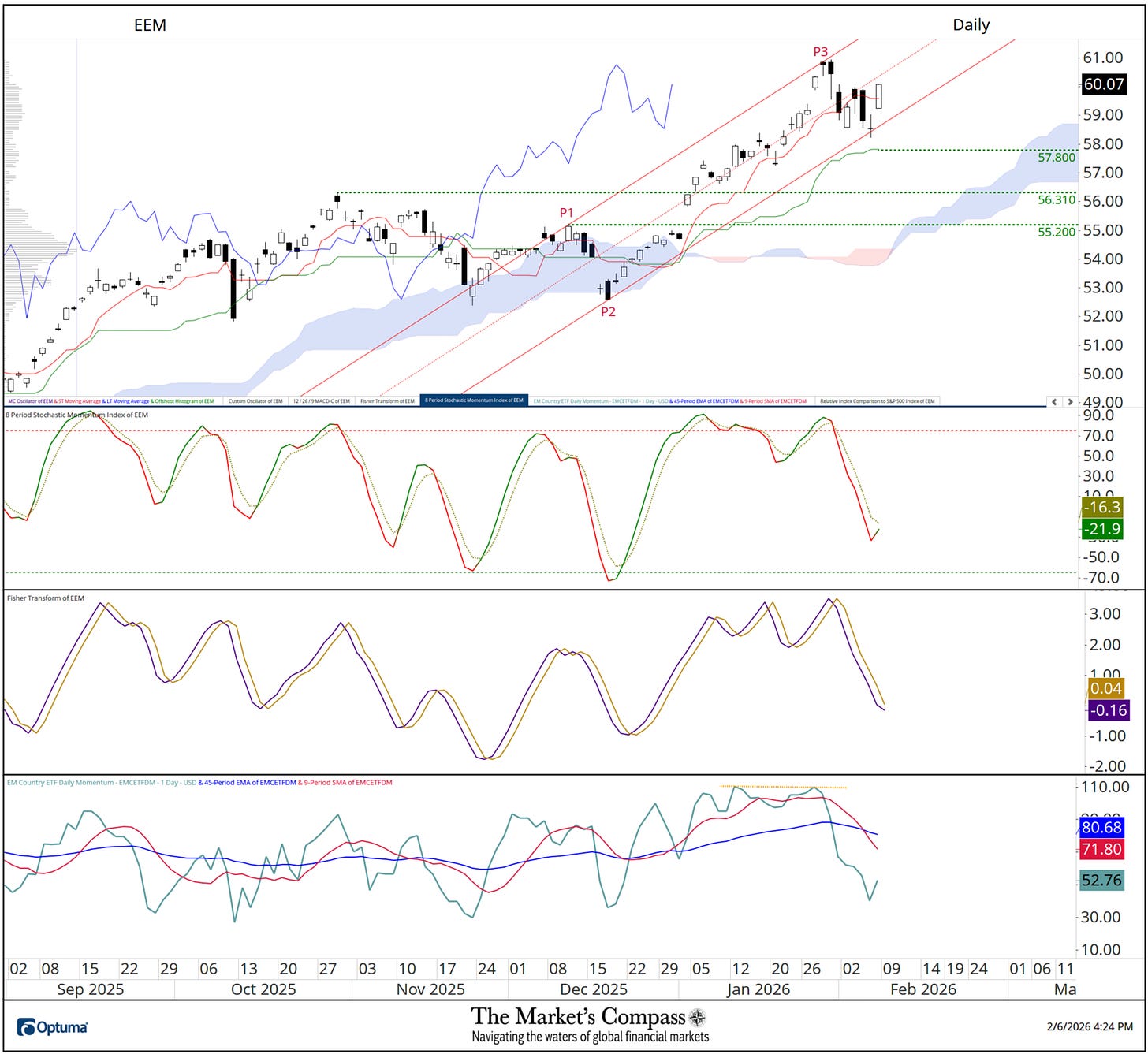

Within the earlier Rising Markets Nation ETF Examine (revealed on January nineteenth), I urged that “a retracement is forthcoming within the quick time period which is hardly a shock contemplating how stretched the EEM has develop into”. That technical thesis proved to be untimely and the EEM rallied to new highs however every week in the past, final Thursday the chickens lastly got here house to roost. When it grew to become evident that the retracement was unfolding final final week I added a brand new Schiff Modified Pitchfork (crimson P1 by means of P3). The EM Nation ETF Every day Momentum / Breadth Oscillator failed to verify the highs at P3 (yellow dashed line within the decrease panel) giving me confidence that the backing and filling was about to unfold. Final Thursday the Decrease Parallel (stable crimson line) provided a measure of value help resulting in Friday’s rally. That rally led to a slowing of the decline in each the Stochastic Momentum Index and the Fisher Remodel* though each stay beneath their sign strains. Solely a comply with by means of to Friday’s value rally by means of the Median Line (crimson dotted line) of the newly drawn Pitchfork would recommend that the value pullback could have run its course. Key phrase “could”.

*The Fisher Remodel is a technical evaluation indicator used to determine potential value reversal by remodeling value information right into a Gaussian regular distribution and was developed by John Ehlers.