Welcome to this week’s publication of the Market’s Compass Developed Markets Nation (DMC) ETF Research #560. It highlights the technical modifications of the 21 DM Nation ETFs that I monitor on a weekly foundation and publish each third week. There are three ETF Research that embody the Market’s Compass US Index and Sector (USIS) ETF Research, the Developed Markets Nation (DMC) ETF Research and the Rising Markets Nation (EMC) ETF Research. The three Research are usually printed each three weeks and are despatched to my paid Substack subscriber’s electronic mail. There’s additionally a Weekly publication that’s despatched to paid subscribers each Sunday titled The Market’s Compass Crypto Candy Sixteen Research that tracks the technical situation of sixteen of the bigger cap Cryptocurrencies.

In celebration of the primary day of Autumn I’m sending this week’s Research to free subscribers as effectively!

To know the methodology utilized in establishing the target DM Nation ETF Particular person Technical Rankings go to the mc’s technical indicators web page at www.themarketscompass.com and choose “dm nation etfs”. What follows is a Cliff Notes model* of the complete clarification…

*The technical rating system is a quantitative strategy that makes use of a number of technical issues that embody however will not be restricted to pattern, momentum, measurements of accumulation/distribution and relative energy of every particular person DM Nation ETF that may vary between 0 and 50.

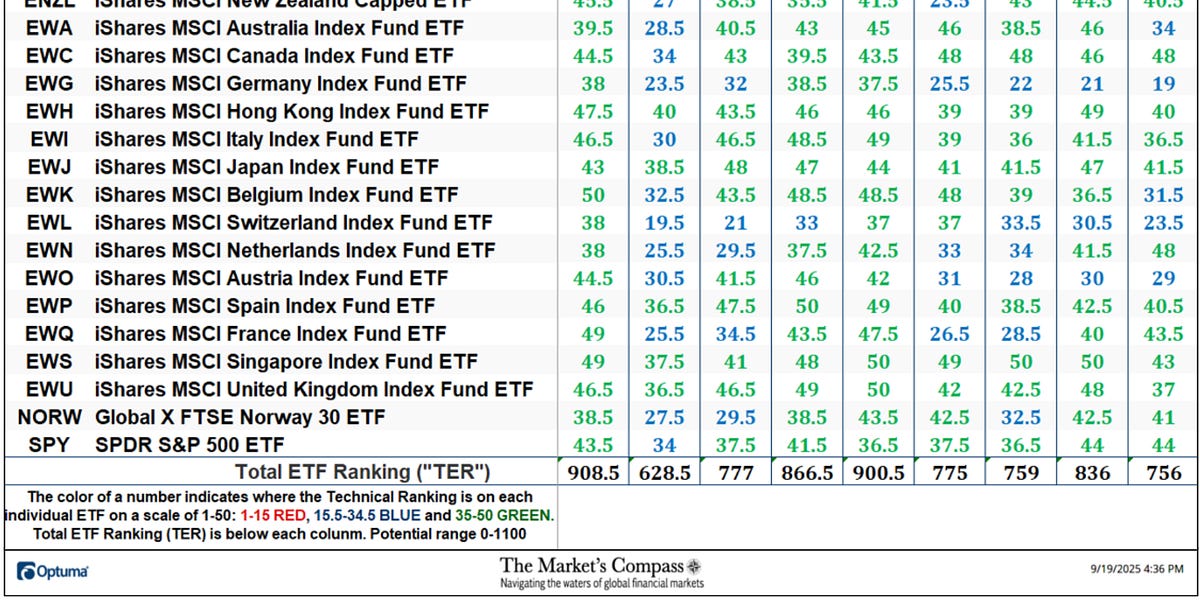

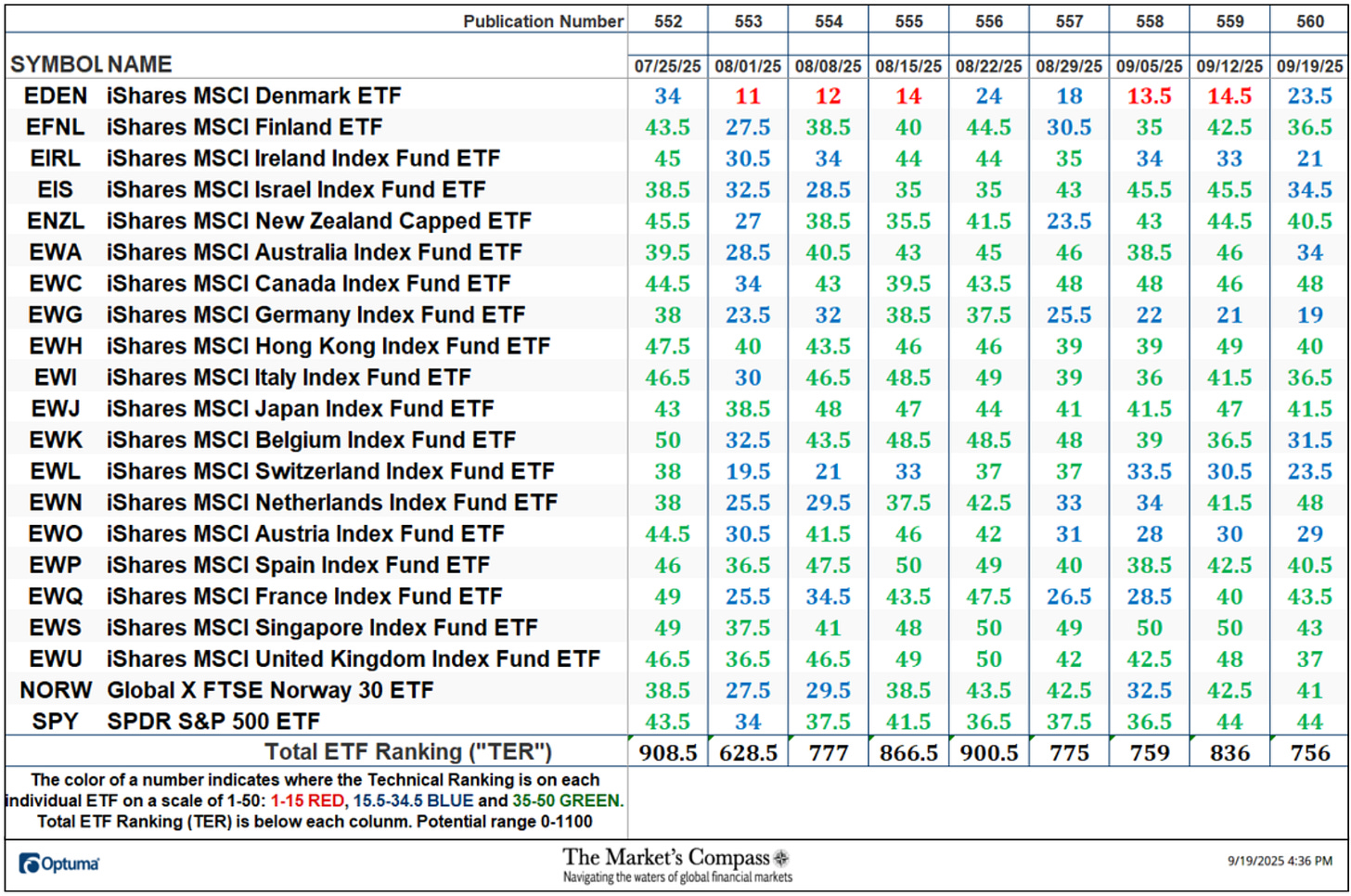

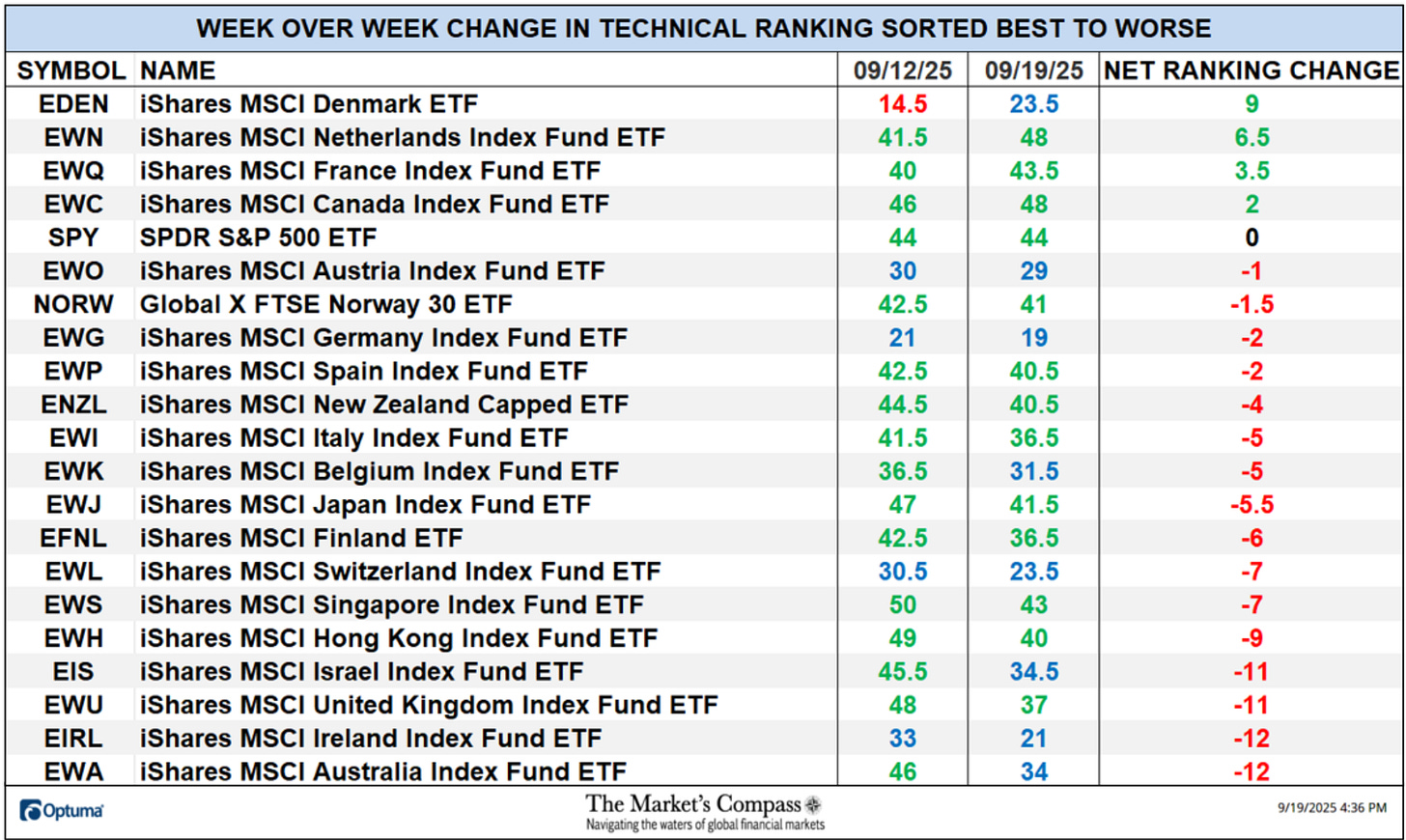

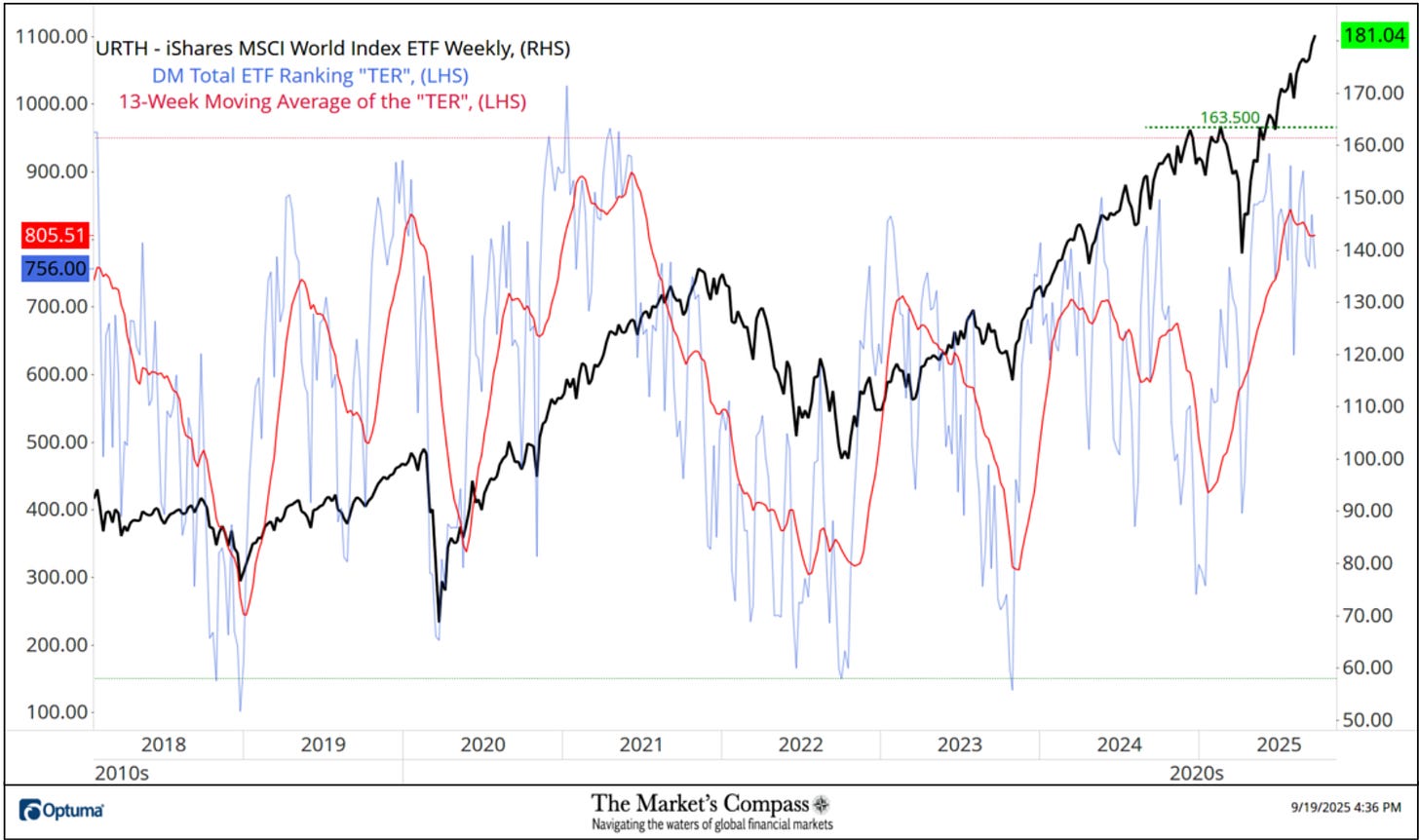

The Developed Markets Complete Technical Rating or “DMTER” fell -9.57% final week to 756 from 836 which was an increase of +10.14% from 759 three weeks in the past.

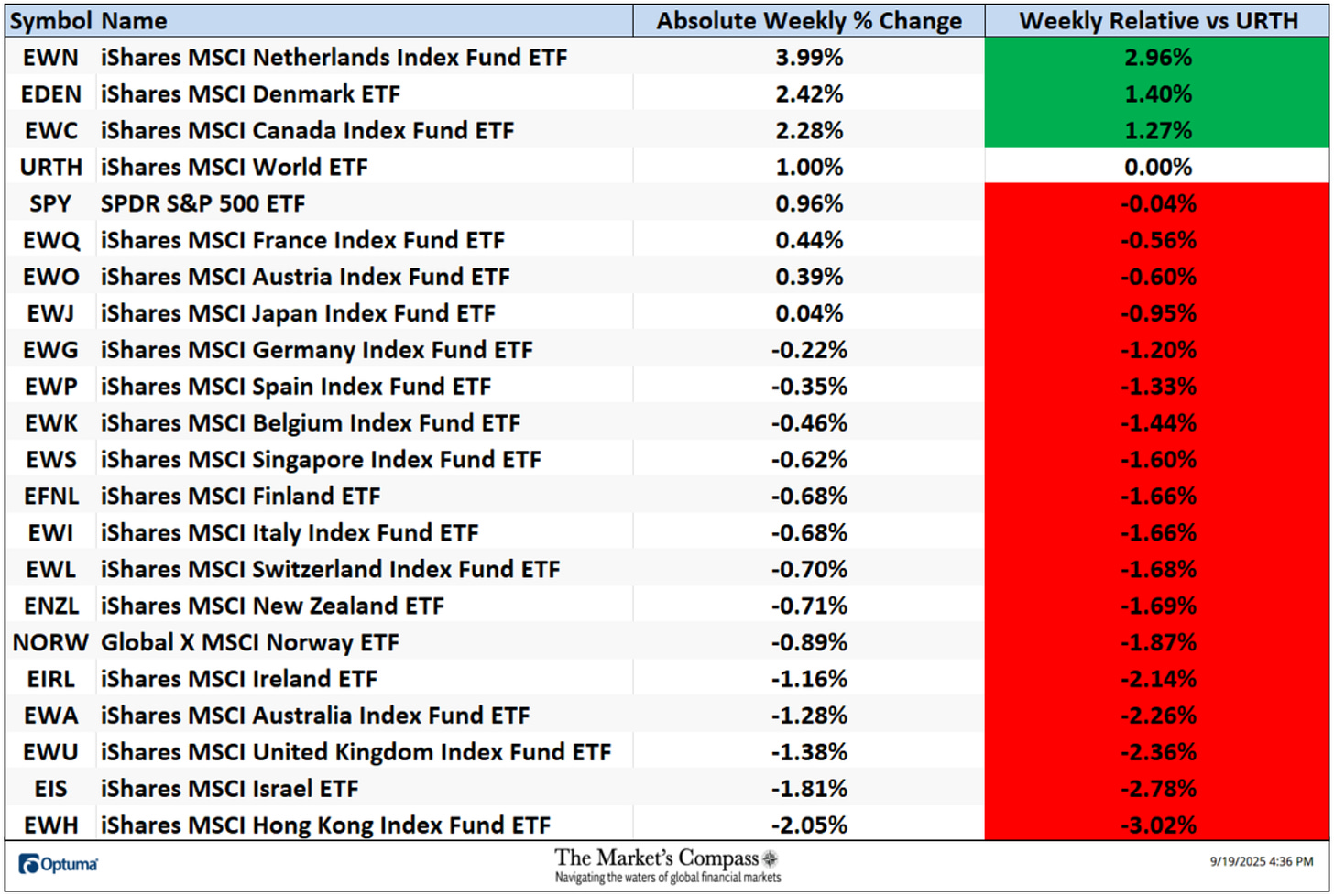

On the finish of final week, solely 4 ETF TRs rose, one was unchanged and sixteen fell (4 ETFs had TRs that dropped double-digits). 13 had been within the “inexperienced zone” (from 35 to 50), and eight had been within the “blue zone” (from 15.5 to 34.5). The week earlier than there have been sixteen TRs within the “inexperienced zone”, 4 had been within the “blue zone”, and one was within the “pink zone” (from 0 to fifteen). The typical TR loss for the week was -2.40, including to the earlier week’s common TR lack of 3.14.

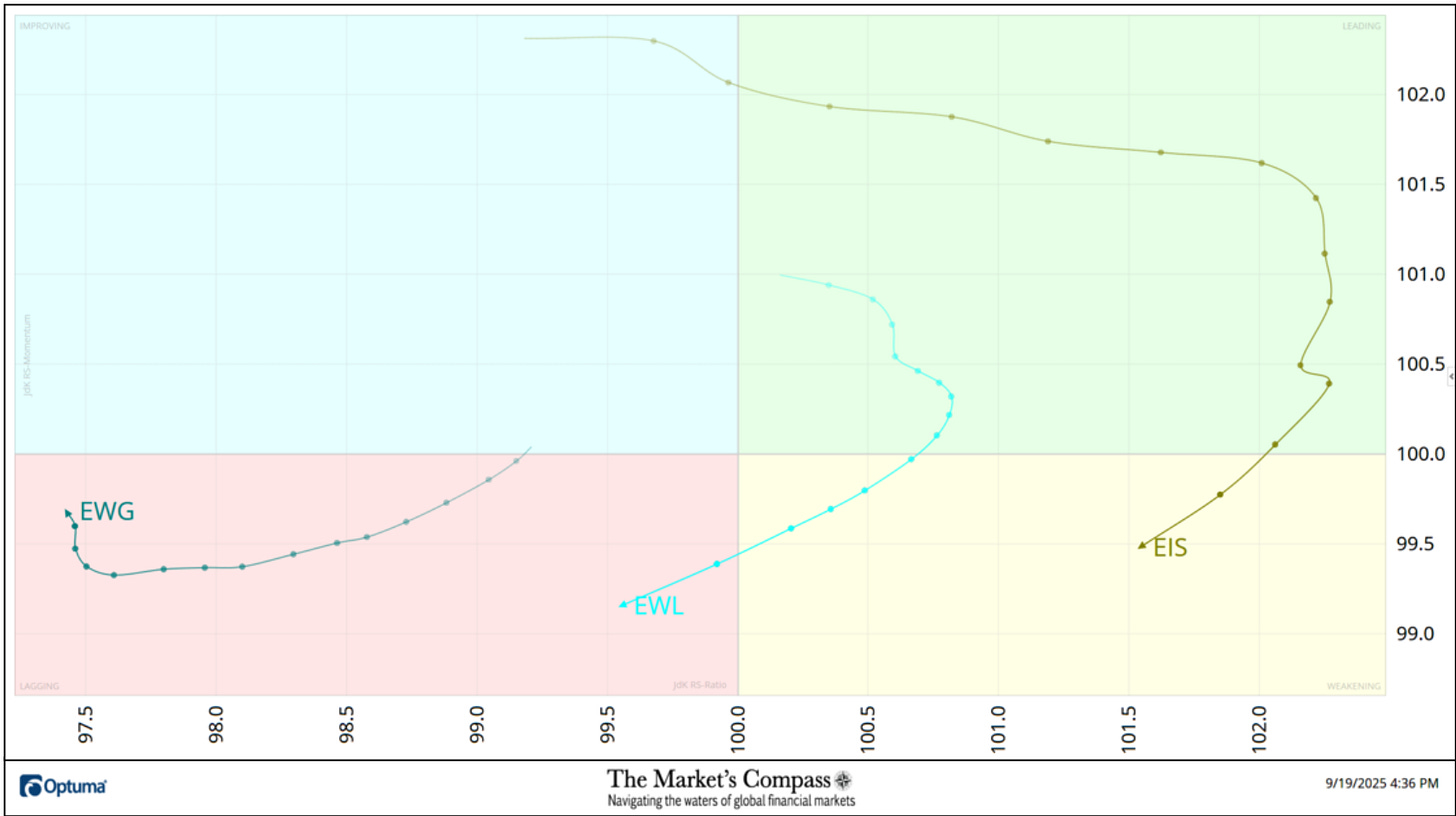

The Relative Rotation Graph, generally known as RRGs had been developed in 2004-2005 by Julius de Kempenaer. These charts are a singular visualization device for relative energy evaluation. Chartists can use RRGs to investigate the relative energy developments of a number of securities towards a standard benchmark, (on this case the URTH) and towards one another over any given time interval (within the case under, each day) over the previous three weeks. The ability of RRG is its means to plot relative efficiency on one graph and present true rotation. All RRGs charts use 4 quadrants to outline the 4 phases of a relative pattern. The Optuma RRG charts makes use of, From Main (in inexperienced) to Weakening (in yellow) to Lagging (in pink) to Enhancing (in blue) and again to Main (in inexperienced). True rotations will be seen as securities transfer from one quadrant to the opposite over time. That is solely a quick clarification of the way to interpret RRG charts. To study extra, see the submit scripts and hyperlinks on the finish of this Weblog.

Not all 21 ETFs are plotted on this RRG Chart. I’ve achieved this for readability functions. These which I consider are of upper technical curiosity stay.

Within the final DM ETF Research printed on September 2nd for the week ending August twenty ninth I introduced consideration to the iShares MSCI Israel Index Fund ETF (EIS) which had risen out of the Lagging Quadrant into the Enhancing Quadrant exhibiting optimistic Relative Energy Momentum. Though momentum started to gradual, it nonetheless continued to notch optimistic Relative Energy till it started to roll over per week in the past, final Tuesday displaying unfavourable Relative Energy Momentum and late final week it fell into the Weakening Quadrant. The iShares MSCI Switzerland Index Fund ETF (EWL) has made a unfavourable three quadrant transfer by falling out of the Main Quadrant, dropping by means of the Weakening Quadrant and into the Lagging Quadrant on the finish of final week it was underperforming the URTH on a Relative Energy foundation. The iShares MSCI Germany Index Fund ETF has been a standout Relative Energy underperformer vs. the benchmark, because it has tracked sideways within the Lagging Quadrant till it hooked barely greater on the finish of final week.

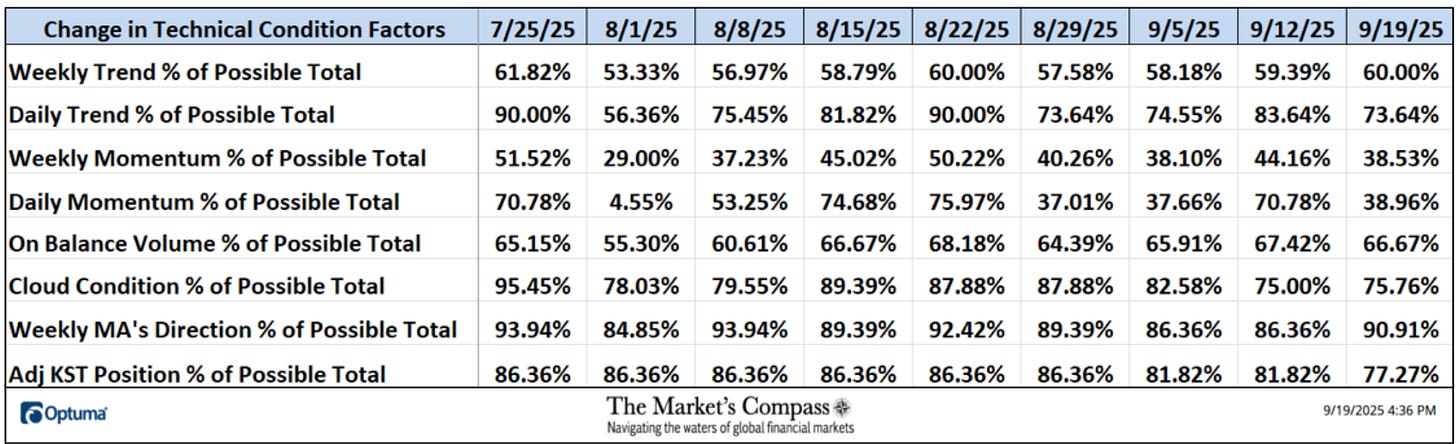

*To know the development the of The Technical Situation Components or TCFs go to the mc’s technical indicators web page at www.themarketscompass.com and choose “dm nation etfs”. For individuals who unfamililar a shortened model* is defined under…

*The Technical Situation Components are utilized within the calculation of the Particular person DM Nation ETF Technical Rankings. What’s proven within the excel panel under is the entire TCFs of all twenty-one TRs. A couple of TCFs carry extra weight than the others, such because the Weekly Pattern Issue and the Weekly Momentum Consider compiling every particular person TR of every of the twenty-one ETFs. Additionally, the TCFs variety of inputs range. Due to that, the excel sheet under calculates every issue’s weekly studying as a proportion of the attainable complete which normalizes the inputs. The essential clarification is that the eight TCFs can vary between 0% and 100%.

The Each day Momentum Technical Situation Issue (“DMTCF”) fell to 38.96% final week from a 70.78% studying the earlier week.

As a affirmation device, if all eight TCFs enhance on per week over week foundation, extra of the 21 ETFs are enhancing internally on a technical foundation, confirming a broader market transfer greater (consider an advance/decline calculation). Conversely, if extra of the 21 TCFs fall on per week over week foundation, extra of the ETFs are deteriorating on a technical foundation confirming the broader market transfer decrease. On a week-over-week foundation three TCFs rose and 5 fell.

A proof of The Complete DM Technical Rating Indicator and the technical interpretation of it, go to the MC’s Technical Indicators web page at www.themarketscompass.com.

It’s merely a affirmation/divergence indicator in addition to an overbought/oversold indicator.

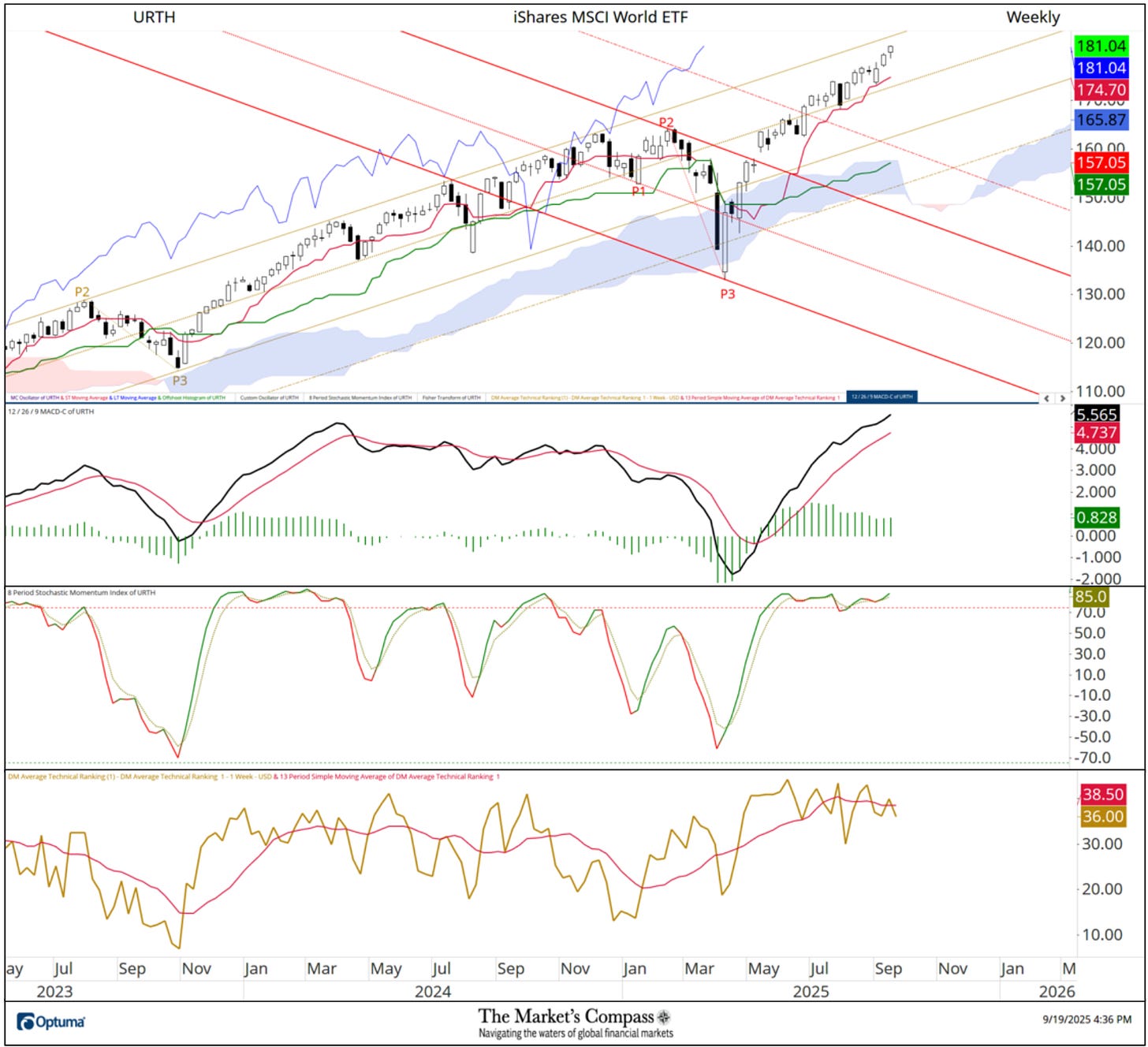

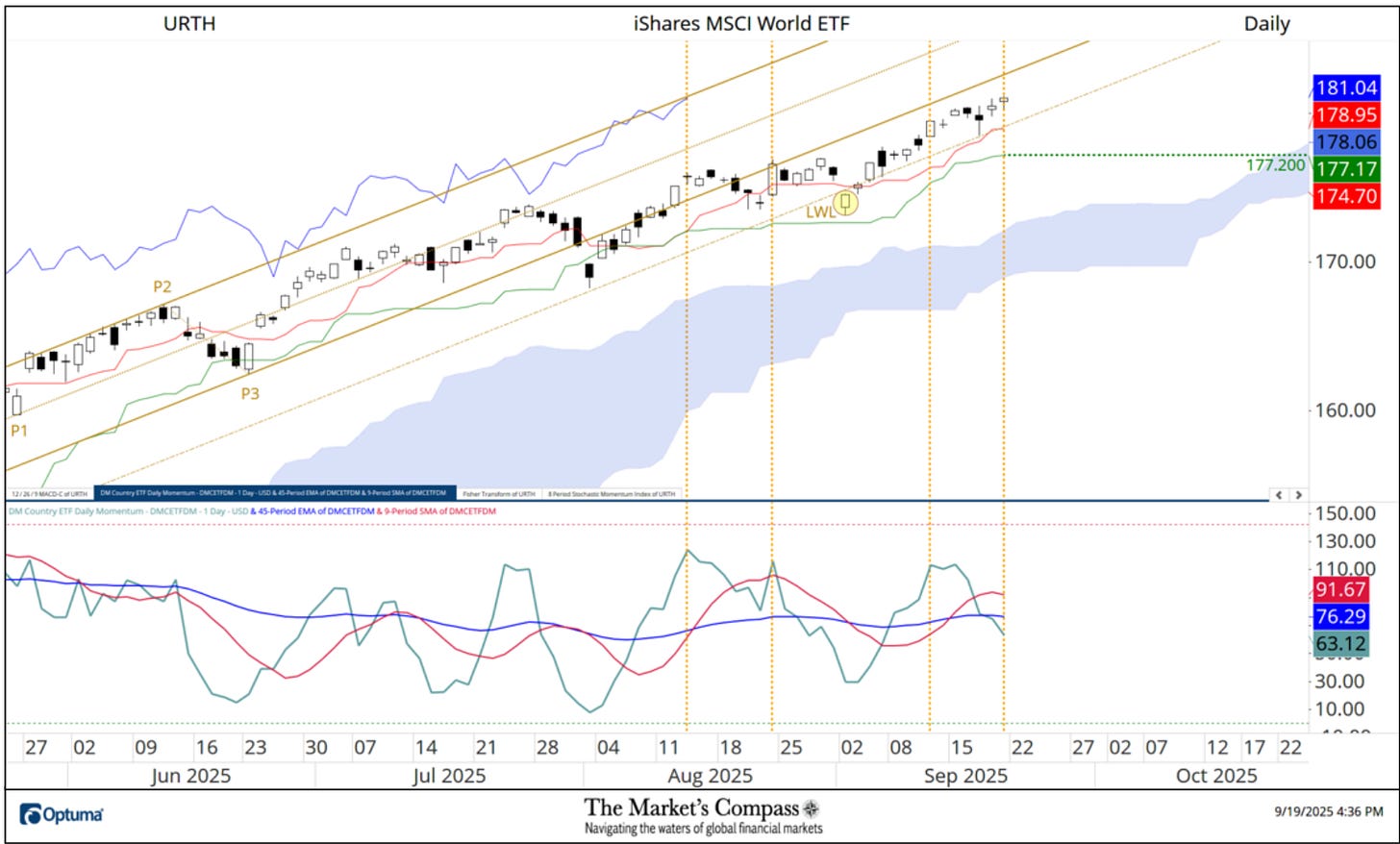

The iShares MSCI World Index ETF closed at yet one more report weekly closing excessive at 181.04 however there continues to be a non-confirmation of the brand new value highs by The DM Complete ETF Rating (blue line) or “TER” because it prints decrease highs and with it the 13-Week Transferring Common of the “TER” (pink line) is stumbling barely decrease. Oversold “TER” readings (150 or decrease) and non-confirmations are usually extra dependable for marking fast value reversals at lows than prolonged durations of overbought at “TER” highs or non-confirmations at value highs. That stated, it stays an indicator price monitoring and as will probably be seen additional into in the present day’s Research there are presently different indicator alerts that the URTH is over prolonged.

The Weekly Common DM Technical Rating (“ATR”) is the common of the person Technical Rankings of the 21 Developed Markets Nation ETFs I monitor. Just like the TER, it’s a affirmation/divergence or overbought/oversold indicator.

As i wrote within the final DM ETF Research “there may be nary a sign in each MACD and the Stochastic Momentum Index that an immanent decline is about to unfold within the URTH” and the situation of these indicators nonetheless don’t provide a sign, however the DM Common Technical Rating nonetheless means that there may very well be an issue (backside indictor panel). The ATR has fallen under the 13-week transferring common from one other decrease excessive however value motion supersedes secondary indicators. Worth has for a second time have discovered help on the Tenkan Plot (pink line) and continues to rise within the confines of the Normal Pitchfork (gold P1 by means of P3). Thus, it’s folly to battle the rally and the psitive value motion. Extra on the short-term technical situation however first…

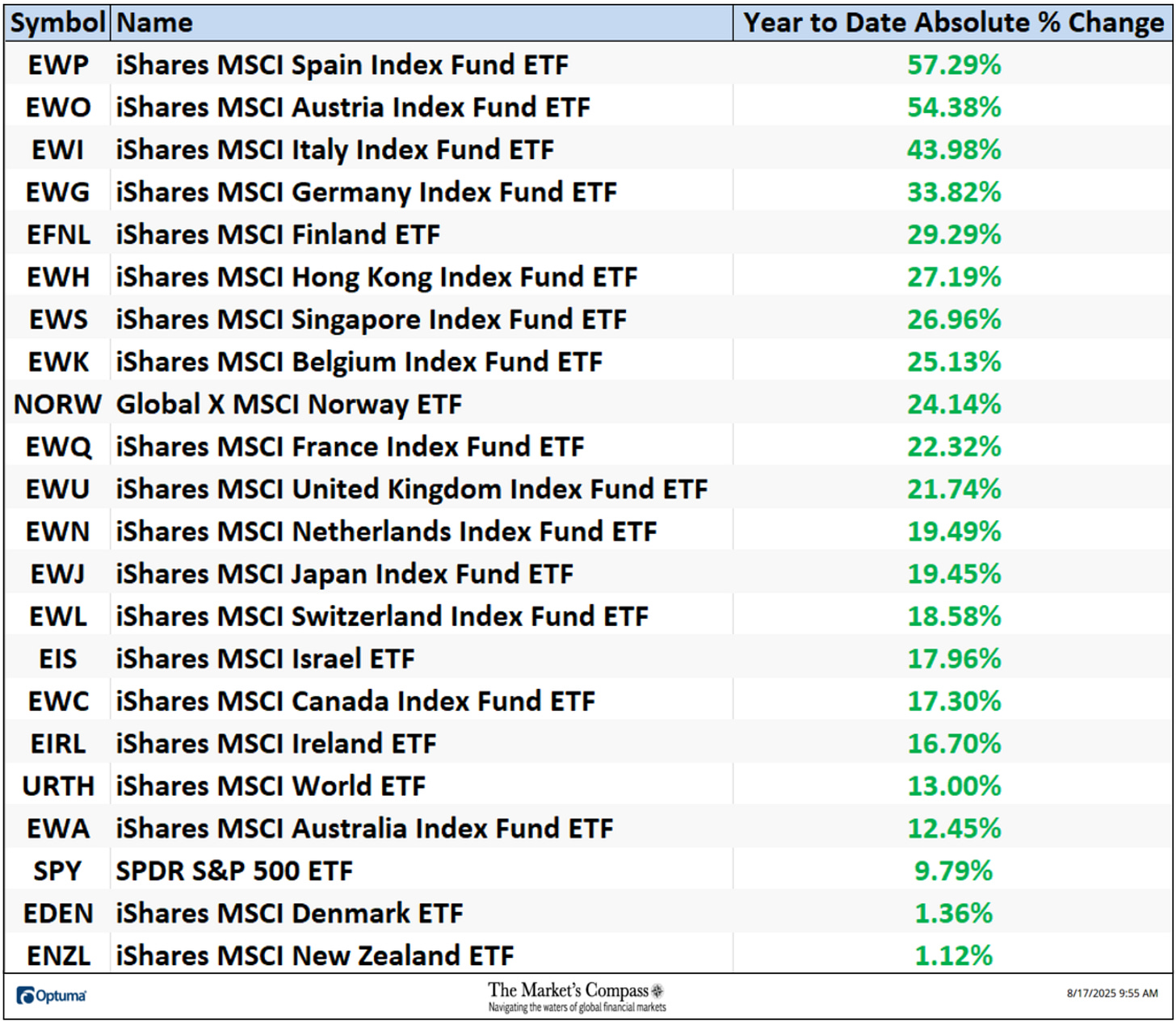

Seven of the 21 Developed Markets ETFs I monitor in these pages had been up on an absolute foundation and 14 fell (5 greater than 1.00%) in what was not a broad endorsement of the rally within the URTH. Solely three of the ETFs outpaced the +1.00% acquire within the iShares World ETF or URTH final week.

On the day of my final printed DM Nation ETF Research on September 2nd the URTH fell under the Decrease Warning Line (gold dashed line) of the Normal Pitchfork (gold P1 by means of P3) that I’ve highlighted with a yellow circle. It recovered again above the Decrease Warning Line the next Wednesday however there been two subsequent assessments of that help however each occasions help held however costs have didn’t reenter the confines of the Pitchfork. Because the begin of the month there have been two extra failures of the DM Nation ETF Each day Momentum / Breadth Oscillator to verify two new closing highs (vertical dashed traces). The indictor has now fallen under each transferring averages.

I’ve purchased consideration to a couple of indication that the Developed Markets I observe haven’t endorsed the transfer within the URTH. However it stays to be seen whether or not these indications will like chickens will come house to roost and produce a correction of a bigger diploma. in value. I feel that the percentages counsel that they’ll.

The YTD Common Absolute % value change of the twenty one Developed Markets County ETFs was +25.48% on the finish of final week.

Charts and value knowledge are courtesy of Optuma. Any time sequence knowledge together with my ETF Technical Rankings will be imported, charted, and again examined in Optuma.

The next hyperlinks are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/movies/introduction-to-rrg/

https://www.optuma.com/movies/optuma-webinar-2-rrgs/

To obtain a 30-day trial of Optuma charting software program go to…