In keeping with onchain information from CryptoQuant, claims that massive holders are massively reaccumulating Bitcoin are exaggerated. The numbers that many share on social media will be distorted by trade strikes, not recent shopping for. That distortion issues as a result of massive transfers tied to exchanges can seem like one entity is piling in, when the motion is commonly inside bookkeeping.

Associated Studying

Whale Pockets Totals Can Be Deceptive

Trade companies typically merge funds from many small accounts into fewer massive wallets for operational or compliance causes. When that occurs, onchain trackers could rely these consolidated addresses as “whales,” inflating the obvious variety of very massive holders.

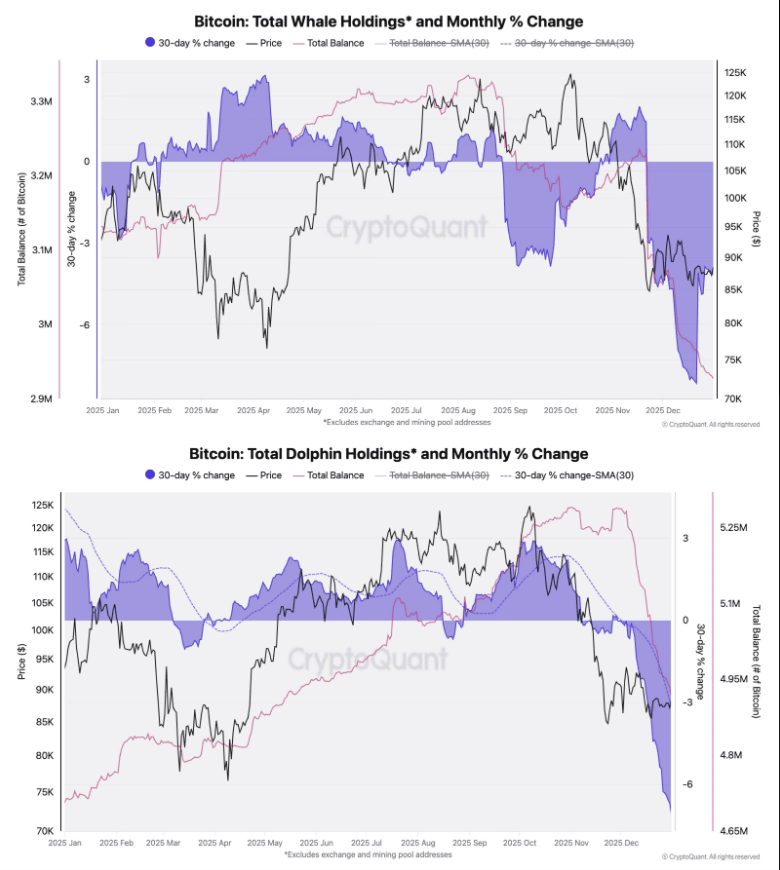

In keeping with Julio Moreno, head of analysis at CryptoQuant, as soon as these exchange-related shifts are faraway from the information, the steadiness held by true massive holders continues to be falling. Balances in addresses holding between 100 to 1,000 BTC have dropped, a development that strains up with outflows from spot ETFs.

No, whales usually are not shopping for monumental quantity of Bitcoin.

Most Bitcoin whale information out there was “affected” by exchanges consolidating a variety of their holdings into fewer addresses with bigger balances, this is the reason whales appear to have amassed a variety of cash just lately.

We… pic.twitter.com/dk9XqqckIX

— Julio Moreno (@jjcmoreno) January 2, 2026

Lengthy-Time period Holders Turning Purchaser

Studies have disclosed that one other group has shifted its conduct. Matthew Sigel, head of digital property analysis at VanEck, says long-term holders have been web accumulators over the previous 30 days after what was their greatest promoting spree since 2019.

That change might scale back one main supply of promoting strain. It doesn’t assure a rally, nevertheless it does imply no less than one key cohort stopped including to the promote aspect. Markets react to who’s shopping for and who’s promoting, and this transfer by long-term holders softens the case {that a} single group is driving costs decrease.

Value Motion Reveals Combined Indicators

Bitcoin has been hovering across the $90,000 space throughout skinny vacation buying and selling. On the time of reporting, the worth was about $89,750 Saturday, with 24-hour quantity close to $52 billion.

The token sits roughly 2.8% under a current day excessive of $90,250 and carries a market capitalization of about $1.75 trillion based mostly on a circulating provide shut to twenty million BTC. Buying and selling has seen sharp strikes up and down, however quantity has been weak, which implies strikes lack the assist wanted for a transparent breakout or breakdown.

Market Strikes Hinge On ETF Flows

Since US spot Bitcoin ETFs turned lively in early 2024, the possession image has modified. ETFs now maintain a big share of on- and off-chain demand, which might shift the place Bitcoin is saved and the way flows seem on onchain charts. Studies counsel that ETF outflows have helped drive decrease balances within the 100–1,000 BTC band, whereas on the identical time some long-term holders are quietly shopping for.

Associated Studying

What This Means For Traders

Taken collectively, the proof factors to consolidation greater than a brand new bull run or a significant crash. Claims of an enormous whale reaccumulation wave had been overblown as a result of they didn’t account for trade consolidation.

But the story shouldn’t be one-sided. Lengthy-term holders have proven shopping for curiosity, at the same time as massive non-exchange addresses proceed to shed some holdings. Future worth route will seemingly depend upon whether or not ETF flows return in dimension and whether or not buying and selling quantity picks up sufficient to substantiate any transfer.

Featured picture from Unsplash, chart from TradingView