XRP collapsed in one in every of its heaviest buying and selling days of 2025, tumbling almost 5% as establishments unloaded into the REX-Osprey ETF debut.

The sell-the-news dynamic erased $11 billion in market worth and left the token preventing to defend vital $2.77 assist.

Information Background

• Inaugural U.S. XRP ETF (REX-Osprey) posted document $37.7 million first-day quantity, the most important ETF launch of 2025.

• Whale wallets moved $812 million in tokens between unknown addresses throughout the session.

• Crypto derivatives noticed $1.7 billion in liquidations, with 90% coming from lengthy positions.

• Fed coverage pivot looms: September inflation cooled to 2.18%, with markets pricing a 50 bps minimize earlier than year-end.

• Bitcoin dominance surged to 57.7% as capital rotated away from altcoins.

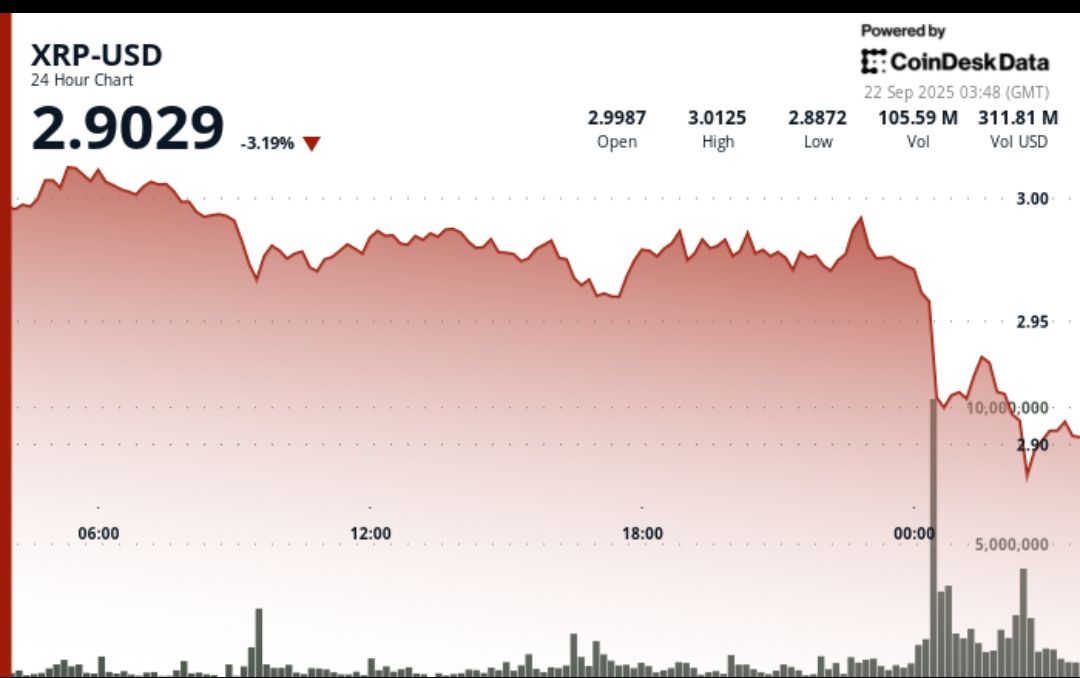

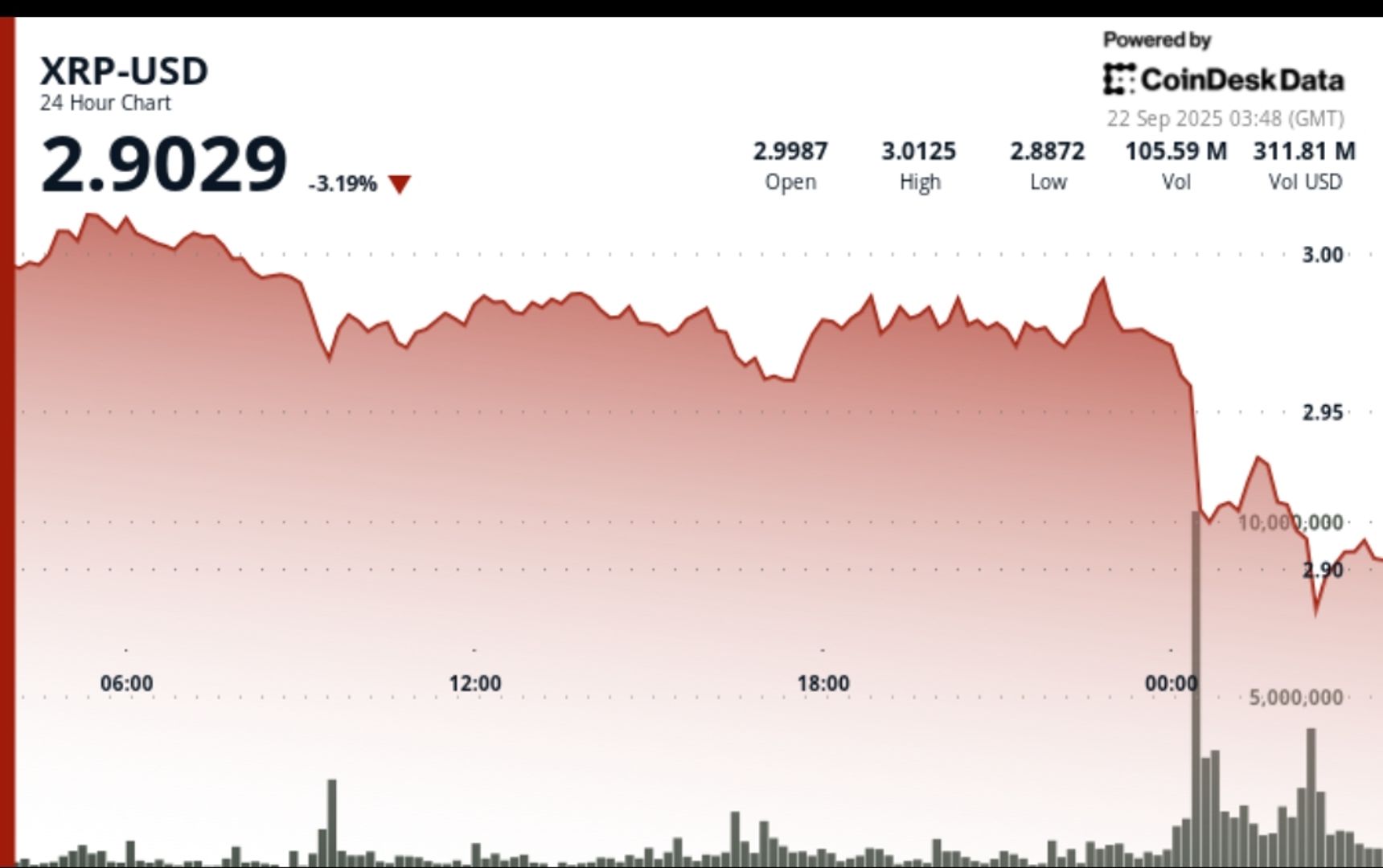

Worth Motion Abstract

• XRP crashed from $2.87 to $2.77 in a 24-hour span (Sep 22 03:00–Sep 23 02:00 GMT), a 4.9% drop throughout a $0.14 vary.

• Flash crash at 06:00 GMT noticed worth plunge from $2.87 to $2.77 on 656.1M quantity (6x day by day avg of 105M).

• Resistance hardened at $2.87 throughout repeated intraday rejection.

• Restoration peaked at $2.86 by 13:00 GMT earlier than stalling.

• Afternoon consolidation held $2.83–$2.87 earlier than sellers regained management.

• Ultimate hour decline took worth from $2.85 to $2.83 (-0.7%), leaving XRP at $2.83 shut.

Technical Evaluation

• Help: $2.77 vital ground from flash crash; secondary stage $2.82 flagged for retest.

• Resistance: Heavy provide zone at $2.87, with decrease highs forming downtrend channel.

• Quantity: 656.1M in crash vs 105M avg confirms institutional dumping.

• Pattern: Decrease highs at $2.856 and decrease lows at $2.83 set up short-term bearish channel.

• Indicators: Momentum skewed bearish, with breakdown threat towards $2.75–$2.70 if $2.82 fails.

What Merchants Are Watching

• Can $2.77 assist survive a second take a look at after the flash crash?

• ETF flows: Will day-two demand stabilize worth or verify a sell-the-news occasion?

• Whale pockets conduct after $812M moved throughout session.

• Fed’s price minimize path and its influence on greenback liquidity.

• BTC dominance at 57.7% — rotation stress on altcoins doubtless persists.