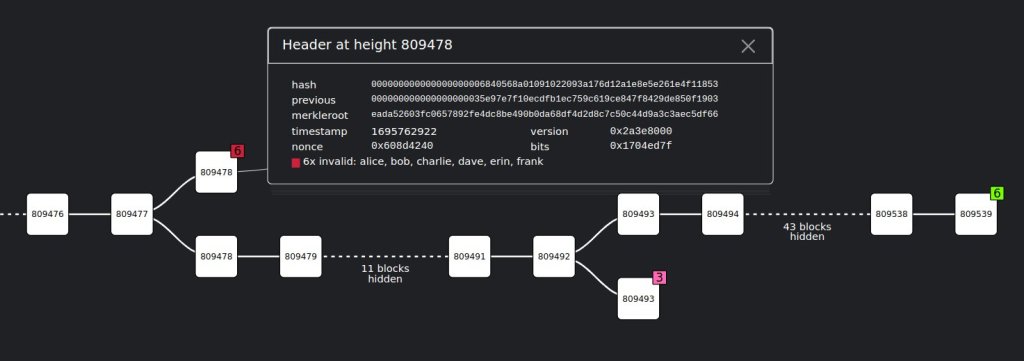

MARA Pool, the Bitcoin mining pool operated by the publicly listed Marathon Digital Holdings, had a transaction ordering concern on September 27 after it mined an invalid block at block top 809478. The invalid block was first picked by an X person, “0xB10C”, earlier than Jameson Lopp, the CTO of Casa, a Bitcoin-focused firm, later confirmed it.

Lopp scanned his node and famous that MARA Pool had spent an output earlier than it was created, validating a double-spent transaction.

Marathon Digital Mined An Invalid Block

In Bitcoin, a mining pool or a person miner can’t approve an “unlawful” transaction originating from any community person. By double-spending, the person posting the transaction tries to cheat the system.

Bitcoin is self-auditing, and each miner and mining pool linked to the community should at all times affirm that each one transactions within the newest block and hooked up to the longest chain are legitimate. If a block incorporates an invalid transaction not supported by different miners, it will likely be rejected. This was the case with the block verified by MARA Pool; different miners routinely dismissed it and didn’t construct on it.

BitMEX Analysis findings present that the block was disregarded due to a transaction ordering drawback. In Bitcoin, miners resolve the order of transactions inside a block based mostly on the charges hooked up.

All these transactions are picked from the mempool, a short lived storage for all unconfirmed transactions. Whereas they will organize them in any order, this adjustments as soon as the block is confirmed after its cryptographic puzzle is solved.

Guaranteeing transactions are ordered chronologically makes Bitcoin proof against double-spending, which may destroy a public community’s credibility. Bitcoin prevents this by routinely proving that solely a selected transaction was the primary to be confirmed on the community, invalidating every other.

Bitcoin Stays Unstable

The occasion additionally coincided with heightened Bitcoin volatility. At September 27 highs, the coin had soared to as excessive as $27,263 and stays capped inside a $1,000 vary, taking a look at worth motion within the each day chart.

Nonetheless, the surge was rapidly met with robust rejections. The coin fell sharply from in the present day’s highs, and an inverted hammer types within the each day chart. Regardless of the pullback, Bitcoin is roughly up 5% from September lows. Consumers have the higher hand since costs are trending contained in the bullish vary established within the second and third weeks of the month.

Presently, costs are trending above the first help at round $26,000. worth traits up to now few weeks, the trail of least resistance is southwards regardless of the latest revival.

Characteristic picture from Canva, chart by TradingView