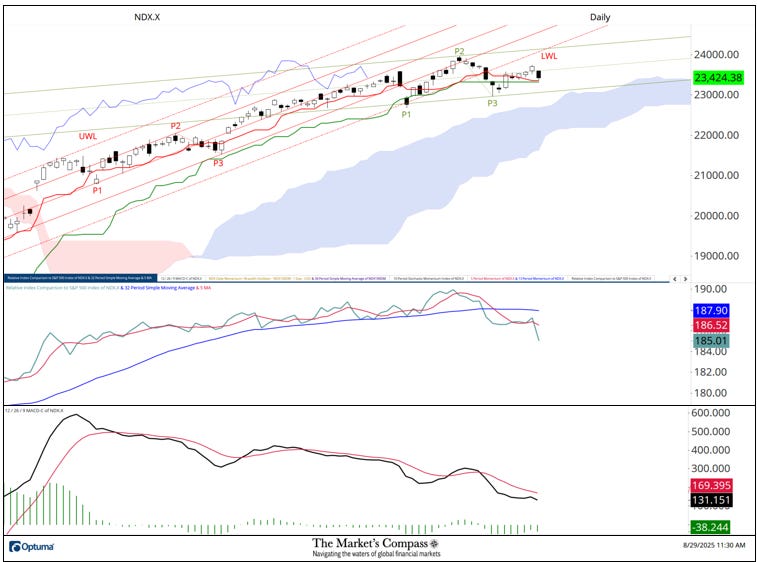

In my Substack Weblog put up revealed every week in the past, final Wednesday, I acknowledged that there have been a number of technical elements, because the title prompt, that there was potential “Early Indicators of a Crack within the Again of the Nasdaq 100 Index’s Rally”. My solely concern at the moment was that I used to be sticking my neck out with that warning, contemplating that over the remainer of the week there was a number of potential information occasions that would invoke volatility within the charges market that may probably overflow into the fairness markets. That proved to be an inexpensive concern, and my technical thesis was promptly “Jackson Holed” final Friday and buyers have been caught “fallacious sided” and equities, together with the NDX Index rallied sharply. In doing so it retook the bottom again above the damaged Kijun Plot (inexperienced line) There was a measure observe by means of over the remainder of the week till immediately. That five-day rally from every week in the past final Wednesday’s low couldn’t even start to problem the Decrease Warning Line (purple dashed line) of the longer-term Commonplace Pitchfork (purple P1 by means of P3).

I drew a shorter-term Schiff Pitchfork (inexperienced P1 although P3) after final Friday’s rally that encompasses what I believe is a distributive prime. Observe the continued Relative underperformance vs. the SPX within the decrease panel. Beneath that, MACD solely briefly stabilized however has turned decrease once more (notice histogram in inexperienced) and stays under its sign line. I now mark first help on the Decrease Parallel of the brand new Schiff Pitchfork and second stays at Cloud Help. Observe that the Cloud is now not mirroring the vector of the longer-term Commonplace Pitchfork. My technical thesis of that we’re witnessing a distributive prime will likely be negated with a rally that’s in a position retake the bottom above the Decrease Parallel (purple LWL) and the August 13th worth pivot at inexperienced P2

Chart is courtesy of Optuma