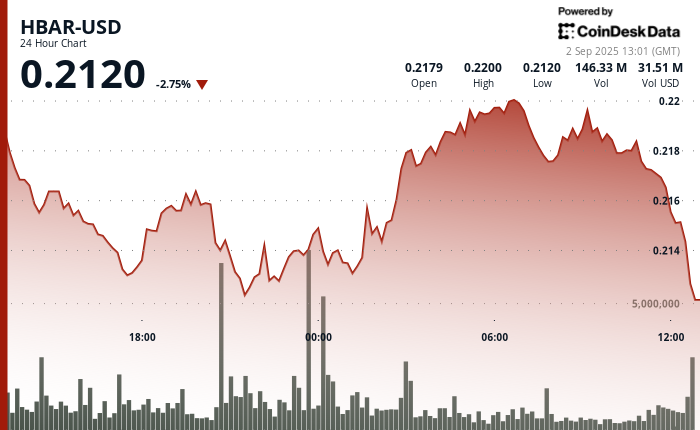

HBAR noticed heightened volatility over the 24-hour interval from Sept. 1, 09:00 to Sept. 2, 08:00, buying and selling inside a $0.013 vary that marked a 6% intraday swing between $0.21 and $0.22.

The token initially slipped from $0.22 right down to help at $0.21, weighed by a surge in liquidation volumes that spiked above 79 million. Nevertheless, as promoting strain subsided, HBAR mounted a restoration, closing the session again close to the $0.22 stage.

Market exercise prompt that bearish momentum misplaced steam as soon as the $0.21 stage was examined, with declining volumes on the rebound signaling a possible shift towards sustained upward momentum.

The buying and selling motion underscores a near-term technical construction the place resilience at key help ranges has saved bullish prospects intact.

The emphasis on real-world functions is positioning Hedera and different enterprise-focused blockchains on the forefront of investor consideration. Alongside Hedera, initiatives similar to Kaspa and Remittix are constructing momentum by concentrating on scalability and cross-border funds, respectively.

With funds innovation resurging as a driver of crypto adoption, Hedera’s company alliances and technological structure put it in a powerful place to learn from the market’s pivot towards utility-driven blockchain infrastructure.

Technical Indicators Evaluation

- Buying and selling bandwidth of $0.013 representing 6 per cent differential from session nadir of $0.21 to apex of $0.22.

- Quantity surges exceeding 79 million throughout preliminary decline section.

- Crucial help threshold examined close to $0.21 earlier than recuperation.

- Diminishing liquidation strain in concluding buying and selling hours.

- Restoration momentum elevating costs in the direction of $0.22 resistance.

- Exhaustion of bearish impetus indicated by quantity patterns.

Disclaimer: Components of this text have been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.